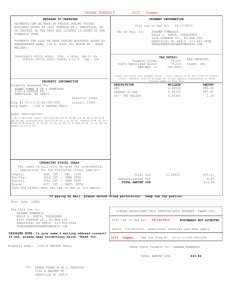

Treasurer Information

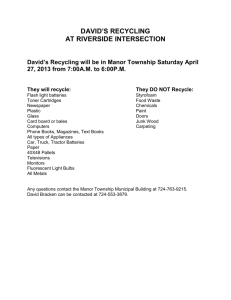

advertisement

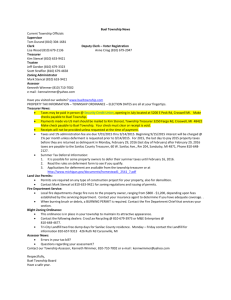

TREASURER - Luana J Fuller 3805 Bell Oak Road - Williamston, Michigan 48895 517-468-3405 - Fax: 517-468-0105 Email: locketwptreas@tds.net · Summer tax bills are mailed the first week in July and are due September 14 th. Unpaid Summer taxes are charged 1% interest on September 15th, and the 1st of every month thereafter until paid Winter tax bills are mailed the first week of December, and are due on February 14th. Winter taxes are determined late after February 14th. The Township Board assesses a 3% penalty on unpaid taxes after February 14th thru the last day of February. Due dates will be extended to the next business day when they occur on either a Saturday, Sunday or Holiday. Please CHECK for the due date on every tax bill as it may change from year to year, or call the Township offices. The Township does not recognize “POST MARKS” AS THE DATE TAX PAYMENTS ARE RECEIVED. If you are mailing your payment, allow time for your payment to reach our office before the due date. If you haven’t received your respective season tax bill by the second week of July, or the second week of December, please call or contact the Township office as soon as possible to receive a duplicate copy. If your mortgage company is listed on your tax bill, a copy has been sent to them, however, it is still the property owners responsibility to make sure the taxes due are paid on time. Property taxes may be paid by mail or at the township office on Tuesday and Thursday. The Township Treasurer cannot accept payment of real estate property taxes, after the last day of February. On March 1st the delinquent roll is turned over to Ingham County Treasurer and taxes can be mailed or paid there. Please call the Ingham County Treasurer (517-676-7220) to get the amount of your unpaid taxes before sending in your check. Principals Residence Exemption Affidavits (PRE) must be filed with the Township Assessor by June 1st. However, if any of the school operating tax is levied on the winter bill, the homeowner has until November 1st to file and be eligible for the Homestead Exemption. · The Taxable Value of your property is set by formula and the Township Supervisor/Assessor, and is reported annually to you by the Assessment Change Notice which is mailed to you in late February. If you do not agree with your assessment, you will need to make a request to the Board of Review to change it. Contact the Township Supervisor/Assessor as soon as possible, the Board of Review convenes early in March to hear such requests. ** Summer deferment forms can be found on the Township Website under forms.