Solution Key for Quiz 1, Spring 2005

advertisement

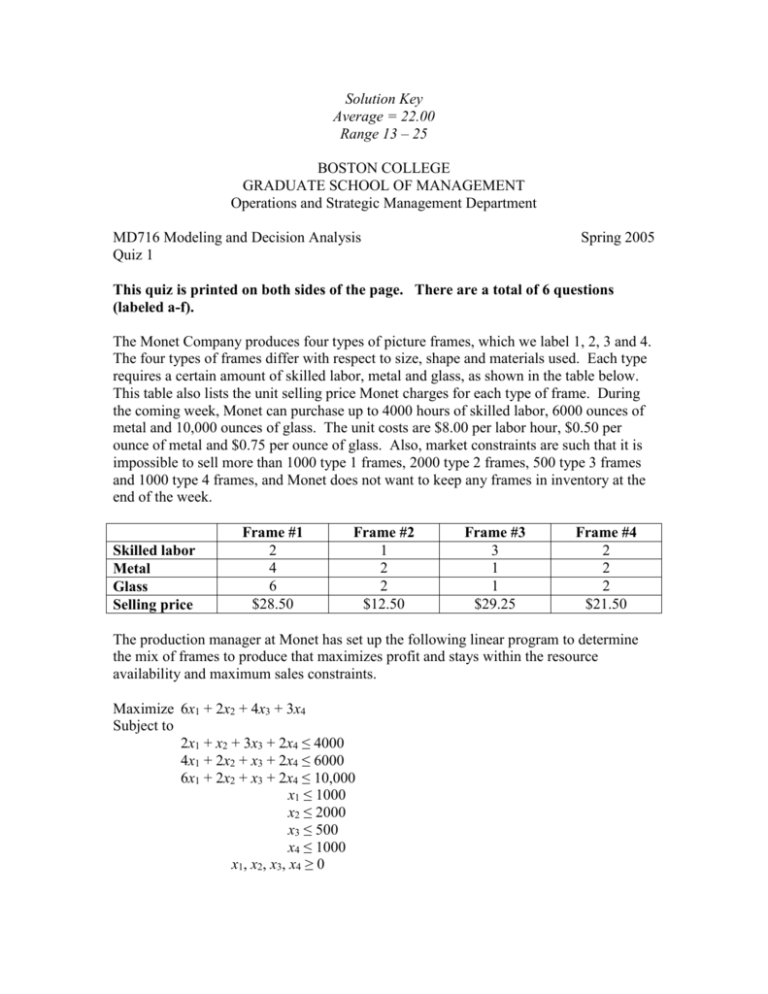

Solution Key Average = 22.00 Range 13 – 25 BOSTON COLLEGE GRADUATE SCHOOL OF MANAGEMENT Operations and Strategic Management Department MD716 Modeling and Decision Analysis Quiz 1 Spring 2005 This quiz is printed on both sides of the page. There are a total of 6 questions (labeled a-f). The Monet Company produces four types of picture frames, which we label 1, 2, 3 and 4. The four types of frames differ with respect to size, shape and materials used. Each type requires a certain amount of skilled labor, metal and glass, as shown in the table below. This table also lists the unit selling price Monet charges for each type of frame. During the coming week, Monet can purchase up to 4000 hours of skilled labor, 6000 ounces of metal and 10,000 ounces of glass. The unit costs are $8.00 per labor hour, $0.50 per ounce of metal and $0.75 per ounce of glass. Also, market constraints are such that it is impossible to sell more than 1000 type 1 frames, 2000 type 2 frames, 500 type 3 frames and 1000 type 4 frames, and Monet does not want to keep any frames in inventory at the end of the week. Skilled labor Metal Glass Selling price Frame #1 2 4 6 $28.50 Frame #2 1 2 2 $12.50 Frame #3 3 1 1 $29.25 Frame #4 2 2 2 $21.50 The production manager at Monet has set up the following linear program to determine the mix of frames to produce that maximizes profit and stays within the resource availability and maximum sales constraints. Maximize 6x1 + 2x2 + 4x3 + 3x4 Subject to 2x1 + x2 + 3x3 + 2x4 ≤ 4000 4x1 + 2x2 + x3 + 2x4 ≤ 6000 6x1 + 2x2 + x3 + 2x4 ≤ 10,000 x1 ≤ 1000 x2 ≤ 2000 x3 ≤ 500 x4 ≤ 1000 x1, x2, x3, x4 ≥ 0 a. (4 points) The coefficient 6 in the objective function is the contribution to profit for each type 1 frame, show (and explain) how this number is computed. Contribution to profit = selling price – labor cost – metal cost – glass cost = 28.50 – 2(8) – 4(.5) – 6(.75) = $6 b. (4 points) Two weeks ago Monet produced 500 of each of the four types of frames. Last week they produced 1000 of frame types 1, 2 and 4, and they produced none of frame type 3. Is it feasible to produce either of these product mixes this week? Explain. Would either of these solutions be optimal this week? Explain without referring to the Excel spreadsheet or Solver reports. By substituting x1=x2=x3=x4=500 into the seven constraints you obtain: 4000≤4000 binding 4500≤6000 non-binding 5500≤6000 non-binding 500≤1000 non-binding 500≤2000 non-binding 500≤500 binding 500≤1000 non-binding Therefore, the solution is feasible. It is NOT optimal because the objective function is not parallel to the binding constraints. And if you reduce the production of frame #3 by 1 unit you can increase the production of the more profitable frame #1 by I unit, thus improving on the current solution. By substituting x1=x2= x4=1000, x3=0 into the constraints you obtain: 5000>4000 not feasible Therefore, the solution is NOT feasible and NOT optimal. The production manager at Monet has used Excel and Solver to optimize the linear programming model. Attached are an Excel spreadsheet, a Solver Answer report and a Solver Sensitivity report for this problem. c. (4 points) What is the optimal solution? How many of each frame type should Monet produce? How much profit will this product mix yield? How many labor hours will they use? How many ounces of metal and glass will they use? You may use any of the information provided to answer this question. Produce 1000 of frame #1, 800 of frame #2, 400 of frame #3 and 0 of frame #4 Profit for this mix is $9200 This mix uses 4000 hours of labor, 6000 ounces of metal and 8000 ounces of glass d. (4 points) Monet’s sales department has been distributing a $1 discount coupon for type 1 frames. What impact will this have on the optimal product mix? What impact will this have on total profit? You may use any of the information provided to answer this question. A $1 discount will reduce the profit contribution of frame #1 by $1. This is less than the allowable decrease so the product mix will not change. Total profit will decrease by $1(1000) = $1000 (assuming that all customers redeem the coupon). e. (4 points) Monet is considering purchasing additional metal from a new supplier. What is the maximum they should pay and what is the maximum amount of metal they should purchase at this price? Explain. Should Monet consider looking for an additional supplier of glass? Why or why not? You may use any of the information provided to answer this question. Monet should pay up to $.90 (shadow price of $.40 + cost of metal$.50) for additional metal up to an additional 2000 ounces (the allowable increase). Monet already has excess glass so there is no need to seek an additional supplier. f. (5 points) Monet is concerned about becoming too reliant on the production of a single product. To address this concern they would like to make sure that no one frame type is produced in a quantity that exceeds 40% of the total product mix. What changes should they make to the linear programming model to implement this policy? Without resolving the model, what impact would you expect these changes to have on the current optimal product mix and profit? The following constraints should be added: x1 ≤ .4(x1+x2+x3+x4) x2 ≤ .4(x1+x2+x3+x4) x3 ≤ .4(x1+x2+x3+x4) x4 ≤ .4(x1+x2+x3+x4) The current solution violates the first of these constraints. Therefore, production of frame #1 will be reduced, production of the other frame types will likely change and profit will decrease. Name____________________________________________________ Section_______