ECONOMIOC ANALYSIS OF THE COPPER MINING

advertisement

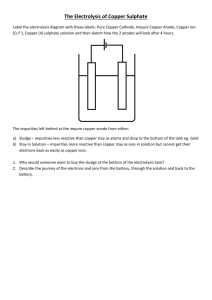

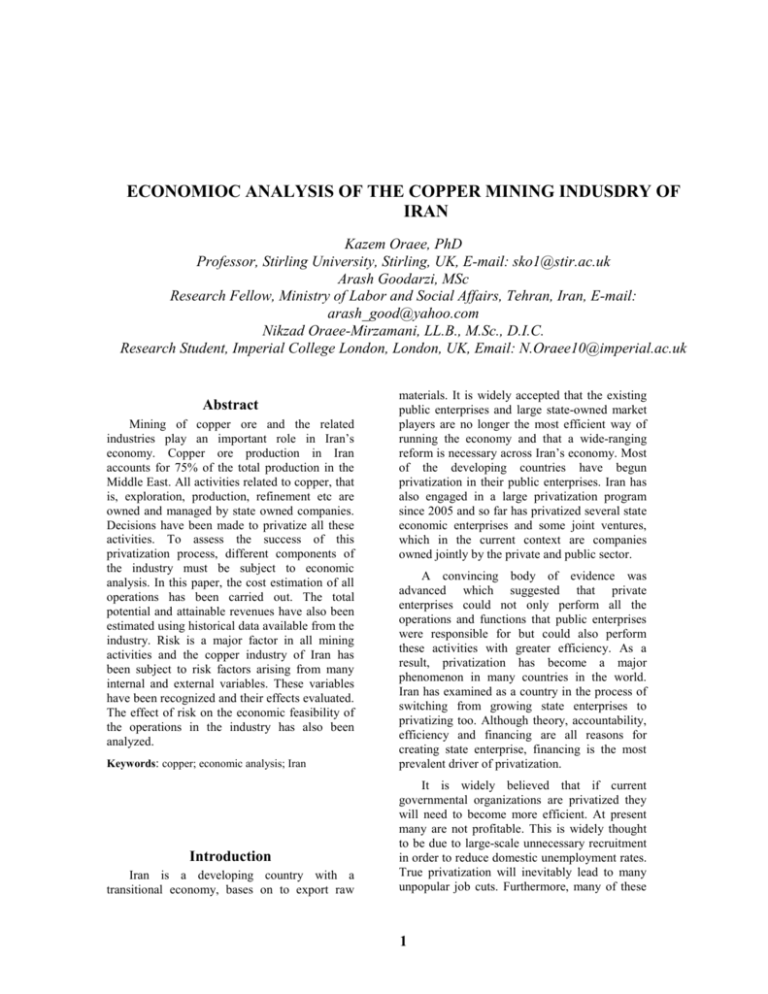

ECONOMIOC ANALYSIS OF THE COPPER MINING INDUSDRY OF IRAN Kazem Oraee, PhD Professor, Stirling University, Stirling, UK, E-mail: sko1@stir.ac.uk Arash Goodarzi, MSc Research Fellow, Ministry of Labor and Social Affairs, Tehran, Iran, E-mail: arash_good@yahoo.com Nikzad Oraee-Mirzamani, LL.B., M.Sc., D.I.C. Research Student, Imperial College London, London, UK, Email: N.Oraee10@imperial.ac.uk Abstract Mining of copper ore and the related industries play an important role in Iran’s economy. Copper ore production in Iran accounts for 75% of the total production in the Middle East. All activities related to copper, that is, exploration, production, refinement etc are owned and managed by state owned companies. Decisions have been made to privatize all these activities. To assess the success of this privatization process, different components of the industry must be subject to economic analysis. In this paper, the cost estimation of all operations has been carried out. The total potential and attainable revenues have also been estimated using historical data available from the industry. Risk is a major factor in all mining activities and the copper industry of Iran has been subject to risk factors arising from many internal and external variables. These variables have been recognized and their effects evaluated. The effect of risk on the economic feasibility of the operations in the industry has also been analyzed. Keywords: copper; economic analysis; Iran Introduction Iran is a developing country with a transitional economy, bases on to export raw materials. It is widely accepted that the existing public enterprises and large state-owned market players are no longer the most efficient way of running the economy and that a wide-ranging reform is necessary across Iran’s economy. Most of the developing countries have begun privatization in their public enterprises. Iran has also engaged in a large privatization program since 2005 and so far has privatized several state economic enterprises and some joint ventures, which in the current context are companies owned jointly by the private and public sector. A convincing body of evidence was advanced which suggested that private enterprises could not only perform all the operations and functions that public enterprises were responsible for but could also perform these activities with greater efficiency. As a result, privatization has become a major phenomenon in many countries in the world. Iran has examined as a country in the process of switching from growing state enterprises to privatizing too. Although theory, accountability, efficiency and financing are all reasons for creating state enterprise, financing is the most prevalent driver of privatization. It is widely believed that if current governmental organizations are privatized they will need to become more efficient. At present many are not profitable. This is widely thought to be due to large-scale unnecessary recruitment in order to reduce domestic unemployment rates. True privatization will inevitably lead to many unpopular job cuts. Furthermore, many of these 1 companies receive subsidies and grants from the government. The history of National Iranian Copper Industries Company Iran has large copper resources and numerous copper porphyries occur in an arc belt extending from northwest Iran, southeast into Pakistan. These deposits are estimated to contain 2 billion tons of copper, comprising around 3.5% of the world’s known copper resources, from which some 20 million tons of pure copper can be obtained. The world’s copper reserves amount to 57 billion tons. In addition, Iran has the 17th largest copper reserves in the world. Kerman Sarcheshmeh Mines Company was established in 1972 following the nationalization of Iranian Mines. The company became the partner of the US Anaconda Company a year later. Finally, the Kerman Sarcheshmeh Mines Company changed its name to National Iranian Copper Industries Company (N.I.C.I.CO) in 1976. The activities of N.I.C.I.CO include exploration, exploitation and the processing and distribution of raw materials in order to produce the final copper products. Economic analysis Economic analysis is a systematic approach to determining the optimum use of scarce resources, which involves comparing alternative ways for achieving a specific objective under given conditions and constraints. It is necessary for making decisions concerning investment activities in every business. Financial resources are limited and therefore any investor must choose the best investment opportunity from those available to him. Before stakeholders spend capital it has become essential to ensure that the proposed outcomes are well researched and cost effective. Economic analysis takes into account the opportunity costs of resources employed and attempts to measure in monetary terms the private and social costs and benefits of a project to the community or economy. A popular strategy for firms is profit maximization or at times the minimization of losses. There are many tactics for achieving this goal. In Iran investing on mining projects in the stock exchange is thought to be a positive step since approximately one third of the economy is dependent on the activities in the mining sector. Therefore for the purposes of N.I.C.I.Co raising capital through the sale of its shares in the stock exchange is thought to be a positive step since it is a large corporation and is bound to provide attractive investment opportunities. Investment opportunities will have different rankings according to their level of predicted profitability. Even if the investor faces one investment opportunity, it must be compared to other profit-generating activities. Thus the concept of the opportunity cost has to form an integral part of every economic analysis. Generally, balance sheet, profit and loss accounts and other financial statements published by public companies present raw, and in some cases meaningless numbers without much analysis. The balance sheet and profit and loss account of N.I.C.I.Co are presented in table 1 and table 2 for the recent triennial fiscal years. Sale analysis Sale analysis is the process of breaking a complex topic such as sale into smaller parts to gain a better understanding of it. A sale analysis is an investigation of a market that is used to forecast the next sales, according to past experiences and prediction of future conditions. Sale analysis is vital when perfect competition prevails in a market, whereas it is not so important in cases of a monopoly producer. The market for the production of copper in Iran is a pure monopoly market. Furthermore a company enjoying monopoly power is not subjected to competitive pressure from the market. Many clients have had to endure long delays before being able to buy products from N.I.C.I.Co in Iran. According to Sale (Import & Export) analysis for the previous two fiscal years, the company has allocated sixty percent (60%) of its sale to the domestic market and the rest have been exported. Cathode copper, wire rod and the concentration of copper are the most valuable products. They comprise some eighty five percent (85%) of the company’s total sales value. The sale of cathode copper accounts for approximately forty five percent (45%) of the total revenue (Tab 3, 4). The prediction of price Pricing and breakeven analysis will determine the impact of a price change on the 2 business. Copper is a finite resource, but, unlike oil, it is not dissipated and therefore can be recycled. Recycling is a major source of copper production in the modern world. As consumption in India and China increases, copper supplies are becoming scarcer. The price of copper has quintupled from the 60-year low in 1999, rising from 1,320 USD per ton in June 1999 to 8,780 USD per ton in May 2006. Prices subsequently dropped to 5,290 USD per ton in February 2007 before rising again to 7,710 USD per ton in April 2007. By early February 2009, however, weakening global demand and a steep fall in commodity prices lead to a drastic fall in prices to 2,540 USD per ton. Some reports however forecast an increasing demand in the near future as the global economic growth resumes. A rise in raw material prices, especially in the metals have been occurred in recent months and the prices rose above 8,300 USD per metric ton in the tenth month of 2010. However notwithstanding the reviving economies, constraints in the production of copper are likely to contribute to the shortfalls and thus the copper price is likely be driven by the rules of demand and supply instead of mere investor speculation. In 2011 the price is estimated to peak at more than 7,500 USD per metric tons on its way to averaging 6,500 USD. Figure 1. The average price of cathode copper from 2001 to 2010 Cost estimation Costs as well as revenues must be calculated. Costs are the monetary value of expenditures for supplies, services, labor, products, equipment and other items purchased for use by a company or other accounting entity. Cost is the total money and resources associated with an activity. A cost is the value of money that has been used up to produce something. The global recession and collapse of copper prices has forced the closure of many high cost mines and adversely impacted on project development. The rapid pace of change in the copper industry makes it even more important for producers and industry observers to truly understand the drivers on cost and profitability, as well as the implications for future copper mining. In N.I.C.I.CO, overheads comprise the largest group of costs which amount to around 40% of the total costs. Overhead costs include the ongoing operational costs. It is usually used to group costs that are necessary to the continued functioning of the business, but which do not directly generate profits. Overhead expenses are all costs on the income statement except for direct labor and direct materials. They include energy, depreciation, transport, rent, repairs, supplies and other such costs (Table 5, 6). Calculation The values that a project will have in the future, and indeed its value in the past, are different from its value in the present. Therefore in order to assess the profitability of a potential investment opportunity, one must compare the present value of a project with the value derived from other investments. Calculating the Net Present Value (NPV) is a useful method for economical evaluation; it is computed as the sum of discounted values of all future returns less initial investment. It is a standard method for using the time value of money to appraise longterm projects. The discount rate that makes the algebraic sum of future returns and initial investment equal to zero is called the Inter Rate Ratio (IRR). The cash flow table is formed according to the balance sheet and the profit and loss account (Table 7). The total assets in 2008 were assumed as cash our flow for year 0 and the summation of net profit and depreciation in 2009 were assumed as cash in for years 1, 2, 3, 4, 5, 6, 7, 8, and 9. In sensitivity studies, different values of PVIF (Present Value Index Factor) are examined and NPV is calculated in each case. 3 Net present value is computed for PVIF=15%, 20%, 25% and 27.8%. The NPV is positive for 15%, 20% and 25% and IRR is 27.8% where the amount of NPV becomes nil. Where inflation and risk are not accounted for, Net Growth is 10% and is therefore an acceptable rate. If however inflation is taken to be 20% in average (as it has been in Iran during the past 25 years) then PVIF = 10 + 20 = 30%. In addition if the level of risk is taken into account, say of around 10%, then PVIF = 30%. Therefore a project where the IRR is 27.8% will be uneconomical. Privatization in Practice A special governmental body has been created tasked with ensuring the correct implementation of the First Chapter of the 4th Economic, Social and Cultural Development Plan of Iran (2005-2009). It is called the Iranian Privatization Organization and is tasked with divesting the shares of N.I.C.I.CO. Forty percent of the shares were offered to the public on two occasions, 20% each time. In 2007 the first 20% of the company was sold for 1.1 billion USD. The investors were mostly other state-owned companies including pension funds and the state broadcasting industry. All shares were sold in less than 7 minutes. In almost every recent case of privatization in Iran, other state-owned entities and companies have been seen to be the main investors. These include state banks, government-linked investment and pension funds. None of the companies which have recently raised capital through public stock offerings have been proven profitable. Nevertheless in every public offering case these shares were sold in a matter of minutes. Therefore it seems that even where investment opportunities in Iran are not deemed profitable, state-owned companies with low profit margins can still sell their shares rather easily. private sector then other market players will be encouraged to enter that market and begin to compete with the incumbent seller. This will increase competition and in turn will drive the firms to produce at a lower cost to the final consumer. In Iran copper is currently produced by N.I.C.I.CO which enjoys monopoly power in the market for copper producers. The absence of adequate competition in this market has lead to shortages of supply and an inflated price, which inevitably affects the overall inflation rate in the economy. It has been shown, using N.I.C.I.CO’s annual report and financial accounts that the company runs inefficiently and that it will therefore profit in the long run from privatization. N.I.C.I.CO has offered 40% of its equity to the public in an attempt to privatize the market for copper production. However other governmental bodies comprised the majority of the new investors. Effectively therefore the company is now shared between more governmental bodies than before. Economists believe such stock offerings will only help in making these industries even more inefficient. References 1- Oraee Kazem, 1998, Analysis productivity, Tehran: Ketab Marv. 2- Oraee Kazem, 2001, Engineering economy, Tehran: Hormozgan university. 3- Oraee Kazem, 2002, The Economics of Mineral Resources: Mashad: Ferdousi university. 4- Oraee Kazem, 2006, New Methodologies in Technological Economics: Tehran: Poly technique of Tehran. 5- Oraee Kazem, 2007, Economics for noneconomists, Tehran: Poly technique of Tehran. Conclusions 6- It is a long-standing rule of economics that when the provision of commodities is concerned, in most cases the private sector will have a greater incentive to produce the goods in the most efficient method possible. Should the production and the sale of a commodity be profitable in the Oraee Kazem, 2008, Quantitative Management: Linear Programming, Tehran: Poly technique of Tehran. 7- Oraee Kazem, 2009, Minerals: The most important sector of the Iran economy, Tehran: Poly technique of Tehran. 4 of 8- Azmudekaran CPA. , 2009, Financial reports of N.I.C.I.Co , Tehran. 5 Table 1- Balance sheet table of National Iranian Copper Company for the recent triennial fiscal years Assets Last year Two last year Three last year Debts and Shareholders’ Equity Last year Two year ago Current assets (Rials) (Rials) (Rials) Current debts (Rials) (Rials) Three year ago (Rials) Cash balance 1,112,048,045,784 2,254,574,829,079 1,090,658,155,539 Commercial revenue accounts 419,231,506,644 176,477,150,180 60,022,251,787 Short-term investments 1,460,967,000,000 361,167,000,000 0 Other revenue accounts 2,172,837,092,268 2,034,031,253,941 4,686,455,143,828 Commercial revenue accounts and deeds Other revenue accounts 1,624,724,513,034 2,806,723,299,106 1,862,048,785,274 Deferred credit 34,788,236,906 43,968,923,752 463,080,605,939 750,681,040,410 614,664,417,691 978,883,540,948 Tax saving 1,246,041,812,928 1,004,365,130,068 674,155,931,207 Materials and goods in hand 4,379,530,786,573 4,140,831,718,813 3,605,208,488,549 Payable dividends 522,998,395,253 35,841,718,505 425,124,612,289 Orders and prepayments 973,398,023,007 782,212,397,791 481,099,447,933 Received financial facilities 674,287,183,167 645,291,147,609 713,277,632,011 Total current assets 10,301,349,408,808 10,960,173,662,480 8,017,898,418,243 Total current debts 5,070,184,227,166 3,939,975,324,055 7,022,116,177,061 Non-current assets Non-current debts Tangible fixed assets 11,639,058,374,275 11,189,170,159,898 11,319,554,456,748 Long-term payable accounts 27,629,900,539 27,629,900,539 27,629,900,539 Non-tangible assets 207,244,879,333 206,704,028,854 107,822,088,338 1,346,692,523,274 1,866,791,202,037 2,552,485,407,534 Long-term investments 205,340,753,000 5,340,753,000 5,340,753,000 Long-term financial facilities received Employees’ retirement bonus saving 737,021,810,603 517,726,909,082 286, 315,139,707 Other assets 1,478,726,761,828 1,326,410,318,591 1,667,652,658,080 Total non-current debts Total non-current assets 13,530,370,768,436 12,727,625,260,343 13,100,369,956,166 Total non-current liabilities 2,111,344,234,416 2,412,148,011,658 2,866,430,447,780 Total liabilities 7,181,528,461,582 6,352,123,335,713 9,888,546,624,841 Capital 5,789,644,600,000 5,789,644,600,000 5,789,644,600,000 Legal reserve 1,373,419,817,418 1,060,315,334,990 617,745,473,925 Other reserves 125,913,843,901 125,913,843,901 125,913,843,901 Accumulated profit 9,361,213,454,343 10,359,801,808,219 4,696,417,831,742 Total shareholders’ equity 16,650,191,715,662 17,335,675,587,110 11,229,721,749,568 Total liabilities and shareholders’ equity Disciplinary accounts party 23,831,720,177,244 23,687,798,922,823 21,118,268,374,409 3,798,121,790,622 4,048,697,909,500 6,904,574,923,609 Shareholders’ equity Total assets 23,831,720,177,244 23,687,798,922,823 21,118,268,374,409 Disciplinary accounts 3,798,121,790,622 4,048,697,909,500 6,904,574,923,609 One billion Rials is equal = one hundred thousand U.S. Dollars 6 Table 2-Profit/Loss table of National Iranian Copper Company for the recent triennial fiscal years Last year Two year ago Three year ago Rials Rials Rials Net Sale 16,276,087,326,723 19,540,079,282,969 16,921,725,830,321 Cost of finished products 8,059,075,456,030 8,039,174,375,235 7,192,984,227,117 Gross profit 8,217,011,870,693 11,500,904,907,734 9,728,741,603,204 Sales, administrative, public expenditures costs 757,133,201,302 1,130,865,898,589 1,261,823,121,261 Other income and operational costs 160,023,023,215 54,526,138,409 222,108,154,810 Operational profit 7,299,855,646,176 10,315,512,870,736 8,244,810,327,133 Financial costs 264,576,648,367 292,452,035,757 404,358,420,622 Other incomes and non-operational costs 50,172,807,984 192,779,832,251 14,544,660,791 Profit emanating from normal activities before deducting taxes 7,085,451,805,793 10,215,840,667,230 7,854,996,567,302 Profit tax of normal activities 823,362,157,241 1,227,485,555,886 590,227,668,625 Net profit 6,262,089,648,552 8,988,355,111,344 7,264,768,898,677 Description 7 Dividends of each share-Net 1,082 1,529 1,187 Table 3- Sale (Import & Export) analysis for the last fiscal year Production For Import For Export Total For Import For Export Total % Weight (ton) Value (Rials) Sulfide’s ore 223,202 0 223,202 13,415,467,984 0 13,415,467,984 0.08 Concentration of copper 0 193,606 193,606 0 2,644,795,430,992 2,644,795,430,992 16.25 Cathode copper 75,519 57,766 133,285 4,094,238,351,642 2,994,225,259,668 7,088,463,611,310 43.55 Concentration of Molybdenum 3,953 494 4,447 1,088,999,829,022 180,778,449,556 1,269,778,278,578 7.8 Concentration of gold & silver 329 0 329 228,313,445,630 0 228,313,445,630 1.4 Wire rod 73,624 1,494 75,118 4,294,952,661,985 120,176,011,931 4,415,128,673,916 27.13 Slab 644 0 644 27,648,469,889 0 27,648,469,889 0.17 Low grade copper 2,694 50,944 53,638 24,590,172,878 560,625,412,226 585,215,585,104 3.6 Sulfuric acid 4,988 0 4,988 3,328,363,320 0 3,328,363,320 0.02 9,775,486,762,350 6,500,600,564,373 16,276,087,326,723 100 (60%) (40%) (=100%) Total Table 4- Sale (Import & Export) analysis for the two fiscal year ago Production For Import For Export Total For Import For Export Total % Weight (ton) Value (Rials) Sulfide’s ore 0 0 0 0 0 0 0.00 Concentration of copper Cathode copper 0 133,111 133,111 0 2,522,266,904,355 2,522,266,904,355 12.91 64,102 57,726 121,828 4,500,609,471,987 4,123,437,339,955 8,624,046,811,942 44.14 8 Concentration of Molybdenum 6,300 184 6,484 1,785,700,543,380 53,761,498,283 1,839,462,041,663 9.41 Concentration of gold & silver 213 0 213 164,294,421,809 0 164,294,421,809 0.84 Wire rod 73,070 302 73,372 5,125,759,081,059 20,618,575,619 5,146,377,656,678 26.34 Slab 4,405 0 4,405 319,423,085,020 0 319,423,085,020 1.63 Low grade copper Sulfuric acid 0 63,531 63,531 0 924,208,361,502 924,208,361,502 4.73 0 0 0 0 0 0 0.00 11,895,786,603,255 7,644,292,679,714 19,540,079,282,969 100 (60%) (40%) (=100%) Total Table 5- The table of finished products cost for the fiscal years For the last fiscal year Description For the two fiscal year ago Rials % to cost finished products Rials % to cost finished products Wages (Direct) -1,506,423,748,633 18.7 -1,333,080,749,178 16.6 Consumption material and parts -1,073,018,067,705 13.3 -917,484,289,872 11.4 Overhead -3,673,113,246,636 45.6 -3,326,289,808,041 41.4 The costs have not been expended to cause halt in production +65,697,358,618 -0.8 +186,092,354,686 -2.3 Total of production costs -6,186,857,704,356 77.0 -5,390,762,492,405 67.1 The cost of wastage in process production -674,104,594,512 8.4 -278,906,342,353 3.5 The purchase of scrap & concentration copper -1,326,543,739,579 16.5 -2,795,493,914,671 34.8 The purchase of cathode copper -95,542,767,686 1.2 0 0.0 Recovery of sulfide’s ore +106,806,569,947 -1.3 +135,579,702,624 -1.7 Production (inventory) value increase +117,166,780,156 -1.5 +345,508,237,027 -4.3 The purchase of oxide’s ore for leaching operation 0 0.0 -55,099,565,457 0.7 Cost of finished products -8,059,075,456,030 100 -8,039,174,375,235 100.0 9 Table 6- The table of overhead cost for the fiscal years For the last fiscal year Description of costs For the two fiscal year ago Rials % to total overhead cost Rials % to total overhead cost Depreciation 1,173,023,114,105 31.9% 1,209,131,558,071 36.4% Stripping 853,813,024,062 23.2% 772,939,703,161 23.2% Energy 238,774,384,580 6.5% 232,850,611,345 7.0% Light transportation 213,504,291,906 5.8% 146,703,044,051 4.4% Cleanliness & horticulture 200,695,300,508 5.5% 150,836,222,704 4.5% Equipment maintenance 188,433,192,393 5.1% 199,956,340,263 6.0% Rent of truck 146,163,826,695 4.0% 53,958,517,626 1.6% Engineering services 113,386,152,683 3.1% 102,329,053,628 3.1% Rent of mining equipment 107,614,727,275 2.9% 78,072,839,081 2.3% 10 Depletion 72,839,449,439 2.0% 85,049,300,665 2.6% Health aids to personnel 64,650,128,537 1.8% 53,275,337,469 1.6% Ore haulage 59,895,995,434 1.6% 45,643,440,874 1.4% Personnel nutrition 46,606,110,529 1.3% 39,340,458,463 1.2% Drilling 46,035,309,296 1.3% 5,370,526,531 0.2% Non cash aids to personnel 45,780,992,263 1.2% 41,437,217,102 1.2% Other costs 44,041,157,684 1.2% 51,090,183,194 1.5% Rent of office & guesthouse Gathering of the wastage copper 23,418,903,495 0.6% 22,685,312,405 0.7% 21,378,818,507 0.6% 16,284,101,666 0.5% Heap embankment 13,058,367,245 0.4% 19,336,039,742 0.6% Total overhead cost 3,673,113,246,636 100% 3,326,289,808,041 100% Table 7- The economical evaluation of N.I.C.O.CO for next 10 years Cash in Cash out NCF Billion Rials Billion Rials Billion Rials 0 0 24,000 1 7500 2 DCF PVIF DCF (20%) PVIF (25%) (25%) (27.8%) (27.8%) 1.000 -24000.0 0.250 -6000.0 1.000 -24000.0 6521.7 0.833 6250.0 0.250 1875.0 0.782 5868.5 0.756 5671.1 0.694 5208.3 0.250 1875.0 0.612 4592.0 7,500 0.658 4931.4 0.579 4340.3 0.250 1875.0 0.479 3593.1 0 7,500 0.572 4288.1 0.482 3616.9 0.250 1875.0 0.375 2811.5 7500 0 7,500 0.497 3728.8 0.402 3014.1 0.250 1875.0 0.293 2199.9 6 7500 0 7,500 0.432 3242.5 0.335 2511.7 0.250 1875.0 0.230 1721.4 7 7500 0 7,500 0.376 2819.5 0.279 2093.1 0.250 1875.0 0.180 1346.9 PVIF (15%) -24,000 0 7500 3 DCF (15%) PVIF (20%) 1.000 -24000.0 7,500 0.870 0 7,500 7500 0 4 7500 5 Year 11 DCF 8 7500 0 7,500 0.327 2451.8 0.233 1744.3 0.250 1875.0 0.141 1053.9 9 7500 0 7,500 0.284 2132.0 0.194 1453.6 0.250 1875.0 0.110 824.7 NPV (Billion Rials): 11786.9 6232.2 12 10875.0 12.0