Chapter 11 The Efficient Market Hypothesis

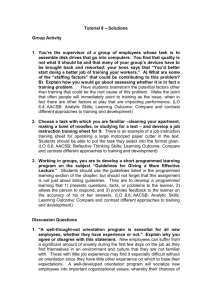

advertisement

Chapter 11 - The Efficient Market Hypothesis Chapter 11 The Efficient Market Hypothesis Multiple Choice Questions 1. If you believe in the ________ form of the EMH, you believe that stock prices reflect all relevant information including historical stock prices and current public information about the firm, but not information that is available only to insiders. A. semistrong B. strong C. weak D. semistrong, strong, and weak E. hard 2. When Maurice Kendall examined the patterns of stock returns in 1953 he concluded that the stock market was __________. Now, these random price movements are believed to be _________. A. inefficient; the effect of a well-functioning market B. efficient; the effect of an inefficient market C. inefficient; the effect of an inefficient market D. efficient; the effect of a well-functioning market E. irrational; even more irrational than before 3. The stock market follows a __________. A. random walk B. submartingale C. predictable pattern that can be exploited D. random walk and a predictable pattern that can be exploited E. submartingale and a predictable pattern that can be exploited 11-1 Chapter 11 - The Efficient Market Hypothesis 4. A hybrid strategy is one where the investor A. uses both fundamental and technical analysis to select stocks. B. selects the stocks of companies that specialize in alternative fuels. C. selects some actively-managed mutual funds on their own and uses an investment advisor to select other actively-managed funds. D. maintains a passive core and augments the position with an actively managed portfolio. E. None of these are correct. 5. The difference between a random walk and a submartingale is the expected price change in a random walk is ______ and the expected price change for a submartingale is ______. A. positive; zero B. positive; positive C. positive; negative D. zero; positive E. zero; zero 6. Proponents of the EMH typically advocate A. an active trading strategy. B. investing in an index fund. C. a passive investment strategy. D. an active trading strategy and investing in an index fund. E. investing in an index fund and a passive investment strategy. 7. Proponents of the EMH typically advocate A. buying individual stocks on margin and trading frequently. B. investing in hedge funds. C. a passive investment strategy. D. buying individual stocks on margin and trading frequently and investing in hedge funds. E. investing in hedge funds and a passive investment strategy. 11-2 Chapter 11 - The Efficient Market Hypothesis 8. If you believe in the _______ form of the EMH, you believe that stock prices only reflect all information that can be derived by examining market trading data such as the history of past stock prices, trading volume or short interest. A. semistrong B. strong C. weak D. semistrong, strong, and weak E. None of these are correct. 9. If you believe in the _________ form of the EMH, you believe that stock prices reflect all available information, including information that is available only to insiders. A. semistrong B. strong C. weak D. semistrong, strong, and weak E. None of these are correct. 10. If you believe in the reversal effect, you should A. buy bonds in this period if you held stocks in the last period. B. buy stocks in this period if you held bonds in the last period. C. buy stocks this period that performed poorly last period. D. go short. E. both buy stocks this period that performed poorly last period and go short. 11. __________ focus more on past price movements of a firm's stock than on the underlying determinants of future profitability. A. Credit analysts B. Fundamental analysts C. Systems analysts D. Technical analysts E. Credit analysts, Fundamental analysts, Systems analysts, and Technical analysts 11-3 Chapter 11 - The Efficient Market Hypothesis 12. _________ above which it is difficult for the market to rise. A. A book value is a value B. A resistance level is a value C. A support level is a value D. A book value and a resistance level are values E. A book value and a support level are values 13. _________ below which it is difficult for the market to fall. A. An intrinsic value is a value B. A resistance level is a value C. A support level is a value D. An intrinsic value and a resistance level are values E. A resistance level and a support level are values 14. ___________ the return on a stock beyond what would be predicted from market movements alone. A. An irrational return is B. An economic return is C. An abnormal return is D. An irrational return and an economic return are E. An irrational return and an abnormal return are 15. The debate over whether markets are efficient will probably never be resolved because of ________. A. the lucky event issue B. the magnitude issue C. the selection bias issue D. the lucky event issue, magnitude issue, and selection bias issue E. None of these answers are correct. 11-4 Chapter 11 - The Efficient Market Hypothesis 16. A common strategy for passive management is ____________. A. creating an index fund B. creating a small firm fund C. creating an investment club D. creating an index fund and creating an investment club E. creating a small firm fund and creating an investment club 17. Arbel (1985) found that A. the January effect was highest for neglected firms. B. the book-to-market value ratio effect was highest in January. C. the liquidity effect was highest for small firms. D. the neglected firm effect was independent of the small firm effect. E. small firms had higher book-to-market value ratios. 18. Researchers have found that most of the small firm effect occurs A. during the spring months. B. during the summer months. C. in December. D. in January. E. randomly. 19. Basu (1977, 1983) found that firms with low P/E ratios A. earned higher average returns than firms with high P/E ratios. B. earned the same average returns as firms with high P/E ratios. C. earned lower average returns than firms with high P/E ratios. D. had higher dividend yields than firms with high P/E ratios. E. None of these are correct. 20. Basu (1977, 1983) found that firms with high P/E ratios A. earned higher average returns than firms with low P/E ratios. B. earned the same average returns as firms with low P/E ratios. C. earned lower average returns than firms with low P/E ratios. D. had higher dividend yields than firms with low P/E ratios. E. None of these are correct. 11-5 Chapter 11 - The Efficient Market Hypothesis 21. Jaffe (1974) found that stock prices _________ after insiders intensively bought shares. A. decreased B. did not change C. increased D. became extremely volatile E. became much less volatile 22. Jaffe (1974) found that stock prices _________ after insiders intensively sold shares. A. decreased B. did not change C. increased D. became extremely volatile E. became much less volatile 23. Banz (1981) found that, on average, the risk-adjusted returns of small firms A. were higher than the risk-adjusted returns of large firms. B. were the same as the risk-adjusted returns of large firms. C. were lower than the risk-adjusted returns of large firms. D. were unrelated to the risk-adjusted returns of large firms. E. were negative. 24. Banz (1981) found that, on average, the risk-adjusted returns of large firms A. were higher than the risk-adjusted returns of small firms. B. were the same as the risk-adjusted returns of small firms. C. were lower than the risk-adjusted returns of small firms. D. were unrelated to the risk-adjusted returns of small firms. E. were negative. 25. Proponents of the EMH think technical analysts A. should focus on relative strength. B. should focus on resistance levels. C. should focus on support levels. D. should focus on financial statements. E. are wasting their time. 11-6 Chapter 11 - The Efficient Market Hypothesis 26. Studies of positive earnings surprises have shown that there is A. a positive abnormal return on the day positive earnings surprises are announced. B. a positive drift in the stock price on the days following the earnings surprise announcement. C. a negative drift in the stock price on the days following the earnings surprise announcement. D. both a positive abnormal return on the day positive earnings surprises are announced and a positive drift in the stock price on the days following the earnings surprise announcement. E. both a positive abnormal return on the day positive earnings surprises are announced and a negative drift in the stock price on the days following the earnings surprise announcement. 27. Studies of negative earnings surprises have shown that there is A. a negative abnormal return on the day negative earnings surprises are announced. B. a positive drift in the stock price on the days following the earnings surprise announcement. C. a negative drift in the stock price on the days following the earnings surprise announcement. D. both a negative abnormal return on the day negative earnings surprises are announced and a positive drift in the stock price on the days following the earnings surprise announcement. E. both a negative abnormal return on the day negative earnings surprises are announced and a negative drift in the stock price on the days following the earnings surprise announcement. 28. Studies of stock price reactions to news are called A. reaction studies. B. event studies. C. drift studies. D. both reaction studies and drift studies. E. both event studies and drift studies. 11-7 Chapter 11 - The Efficient Market Hypothesis 29. On November 22, 2009 the stock price of WalMart was $39.50 and the retailer stock index was 600.30. On November 25, 2009 the stock price of WalMart was $40.25 and the retailer stock index was 605.20. Consider the ratio of WalMart to the retailer index on November 22 and November 25. WalMart is _______ the retail industry and technical analysts who follow relative strength would advise _______ the stock. A. outperforming; buying B. outperforming; selling C. underperforming; buying D. underperforming; selling E. equally performing; neither buying nor selling 30. Work by Amihud and Mendelson (1986, 1991) A. argues that investors will demand a rate of return premium to invest in less liquid stocks. B. may help explain the small firm effect. C. may be related to the neglected firm effect. D. may help explain the small firm effect and may be related to the neglected firm effect. E. argues that investors will demand a rate of return premium to invest in less liquid stocks, may help explain the small firm effect, and may be related to the neglected firm effect. 31. Fama and French (1992) found that the stocks of firms within the highest decile of bookto-market ratios had average monthly returns of _______ while the stocks of firms within the lowest decile of book-to-market ratios had average monthly returns of________. A. greater than 1%; greater than 1% B. greater than 1%; less than 1% C. less than 1%; greater than 1% D. less than 1%; less than 1% E. less than 0.5%; greater than 0.5% 32. A market decline of 23% on a day when there is no significant macroeconomic event ______ consistent with the EMH because ________. A. would be; it was a clear response to macroeconomic news B. would be; it was not a clear response to macroeconomic news C. would not be; it was a clear response to macroeconomic news D. would not be; it was not a clear response to macroeconomic news E. None of these are correct. 11-8 Chapter 11 - The Efficient Market Hypothesis 33. In an efficient market, __________. A. security prices react quickly to new information B. security prices are seldom far above or below their justified levels C. security analysis will not enable investors to realize superior returns consistently D. one cannot make money E. security prices react quickly to new information, are seldom far above or below their justified levels, and security analysis will not enable investors to realize superior returns consistently 34. The weak form of the efficient market hypothesis asserts that A. stock prices do not rapidly adjust to new information contained in past prices or past data. B. future changes in stock prices cannot be predicted from past prices. C. technicians cannot expect to outperform the market. D. stock prices do not rapidly adjust to new information contained in past prices or past data and future changes in stock prices cannot be predicted from past prices. E. future changes in stock prices cannot be predicted from past prices and technicians cannot expect to outperform the market. 35. A support level is the price range at which a technical analyst would expect the A. supply of a stock to increase dramatically. B. supply of a stock to decrease substantially. C. demand for a stock to increase substantially. D. demand for a stock to decrease substantially. E. price of a stock to fall. 36. A finding that _________ would provide evidence against the semistrong form of the efficient market theory. A. low P/E stocks tend to have positive abnormal returns B. trend analysis is worthless in determining stock prices C. one can consistently outperform the market by adopting the contrarian approach exemplified by the reversals phenomenon D. low P/E stocks tend to have positive abnormal returns and trend analysis is worthless in determining stock prices E. low P/E stocks tend to have positive abnormal returns and one can consistently outperform the market by adopting the contrarian approach exemplified by the reversals phenomenon 11-9 Chapter 11 - The Efficient Market Hypothesis 37. The weak form of the efficient market hypothesis contradicts A. technical analysis, but supports fundamental analysis as valid. B. fundamental analysis, but supports technical analysis as valid. C. both fundamental analysis and technical analysis. D. technical analysis, but is silent on the possibility of successful fundamental analysis. E. None of these is correct. 38. Two basic assumptions of technical analysis are that security prices adjust A. rapidly to new information and market prices are determined by the interaction of supply and demand. B. rapidly to new information and liquidity is provided by security dealers. C. gradually to new information and market prices are determined by the interaction of supply and demand. D. gradually to new information and liquidity is provided by security dealers. E. rapidly to information and to the actions of insiders. 39. Cumulative abnormal returns (CAR) A. are used in event studies. B. are better measures of security returns due to firm-specific events than are abnormal returns (AR). C. are cumulated over the period prior to the firm-specific event. D. are used in event studies and are better measures of security returns due to firm-specific events than are abnormal returns (AR). E. are used in event studies and are cumulated over the period prior to the firm-specific event. 40. Studies of mutual fund performance A. indicate that one should not randomly select a mutual fund. B. indicate that historical performance is not necessarily indicative of future performance. C. indicate that the professional management of the fund insures above market returns. D. indicates both that one should not randomly select a mutual fund and that historical performance is not necessarily indicative of future performance. E. indicate both that historical performance is not necessarily indicative of future performance and that the professional management of the fund insures above market returns. 11-10 Chapter 11 - The Efficient Market Hypothesis 41. The likelihood of an investment newsletter's successfully predicting the direction of the market for three consecutive years by chance should be A. between 50% and 70%. B. between 25% and 50%. C. between 10% and 25%. D. less than 10%. E. greater than 70%. 42. In an efficient market the correlation coefficient between stock returns for two nonoverlapping time periods should be A. positive and large. B. positive and small. C. zero. D. negative and small. E. negative and large. 43. The weather report says that a devastating and unexpected freeze is expected to hit Florida tonight, during the peak of the citrus harvest. In an efficient market one would expect the price of Florida Orange's stock to A. drop immediately. B. remain unchanged. C. increase immediately. D. gradually decline for the next several weeks. E. gradually increase for the next several weeks. 44. Matthews Corporation has a beta of 1.2. The annualized market return yesterday was 13%, and the risk-free rate is currently 5%. You observe that Matthews had an annualized return yesterday of 17%. Assuming that markets are efficient, this suggests that A. bad news about Matthews was announced yesterday. B. good news about Matthews was announced yesterday. C. no news about Matthews was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. 11-11 Chapter 11 - The Efficient Market Hypothesis 45. Nicholas Manufacturing just announced yesterday that its fourth quarter earnings will be 10% higher than last year's fourth quarter. You observe that Nicholas had an abnormal return of −1.2% yesterday. This suggests that A. the market is not efficient. B. Nicholas' stock will probably rise in value tomorrow. C. investors expected the earnings increase to be larger than what was actually announced. D. investors expected the earnings increase to be smaller than what was actually announced. E. earnings are expected to decrease next quarter. 46. When Maurice Kendall first examined stock price patterns in 1953, he found that A. certain patterns tended to repeat within the business cycle. B. there were no predictable patterns in stock prices. C. stocks whose prices had increased consistently for one week tended to have a net decrease the following week. D. stocks whose prices had increased consistently for one week tended to have a net increase the following week. E. the direction of change in stock prices was unpredictable, but the amount of change followed a distinct pattern. 47. If stock prices follow a random walk A. it implies that investors are irrational. B. it means that the market cannot be efficient. C. price levels are not random. D. price changes are random. E. price movements are predictable. 48. The main difference between the three forms of market efficiency is that A. the definition of efficiency differs. B. the definition of excess return differs. C. the definition of prices differs. D. the definition of information differs. E. they were discovered by different people. 11-12 Chapter 11 - The Efficient Market Hypothesis 49. Chartists practice A. technical analysis. B. fundamental analysis. C. regression analysis. D. insider analysis. E. psychoanalysis. 50. Which of the following are used by fundamental analysts to determine proper stock prices? I) trendlines II) earnings III) dividend prospects IV) expectations of future interest rates V) resistance levels A. I, IV, and V B. I, II, and III C. II, III, and IV D. II, IV, and V E. All five items are used by fundamental analysts. 51. Which of the following are used by technical analysts to determine proper stock prices? I) trendlines II) earnings III) dividend prospects IV) expectations of future interest rates V) resistance levels A. I and V B. I, II, and III C. II, III, and IV D. II, IV, and V E. I and II 11-13 Chapter 11 - The Efficient Market Hypothesis 52. According to proponents of the efficient market hypothesis, the best strategy for a small investor with a portfolio worth $40,000 is probably to A. perform fundamental analysis. B. exploit market anomalies. C. invest in Treasury securities. D. invest in derivative securities. E. invest in mutual funds. 53. Which of the following are investment superstars who have consistently shown superior performance? I) Warren Buffet II) Phoebe Buffet III) Peter Lynch IV) Merrill Lynch V) Jimmy Buffet A. I, III, and IV B. II, III, and IV C. I and III D. III and IV E. I, III, IV, and V 54. Google has a beta of 1.0. The annualized market return yesterday was 11%, and the riskfree rate is currently 5%. You observe that Google had an annualized return yesterday of 14%. Assuming that markets are efficient, this suggests that A. bad news about Google was announced yesterday. B. good news about Google was announced yesterday. C. no news about Google was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. 11-14 Chapter 11 - The Efficient Market Hypothesis 55. Music Doctors has a beta of 2.25. The annualized market return yesterday was 12%, and the risk-free rate is currently 4%. You observe that Music Doctors had an annualized return yesterday of 15%. Assuming that markets are efficient, this suggests that A. bad news about Music Doctors was announced yesterday. B. good news about Music Doctors was announced yesterday. C. no news about Music Doctors was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. 56. QQAG has a beta of 1.7. The annualized market return yesterday was 13%, and the riskfree rate is currently 3%. You observe that QQAG had an annualized return yesterday of 20%. Assuming that markets are efficient, this suggests that A. bad news about QQAG was announced yesterday. B. good news about QQAG was announced yesterday. C. no significant news about QQAG was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. 57. QQAG just announced yesterday that its fourth quarter earnings will be 35% higher than last year's fourth quarter. You observe that QQAG had an abnormal return of −1.7% yesterday. This suggests that A. the market is not efficient. B. QQAG stock will probably rise in value tomorrow. C. investors expected the earnings increase to be larger than what was actually announced. D. investors expected the earnings increase to be smaller than what was actually announced. E. earnings are expected to decrease next quarter. 58. LJP Corporation just announced yesterday that it would undertake an international joint venture. You observe that LJP had an abnormal return of 3% yesterday. This suggests that A. the market is not efficient. B. LJP stock will probably rise in value again tomorrow. C. investors view the international joint venture as bad news. D. investors view the international joint venture as good news. E. earnings are expected to decrease next quarter. 11-15 Chapter 11 - The Efficient Market Hypothesis 59. Music Doctors just announced yesterday that its first quarter sales were 35% higher than last year's first quarter. You observe that Music Doctors had an abnormal return of −2% yesterday. This suggests that A. the market is not efficient. B. Music Doctors stock will probably rise in value tomorrow. C. investors expected the sales increase to be larger than what was actually announced. D. investors expected the sales increase to be smaller than what was actually announced. E. earnings are expected to decrease next quarter. 60. The Food and Drug Administration (FDA) just announced yesterday that they would approve a new cancer-fighting drug from King. You observe that King had an abnormal return of 0% yesterday. This suggests that A. the market is not efficient. B. King stock will probably rise in value tomorrow. C. King stock will probably fall in value tomorrow. D. the approval was already anticipated by the market. E. None of these is correct. 61. Your professor finds a stock-trading rule that generates excess risk-adjusted returns. Instead of publishing the results, she keeps the trading rule to herself. This is most closely associated with ________. A. regret avoidance B. selection bias C. framing D. insider trading E. None of these is correct. 62. At freshman orientation, 1,500 students are asked to flip a coin 20 times. One student is crowned the winner (tossed 20 heads). This is most closely associated with ________. A. regret avoidance B. selection bias C. overconfidence D. the lucky event issue E. None of these is correct. 11-16 Chapter 11 - The Efficient Market Hypothesis 63. Sehun (1986) finds that the practice of monitoring insider trade disclosures, and trading on that information, would be ________. A. extremely profitable for long-term traders B. extremely profitable for short-term traders C. marginally profitable for long-term traders D. marginally profitable for short-term traders E. not sufficiently profitable to cover trading costs 64. If you believe in the reversal effect, you should A. sell bonds in this period if you held stocks in the last period. B. sell stocks in this period if you held bonds in the last period. C. sell stocks this period that performed well last period. D. go long. E. sell stocks this period that performed well last period and go long. 65. Patell and Woflson (1984) report that most of the stock price response to corporate dividend or earnings announcements occurs within ____________ of the announcement. A. 10 minutes B. 45 minutes C. 2 hours D. 4 hours E. 2 trading days Short Answer Questions 66. Discuss the various forms of market efficiency. Include in your discussion the information sets involved in each form and the relationships across information sets and across forms of market efficiency. Also discuss the implications for the various forms of market efficiency for the various types of securities' analysts. 11-17 Chapter 11 - The Efficient Market Hypothesis 67. What is an event study? It is a test of what form of market efficiency? Discuss the process of conducting an event study, including the best variable(s) to observe as tests of market efficiency. 68. Discuss the small firm effect, the neglected firm effect, and the January effect, the tax effect and how the four effects may be related. 69. Why might the degree of market efficiency differ across various markets? State three reasons why this might occur and explain each reason briefly. 70. With regard to market efficiency, what is meant by the term "anomaly"? Give three examples of market anomalies and explain why each is considered to be an anomaly. 11-18 Chapter 11 - The Efficient Market Hypothesis Chapter 11 The Efficient Market Hypothesis Answer Key Multiple Choice Questions 1. If you believe in the ________ form of the EMH, you believe that stock prices reflect all relevant information including historical stock prices and current public information about the firm, but not information that is available only to insiders. A. semistrong B. strong C. weak D. semistrong, strong, and weak E. hard The semistrong form of the EMH maintains that stock prices immediately reflect all historical and current public information, but not inside information. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 2. When Maurice Kendall examined the patterns of stock returns in 1953 he concluded that the stock market was __________. Now, these random price movements are believed to be _________. A. inefficient; the effect of a well-functioning market B. efficient; the effect of an inefficient market C. inefficient; the effect of an inefficient market D. efficient; the effect of a well-functioning market E. irrational; even more irrational than before Random price changes were originally thought to be driven by irrationality. Now, financial economists believe random price changes occur because markets are informationally efficient. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Efficient Market Hypothesis 11-19 Chapter 11 - The Efficient Market Hypothesis 3. The stock market follows a __________. A. random walk B. submartingale C. predictable pattern that can be exploited D. random walk and a predictable pattern that can be exploited E. submartingale and a predictable pattern that can be exploited The stock market follows a submartingale. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 4. A hybrid strategy is one where the investor A. uses both fundamental and technical analysis to select stocks. B. selects the stocks of companies that specialize in alternative fuels. C. selects some actively-managed mutual funds on their own and uses an investment advisor to select other actively-managed funds. D. maintains a passive core and augments the position with an actively managed portfolio. E. None of these are correct. A hybrid strategy is one where the investor maintains a passive core and augments the position with an actively managed portfolio. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Implications of the EMH 11-20 Chapter 11 - The Efficient Market Hypothesis 5. The difference between a random walk and a submartingale is the expected price change in a random walk is ______ and the expected price change for a submartingale is ______. A. positive; zero B. positive; positive C. positive; negative D. zero; positive E. zero; zero A random walk has an expected price change of zero and a submartingale has a positive expected price change. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Efficient Market Hypothesis 6. Proponents of the EMH typically advocate A. an active trading strategy. B. investing in an index fund. C. a passive investment strategy. D. an active trading strategy and investing in an index fund E. investing in an index fund and a passive investment strategy Believers of market efficiency advocate passive investment strategies, and an investment in an index fund is one of the most practical passive investment strategies, especially for small investors. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 11-21 Chapter 11 - The Efficient Market Hypothesis 7. Proponents of the EMH typically advocate A. buying individual stocks on margin and trading frequently. B. investing in hedge funds. C. a passive investment strategy. D. buying individual stocks on margin and trading frequently and investing in hedge funds E. investing in hedge funds and a passive investment strategy Believers of market efficiency advocate passive investment strategies, and an investment in an index fund is one of the most practical passive investment strategies, especially for small investors. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 8. If you believe in the _______ form of the EMH, you believe that stock prices only reflect all information that can be derived by examining market trading data such as the history of past stock prices, trading volume or short interest. A. semistrong B. strong C. weak D. semistrong, strong, and weak E. None of these are correct. The information described above is market data, which is the data set for the weak form of market efficiency. The semistrong form includes the above plus all other public information. The strong form includes all public and private information. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 11-22 Chapter 11 - The Efficient Market Hypothesis 9. If you believe in the _________ form of the EMH, you believe that stock prices reflect all available information, including information that is available only to insiders. A. semistrong B. strong C. weak D. semistrong, strong, and weak E. None of these are correct. The strong form includes all public and private information. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 10. If you believe in the reversal effect, you should A. buy bonds in this period if you held stocks in the last period. B. buy stocks in this period if you held bonds in the last period. C. buy stocks this period that performed poorly last period. D. go short. E. both buy stocks this period that performed poorly last period and go short The reversal effect states that stocks that do well in one period tend to perform poorly in the subsequent period, and vice versa. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 11-23 Chapter 11 - The Efficient Market Hypothesis 11. __________ focus more on past price movements of a firm's stock than on the underlying determinants of future profitability. A. Credit analysts B. Fundamental analysts C. Systems analysts D. Technical analysts E. Credit analysts, Fundamental analysts, Systems analysts, and Technical analysts Technicians attempt to predict future stock prices based on historical stock prices. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Implications of the EMH 12. _________ above which it is difficult for the market to rise. A. A book value is a value B. A resistance level is a value C. A support level is a value D. A book value and a resistance level are values E. A book value and a support level are values When stock prices have remained stable for a long period, these prices are termed resistance levels; technicians believe it is difficult for the stock prices to penetrate these resistance levels. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Implications of the EMH 11-24 Chapter 11 - The Efficient Market Hypothesis 13. _________ below which it is difficult for the market to fall. A. An intrinsic value is a value B. A resistance level is a value C. A support level is a value D. An intrinsic value and a resistance level are values E. A resistance level and a support level are values When stock prices have remained stable for a long period, these prices are termed support levels; technicians believe it is difficult for the stock prices to penetrate these support levels. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Implications of the EMH 14. ___________ the return on a stock beyond what would be predicted from market movements alone. A. An irrational return is B. An economic return is C. An abnormal return is D. An irrational return and an economic return are E. An irrational return and an abnormal return are An economic return is the expected return, based on the perceived level of risk and market factors. When returns exceed these levels, the returns are called abnormal returns. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Event Studies 11-25 Chapter 11 - The Efficient Market Hypothesis 15. The debate over whether markets are efficient will probably never be resolved because of ________. A. the lucky event issue B. the magnitude issue C. the selection bias issue D. the lucky event issue, magnitude issue, and selection bias issue E. None of these answers are correct. The lucky event issue, magnitude issue, and selection bias issue all exist and make rigid testing of market efficiency difficult or impossible. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Markets 16. A common strategy for passive management is ____________. A. creating an index fund B. creating a small firm fund C. creating an investment club D. creating an index fund and creating an investment club E. creating a small firm fund and creating an investment club The index fund is, by definition, passively managed. The other investment alternatives may or may not be managed passively. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Implications of the EMH 11-26 Chapter 11 - The Efficient Market Hypothesis 17. Arbel (1985) found that. A. the January effect was highest for neglected firms. B. the book-to-market value ratio effect was highest in January. C. the liquidity effect was highest for small firms. D. the neglected firm effect was independent of the small firm effect. E. small firms had higher book-to-market value ratios. Arbel divided firms into highly researched, moderately researched, and neglected groups based on the number of institutions holding the stock. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Efficient Markets 18. Researchers have found that most of the small firm effect occurs A. during the spring months. B. during the summer months. C. in December. D. in January. E. randomly. Much of the so-called small firm effect simply may be the tax-effect as investors sell stocks on which they have losses in December and reinvest the funds in January. As small firms are especially volatile, these actions affect small firms in a more dramatic fashion. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Markets 11-27 Chapter 11 - The Efficient Market Hypothesis 19. Basu (1977, 1983) found that firms with low P/E ratios A. earned higher average returns than firms with high P/E ratios. B. earned the same average returns as firms with high P/E ratios. C. earned lower average returns than firms with high P/E ratios. D. had higher dividend yields than firms with high P/E ratios. E. None of these are correct. Firms with high P/E ratios already have an inflated price relative to earnings and thus tend to have lower returns than low P/E ratio stocks. However, the P/E ratio may capture risk not fully impounded in market betas so this may represent an appropriate risk adjustment rather than a market anomaly. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Markets 20. Basu (1977, 1983) found that firms with high P/E ratios A. earned higher average returns than firms with low P/E ratios. B. earned the same average returns as firms with low P/E ratios. C. earned lower average returns than firms with low P/E ratios. D. had higher dividend yields than firms with low P/E ratios. E. None of these are correct. Firms with high P/E ratios already have an inflated price relative to earnings and thus tend to have lower returns than low P/E ratio stocks. However, the P/E ratio may capture risk not fully impounded in market betas so this may represent an appropriate risk adjustment rather than a market anomaly. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Markets 11-28 Chapter 11 - The Efficient Market Hypothesis 21. Jaffe (1974) found that stock prices _________ after insiders intensively bought shares. A. decreased B. did not change C. increased D. became extremely volatile E. became much less volatile Insider trading may signal private information. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Efficient Markets 22. Jaffe (1974) found that stock prices _________ after insiders intensively sold shares. A. decreased B. did not change C. increased D. became extremely volatile E. became much less volatile Insider trading may signal private information. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Efficient Markets 11-29 Chapter 11 - The Efficient Market Hypothesis 23. Banz (1981) found that, on average, the risk-adjusted returns of small firms A. were higher than the risk-adjusted returns of large firms. B. were the same as the risk-adjusted returns of large firms. C. were lower than the risk-adjusted returns of large firms. D. were unrelated to the risk-adjusted returns of large firms. E. were negative. Banz found A to be true, although subsequent studies have attempted to explain the small firm effect as the January effect, the neglected firm effect, etc. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Efficient Markets 24. Banz (1981) found that, on average, the risk-adjusted returns of large firms A. were higher than the risk-adjusted returns of small firms. B. were the same as the risk-adjusted returns of small firms. C. were lower than the risk-adjusted returns of small firms. D. were unrelated to the risk-adjusted returns of small firms. E. were negative. Banz found A to be true, although subsequent studies have attempted to explain the small firm effect as the January effect, the neglected firm effect, etc. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Efficient Markets 11-30 Chapter 11 - The Efficient Market Hypothesis 25. Proponents of the EMH think technical analysts A. should focus on relative strength. B. should focus on resistance levels. C. should focus on support levels. D. should focus on financial statements. E. are wasting their time. Technical analysts attempt to predict future stock prices from historic stock prices; proponents of EMH believe that stock price changes are random variables. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Implications of the EMH 26. Studies of positive earnings surprises have shown that there is A. a positive abnormal return on the day positive earnings surprises are announced. B. a positive drift in the stock price on the days following the earnings surprise announcement. C. a negative drift in the stock price on the days following the earnings surprise announcement. D. both a positive abnormal return on the day positive earnings surprises are announced and a positive drift in the stock price on the days following the earnings surprise announcement. E. both a positive abnormal return on the day positive earnings surprises are announced and a negative drift in the stock price on the days following the earnings surprise announcement. The market appears to adjust to earnings information gradually, resulting in a sustained period of abnormal returns. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Markets 11-31 Chapter 11 - The Efficient Market Hypothesis 27. Studies of negative earnings surprises have shown that there is A. a negative abnormal return on the day negative earnings surprises are announced. B. a positive drift in the stock price on the days following the earnings surprise announcement. C. a negative drift in the stock price on the days following the earnings surprise announcement. D. both a negative abnormal return on the day negative earnings surprises are announced and a positive drift in the stock price on the days following the earnings surprise announcement. E. both a negative abnormal return on the day negative earnings surprises are announced and a negative drift in the stock price on the days following the earnings surprise announcement. The market appears to adjust to earnings information gradually, resulting in a sustained period of abnormal returns. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Markets 28. Studies of stock price reactions to news are called A. reaction studies. B. event studies. C. drift studies. D. both reaction studies and drift studies. E. both event studies and drift studies. Studies of stock price reactions to news are called event studies. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Event Studies 11-32 Chapter 11 - The Efficient Market Hypothesis 29. On November 22, 2009 the stock price of WalMart was $39.50 and the retailer stock index was 600.30. On November 25, 2009 the stock price of WalMart was $40.25 and the retailer stock index was 605.20. Consider the ratio of WalMart to the retailer index on November 22 and November 25. WalMart is _______ the retail industry and technical analysts who follow relative strength would advise _______ the stock. A. outperforming, buying B. outperforming, selling C. underperforming, buying D. underperforming, selling E. equally performing, neither buying nor selling 11/22: $39.50/600.30 = 0.0658; 11/25: $40.25/605.20 = 0.0665; Thus, WalMart's relative strength is improving and technicians using this technique would recommend buying. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Implications of the EMH 30. Work by Amihud and Mendelson (1986, 1991) A. argues that investors will demand a rate of return premium to invest in less liquid stocks. B. may help explain the small firm effect. C. may be related to the neglected firm effect. D. may help explain the small firm effect and may be related to the neglected firm effect. E. argues that investors will demand a rate of return premium to invest in less liquid stocks, may help explain the small firm effect, and may be related to the neglected firm effect. Lack of liquidity may affect the returns of small and neglected firms; however the theory does not explain why the abnormal returns are concentrated in January. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Markets 11-33 Chapter 11 - The Efficient Market Hypothesis 31. Fama and French (1992) found that the stocks of firms within the highest decile of bookto-market ratios had average monthly returns of _______ while the stocks of firms within the lowest decile of book-to-market ratios had average monthly returns of________. A. greater than 1%, greater than 1% B. greater than 1%, less than 1% C. less than 1%, greater than 1% D. less than 1%, less than 1% E. less than 0.5%, greater than 0.5% This finding suggests either that low book-to-market ratio firms are relatively overpriced, or that the book-to-market ratio is serving as a proxy for a risk factor that affects expected equilibrium returns. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Efficient Markets 32. A market decline of 23% on a day when there is no significant macroeconomic event ______ consistent with the EMH because ________. A. would be, it was a clear response to macroeconomic news B. would be, it was not a clear response to macroeconomic news C. would not be, it was a clear response to macroeconomic news D. would not be, it was not a clear response to macroeconomic news E. None of these are correct. This happened on October 19, 1987. Although this specific event is not mentioned in this edition of the book, it is an example of something that would be considered a violation of the EMH. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Markets 11-34 Chapter 11 - The Efficient Market Hypothesis 33. In an efficient market, __________. A. security prices react quickly to new information B. security prices are seldom far above or below their justified levels C. security analysis will not enable investors to realize superior returns consistently D. one cannot make money E. security prices react quickly to new information, are seldom far above or below their justified levels, and security analysis will not enable investors to realize superior returns consistently Security prices react quickly to new information, security prices are seldom far above or below their justified levels, and security analysis will not enable investors to realize superior returns consistently; however, even in an efficient market one should be able to earn the appropriate risk-adjusted rate of return. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Efficient Market Hypothesis 34. The weak form of the efficient market hypothesis asserts that A. stock prices do not rapidly adjust to new information contained in past prices or past data. B. future changes in stock prices cannot be predicted from past prices. C. technicians cannot expect to outperform the market. D. stock prices do not rapidly adjust to new information contained in past prices or past data and future changes in stock prices cannot be predicted from past prices E. future changes in stock prices cannot be predicted from past prices and technicians cannot expect to outperform the market The weak form of the efficient market hypothesis asserts that future changes in stock prices cannot be predicted from past prices; therefore, technicians cannot expect to outperform the market. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Efficient Market Hypothesis 11-35 Chapter 11 - The Efficient Market Hypothesis 35. A support level is the price range at which a technical analyst would expect the A. supply of a stock to increase dramatically. B. supply of a stock to decrease substantially. C. demand for a stock to increase substantially. D. demand for a stock to decrease substantially. E. price of a stock to fall. A support level is considered to be a level below that the price of the stock is unlikely to fall and is believed to be determined by market psychology. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Implications of the EMH 36. A finding that _________ would provide evidence against the semistrong form of the efficient market theory. A. low P/E stocks tend to have positive abnormal returns B. trend analysis is worthless in determining stock prices C. one can consistently outperform the market by adopting the contrarian approach exemplified by the reversals phenomenon D. low P/E stocks tend to have positive abnormal returns and trend analysis is worthless in determining stock prices E. low P/E stocks tend to have positive abnormal returns and one can consistently outperform the market by adopting the contrarian approach exemplified by the reversals phenomenon Both low P/E stocks tending to have positive abnormal returns and the ability to consistently outperform the market by adopting the contrarian approach exemplified by the reversals phenomenon are inconsistent with the semistrong form of the EMH. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Market Hypothesis 11-36 Chapter 11 - The Efficient Market Hypothesis 37. The weak form of the efficient market hypothesis contradicts A. technical analysis, but supports fundamental analysis as valid. B. fundamental analysis, but supports technical analysis as valid. C. both fundamental analysis and technical analysis. D. technical analysis, but is silent on the possibility of successful fundamental analysis. E. None of these is correct. The weak form of the efficient market hypothesis contradicts technical analysis, but is silent on the possibility of successful fundamental analysis. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Market Hypothesis 38. Two basic assumptions of technical analysis are that security prices adjust A. rapidly to new information and market prices are determined by the interaction of supply and demand. B. rapidly to new information and liquidity is provided by security dealers. C. gradually to new information and market prices are determined by the interaction of supply and demand. D. gradually to new information and liquidity is provided by security dealers. E. rapidly to information and to the actions of insiders. Technicians follow market data such as price changes and volume of trading (as indicator of supply and demand) believing that they can identify price trends as security prices adjust gradually. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Implications of the EMH 11-37 Chapter 11 - The Efficient Market Hypothesis 39. Cumulative abnormal returns (CAR) A. are used in event studies. B. are better measures of security returns due to firm-specific events than are abnormal returns (AR). C. are cumulated over the period prior to the firm-specific event. D. are used in event studies and are better measures of security returns due to firm-specific events than are abnormal returns (AR). E. are used in event studies and are cumulated over the period prior to the firm-specific event. As leakage of information occurs, the accumulated abnormal returns that are abnormal returns summed over the period of interest (around the event date) are better measures of the effect of firm-specific events. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Event Studies 40. Studies of mutual fund performance A. indicate that one should not randomly select a mutual fund. B. indicate that historical performance is not necessarily indicative of future performance. C. indicate that the professional management of the fund insures above market returns. D. indicates both that one should not randomly select a mutual fund and that historical performance is not necessarily indicative of future performance. E. indicate both that historical performance is not necessarily indicative of future performance and that the professional management of the fund insures above market returns. Studies show that, in general, funds do not outperform the market and that historical performance is not necessarily an indicator of future performance. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Mutual Fund/Analyst Performance 11-38 Chapter 11 - The Efficient Market Hypothesis 41. The likelihood of an investment newsletter's successfully predicting the direction of the market for three consecutive years by chance should be A. between 50% and 70%. B. between 25% and 50%. C. between 10% and 25%. D. less than 10%. E. greater than 70%. The probability of successful prediction for 3 consecutive years is 12.5%. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Mutual Fund/Analyst Performance 42. In an efficient market the correlation coefficient between stock returns for two nonoverlapping time periods should be A. positive and large. B. positive and small. C. zero. D. negative and small. E. negative and large. In an efficient market there should be no serial correlation between returns from nonoverlapping periods. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Efficient Market Hypothesis 11-39 Chapter 11 - The Efficient Market Hypothesis 43. The weather report says that a devastating and unexpected freeze is expected to hit Florida tonight, during the peak of the citrus harvest. In an efficient market one would expect the price of Florida Orange's stock to A. drop immediately. B. remain unchanged. C. increase immediately. D. gradually decline for the next several weeks. E. gradually increase for the next several weeks. In an efficient market the price of the stock should drop immediately when the bad news is announced. If later news changes the perceived impact to Florida Orange, the price may once again adjust quickly to the new information. A gradual change is a violation of the EMH. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Event Studies 44. Matthews Corporation has a beta of 1.2. The annualized market return yesterday was 13%, and the risk-free rate is currently 5%. You observe that Matthews had an annualized return yesterday of 17%. Assuming that markets are efficient, this suggests that A. bad news about Matthews was announced yesterday. B. good news about Matthews was announced yesterday. C. no news about Matthews was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. AR = 17% − (5% + 1.2 (8%)) = +2.4%. A positive abnormal return suggests that there was firm-specific good news. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Event Studies 11-40 Chapter 11 - The Efficient Market Hypothesis 45. Nicholas Manufacturing just announced yesterday that its fourth quarter earnings will be 10% higher than last year's fourth quarter. You observe that Nicholas had an abnormal return of −1.2% yesterday. This suggests that A. the market is not efficient. B. Nicholas' stock will probably rise in value tomorrow. C. investors expected the earnings increase to be larger than what was actually announced. D. investors expected the earnings increase to be smaller than what was actually announced. E. earnings are expected to decrease next quarter. Anticipated earnings changes are impounded into a security's price as soon as expectations are formed. Therefore a negative market response indicates that the earnings surprise was negative, that is, the increase was less than anticipated. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Event Studies 46. When Maurice Kendall first examined stock price patterns in 1953, he found that A. certain patterns tended to repeat within the business cycle. B. there were no predictable patterns in stock prices. C. stocks whose prices had increased consistently for one week tended to have a net decrease the following week. D. stocks whose prices had increased consistently for one week tended to have a net increase the following week. E. the direction of change in stock prices was unpredictable, but the amount of change followed a distinct pattern. The first studies in this area were made possible by the development of computer technology. Kendall's study was the first to indicate that markets were efficient. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Implications of the EMH 11-41 Chapter 11 - The Efficient Market Hypothesis 47. If stock prices follow a random walk A. it implies that investors are irrational. B. it means that the market cannot be efficient. C. price levels are not random. D. price changes are random. E. price movements are predictable. A random walk means that the changes in prices are random and independent. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Efficient Market Hypothesis 48. The main difference between the three forms of market efficiency is that A. the definition of efficiency differs. B. the definition of excess return differs. C. the definition of prices differs. D. the definition of information differs. E. they were discovered by different people. The main difference is that weak form encompasses only historical data, semistrong form encompasses historical data and current public information, and strong form encompasses historical data, current public information, and inside information. All of the other definitions remain the same. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Market Hypothesis 11-42 Chapter 11 - The Efficient Market Hypothesis 49. Chartists practice A. technical analysis. B. fundamental analysis. C. regression analysis. D. insider analysis. E. psychoanalysis. Chartist is another name for a technical analyst. AACSB: Analytic Bloom's: Understand Difficulty: Basic Topic: Implications of the EMH 50. Which of the following are used by fundamental analysts to determine proper stock prices? I) trendlines II) earnings III) dividend prospects IV) expectations of future interest rates V) resistance levels A. I, IV, and V B. I, II, and III C. II, III, and IV D. II, IV, and V E. All five items are used by fundamental analysts. Fundamental analysts look at factors such as earnings, dividend prospects, expectation of future interest rates, and risk of the firm. The information is used to determine the present value of future cash flows to stockholders. Technical analysts use trendlines and resistance levels. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Implications of the EMH 11-43 Chapter 11 - The Efficient Market Hypothesis 51. Which of the following are used by technical analysts to determine proper stock prices? I) trendlines II) earnings III) dividend prospects IV) expectations of future interest rates V) resistance levels A. I and V B. I, II, and III C. II, III, and IV D. II, IV, and V E. I and II Fundamental analysts look at factors such as earnings, dividend prospects, expectation of future interest rates, and risk of the firm. The information is used to determine the present value of future cash flows to stockholders. Technical analysts use trendlines and resistance levels. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Implications of the EMH 52. According to proponents of the efficient market hypothesis, the best strategy for a small investor with a portfolio worth $40,000 is probably to A. perform fundamental analysis. B. exploit market anomalies. C. invest in Treasury securities. D. invest in derivative securities. E. invest in mutual funds. Individual investors tend to have relatively small portfolios and are usually unable to realize economies of size. The best strategy is to pool funds with other small investors and allow professional managers to invest the funds. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Mutual Fund/Analyst Performance 11-44 Chapter 11 - The Efficient Market Hypothesis 53. Which of the following are investment superstars who have consistently shown superior performance? I) Warren Buffet II) Phoebe Buffet III) Peter Lynch IV) Merrill Lynch V) Jimmy Buffet A. I, III, and IV B. II, III, and IV C. I and III D. III and IV E. I, III, IV, and V Warren Buffet manages Berkshire Hathaway and Peter Lynch managed Fidelity's Magellan Fund. Phoebe Buffet is a character on NBC's "Friends" and Jimmy Buffet is "Wasting Away in Margaritaville." Merrill Lynch isn't a person. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Mutual Fund/Analyst Performance 54. Google has a beta of 1.0. The annualized market return yesterday was 11%, and the riskfree rate is currently 5%. You observe that Google had an annualized return yesterday of 14%. Assuming that markets are efficient, this suggests that A. bad news about Google was announced yesterday. B. good news about Google was announced yesterday. C. no news about Google was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. AR = 14% − (5% + 1.0 (6%)) = +3.0%. A positive abnormal return suggests that there was firm-specific good news. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 11-45 Chapter 11 - The Efficient Market Hypothesis 55. Music Doctors has a beta of 2.25. The annualized market return yesterday was 12%, and the risk-free rate is currently 4%. You observe that Music Doctors had an annualized return yesterday of 15%. Assuming that markets are efficient, this suggests that A. bad news about Music Doctors was announced yesterday. B. good news about Music Doctors was announced yesterday. C. no news about Music Doctors was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. AR = 15% − (4% + 2.25 (8%)) = −7.0%. A negative abnormal return suggests that there was firm-specific bad news. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 56. QQAG has a beta of 1.7. The annualized market return yesterday was 13%, and the riskfree rate is currently 3%. You observe that QQAG had an annualized return yesterday of 20%. Assuming that markets are efficient, this suggests that A. bad news about QQAG was announced yesterday. B. good news about QQAG was announced yesterday. C. no significant news about QQAG was announced yesterday. D. interest rates rose yesterday. E. interest rates fell yesterday. AR = 20% − (3% + 1.7 (10%)) = 0.0%. A positive abnormal return suggests that there was firm-specific good news and a negative abnormal return suggests that there was firm-specific bad news. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 11-46 Chapter 11 - The Efficient Market Hypothesis 57. QQAG just announced yesterday that its fourth quarter earnings will be 35% higher than last year's fourth quarter. You observe that QQAG had an abnormal return of −1.7% yesterday. This suggests that A. the market is not efficient. B. QQAG stock will probably rise in value tomorrow. C. investors expected the earnings increase to be larger than what was actually announced. D. investors expected the earnings increase to be smaller than what was actually announced. E. earnings are expected to decrease next quarter. Anticipated earnings changes are impounded into a security's price as soon as expectations are formed. Therefore a negative market response indicates that the earnings surprise was negative, that is, the increase was less than anticipated. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 58. LJP Corporation just announced yesterday that it would undertake an international joint venture. You observe that LJP had an abnormal return of 3% yesterday. This suggests that A. the market is not efficient. B. LJP stock will probably rise in value again tomorrow. C. investors view the international joint venture as bad news. D. investors view the international joint venture as good news. E. earnings are expected to decrease next quarter. The positive abnormal return suggests that investors view the international joint venture as good news. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 11-47 Chapter 11 - The Efficient Market Hypothesis 59. Music Doctors just announced yesterday that its first quarter sales were 35% higher than last year's first quarter. You observe that Music Doctors had an abnormal return of −2% yesterday. This suggests that A. the market is not efficient. B. Music Doctors stock will probably rise in value tomorrow. C. investors expected the sales increase to be larger than what was actually announced. D. investors expected the sales increase to be smaller than what was actually announced. E. earnings are expected to decrease next quarter. The negative abnormal return suggests that investors expected the sales increase to be larger than what was actually announced. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 60. The Food and Drug Administration (FDA) just announced yesterday that they would approve a new cancer-fighting drug from King. You observe that King had an abnormal return of 0% yesterday. This suggests that A. the market is not efficient. B. King stock will probably rise in value tomorrow. C. King stock will probably fall in value tomorrow. D. the approval was already anticipated by the market. E. None of these is correct. The approval was already anticipated by the market. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Event Studies 11-48 Chapter 11 - The Efficient Market Hypothesis 61. Your professor finds a stock-trading rule that generates excess risk-adjusted returns. Instead of publishing the results, she keeps the trading rule to herself. This is most closely associated with ________. A. regret avoidance B. selection bias C. framing D. insider trading E. None of these is correct. This is an example of selection bias. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 62. At freshman orientation, 1,500 students are asked to flip a coin 20 times. One student is crowned the winner (tossed 20 heads). This is most closely associated with ________. A. regret avoidance B. selection bias C. overconfidence D. the lucky event issue E. None of these is correct. This is an example of the lucky event issue. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 11-49 Chapter 11 - The Efficient Market Hypothesis 63. Sehun (1986) finds that the practice of monitoring insider trade disclosures, and trading on that information, would be ________. A. extremely profitable for long-term traders B. extremely profitable for short-term traders C. marginally profitable for long-term traders D. marginally profitable for short-term traders E. not sufficiently profitable to cover trading costs Answer E; not sufficiently profitable to cover trading costs. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Efficient Markets 64. If you believe in the reversal effect, you should A. sell bonds in this period if you held stocks in the last period. B. sell stocks in this period if you held bonds in the last period. C. sell stocks this period that performed well last period. D. go long. E. sell stocks this period that performed well last period and go long The reversal effect states that stocks that do well in one period tend to perform poorly in the subsequent period, and vice versa. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Efficient Markets 11-50 Chapter 11 - The Efficient Market Hypothesis 65. Patell and Woflson (1984) report that most of the stock price response to corporate dividend or earnings announcements occurs within ____________ of the announcement. A. 10 minutes B. 45 minutes C. 2 hours D. 4 hours E. 2 trading days The correct answer is 10 minutes. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Efficient Markets Short Answer Questions 11-51 Chapter 11 - The Efficient Market Hypothesis 66. Discuss the various forms of market efficiency. Include in your discussion the information sets involved in each form and the relationships across information sets and across forms of market efficiency. Also discuss the implications for the various forms of market efficiency for the various types of securities' analysts. The weak form of the efficient markets hypothesis (EMH) states that stock prices immediately reflect market data. Market data refers to stock prices and trading volume. Technicians attempt to predict future stock prices based on historic stock price movements. Thus, if the weak form of the EMH holds, the work of the technician is of no value. The semistrong form of the EMH states that stock prices include all public information. This public information includes market data and all other publicly available information, such as financial statements, and all information reported in the press relevant to the firm. Thus, market information is a subset of all public information. As a result, if the semistrong form of the EMH holds, the weak form must hold also. If the semistrong form holds, then the fundamentalist, who attempts to identify undervalued securities by analyzing public information, is unlikely to do so consistently over time. In fact, the work of the fundamentalist may make the markets even more efficient! The strong form of the EMH states that all information (public and private) is immediately reflected in stock prices. Public information is a subset of all information, thus if the strong form of the EMH holds, the semistrong form must hold also. The strong form of EMH states that even with inside (legal or illegal) information, one cannot expect to outperform the market consistently over time. Studies have shown the weak form to hold when transactions costs are considered. Studies have shown the semistrong form to hold in general, although some anomalies have been observed. Studies have shown that some insiders (specialists, major shareholders, major corporate officers) do outperform the market. Feedback: The purpose of this question is to assure that the student understands the interrelationships across different forms of the EMH, across the information sets, and the implications of each form for different types of analysts. AACSB: Reflective Thinking Bloom's: Analyze Difficulty: Intermediate Topic: Efficient Market Hypothesis 11-52 Chapter 11 - The Efficient Market Hypothesis 67. What is an event study? It is a test of what form of market efficiency? Discuss the process of conducting an event study, including the best variable(s) to observe as tests of market efficiency. A event study is an empirical test which allows the researcher to assess the impact of a particular event on a firm's stock price. To do so, one often uses the index model and estimates et, the residual term which measures the firm-specific component of the stock's return. This variable is the difference between the return the stock would ordinarily earn for a given level of market performance and the actual rate of return on the stock. This measure is often referred to as the abnormal return of the stock. However, it is very difficult to identify the exact point in time that an event becomes public information; thus, the better measure is the cumulative abnormal return, which is the sum of abnormal returns over a period of time (a window around the event date). This technique may be used to study the effect of any public event on a firm's stock price; thus, this technique is a test of the semistrong form of the EMH. Feedback: The rationale for this question is to ascertain if the student understands the methodology most commonly used as a test of the semistrong form of market efficiency. AACSB: Reflective Thinking Bloom's: Analyze Difficulty: Challenge Topic: Event Studies 11-53 Chapter 11 - The Efficient Market Hypothesis 68. Discuss the small firm effect, the neglected firm effect, and the January effect, the tax effect and how the four effects may be related. Studies have shown that small firms earn a risk-adjusted rate of return greater than that of larger firms. Additional studies have shown that firms that are not followed by analysts (neglected firms) also have a risk-adjusted return greater than that of larger firms. However, the neglected firms tend to be small firms; thus, the neglected firm effect may be a manifestation of the small firm effect. Finally, studies have shown that returns in January tend to be higher than in other months of the year. This effect has been shown to persist consistently over the years. However, the January effect may be the tax effect, as investors may have sold stocks with losses in December for tax purposes and reinvested in January. Small firms (and neglected firms) would tend to be more affected by this increased buying than larger firms, as small firms tend to sell for lower prices. Feedback: The purpose of this question is to reinforce the interrelationships, that "effects" may not always be independent and thus readily identifiable. In addition, these effects are widely discussed in the financial press, and the January effect appears to be quite persistent. AACSB: Reflective Thinking Bloom's: Analyze Difficulty: Intermediate Topic: Efficient Markets 11-54 Chapter 11 - The Efficient Market Hypothesis 69. Why might the degree of market efficiency differ across various markets? State three reasons why this might occur and explain each reason briefly. 1. Market efficiency depends on information being essentially free and costless to market participants. In the U.S. this is the case to a large extent. The U.S. markets are well developed and professional analysts often follow securities. Information is available on television, in the press, and on the Internet. The opposite may be true in other markets, such as those of developing countries, where there are fewer or no analysts and few market participants with these resources. 2. Accounting disclosure requirements are different across markets. In the U.S. firms must meet SEC requirements to be publicly traded. In other countries the requirements may be different or nonexistent. This has implications about the ease with which analysts can evaluate the company to determine its proper value. 3. Markets for "neglected" stocks may be less efficient than markets for stocks that are heavily followed by analysts. If analysts feel that it is not worthwhile to give their attention to particular stocks then ample information about these stocks will not be readily available to investors. Feedback: This question leads the student to look at some of the fundamental reasons for market efficiency and why there may be differences among markets with regard to the reasons. Alternative answers are possible. AACSB: Reflective Thinking Bloom's: Analyze Difficulty: Intermediate Topic: Efficient Markets 11-55 Chapter 11 - The Efficient Market Hypothesis 70. With regard to market efficiency, what is meant by the term "anomaly"? Give three examples of market anomalies and explain why each is considered to be an anomaly. Anomalies are patterns that should not exist if the market is truly efficient. Investors might be able to make abnormal profits by exploiting the anomalies, which doesn't make sense in an efficient market. Possible examples include, but are not limited to, the following. The small-firm effect—average annual returns are consistently higher for small-firm portfolios, even when adjusted for risk by using the CAPM. The January effect—the small-firm effect occurs virtually entirely in January. The neglected-firm effect—small firms tend to be ignored by large institutional traders and stock analysts. This lack of monitoring makes them riskier and they earn higher risk-adjusted returns. The January effect is largest for neglected firms. The liquidity effect—investors demand a return premium to invest in less-liquid stocks. This is related to the small-firm effect and the neglected-firm effect. These stocks tend to earn high risk-adjusted rates of return. Book-to-market ratios—firms with the higher book-to-market-value ratios have higher riskadjusted returns, suggesting that they are underpriced. When combined with the firm-size factor, this ratio explained returns better than systematic risk as measured by beta. The reversal effect—stocks that have performed best in the recent past seem to underperform the rest of the market in the following periods, and vice versa. Other studies indicated that this effect might be an illusion. These studies used portfolios formed mid-year rather than in December and considered the liquidity effect. Investors should not be able to earn excess returns by taking advantage of any of these. The market should adjust prices to their proper levels. But these things have been documented to occur repeatedly. Feedback: This question tests whether the student grasps the basic concept of anomalies and allows some choice in explaining some of them. AACSB: Reflective Thinking Bloom's: Analyze Difficulty: Intermediate Topic: Efficient Markets 11-56