January 29, 2009 Did you know…? Congress and the President

advertisement

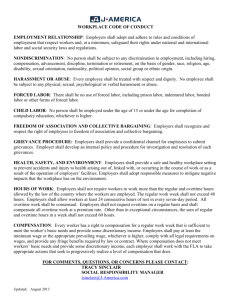

Global Employment Law Update U.S. Edition January 29, 2009 Did you know…? Congress and the President Open Floodgates to More Pay Discrimination Litigation: Guidance for Employers Summary On Jan. 29, 2009, President Obama signed the much anticipated Lilly Ledbetter Fair Pay Act ("Ledbetter Act") into law. The new law dramatically increases employers’ risk and exposure to pay discrimination claims because it: Resets the statute of limitations for filing a wage claim each time an employee receives a paycheck, allowing employees to bring wage claims years after the alleged discrimination initially occurred. Applies to alleged discriminatory pay practices based on all protected categories, including race, gender, age, color, disability, national origin and religion. Expands the definition of an unlawful employment practice to not only include discrete "decisions" regarding compensation, but to include any "other practice" that affects an employee’s compensation. Creates greater burdens for employers to defend against or mitigate liability given that the alleged discriminatory decisions, practices or events may have occurred many years before. Waiting next in line in Congress is the Paycheck Fairness Act. If passed, it will pave the way for many more Equal Pay Act actions by, among other things, allowing plaintiffs to recover punitive and compensatory damages, authorize opt-in class actions, add nonretaliation provisions and significantly curtail affirmative defenses currently available to employers. Given the Ledbetter Act and pending equal pay legislation, employers are well-advised to carefully scrutinize their pay policies and records and consider fixing past problems to better position themselves to defend against future wage discrimination claims. Background The Ledbetter Act was passed in response to the 2007 United States Supreme Court decision in Ledbetter v. Goodyear Tire & Rubber Co. Plaintiff Lilly Ledbetter worked for Goodyear from 1979 to 1998. Once she retired, she filed a gender discrimination claim against Goodyear on the grounds that she received smaller annual pay increases than her male counterparts throughout her employment. While a jury initially found that Goodyear’s pay practices were discriminatory, the Supreme Court nonetheless held that Ledbetter’s claim was time-barred. The Court narrowly construed Title VII’s statute of limitations for equal pay claims, concluding that the time for filing a claim begins when the discreet discriminatory pay decision occurs rather than each time an employee receives a paycheck affected by the initial decision. The New Act The Ledbetter Act effectively overturns the Supreme Court’s 2007 ruling, but it also does much more. Once signed, it will amend Title VII, the Americans with Disabilities Act of 1990 (ADA), the Rehabilitation Act of 1973 and the Age Discrimination in Employment Act of 1967 (ADEA) to specify that unlawful discrimination occurs when: (1) "a discriminatory compensation decision or other practice is adopted," (2) "when an individual becomes subject to a discriminatory compensation decision or other practice," or (3) "when an individual is affected by application of a discriminatory compensation decision or other practice, including each time wages, benefits, or other compensation is paid, resulting in whole or in part from such a decision or other practice" (emphasis added). Implications for Employers The Ledbetter Act has many important implications for employers. First, given the change in the statute of limitations, the Ledbetter Act exposes employers to pay discrimination liability for alleged discriminatory decisions perhaps made years earlier by decision-makers who are no longer employed by the company and/or based on records that no longer exist. Under this new "paycheck rule," the statute of limitations for filing a wage claim resets each time the employee receives a paycheck, benefits or other compensation. An employee can recover back pay and other relief for up to two years preceding the filing of a charge where the unlawful employment practices that occurred during the charge filing period are similar or related to practices that occurred previously. Another important implication is that the Ledbetter Act applies to claims of pay discrimination under Title VII, the ADA, the Rehabilitation Act, and the ADEA. Thus, it is not limited to claims based on gender discrimination (the subject of Ledbetter’s lawsuit) but also applies to pay discrimination based on race, national origin, religion, age and disability. The broad language of the Ledbetter Act also causes potential concerns, as it prohibits discriminatory compensation decisions as well as "other practices" that affect compensation. This language suggests that any practice that affects compensation—not just discreet "decisions"—may trigger a discriminatory compensation claim. For example, an employee might argue that "other practices" includes an old performance review or system that impacted the employee’s current compensation. The Ledbetter Act on its face is unclear as to what "other practices" means. Certainly, employers should be wary that creative plaintiffs attorneys will take advantage of the inclusion of the broad terms "other practices" in future lawsuits. Moreover, the Ledbetter Act states that the statute of limitations clock runs from the time any "wages, benefits, or other compensation" is paid. While it is unclear what "other compensation" means, it might include payments made after the employment relationship ends, such as pension payments. Beware of the Paycheck Fairness Act on the Horizon Employers should also beware that Congress is moving quickly to adopt the Paycheck Fairness Act, which would make defending pay discrimination claims even more difficult for employers. The Paycheck Fairness Act passed the House on Jan. 9, 2009, and the Senate is currently considering a companion bill. Among other things, the Paycheck Fairness Act would amend the Equal Pay Act to: (1) provide for compensatory and punitive damages rather than lost wages only; (2) authorize opt-out instead of opt-in class actions for equal pay claims; (3) add non-retaliation provisions; and (4) significantly narrow the affirmative defenses available to employers. Changes to the affirmative defenses are especially noteworthy. Under the current Equal Pay Act, employers can defeat a pay discrimination claim by proving the pay decision was based on "any factor other than sex." The pending legislation would shift the burden to employers to prove that the factor other than sex: (1) is not based upon or derived from a sex-based differential in compensation; (2) is job-related with respect to the position in question; and (3) is consistent with business necessity. Furthermore, the new law would allow employees to rebut the defense by showing that the employer would have been able, but refused to, adopt an alternative practice that would serve the same purpose without producing the same result. The new law would create huge obstacles for employers in establishing a "factor other than sex" defense. Employers accordingly will have to rely more on the three other acceptable defenses available under the Equal Pay Act, namely seniority, merit, and quantity or quality of production. This change to the "factor other than sex" defense would also indirectly affect discrimination claims brought under Title VII, as Title VII incorporates by reference the defenses available under the Equal Pay Act. Best Practices for Preventing Pay Discrimination Claims in the Wake of New Legislation Given the far-reaching implications of the Ledbetter Act (and the expected Paycheck Fairness Act), employers are advised to be proactive in detecting and resolving discriminatory pay practices to protect themselves from an anticipated surge in pay litigation. Conduct a Privileged Audit Employers should carefully consider whether, and how, to audit their pay practices to determine if any changes are necessary. Such an audit should typically be conducted by or at the direction of legal counsel in a manner sufficient to preserve the attorney-client privilege. If employers do not take proper steps to invoke this privilege, plaintiffs will be entitled in litigation to discover any and all analyses, whether favorable or unfavorable. An appropriate audit should be broad-sweeping. For example, an audit should evaluate a variety of statistics, policies and practices, personnel records and possibly include interviews. Because the legislation goes beyond gender bias, it should cover all the protected categories: gender, race, color, age, disability, national origin and religion. Such an audit might explore the many records, and variables, that affect the payment of compensation and other job-related benefits over time, including for example:* All types and amounts of compensation and benefits provided (e.g., bonuses, pensions, profit-sharing, stock options, etc.). Job duties, including quantity and quality of production and supervision responsibilities. Classification (salaried vs. hourly). Tenure with the company (seniority). Experience in field and education attained. Promotions, training, and other opportunities for advancement provided. Discipline, terminations, layoffs, and other types of demotions or decreases in responsibilities. Employee status (i.e., part-time vs. full-time, permanent vs. temporary). Performance policies and actual ratings. Market rates for compensation in comparable geographic locations. *This summary is intended to be illustrative only and does not suggest what may or may not be properly included in a particular employer’s audit. Maintain Appropriate Record Retention Policies and Procedures Employers should ensure they have policies and procedures in place for retaining documents and other data supporting the pay decisions they make. While retaining data can become quite burdensome and expensive over time, technology vendors are increasingly offering viable solutions, and the benefits may prove to outweigh the costs if litigation arises. Employers should weigh these considerations in assessing their retention policies and programs. Orrick’s Team Orrick’s Global Employment Law Group deals regularly with pay and discrimination issues. We offer practical advice and expertise to help our clients chose the best options for meeting their legal obligations in this changing area of the law, including: Advising on audits. Reviewing employment policies and handbooks. Creating training materials for HR, legal and decision-makers. Advising on data retention policies.