"The Impact of Globalization on Argentina and the Southern Cone"

advertisement

1

"The Impact of Globalization in Latin America"

IES - Buenos Aires, 2006

DESCRIPTION: An in-depth analysis of the globalization process and its effects on

regional markets, regional economic integration and free trade pacts. US and

European business strategies for the Latin American markets.

INSTRUCTOR: Marcelo Simon (MBA, Pace University NY, USA; MS, BS in

Industrial Engineering, Instituto Tecnológico de Buenos Aires, Buenos Aires,

Argentina)

METHOD OF PRESENTATION: Lectures, discussions, writing assignments and

visits to business and economic institutions.

LANGUAGE OF INSTRUCTION: English

REQUIRED WORK AND FORM OF ASSESSMENT: Class participation (20%);

weekly reports (10%); mid-term exam (25%); final report (15%); and final exam (30%).

REQUIRED READINGS:

- "The Impact of Globalization in Latin America" (M. Simon, January 2006)

RECOMMENDED READINGS:

- The Competitive Advantage of Nations by Michael Porter (Free Press, June 1998).

- Globalization and Its Discontents, 1st edition, by Joseph E. Stiglitz (W.W. Norton &

Company, June 2002).

- The clash of civilizations by Samuel Huntington (Touchstone Books; January 1998)

1

2

COURSE CONTENTS

(Divided in 25 class sessions of 1.5 hours each one)

Classes 1 and 2:

1 - Introduction

- Argentina today

Classes 3 to 5:

2. Historical processes towards the current Latin American political division

-

Spanish and Portuguese on the advanced guard in the conquest of America

Initial conquering methodology

The Viceroyalties

Audiencias

Maps

Some comments on colonial Administration

Brief history of the emancipation of Spanish and Portuguese colonies in America

A more detailed explanation on the countries’ national histories

The Independence process in Peru, Bolivia, Chile, Paraguay, Argentina and Uruguay

The Congress of Panama of 1826

Brief additional historical information of some Southern Cone countries

Latin America - U.S. RELATIONS (By Warren Dean)

Class 6:

3. Economic, demographic, and Social Highlights of the region

-

Selected Latin American Countries Economic Briefs

Race diversity

Human Development

Educational deficits and gaps in the region

Globalization and employment

Social protection

The social agenda

Class 7

4. Integration processes in the region

-

Sub-regional integration schemes and intra-regional free trade agreements

Macroeconomic Indicators Mercosur

Class 8:

5. Globalization: A historical and multidimensional perspective

-

The globalization process

Non economic dimensions of globalization

Opportunities and risks arising from globalization

Class 9

6. The economic dimension of Globalization

-

International trade and investment

International finance and the macroeconomic regime

International migration

International mobility of several chosen factors

2

3

Class 10:

7. Inequalities and asymmetries in the global order

-

Inequalities in global income distribution

Basic Asymmetries in the global order

Class 11

8. An agenda for the global order

-

Fundamental principles for the construction of a better global order

National strategies for dealing with globalization

The key role of action at the regional level

The global agenda

Class 12:

9. External vulnerability and macroeconomic policy

-

Composition of external financing and vulnerability

Globalization and real macroeconomic instability

The domestic domain: offsetting volatility through countercyclical Macro- economic

policies

The international domain: strengthening the governance of financial globalization.

Class 13: Mid-term

Class 14

10. Globalization and environmental sustainability

-

The impact of productive restructuring on sustainable development

Changes in the production structure and their effects on environmental sustainability

Economic globalization and the environment

Classes 15 and 16:

11. The Latin America agenda for trade and investment

-

The national agenda

The regional agenda

The international agenda

Classes 17 and 18:

12. Michael Porter's Competitive Advantage

-

Competitive Strategy

Competitive Advantage

The Competitive Advantage of Nations

Class 19 and 20:

13. The integration of Latam in global trade and production systems

-

Trade specialization in Latam

Investment flows and different corporate strategies being used in the region

Class 21:

14. FDI Today

-

Regional Panorama

Panorama for the different strategies, agents and modalities of FDI’s in latam

3

4

Classes 22 and 23

15. Argentina: FDI and Corporate strategies

-

Foreign Capital in the Argentine Economy

Strategies of MNCs in Argentina

Class 24

Course’s wrap up, debate, delivery and presentation of Final Reports

Class 25

Final test

CHRONOGRAM

Classes 1 - 2

Class 3-5

Class 6

Class 7

Class 8

Class 9

Class10

Class 11

Class 12

Class 13

Class 14

Classes 15 - 16

Classes 17 - 18

Classes 19 - 20

Class 21

Classes 22 - 23

Class 24

Class 25

Chapter 1

Chapter 2

Chapter 3

Chapter 4

Chapter 5

Chapter 6

Chapter 7

Chapter 8

Chapter 9

Mid- Term

Chapter 10

Chapter 11

Chapter 12

Chapter 13

Chapter 14

Chapter 15

Wrap up, debate and delivery of Final Rep.

Final Test

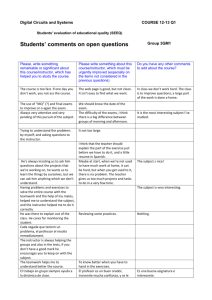

STUDENTS´ WEEKLY REPORTS

The students will deliver a 1 page weekly report about the subjects mentioned below or

about any other subject required by the professor (including translations of some

economic news)

Chapter 2

1. Bolivar and San Martin Summit in Guayaquil

Chapter 3

2. Human Development Index for different sectors of Latam

4

5

Chapter 4

3. A brief description of the S. Huntington´s book “The clash of civilizations”. Identify the

groups of countries of the different cultures and the leader of each one, as described in

the book.

4. The US - CAFTA and the US-Chile Free Trade Agreement

5: The FTAA advancements. The Summit of the Americas, Mar del Plata, Nov. 2005.

Chapter 5

6. The WTO meetings (Doha, Uruguay Rounds and subsequent negotiations)

Chapter 6

7. Definition of balances: trade, current account and payment.

Chapter 7

8. Brief synthesis of Stiglitz concepts in his book: “Globalization and Its Discontents”

Chapter 9

9. The Argentine default.

Chapter 10

10. An update of what is going on with the Kyoto Protocols negotiations.

Chapter 12

11. A comparison between Chilean and Argentine economic evolutions since 1982.

Chapter 15

12. A brief report of a Multinational Company’s performance in Argentina (any one you

choose)

STUDENTS´ FINAL REPORT

All the topics mentioned below, have to be included in this 5-10 page report:

1. What reasons do you identify, after you Argentine experience, which may justify the

comparative economic and politic development lag of the country in comparison with the

USA? (Remember that 100 years both countries had a similar level of economic

development)

2. Your perception of the current Argentine business environment

3. WTO and negotiations taking place: Which are you opinions?

4. Your opinion in relation to the impacts of globalization in Latin America

5. Your opinion on the advantage (disadvantage) of the FTAA (Free Trade Agreement of

the Americas)

6. Your conclusions of this course

5

6

"The Impact of Globalization in Latin America"

IES - Buenos Aires, 2006

Introduction

(Session 1)

In IB 310 "The Impact of Globalization on Argentina and the Southern Cone" we will go

through an in-depth analysis of the globalization process and its effects on regional markets,

regional economic integration and free trade pacts. We will also analyze the business

strategies of US and European companies in the Latin American markets.

We will start with a brief economic background of Argentina and a historical background of the

Latin American region, in order to give the students a basic understanding of the country and

of origin of its current political division. We will then see some economic, political and human

variables of the different countries.

The following stage will be a brief explanation of the Free Trade Agreements that have been

conformed during the last decades, their members and features and the processes towards

new integration agreements within the region and with countries outside the region, such the

case of the FTAA agreement (Free Trade Agreement of The Americas) that is being shaped

among the Nafta and the Latin American countries.

We will analyze the globalization process from a historical point of view, the different periods of

globalization and the main traits of each one of these periods. We will make an economic

analysis of the globalization process, analyze some recommendable strategies at local,

regional and global order, for a better insertion in the globalization process, strategies that may

give the region’s countries the opportunity of increasing their human development, their

standard of living, education, health standards and so forth.

We will briefly analyze the macroeconomic policies and the external vulnerability of the

region’s countries and the environmental consequences of globalization

In the final stage of the course, we will give the students a brief scope of Foreign Direct

Investments (FDIs) in the region, the strategies that have been applied by Transnational

Companies (TNCs)and a brief update of nowadays’ foreign investments.

During the course, the students will prepare research papers on different subjects that will give

them a better understanding of globalization and the region.

The present report is the basic bibliography for the course, even though there several

recommended books listed in the course’s syllabus that may help the students to strengthen

their understanding of the effects of the globalization process in the region.

6

7

1. Argentina Today

(Classes 1 and 2)

We are going to make a brief synthesis of the background and the current economic and political

situation of the country.

1. I. Background

Argentina has not been institutionally stable for the last 70 years, since the military coup d’etat of

J.E. Uriburu of 1930 that ousted radical president Hipólito Yrigoyen. Since then, a succession of

conservative governments (at the beginning), radicals, peronists, and basically military, took

place until 1983, when democracy was finally reinstalled.

Once among the world's most prosperous economies, Argentina experienced slow

economic growth from the 1940s. From the 7th per capita GNP worldwide and the 50 % of

total South American GNP enjoyed in 1920, those values have descended to the 40th and

less than 10 % at the present time.

Foreign debt growth path: The evolution of the country’s foreign debt is the following:

By the end of Isabel Perón’s government

The military

Radicals

Menem

De La Rua

Default in December 2001

KIrchner after default negotiations

u$s 5.8 billion (1976)

u$s 50 B (1983);

u$s 72 B; (1989)

u$s 130 B (1999)

u$s 144 B (2001)

u$s 120/130 B (2006)

1. II. The Alfonsin Presidency (1983/1989)

After 7 years of a military government, Raul Alfonsin (of the UCR, Union Civica Radical) is

named President. During this period, Argentina suffered a long recession. Savings and

investment rates fell from the mid-1970s until 1991. Argentines, responding to the unstable

macroeconomic environment, increasingly saved and invested abroad. Labor productivity fell

and poverty worsened.

This economic performance was traceable to chronic public sector deficits and endemic inflation.

After the return to constitutional democracy in 1983, public demands to control inflation were

translated into four successive stabilization programs. All failed to eradicate inflation, and each

ended in a more virulent inflation than the one preceding it. The main reason for these failures

was the inability of the stabilization programs made in order to diminish the structural

deficit of the public sector

In 1989, after a process of hyperinflation Alfonsin finally resigned (inflation from March

1989 to May 1990: over 5,000 %)

7

8

1. III. The Menem Presidency (1989/1999)

When Argentina's newly elected President, Carlos Menem, in June 1989, the situation was

unstable. The country had passed through a previous hyper-inflationary process (beginnings of

1989)

The convertibility: To achieve stability, a cure for Argentina's endemic inflation and unstable

money was required. Then in 1991, an orthodox currency board was settled. The road began on

April 1, 1991, when Carlos Menem's government installed what was known locally as a

"convertibility system" to rid Argentina of hyperinflation and give the country a confidence shock.

Under the Convertibility Law, the peso and the U.S. dollar both circulated legally at a 1-to-1

exchange rate. The owner of a peso had a property right in a dollar and could freely exercise

that right by converting a peso into a dollar. That redemption pledge was credible because the

central bank was required by law to hold foreign reserves to fully cover its peso liabilities (some

kind of a “gold standard but supported with dollar reserves instead of gold).

Argentina's monetary system from April 1, 1991 to January 6, 2002 was known locally as

convertibility. It was an unusual name for an unusual system. The convertibility system was

not an orthodox currency board. Rather, it was a currency board-like system: a mixture of

currency board and central banking features.

The three defining features of an orthodox currency board are:

-

a fixed exchange rate with its anchor currency,

-

unrestricted convertibility into and out of the anchor currency at the fixed rate, and

-

Net reserves of 100 percent or slightly more of the board's monetary liabilities, held in

foreign assets only.

Under the convertibility system the Banco Central (the Nation’s Federal Reserve) also retained

the power to regulate banks, such as by setting reserve ratios. It was also unofficially a lender of

last resort,

FDIs flows during the 1990s: During Menem’s Presidency and since 1991, the country had 19

consecutive quarters of economic expansion until the Mexican devaluation in December 1994,

known as the “Tequila Effect”, which led to a considerable change in GDP trend. Nevertheless,

the financial roots of the crisis allowed a relatively fast recovery. This new period of growth

lasted 11 quarters, until the Russian devaluation and the Asiatic crisis, accompanied by the

Brazilian devaluation provoked a significant recession, showing once again the vulnerability of

the Argentine economy to external shocks.

FDI (See Graph 1) inflows into Argentina began to increase during the late ‘80s after

decades of economic isolation and gathered a momentum during the ‘90s, reaching a

total amount of about us$ 80 billion during the period 1992-2000, peaking almost us$ 24

billion in 1999 (then 10.4 B in 2000, 2.1 B in 2001. By 2002 FDI decreased to less than 1 billion,

90 % less than the average of the period 1995-2000. By 2005, this amount is growing again)

8

9

During the ‘90s, the argentine government implemented several economic reforms, which

favored FDI inflows:

- The introduction of the convertibility regime with a fixed exchange rate (which

lasted over ten years).

- Privatization of most state owned companies.

- Legislation permitting free capital movements.

Initially, the new owners after privatizations were:

- The state itself (in a small percentage),

- Some local groups

- And multinationals.

In a following stage, companies gradually restructured their capital base, when the foreign

companies bought stakes form local companies.

Privatizations were the main magnet for foreign investment. From 1993 on, when national

YPF Oil Company was finally sold, a shift from privatization to Mergers and Acquisitions

(M&As) of privately-owned companies occurred. During the period 1992 - 2001, over 55% of

FDIs in Argentina corresponded to asset transfers involving “change of hands” rather than new

investment. A great deal of these purchases was done with external borrowing, benefiting from

the international liquidity of that time (non financial sector borrowed over us$ 35 billion during

that period)

9

10

Reasons for the recession and posterior crisis

On the other hand, in the late 90’s, Argentina was hit by a combination of external and domestic

factors:

- Internationally: They include the 1998 Asian crisis, a weakening currency in neighboring

Brazil (making Argentina's exports more uncompetitive in comparison), a global

economic slowdown (reducing demand for exports from Argentina) and a continued weak

capital market (reducing portfolio investments and increasing interest rates on loans).

- Domestically: The Menem administration (1989/1999) had huge fiscal deficits and

continued to borrow in excess. At the same time, the Convertibility Plan had failed to

work properly.

Although de la Rúa (1999/2001) won the 1999 elections as an opponent to Menem's

economic policies, he largely continued the same policies.

1. IV. De La Rua´s Presidency (1999/2001)

De La Rua became President in 1999 as the leader of an alliance between the traditional Party

UCR (Union Cívica Radical) and the Frepaso (Frente Pais Solidario)

When de la Rua’s Presidency started, the country already had two years of economic

recession. Expectations turned strongly negative and the impossibility to restart growth

increased doubts about debt sustainability.

The resignation of the vice-president in October 2000 made things even worse and

weakened in a remarkable way the government. Sovereign risk (as measured by the spread

of Argentine dollar external bonds over those of the US Treasure) showed the first significant

increase from the beginning of De la Rúa government.

In March 2001, in the face of declining market confidence and the failure to meet IMF targets for

the first quarter, the Minister of Economy resigned and another Minister took place for only 20

days and left due to an unsuccessful attempt to lower the fiscal expenditure. Cavallo, who had

been Minister of Economy during President Menem’s first term and was widely known as the

“Father of the Convertibility”, replaced him. All these events had strong implications –in terms of

uncertainty– on the evolution of economic policy and the financial system. These implications

were reflected in a mini bank run in the first quarter of 2001.

Another negative signal for the markets, viewed as a decline in Central Bank

independence, was Cavallo’s replacement of the Central Bank President in April. In June,

the original convertibility had disappeared. In addition, a preferential exchange rate for

commercial transactions was announced, so that Argentina had a dual exchange rate. To all

these events, one must add the fact that for the first time Argentina could not rollover its debt at

a reasonable spread. The deterioration in expectations became generalized, both inside and

outside the country.

Country risk rose sharply and rumors about possible resignations – of the President and

ministers– spread rapidly. In July the second bank run of the year started what turned out to be a

process of no return. The measures taken from that moment on: zero deficits, cuts in salaries

10

11

and pensions, and a Mega-canje (debt exchange), failed to restore confidence and bank

deposits continued to flee, becoming even more severe in November. The response was a set of

restrictions on deposits withdrawal (Corralito) implemented on December 2001

The “Corralito”: Economy Minister Domingo Cavallo introduced restrictions to the

withdrawal of cash from bank deposits (corralito), intending to stop the draining of deposits

that had been taking place throughout 2001 and had reached the point were 25% of all the

money in the banks had been withdrawn. These measures were aimed at controlling the

banking crisis for a period of 90 days, until the exchange of Argentina's public debt could be

completed.

Although people could still use their money via credit cards, checks and other forms of non-cash

payments, the enforcement of these measures caused delays and problems for the general

population and especially for businesses. Massive queues at every bank and growing reports of

political crisis contributed to inflame Argentina's political scenario.

In this context, certain factions of the opposition, as well as interest groups who wanted a

devaluation of the Argentine peso, seized the opportunity to fuel public anger and replace the

government.

The Political aspects of De la Rua´s resignation: In late 2000, a political scandal broke out

when it was reported that the SIDE, Argentina's intelligence service had paid massive bribes to a

number of senators to approve a controversial Labor Reform Act. The head of SIDE, Fernando

de Santibañes, was a personal friend of De la Rúa. The crisis came to a head on October

2000, when Vice President Carlos Álvarez resigned, citing De la Rúa's unwillingness to

tackle corruption.

During March 2001 another crisis finally caused the resignation of all the FrePaSo

Cabinet ministers, leaving President de la Rúa without political support. The

congressional elections of October 2001 were a disaster for the government, which lost

many of its seats in the Senate and the House of Deputies to the Peronists. The election

results marked also a growing unrest within Argentina's voters, who took to cast millions of null

or blank votes. After losing during mid-term elections for congress in October 2001, de la Rúa

pledged to continue his economic policies of austerity, but appeared weaker. When riots broke

out in December, and he failed to obtain the necessary support from the opposition

Peronists, he had no choice but to resign. By December 20 and after a series of riots, De

La Rua finally resigned. Ten days later pay-back installments of the huge Argentine

foreign debt payment (over US$ 140 billion) were defaulted (suspended).

1. V. Presidency of Adolfo Rodriguez Sa (the 8 last days of 2001)

From the first moment, Rodríguez Saá embarked on ambitious projects aimed at giving him

popularity. In his inaugural speech, he announced that Argentina would default on its

foreign debt, an announcement received by rousing applause from the members of

Congress. He then proceeded to announce the issuing of a "third currency" (alongside with the

peso and the dollar) to boost consumption..

After a new social unrest on December, Rodríguez Saá called for a summit of Peronist

governors at the Presidential holiday retreat of Chapadmalal. Of the fourteen Peronist

governors, only five attended. Realizing that he lacked support from his own party, Rodríguez

11

12

Saá returned to his home province to announce his own resignation to the Presidency after

barely a week in office.

1. VI. What caused Argentina's crisis?

As we said, in March 2001, de la Rua appointed Domingo Cavallo to economy minister, his third

since he became president. Cavallo had gained worldwide fame as economy minister in the

Menem government when he slashed hyper-inflation by introducing the Convertibility Plan.

In one of his first major acts this time round, Cavallo convinced Congress in July to pass a "Zero

Deficit" law, which prohibited the government from spending a cent more than it collects in taxes

each month. The new law was one factor in the decision by the International Monetary Fund in

August to provide $8 billion in fresh loans and loan guarantees following the December rescue

package of $40 billion. However, neither the appointment of Cavallo nor the IMF loan

helped the country's international standing as much as the government had hoped.

After Cavallo’s and de la Rua’s resignation in December 2001, Argentine President

Rodriguez Sa declared the default of the public and external debt, and ten days later,

President Duhalde declared the abandonment of the system of convertibility

Many observers have explained the crisis in terms of the deficiencies of Argentina's peg

to the U.S. dollar under a type of currency board arrangement. While the currency board

did play a role, it also can be argued that the main cause of the crisis was Argentina's

persistent inability to reduce its high public and external debts and fiscal deficit. These

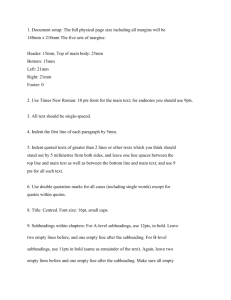

made the economy vulnerable to adverse

economic shocks and shifts in market

Figure 1

sentiment.

Figure 1 illustrates the trend in the public

debt/GDP ratio in Argentina since 1995, as

reported by the International Monetary Fund

(IMF). This ratio measures the total amount of

public debt relative to the ability of the

economy to produce (taxable) income to

service it. In the figures, the thick solid line

shows the actual path while the thinner solid

lines and dashed lines represent alternative

scenarios anticipated by the IMF first under a

1998 Extended Fund Facility (EFF) program

then under a 2000 Stand-by Arrangement

(SBA). (For descriptions of these financing

arrangements, see IMF 2002b.) The figure

reveals that Argentina's public debt/GDP ratio

rose rapidly, from 35% in 1995 to nearly 65%

2001.

and

in

It is also apparent that under IMF

consultations,

it

was

consistently

anticipated

that

Argentina's

public

12

13

debt/GDP ratio would stabilize or fall, but this did not happen. The actual path of the

public debt/GDP ratio far exceeded the IMF projections in five different reviews between

1998 and 2000.

There is no unambiguous threshold at which public debt becomes unsustainable, and

Argentina's public debt/GDP ratio of 65% in 2001 was still lower than that observed in

some European countries. However, given the history of defaults and macroeconomic

instability in emerging markets like Argentina, their threshold sustainable public debt

may be much lower than in advanced economies. Furthermore, limitations on tax collection

capability imply that a higher public debt/GDP ratio makes emerging markets more vulnerable to

adverse shifts in market sentiment that raise the cost of funds. In line with this, large spikes in

the yield on public debt occur in emerging markets that are rarely seen in advanced economies.

For example, between January and November 2001, investor uncertainty raised the yield on an

Argentine 10-year government bond (denominated in U.S. dollars) about 20 percentage points,

to around 35%, signaling the growing unwillingness of investors to hold Argentine debt. Such a

sharp rise in the interest rate, as well as a default and (self-fulfilling) crisis, is more likely if the

public debt/GDP ratio is 65% (as in Argentina) than if it is around for example South Korea that

has 30 %.

Argentina also was vulnerable because its capital account was open and there was a

large amount of borrowing in foreign currency from abroad. A large external debt made

Argentina vulnerable to default not only in the event that interest rates rose, but also in

the event that the currency depreciated sharply, as this increased the repayment burden

in domestic currency.

Argentina's exports of goods and services are quite low, about 10% of GDP, implying

very high external debt/export ratios that accentuate its vulnerability to external debt

crises.

Why did Argentina's debt ratios rise? : Argentina's debt ratios rose for at least two reasons.

First, primary fiscal surpluses (government revenues minus expenditures exclusive of interest

payments on the debt) were not large enough to cover interest payments and also retire some of

the outstanding public debt. Between 1991 and 2000, Argentina's primary surpluses averaged

0.14% of GDP. These surpluses were remarkable achievements, given Argentina's past history,

but they were still well below interest payments, which averaged 2.4% of GDP over this period.

There were significant obstacles to reducing expenditures and raising revenues.

On the expenditure side, the government was a large employer and, for political reasons,

found it hard to cut its wage bill. The central government also found it hard to control

spending by provincial governments, whose liabilities it was eventually forced to assume. At the

same time, revenues were adversely affected by difficulties in tax collection and, after the

recession of 1999, by falling output and rising unemployment.

Second, export growth (and therefore economic growth) was not sufficiently robust to

improve the country's ability to meet its debt obligations and lower debt/GDP ratios. In the

1990s, the dollar value of Argentina's exports of goods and services grew at 7.7% a year, less

than the nearly 9% growth in its external debt and well below the rate of growth of exports in

Asian economies such as South Korea or Malaysia (10%-11%). Exports also suffered

following the 1999 collapse of the Brazilian real because Argentina's rigid currency board

arrangement produced an overvalued currency. Indeed, the focus on maintaining a rigid

peg at all costs appears to have diverted attention away from the risks of not paying

attention to real sector fundamentals.

13

14

1. VII. Lessons from the failure of the Argentine convertibility experience

After the Argentine default and the abandonment of the convertibility, there we may rescue

several lessons for the international financial community and for the LDCs central banks:

- One obvious and important lesson for the Asian countries from Argentina's failed

currency board is that an improper exchange rate peg is doomed to failure, no matter

how rigorously one imposes conditions to engender credibility.

- Another lesson is that exchange rate arrangements are no cure for problems in the area

of macroeconomic policy. Despite the relatively strong set of rules governing the conduct

of Argentina's currency board, the regime collapsed in relatively short order when

domestic and foreign investors determined that the Argentine government's fiscal

policies were unsustainable.

- Finally, many would argue that the ultimate lesson from Argentina's currency crisis is

that no fixed exchange rate regime, even one as institutionally strong as was the

Argentina's convertibility, is completely sound. As a result, it will sooner or later lose its

credibility. Moreover, since financial contracts will have been written in the domestic currency,

this loss of credibility will have real effects and likely will precipitate a financial crisis, or at least a

severe disruption to the real side of the economy. As such, floating may be a superior policy

over the long run.

1. VIII. The designation of Eduardo Duhalde (2002/2003)

In December 2001 President Duhalde started a less than two year provisional mandate, until

May 2003, when President Kirchner started his four year period of government. Duhalde was

one of the top leaders of the Peronist Party. However, many had thought that Duhalde’s political

career was ruined after his defeat in the 1999 presidential elections. In an extremely ironic twist

of events, Duhalde was called to complete the term of the man who beat him in the elections,

Fernando De la Rúa. This was not to be a provisional Presidency, and Duhalde was designated

to serve until the 2003 presidential elections.

With the passage of the Law of Public Emergency and Reform of the Exchange Rate

Regime on January 6, 2002, with Eduardo Duhalde in the Presidency, the convertibility

system was abandoned. The peso started to float against the dollar

Duhalde and his Economy Minister Jorge Remes Lenicov decided on an even more

extreme freezing of the bank deposits, which was then coupled with the so-called

pesificación (forced transformation of all dollar-denominated accounts into pesos at an

arbitrary fixed exchange rate) and a huge devaluation.

The GDP (the size of the economy is dollar terms), after the Peso devaluation, lowered

from almost us$ 300 billions to us$ 145 billions.

Asymmetric “pesificación” (an Argentine invention) : The convertibility coexisted with (some

of these issues have already been described):

- A high residual inflation - during its first two years- No differential increase of productivity

- A chronic fiscal deficit of between us$ 5 and 10 billons annually (2 to 3 % of GNP),

- The constant increase of foreign debt

14

15

-

The revaluation of the dollar against the other strong currencies (euro, yen) during 2000

and 2001 (remember convertibility ended in December 2001)

The Brazilian devaluation of 1999, the Russian and South East Asia crises.

After the recession that harassed the country from 1998 to the 2001 and the lack of

competitiveness of the exchange rate, the Duhalde Administration decided to abandon

the fixed rate which tied 1:1 the peso to the dollar for more than a decade.

The national economic crisis itself, along with the IMF’s ignorance of the national situation,

conditioned the government to this devaluation with no control over the resulting exchange rate

and with no alternative plan to convertibility. As a result of this erratic and unplanned

exchange rate liberation and the abandonment of the convertibility, the Argentine peso was

devaluated from a 1:1 parity to almost 4:1 in few months (at the moment is close to 3:1)

The problems associated to the repayment of companies and individuals’ banking debts,

motivated the government to the invention of the “pesificación", which allowed debtors

to pay their dollar’s debts at an exchange rate of 1:1, while the creditors receive 1.4:1

(with the real value for the dollar of over 3:1). So that, banks were forced to convert

dollar-denominated loans into pesos at the pre-devaluation 1 to 1 exchange rate. At the

same time, dollar-denominated time deposits were converted into pesos as the rate of 1.4

pesos per dollar. This action alone wiped out the entire capital of the banking system.

1. IX. President Kirchner (2003 until today)

President Kirchner began his term by taking bold steps to establish his authority. He has sacked

top officers in the military and police force, called for the chief justice of the Supreme Court to

resign, and tightened the government’s grip on state-owned banks and pension funds. Kirchner

has also pushed through initiatives to crack down on the widespread tax evasion that contributes

to Argentina's continuing fiscal problems. On the other hand President Kirchner showed a

tendency to concentrate too much power, probably as he used to do as a governor of

Santa Cruz, a small province or Argentina.

The Justice and the Legislative Power to some extent are not independent. Therefore the

quality of the democracy of Argentina has become impoverished

President Kirchner and his allies have won the mid-term congressional election of 2005

what gave him additional power

Additional information:

-

-

-

The GDP lowered 11.1% during the 2002, an all times record. But since 2003 -when

the country emerged from its multi-year recession - Argentina’s economy shows

positive growth. Its GDP has grown over 8 % during 2003, 2004 and 2005.

However, the economy is still accumulating several potential problems (low level

of investments, inflation, still high levels of poverty, etc.). By midst 2005 GDP has

reached its previous highest point of 1998, which means that the country has not

grown in 7 years.

By 2005 almost 37 % of Argentine population was below the level of poverty

(compared with a historical level below 20 %).

Exports, are growing since the 2002 peso devaluation

15

16

-

The financial system: From total deposits of u$s 80 B in the beginning of 2001,

they lowered to u$s some 50 B nowadays.

Even though officially it is around 10 %, real unemployment rate nears 15%

The inflation since December 2001 has been superior to 70 %

It has been a merit for Duhalde and Kirchner’s administrations to have avoided

hyperinflation

There is a relative social pacification

The debt negotiation of the majority of the national foreign debt has been

accomplished and the country has recently cancelled its debt of almost 10 billions

with the IMF (International Monetary Fund)

1. X. The Argentine Banking Crisis

1. XI. The Banking system before the crisis:

During the ´90s several Multinational banks acquired Argentine banks.. Figure 5.3 gives a

brief comparison with Mexico of the domestic banking system’s foreign ownership

At the beginnings of year 2001 total deposits in the Argentine financial system totalized us$ 80

billions. By the end of 2005, after the economic crisis of the country (1998/2002) the total

amount was somewhere around the us$ 50 billions

16

17

1. XII. The December 2001 banking crisis

The Argentine banking crisis of 2001–02 materialized because of a combination of underlying

fragilities in the banking system in the late 1990s, coupled with policies in 2001–02 that

destroyed the franchise value of banks by rendering the payments system ineffective. Two types

of fragilities emerged during the late 1990s.

-

First, the soundness of the banking system depended on maintaining a tied

exchange rate because of the large amounts of bank dollar lending to borrowers

with peso-denominated sources of income.

-

Second, there was increased bank exposure to government risk. The chart (bellow)

shows the evolution of the share of government paper in banks’ balance sheets since

1990.

This share declined significantly until 1994; increased temporarily as a result of the banking

crisis resolution in 1995–96; after a partial correction in 1997–98, resumed an upward path; and

by the end of 2001 reached a level close to that in 1990. Among all types of banks, public banks

had the largest share of government paper in their assets. Although there was a compulsory

sale of government bonds to banks, this only happened in late 2001. Banks held increasing

amounts of government paper and underestimated the risks of holding government

liabilities. This risk increased during the late 1990s and into 2001 as the fiscal balance

deteriorated and public sector indebtedness increased.

The combination of a growing stock of public debt, increasing overall fiscal deficits, and

no sign of economic recovery during 2001 fueled perceptions of government default and

abandonment of convertibility. As these perceptions threatened to expose the risks in banks’

balance sheets, a significant withdrawal of deposits took place that year. By the end of 2001, the

banking system had lost about 20 percent of de-posits. As a response to the deposit loss, in

December 2001, the government imposed limits on withdrawals of deposits. Moreover,

depositors’ fears were validated in January 2002 when the government declared default and

devaluated the peso.

17

18

Thus, in early 2002, Argentina found itself with a currency crisis, a debt crisis, and

a banking crisis. On top of the economic and financial difficulties, the country was in

the middle of a severe political crisis that had manifested itself in, among other events,

the resignation of the president in December 2001. This complex situation meant that any

process of banking crisis resolution would face unusually severe constraints. The funding

constraint was particularly severe because the default on external obligations implied a total

exclusion of Argentina from international capital markets. The recession deepened in 2002 and

reached a decline in the rate of growth of economic activity of more than 10 percent. In addition,

the funding constraint meant the government was unable to collect sufficient revenues to

allocate to the resolution of the crisis.

The initial steps taken by the authorities after the default further tightened the constraints for

banking crisis resolution, especially with regard to the treatment of foreign banks, which in the

past (in 1995) had played an important role in bringing the system back to solvency. Moreover,

regulatory independence—a necessity for credible restructuring programs—had been

significantly weakened during 2001 with the limitations imposed on the autonomy of the central

bank and the dismissal of its president.

Government policy actions and the crisis : On top of the overexposure of the banking

system’s to government risk, several government measures (most of them already

explained) affected seriously both the liquidity as well as the capital position of the

financial system.

These measures that stand out for their negative impact on the banking system are the

following:

1. In November 2001, the government exchanged government bonds held by banks for

illiquid government bonds ("préstamos garantizados") generating a reduction of about 30

percent in their net present value. This measure affected both the capital position as well

as the liquidity of banks prompting a bank run.

2. Shortly after, the government imposed a control on the interest rate paid on deposits

accelerating the run on the banking system.

3. Following the imposition of controls on the deposit interest rate, the government opted

to freeze deposits in the banking system, and impose tight controls on cash withdrawals,

a system known as the "corralito".

4. In the first quarter of 2002, the government declared default on its debts, and

devaluated the currency.

5. Following the devaluation, the government imposed the “asymmetric pesification” of

bank assets and liabilities.

6. Then, Congress passed legislation that undermined the value of private assets by

suspending for 6 months all legal actions by creditors to collect on their debts.

7. Reflecting the lack of confidence in the solvency of the banking system, a flight to

quality translated into "capital flight to quality abroad".

18

19

Foreign Banks leaving the country: Several banks that have decided to leave the country

since December of 2001:

-

Scotia Bank of Canada

-

Credit Agricole (France)

-

Societé Generale (France)

-

ING Barings (Holland)

-

Deustch Bank (Germany)

-

Bank of Boston (USA)

-

Banamex (the Mexican Subsidiary of the Citibank)

-

Grupo Intesa (Italy owner of Banco Sudameris)

Only 1 foreign bank has settled a new subsidiary in Argentina since then. In December 2005, the

Standard Bank of South Africa purchased a part of the assets of the Bank of Boston

1. XIII. Lesson from the crisis:

1. Constraints (Developed Countries versus LDC)

SOURCE www.iadb.org

2. Banking Crisis triggers

We may say that as long as the banks remain liquid, banking distress can persist for a

prolonged period, until some trigger leads depositors and creditors to lose confidence in

the banking system. These can be market, policy, or political shocks that become the "wakeup

call" for dealing with problems so far ignored, causing dramatic shifts in expectations and

systemic bank runs:

A loss of confidence in the government and its ability to implement its

macroeconomic framework can trigger a systemic crisis. Such concerns erode

confidence in the banking sector as well as, often, the currency.

19

20

In addition, if the medium-term sustainability of a country's macroeconomic

policies, including its external debt, comes under question, are in doubt, private

confidence in the economic outlook can erode, resulting in the emergence of banking

pressures and, in unaddressed, banking distress.

The emergence of illiquidity in one bank can quickly spread to others through

contagion, as bank or payment system weaknesses destroy credibility of all banks, and

lead to creditor and depositor runs regardless of the soundness of individual banks.

Contagion is in this case local, but can also be international, when it is caused by the

emergence of a systemic crisis in a country related through financial and trade channels.

But maybe the most important issue is not the specific reasons of a banking crisis, but the ability

of the political authorities to come together to develop a strategy and then implement it. Political

decision makers must recognize that there is a problem and make quick and resolute actions.

Developing a political consensus on the path forward is a critical step. Most importantly, the

process must be seen as fair and transparent.

The importance of the integrity of the payment system cannot be overstressed. When this

banking system fails it causes an enormous contraction in economic activity that, beyond

its large social costs, also complicates fiscal solvency and limits the ability of the

government to solve the crisis. Therefore, the Argentine crisis suggests that countries should

be even more willing to pay the costs of ensuring a well functioning payment system in times of

crisis.

3. Avoiding Bad Banking: Weak supervisory frameworks may include: allowing for

concentrated lending, portfolio mismatches, inadequate loan valuation that overstate

bank profits and capital, incompetent management, etc. Supervision may also lack authority,

and have an insufficient number of skilled staff who may be poorly motivated and compensated.

Poor transparency, limited financial disclosure, and poor accounting and auditing

practices mean that the market—that is, bank creditors—will not have sufficient

information to exert discipline on bank owners.

4. Macroeconomic weaknesses and intervention: By the time the crisis started, the system

was well capitalized and could have withstood significant losses in the value of its assets.

However, it could not survive a set of interventions that destroyed the confidence on

banks (such as the corralito) and expropriated its capital (such as asymmetric

pesification). Therefore, good financial regulation and supervision while necessary are

not sufficient to protect banks from crises.

5. Markets in local Currency: Countries that plan to maintain flexible exchange rates

should develop policies designed to increase the market for domestic currency

denominated assets both at home and in the international market.

6. Banks should match maturity Assets – Liabilities: The Argentine crisis shows that

when the longer term bonds are purchased by banks, they can generate maturity

mismatches, as bank deposits are of much shorter maturity than government bonds.

20

21

When a systemic crisis occurs, the decline in deposits takes place at the same time that bond

prices are very low and that the central bank is struggling to protect its level of international

reserves by controlling domestic credit. The increased maturity of the debt complicates

banking crisis management.

7. Autonomy of the Central Bank: The autonomy of the central bank has increasingly

become an accepted international standard. This allows them to act in the best interest of the

country, aiming monetary policy at controlling inflation and ensuring financial stability.

1. XIV. Resolving the Banking Crisis

Resolving a banking crisis entails three principal tasks:

-

First, the proper functioning of the payment system should be restored.

-

Second, rebuilding confidence in the banking system requires restoring an

adequate liquidity and capital base. Restoring confidence in the financial system

requires addressing the problems affecting both solvency and liquidity in the shortest

possible time frame.

-

Third, the reestablishment of confidence in the value of the national currency

requires the central bank to regain control over monetary policy, which can only be

achieved if the central bank is not required to finance fiscal deficits or to offer recurrent

net financing to support weak banks. In particular, to attain a healthier financial system

over the medium term, the role of public banks should be redefined through restructuring

and/or privatization.

The capital position of Argentine banks has been drastically reduced because of:

-

The value of (defaulted) government bonds

-

The effects of asymmetric pesification. (The government compensated banks for

the effects of asymmetric pesification by issuing dollar-denominated bonds)

-

The significant uncertainty that has developed as regards to the value of banks´

claims on the private sector.

1. XV. Banking crisis resolution and system’s restructuring: Uruguay - Argentina,

a brief comparison

The banking crisis resolution processes in Argentina and Uruguay in the early 2000s were

contrasting events in terms of adherence to the basic principles. The effects of the crisis in

Argentina had adverse consequences on Uruguay’s banking system, mainly because

about 40 percent of bank deposits in Uruguayan banks were held by Argentines. Following

the imposition of the deposit freeze in Argentina, Argentine depositors began to withdraw their

funds in Uruguay.

The initial withdrawal of deposits resulting from contagion in Argentina was followed by

additional withdrawals by Uruguayan residents who feared that the banking system was

21

22

experiencing solvency problems. By the end of July 2002, total withdrawal of deposits

had reached 42 percent.

Even though the Uruguayan banking system did not have significant exposure to government

risk (only 3 percent in 2001), it suffered from the same problem of currency mismatches as in the

Argentine case (about 80 percent of total loans were dollar denominated and half of the

dollar loans were extended to borrowers with Uruguayan peso-denominated income).

The crucial difference between Argentina and Uruguay case was the willingness of the

multilateral organizations to provide financial support to Uruguay:

- First, because the crisis in Uruguay was perceived as contagion from Argentina.

- Second, Uruguay did not default on its external debt obligations and maintained a

market-friendly approach to creditors that eventually culminated in a successful debt exchange

in May 2003.

- Third, the Uruguayan authorities were able to persuade the headquarters of foreign

banks to recapitalize their branches and subsidiaries, while policy decisions by the Argentine

authorities penalized foreign banks.

Uruguay in contrast to developments in Argentina:

- The Uruguayan authorities made it a priority to preserve the payments system and

contain depositors’ loss of confidence.

- Uruguay had a crawling peg exchange rate policy instead of a Convertibility.

- The Uruguayan authorities made significant efforts in differentiating their policies

from those in Argentina: As international reserves experienced a sharp fall, market

fears of a potential outcome similar to that in Argentina intensified. However, throughout

this period, Uruguay did not impose conversion of dollar deposits into pesos, freeze

deposits, or default on external debt.

Lessons from comparing both the banking crisis: The experiences indicate that an

adequate resolution process improves public confidence in the capacity of the authorities

to tackle future problems and the banking system becomes more resilient to future

adverse shocks and contagion.

Some major lessons emerge:

- First, that those parties responsible for the crisis, should pay most of the costs of

restructuring.

- Second, demonstrating sufficient political will is a big help for an effective resolution of

the crisis

- Third, constraints for developed and developing countries differ significantly and are

much more severe in developing than in developed countries.

- Fourth, a crisis should be used as an opportunity to strengthen supervision and improve

the quality of bank management. This was the strategy followed by Argentina in the crisis

1995 after the Mexican Tequila Effect, but not in 2002.

Fifth, foreign banks can play an important role during a systemic banking crisis in two

ways. First, foreign banks are perceived as relatively stronger than local banks. And

second - without changing the rules of the game- headquarters of foreign banks could

provide lender of last resort facilities and capitalize their subsidiaries, limiting the cost

of the crisis. This was the case in Uruguay but not in Argentina.

22

23

1. XVI. Argentina Today’s Banking System

In January 2006N Argentine banking system has approximately us$ 50 billions of total deposits,

compared with us$ 80 billions in January 2001.

Insolvent banks have been closed over the last three years coupled with many

international banks writing off their Argentine banking investments. At present, the banking

system is slowly regaining confidence but remains vulnerable. In addition, the banking freeze

has been removed as capital controls have been dismantled with economic stability returning.

The access to financing is very limited, compared not only internationally but also with

the domestic’s historical ratios, the credit stock is very low. .As a consequence of the

several adverse economic shocks the country suffered between 1998 and 2001, private sector

credit is a pitiful 10% of economic output ($12 billion ) compared to 25% of GDP in 1999 (see

tables below)

23

24

2. Historical processes towards the current Latin American political

division

(Classes 3 to 5)

2. I. Spanish and Portuguese on the advanced guard in the conquest of America

(extracted from a historical novel)

“The sailors estimated the latitude by the Polar star (the latitude was the only way to know the

position of the ship). However, the farther they went south, this star disappeared, making way to

a diabolical night full of new stars, which confused the sailors, and drowned them mercilessly

into the dark sea towards the intangible” (from a historic novel) .

Three elements were distinctive on Portuguese and Spanish advanced guard in the conquest of

America.

1. With the arrival of the math tables, calculated by Cresques in the “Almanac Perpetuum”,

the sailors started to use the altitude of the sun as a landmark of latitude. As the day

occurs in all seas, the latitude was determined even on cloudy days. Nobody got lost,

even on the Sea (Jafuda Cresques, who discovered the math tables of astrolabic

declination by the position of the sun. His information was stolen by the Portuguese

crown)

2. Secondly, the design of the caravels: Inspired in the combination of the big ships

designed by the Arabs for moving big loads and the small ships that went down the river

Douro, the caravel was created- the most improbable ship ever created by man-. Being

such a light ship, one fifth of the size of the traditional ones, the caravel didn’t cut water; it

flew over it, which made it safe and fast. By using crooked and unstable sails, they took

advantage of the winds.

3. Finally, an invention that came from Northern Europe: The compass.

Initial conquering methodology: The crown of Castile acknowledged the authority of the

pope to give territorial grants, who, at the same time, determined which king should instill and

strengthen government and the Christian faith to the indigenous people.

Pope Alexander VI divided the world in two parts and assigned them for the conquest to

Spaniards and Portuguese. France, England and Holland did not accept this agreement,

but they were still lagging far behind in terms of technology and logistics for this type of

expeditions.

The kings of Spain Fernando and Isabel authorized the “adelantados” (advanced ones) to

explore and conquer the new territories in America. From the beginning (1492) to the middle

of the XVI century, the expeditions were financed on the same system used in the

Crusades, through some kind of “Risk Investments”. These “adelantados” were granted

some rights- they were actually private investors- so that Spain would receive the

acknowledgement of its sovereignty in these lands, and a fifth of the benefits.

Based upon this colonization methodology, the South American Region (From Panama down

south) was divided in different sectors (strips) and assigned to “adelantados” or families who

24

25

would occupy and colonize and “evangelize” the region (among them, the Welser and Fugger,

families of German bankers linked to the crown of Charles V). The following concessions were

made:

-

New Andalusia: Welser

New Castile: Francisco Pizarro

New Toledo: Diego de Almagro

Río de la Plata: Pedro de Mendoza

South: Fugger. They abandoned the initiative due to their economic links to the

Portuguese crown (they could not favor the Spanish competitors). This region was then

assigned to Acazaba (that fails searching for gold in the inside of Patagonia. Then he is

murdered by his followers who abandoned the region). It remains unsettled, and “as an

Indian Space” where the Indians were displaced from the other regions where the

Spanish colonization became strong.

The treaty of Tordesillas: The Tordesillas Treaty (1494) between the crowns of Spain and

Portugal -with the participation of the Pope- is signed and defines the boundaries of the

Portuguese properties in Eastern of South America. From this subdivision of the American

territories -and the subsequent Spanish viceroyalties and captaincies in South America-,

the current 10 South American countries and Panama were conceived.

Fraile Bartolomé de Las Casas: Fray Dominic, previously a conqueror himself, made the

first and most famous defense of the indigenous people against the excess of the first

settlers. He blamed them of the high mortality of Indians that ended in the lack of population in

the island “la Espanola” and the posterior pursuit of indigenous people in Cuba and the

continent. He also pursued the forbiddance of the “mita” and “encomienda”, institutions that were

granted to Spanish colonists by royal decree (the indigenous people bound to forced labor and

personal service) etc.

A reason for the atomization of Latin America: The sizes of the regions to colonize,

together with the existence of a variety of autonomous and distinctive cultures, were

some of the factors that influenced the later atomization of the Spanish America (in

opposition to the integration of USA. We can research together the existence of other factors)

that led to the formation of the current Hispanic nations of the continent.

2. II. The Viceroyalties

By mid XVI century, the crown of Castile displaces “adelantados”, constituting the

different viceroyalties in America. Among the reasons for this change of the colonization

policy, were the excess committed by these “adelantados" against the Indian

communities, the increasing population of the Spanish colonies in America and the

increasing expectancies of the economic return of the new colonies. Therefore by midst

XVI century, Spain as well as Portugal, instituted the viceroyalty system to govern their

possessions in the New World.

25

26

During the nearly three centuries of the colonial period, legal records and documents were

subject to the jurisdiction of the appropriate viceroyalties. The following viceroyalties functioned

in Latin America during these time periods:

•Brazil

1549–1822

•Rio de la Plata

(Argentina, Paraguay, Uruguay,

parts of Bolivia)

•Nueva España

(Central America,

the Caribbean, Mexico,

the Philippines, Venezuela)

•Nueva Granada

(Colombia, Ecuador,

Panama, Venezuela)

•Peru

(Chile, Peru, parts of Bolivia)

•Santo Domingo

(the Caribbean)

1776–1810

1534 –1821

1717–1724,

1740–1819

1543 –1821

1509–1526

2. III. Audiencias

Legislative divisions called audiencias functioned under the Spanish viceroyalties. These

audiencias supervised local courts, applied Spanish law, and served to establish a legal tradition

that has persisted in Hispanic America. The jurisdictions of the audiencias formed the basic

referential territories of the Latin American republics once they gained independence from Spain.

The following list indicates the years in which audiencias were established under each

viceroyalty:

Nueva España

•Caracas

•Guatemala

•Nueva España

•Nueva Galicia

1786

1543, 1570

1527

1548

Nueva Granada

•Bogotá

•Panamá

•Quito

1549

1538, 1563

1563

Peru

•Cuzco

•Lima

•Santiago

1787

1542

1609

26

27

Peru (Alto Peru) and Rio de la Plata

•Buenos Aires

1661

•Charcas

1559

Santo Domingo

•Santo Domingo

1511

The following maps 1 and 2 briefly depicts de Spanish

colonies

Map 1. Viceroyalty of New Spain and its Audiencia Districts

Boundaries of Viceroyalty

Audiencia Boundaries

Audiencia of

Nueva Galicia

Audiencia of Havana

Mexico

Mexico City

Audiencia of

Guatemala

Audiencia of

Santo Domingo

Puerto

Santo Domingo Rico

Caracas

27

28

Map 2. Viceroyalty of Peru and its Audiencia Districts

Audiencia of

New Granada

Audiencia

of Panama

Audiencia

of Quito

Audiencia

of Lima

Santa Fé de Bogotá

Quito

Lima

La Paz

Audiencia

of Charcas

Tropic of Capricorn

Santiago

Audiencia

of Chile

Buenos

Aires

Boundaries of Viceroyalty

Audiencia Boundaries

2. IV. Some comments on colonial Administration

Both the Spanish and Portuguese brought in settlers and established towns all over their

territories.

As we have seen, the Spanish established Viceroyalties in Peru, with seat in Lima, and in

Mexico, with seat Mexico City (Aztec Tenochtitlan). The main economic interest of the Spanish

28

29

lay in gold and silver. The “conquistadores” looked for El Dorado, a mythical land with legendary

sources of gold, and continued to look even after the conquest of the Inca Empire. In 1545, rich

silver deposits were found at Potosi in modern Bolivia. Silver mining peaked in 1590. In

1610 the city had 160.000 inhabitants, which made it the world's 5th largest city. It

produced 60 % of the world's silver production. The silver was annually shipped to Spain by

the Silver Fleet (Treasure Fleet).

The Portuguese were more interested in plantations - sugar, coffee, and in a product which was

indigenous to Brazil's Amazon forest: rubber. In the 16th century, they brought over slaves from

Africa to work these plantations. 1624 the Dutch occupied the Northeast, and were expelled

1654. Both the Spanish and the Portuguese supported catholic mission by the Jesuits (since

1586, in Paraguay and elsewhere) and by the Franciscans (since the 17th century, in California

and elsewhere). In the 1750es, the Jesuit Reductions of Paraguay, profitable socialist

communities run by the native Guarani, were dissolved by force, having attracted the envy of the

plantation owners; the church was no longer strong enough to protect them.

Later on, administrative reorganizations were made. In 1718, the Viceroyalty of New Granada

(Greater Colombia) was split off the Viceroyalty of Peru; in 1776 the Viceroyalty of Del Rio de la

Plata (Greater Argentina) was split off the Viceroyalty of Peru. In Brazil, the capital was moved

from Bahia to Rio de Janeiro in 1763

Changing Royal Families in Spain

In 1588, the Spanish Armada Invencible (The Invincible Navy) was defeated and destroyed by the British,

signaling the beginning of the end of Spanish great power status. Spain was also beset during this XVI

century with a royal family (the Hapsburgs) that was backward, increasingly inbred, and, at the end,

reduced to paralysis by its own inbreeding. Colonial authority was gradually undermined.

The War of Spanish Succession installed a new (and far more vigorous) royal family – The Bourbons on

the Spanish Throne by the beginning of the 18th Century. The Bourbons made a series of reforms (urban,

military, religious, administrative, and economic reforms) the so called "Second conquest of America"

which aimed to obtain an economic recovery and a greater control over the colonies.

The effects of these changes of policies were, on one hand economic success, but on the other hand,

alienation of large segments of the local population, which led to indigenous rebellions and riots (Tupac

Amaru rebellion, 1780); Creole conspiracies and finally the first calls for Independence.

2. V. A brief explanation of the emancipation process of the Spanish and

Portuguese colonies in America.

The nature of the emancipating process differs between the Spanish and the Portuguese

colonies. As we will see later on, the displacement of the Portuguese crown to Brazil, as a result

of the Napoleonic invasion to Portugal, allows a consolidated and somehow pacific process of

the independence in Brazil.

29

30

After more than 300 years of Spanish domination in America, several factors contributed to the

acceleration of the emancipating processes in the continent. Some of them are:

1. The U.S. Independence, the French Revolution and the liberal ideas that

propagated from these events (Rousseau, Voltaire, etc)

2. The Napoleonic invasion of Spain, after that, the Spanish citizens in America

denied their subordination to Jose Bonaparte (Pepe Botella, brother of Napoleon)

who was arbitrarily declared Emperor of Spain replacing King Fernando VII.

3. The economic interest of powerful nations such us England, France and Holland,

which saw in the Spanish colonies growing markets for their products. Spain had

monopolized trade for its colonies for centuries (talk about this methodology)

4

The appearance of local bourgeoisie/ middle class (criollos/natives) in the

colonies, after three centuries of Spanish settlement in the continent.

In the beginning of XIX century, revolutionary outbreaks started in most Spanish colonies. We

can identify three main revolutionary centers:

1. The first one in Mexico

2. The second one in Buenos Aires

3. The third and most important one, in the General Captaincy of Venezuela, the

viceroyalty of New Granada and the Kingdom of Quito.

From 1810 to 1825, a process of emancipation process took place. It ended with the

independence of Bolivia, the last Spanish dominated colony in the continent. At that time,

only insular colonies (Cuba, Puerto Rico and Dominican Republic) still depended on the

Spanish crown.

The Brazilian emancipation has to be considered as an autonomous matter and was done

in a pacific way. The Portuguese crown was shifted to Brazil, escaping from the Napoleonic

invasion and members of the royal house declared the Brazilian independence of Portugal.

Brazil’s original status quo, emancipated as an empire, lasts until the midst of the XIX century,

when it turns to a Federal and Republican type of government.

To some extent, the royal presence in Brazil was helpful for the territorial consolidation of

the Portuguese America (compared to the atomization of Spanish America). Although the

southern State of Rio Grande do Sul declared itself independent, the rebellion was suppressed a

few years later.

The result of this difference between atomization-consolidation is reflected on the Brazil’s

dimensions and geopolitical weight, compared to the Hispanic American countries.

30

31

A brief synthesis of the whole Latin American independence process is as follows:

Year

1788

Location and Event

(Spain) Charles II dies, succeeded by Charles IV

1789

(France) May: French Revolution

(Brazil) Inconfidencia Mineira – failed conspiracy to establish a republic

1791

(Haiti) Slave revolt begins movement for independence

1794

(Haiti) French abolish slavery in attempt to quell revolt

1795

(Haiti) Spain cedes eastern side of island due to turmoil surrounding revolt

1798

(Brazil) Conspiracy of the Tailors – failed attempt to establish a republic

1799

(France) Napoleon Bonaparte comes to power

1801

(Haiti) Toussaint conquers eastern portion of island

1802

(Haiti) Toussaint reaches truce with French

1803

(Haiti) French break truce, arrest Toussaint, he dies in prison in April

(Haiti) November: French surrender and secure Haitian independence

1804

(Spain and Mexico) Consolidación de Vales Reales – Church wealth sequestered

1806

(Rio de la Plata) British invade Buenos Aires

1807

(Portugal) French invade, royal family flees in November to Brazil

1808

(Spain) March: French invade Spain, Charles IV and Ferdinand VII abdicate

(Spain) May: Charles IV and Ferdinand VII exiled, Joseph Bonaparte assumes power and

becomes Jose I

(Spain) First regional juntas in opposition to French invasion

(Mexico) September: Viceroy Iturrigaray overthrown

1809

(Mexico) Queretaro conspiracy led by Miguel Hidalgo

1810

(Caracas) April: Cabildo abierto

(Buenos Aires) May: Cabildo abierto

(Bogota) July: Cabildo abierto

(Santiago, Chile) September: Cabildo abierto

(Spain) Junta Central flees to Cadiz – last city beyond French control

(Mexico) September 16: Grito de Dolores – begins Hidalgo revolt

1811

(Venezuela) July: Francisco de Miranda and Simon Bolivar declare First Republic

(Mexico) Miguel Hidalgo executed

31

32

1812

(Spain) March: Junta in Cadiz passes Liberal Constitution – establishes constitutional

monarch, including colonial representation in new legislative assembly

(Venezuela) Caracas earthquake

(Venezuela) July: First Republic falls

1813

(Mexico) Revolt of José María Morelos

(Venezuela) Bolivar leads Second Republic

1814

(Spain) Napoleon defeated, Ferdinand VII restored, Constitution of 1812 voided

(Venezuela) Spanish reinforcements arrive, Bolivar forced to flee

(Jamaica) Bolivar writes “Jamaica Letter”

(Mexico) Morelos takes Acapulco

1815

(Mexico) Morelos captured and executed

(Brazil) King John VI formally declares United Kingdom of Portugal, Brazil

1816

(Venezuela) Bolivar begins third campaign with aid from Haiti

(Rio de la Plata) July: Argentina’s formal Declaration of Independence

1817

(Venezuela) Bolivar allies with José Antonio Páez

(Rio de la Plata) José de San Martín crosses Andes into Chile

1818

(Chile) Battle of Maipu secures Chilean independence

1819

(Colombia) Congress of Angostura, Republic of Colombia declared

(Colombia) August: Bolivar captures Bogota

1820

(Spain) Riego Revolt against Ferdinand VII, restoration of Constitution of 1812

(Peru) August: San Martin arrives in Peru

1821

(Mexico) August: Agustin Iturbide achieves independence with the Plan de Iguala

(Venezuela) June: Battle of Carabobo – secures Venezuelan independence

(Ecuador) Guayaquil falls to Antonio Jose de Sucre, ally of Bolivar

(Brazil) John VI returns to Portugal, leaves Dom Pedro I in charge

1822

(Ecuador) July: Bolivar and San Martin meet, San Martin retires

(Mexico) October: Iturbide crowned, Augustin I, Constitutional Emperor

(Brazil) September: Dom Pedro I declares Brazilian independence

1823

(Mexico) February: Iturbide forced to abdicate

(Peru) September: Bolivar enters Lima

1824

(Peru) Final campaigns in war of independence

1825

(Peru) January: Sucre wins battle of Ayacucho – liberates Peru and Bolivia

32

33

2. VI. A more detailed explanation on the countries’ national histories.

We will divide the countries in the following groups, as they have some common

historical patterns :

-

Mexico and Central America (Guatemala, El Salvador, Honduras, Nicaragua

y Costa Rica)

Greater Hispanic Antilles (Cuba, Puerto Rico and Dominican Republic)

Colombia, Ecuador Panama and Venezuela

Peru, Bolivia, Chile, Paraguay Argentina and Uruguay

Brazil

Mexico and Central America

Mexico

The Spanish conquest of the continent begins in the Caribbean region, and the first settlement in

the mainland was the foundation of Villa Rica de la Vera Cruz.

Hernan Cortez was sent by Diego de Velasquez the governor of Cuba, to explore the continent.

Later on Cortez denied Velasquez´ authority over him and was named Captain General by his

men in Vera Cruz, depending from then on directly on the crown. After several disputes among

Spanish, Indians, and between Indians and Spanish, Cortez, together with the opposed tribes

finally dominated the city of Tenochtitlan, center of the Mexica Empire.

The Viceroyalty of New Spain was created in 1535. During the 1800s New Spain enjoyed an

enviable position. Mining, industry and agriculture. Major centers of learning and a good urban

administration. 42% were of population were Indian descent, 18% white and 38% were mestizo.

The Viceroy's power extended south to present day Panama and as far north as California.

However, this colonial system contained the seeds of its own destruction. Native born Criollos,

people of European decent, born in New Spain, resented Spanish monopolization of political

power and the economic system which favored the Spanish-born. At the same time, Spain's

authority in Europe declined as did its position as a world leader (as mentioned in previous

paragraphs). These problems prompted the final break from Spain in 1820, a revolution lead by

two priests, Miguel Hidalgo y Costilla and Jose Maria Morelos y Pavon.

The period between 1823 and 1855 was called “the age of Santa Anna”. During this period,

Mexico faced staggering problems. By the 1850's these chaotic events led to disaster. Texas

had declared its independence on March 2, 1836 and by 1846, Mexico was embroiled in a war

with the United States. Mexico lost over half of its territory, including the areas of the current

States of California, New Mexico and Northern Arizona. Santa Anna in exchange for his freedom

signed the peace treaty of Guadalupe-Hidalgo with the United States.

Central America (Guatemala, El Salvador, Honduras, Nicaragua y Costa Rica)