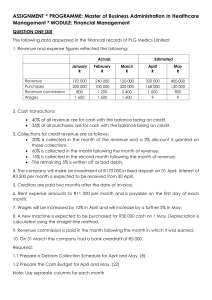

Cash- Flow Analysis

advertisement

Cash- Flow Analysis Time Value of Money The future value x of a sum P invested at annual interest rate I is: x P(1 i) t (Eq. 1) where t is the future time The present worth P of a future sum x is: x P (Eq. 2) (1 i ) t 1 Present worth factor: PWF (i, t ) (Eq.3) (1 i ) t See handout table 12.1 Example 12.1: Assume that opportunity A generates benefits equal to $100, $150, and $200 at the end of years 1, 2, and 3, respectively. Assume that opportunity B yields benefits of $225 in year 2 and $225 in year 3. Therefore over 3 years, both opportunities A and B yield benefits of $450. However, the timing of the benefits received is different in each case. By using the present-worth technique, their two benefit flows can be viewed in terms of today’s dollar value. Solution: Step 1 Compute the present-worth factor PWF using Eq. 3. With an interest rate of 10 percent, the calculation of present-worth factors is as follows: 1 1 0.9091 1 (1 0.10) (1.10)1 1 1 0.8264 Year 2 2 (1 0.10) (1.10) 2 1 1 0.7513 Year 3 3 (1 0.10) (1.10) 3 Year 1 Step 2 Compute the present worth of each opportunity benefit flow by multiplying the presentworth factor by the annual benefit amount. Year 1 2 3 Total Present-worth factor 0.9091 0.8264 0.7513 Annual benefit ($) A B 100 0 150 225 200 225 450 450 Present worth ($) A B 90.91 0 123.96 185.94 150.26 169.04 365.13 354.98 Inflation reduces future value by (1+j) where j is the inflation rate per year t (1 i) t x P P(1 i ) (1 j ) i j Where i i j Effective interest rate 1 j Series of Payments Suppose a series of annual or monthly sums is invested to pay off a loan (e.g. mortgage) The sum of payments is P P P S ann ann 2 ann 3 ... 1 i (1 i) (1 i) Pann 1 i 1 i .... 1 2 1 1 i Pann i The annual payments to pay for the solar system t i Pann S S CRF i, t t 1 1 i See handout of Capital-recovery factor Example 12.3 The owner of a four-unit apartment building of masonry construction is considering a retrofit installation of a solar heater. Under the existing climatic conditions it is expected that the solar unit can supply 87.5 10 6 kJ/yr and will thus save 5530 liters of fuel oil (with an effective heating value of 15,800 kJ/liter and an efficiency of 43 percent in the existing heating plant). In present dollars, this savings resulting from the solar unit represents a sum of $510 (9.2¢/liter of fuel oil saved). If the owner can borrow money for the solar retrofit at 10 present per year and wants to repay the loan in 7.8 yr. how much should the owner invest in the solar-heating system? Solution: If Pann $510 (savings resulting from solar energy for fuel oil) j 0.12 (expected increase in fuel cost) i 0.10 (interest rate for loan), and t 7.8 (time to repay loan, in years), then 1 0.10 i 1 0.0179 (effective interest rate) 1 0.12 and 0.982 7.8 1 $4,300 0.0179(0.982) 7.8 The owner can pay $4,300 or less for the retrofit installations. Repeat the problem, assuming the repayment time can be extended to 15 yr and government-backed, solar-improvement loans of 5 percent interest are available. Observe the large effect of interest rate on the calculations. S 510