Chapter 15: Capital Structure: Basic Concepts

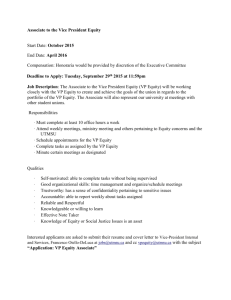

advertisement

Chapter 16: Capital Structure: Basic Concepts

16.2

a.

A firm’s debt–equity ratio is the market value of the firm’s debt divided by the market value of a

firm’s equity.

The market value of Acetate’s debt $9 million, and the market value of Acetate’s equity is $30

million.

Debt–Equity Ratio = Market Value of Debt / Market Value of Equity

= $9 million / $30 million

= 0.30

Therefore, Acetate’s Debt–Equity Ratio is 30%.

b.

The cost of Acetate’s equity is:

rS = rf + S{E(rm) – rf}

= 0.07 + 0.85( 0.21 – 0.07)

= 0.189

The cost of Acetate’s equity (rS) is 18.9%. Assume a cost of debt of 14%(missing in the statement

of the problem).

Acetate’s weighted average cost of capital equals:

rwacc = {B / (B+S)} rB + {S / (B+S)}rS

= ($9 million / $39 million)(0.14) + ($30 million / $39 million)(0.189)

= (0.23)(0.14) + (.77)(0.189)

= 0.1777

Therefore, Acetate’s weighted average cost of capital is 17.77%.

c.

According to Modigliani–Miller Proposition II (No Taxes):

rS = r0 + (B/S)(r0 – rB)

Thus:

0.189= r0 + (9/30)(r0 – 0.14)

Solving for r0:

r0 = 0.1777

Therefore, the cost of capital for an otherwise identical all–equity firm is 17.77%.

This is consistent with Modigliani–Miller’s proposition that, in the absence of taxes, the cost of

capital for an all–equity firm is equal to the weighted average cost of capital of an otherwise

identical levered firm.

Answers to End-of-Chapter Problems

B-

214

16.3

Since Unlevered is an all–equity firm, its value is equal to the market value of its outstanding

shares. Unlevered has 10.4 million shares of common stock outstanding, worth $76 per share.

Therefore, the value of Unlevered is $790.4 million (= 10.4 million shares * $76 per share).

Since Levered is identical to Unlevered in every way except its capital structure and neither firm pays

taxes, the value of the two firms should be equal according to:

Modigliani–Miller Proposition I (No Taxes):

VL =VU

Therefore, the market value of Levered, Inc. should be $790.4 million also.

Since Levered has 4.8 million outstanding shares, worth $98 per share, the market value of Levered’s

equity is $470.4 million. The market value of Levered’s debt is $275 million.

The value of a levered firm equals the market value of its debt plus the market value of its equity.

Therefore, the current market value of Levered, Inc. is:

VL

=B+S

= $275 million + $470.4 million

= $745.4 million

The market value of Levered’s equity needs to be $515 million, $44.6 million higher than its current

market value of $470.4 million, for MM Proposition I to hold.

Since Levered’s market value is less than Unlevered’s market value, Levered is relatively underpriced

and an investor should buy shares of the firm’s stock.

16.4

a.

Plan I:

The earnings after interest will be:

$9,500 – $12,000(0.1) = $8,300

EPS = $8,300 / 900 shares = $9.22/share

Plan II:

The earnings after interest will be:

$9,500 – $15,000(0.1) = $8,000

EPS = $8,000 / 650 shares = $12.31/share

All equity: EPS = $9,500 / 1,100 shares = $8.63/share

Plan II has the highest EPS.

b.

Plan I:

The earnings after interest will be:

($9,500 – $12,000(0.1)) (1–.25) = $6,225

EPS = $6,225 / 900 shares = $6.91/share

Answers to End-of-Chapter Problems

B-

215

Plan II: The earnings after interest will be:

($9,500 – $15,000(0.1))(1–.25) = $6,000

EPS = $6,000 / 650 shares = $9.23/share

All equity: EPS = $95,000 (1–.25) / 1,100 shares = $6.47/share

Plan II has the highest EPS.

16.6

Before the restructuring the market value of Grimsley’s equity was $6,750,000 (= 150,000 shares * $45

per share). Since Grimsley issues $900,000 worth of debt and uses the proceeds to repurchase shares, the

market value of the firm’s equity after the restructuring is $5,850,000 (= $6,750,000 – $900,000).

Because the firm used the $900,000 to repurchase 20,000 shares, the firm has 130,000 (150,000 – 20,000)

shares outstanding after the restructuring. Note that the market value of Grimsley’s stock remains at

$45 per share (= $5,850,000 / 130,000 shares). This is consistent with Modigliani and Miller’s

theory.

Part a: Ms. Cannon

Since Ms. Cannon owned $13,500 worth of the firm’s stock, she owned 0.2% (= $13,500 / $6,750,000) of

Grimsley’s equity before the restructuring. Ms. Cannon also borrowed $2,500 at 17% per annum,

resulting in $425 (= 0.17 * $2,500) of interest payments at the end of the year.

Let Y equal Grimsley’s earnings over the next year. Before the restructuring, Ms. Cannon’s payout,

net of personal interest payments, at the end of the year was:

(0.002)($Y) – $425

After the restructuring, the firm must pay $153,000 (= 0.17 * $900,000) in interest to debt holders at the

end of the year before it can distribute any of its earnings to equity holders. Also, since the market value

of Grimsley’s equity dropped from $6,750,000 to $5,850,000, Ms. Cannon’s $10,000 holding of stock

now represents 0.231% (= $13,500 / $5,850,000) of the firm’s equity. For these two reasons, Ms.

Cannon’s payout at the end of the year will change.

In order for the payout from her post–restructuring portfolio to match the payout from her pre–

restructuring portfolio, Ms. Cannon will need to sell 0.031% (= 0.00231 – 0.002) of Grimsley’s equity.

She will then receive 0.2% of the firm’s earnings, just as she did before the restructuring. Therefore, Ms.

Cannon must sell $1,800 (= 0.00031 * $5,850,000, or 1,800/45 = 40 shares) of Grimsley’s stock and

use the proceeds to retire her debt (so that her debt reduces to 2500-1800 =700). Her new financial

positions are:

Ms. Cannon

Grimsley Shares Borrowing Lending

$

11,700

$700 $

-

You can verify that her new payoffs are:

11,700/5,850,000 ($Y – 153,000) – 700 (0.17) = 0.02$Y – 425 = her old payoffs

Answers to End-of-Chapter Problems

B-

216

Part b. Ms. Finley (Same story: the punchline is that capital structure changes result in more

holdings in percentage; sell the extra equity holdings and use the proceeds for

lending/reducing debt)

Since Ms. Finley owned $58,500 worth of the firm’s stock, she owned 0.866% (= $58,500 / $6,750,000)

of Grimsley’s equity before the restructuring. Ms. Finley also lent $6,000 at 17% per annum, resulting in

the receipt of $1,020 (= 0.17 * $6,000) in interest payments at the end of the year.

Therefore, before the restructuring, Ms.Finley’s payout, net of personal interest payments, at the end of

the year was:

(0.00866)($Y) + $1,020

After the restructuring, the firm must pay $153,000 (= 0.17 * $900,000) in interest to debt holders at the

end of the year before it can distribute any of its earnings to equity holders. Also, since the market value

of Grimsley’s equity dropped from $6,750,000 to $5,850,000, Ms. Finley’s $58,500 holding of stock

now represents 1% (= $58,500 / $5,850,000) of the firm’s equity.

In order for the payout from her post–restructuring portfolio to match the payout from her pre–

restructuring portfolio, Ms. Finley will need to sell 0.134% (= 0.01 – 0.00866) of Grimsley’s equity and

receive $7,839 (= 0.00134 * $$5,850,000). She will add the proceeds to her lending. Her new shares are

worth 50,661, and her lending is now 6000 + 7839.

Ms. Finley

Grimsley Shares Borrowing

$

50,661 $

-

Lending

$13,839

You can verify that her new payoffs = old payoffs.

Part C. Ms. Lease

Since Ms. Lease owned $23,580 worth of the firm’s stock, she owned 0.349% (= $23,580 / $6,750,00) of

Grimsley’s equity before the restructuring. Ms. Lease had no personal position in lending or borrowing.

Therefore, before the restructuring, Ms. Lease’s payout at the end of the year was:

(0.004)($Y)

After the restructuring, Ms. Lease’s $23,580 holding of stock now represents 0.403% (=$23,580 /

$5,850,000) of the firm’s equity. Ms. Lease will need to sell 0.054% (= 0.00403 – 0.00349) of Grimsley’s

equity. Therefore, Ms. Lease must sell $3,159 (0.00054 * $5,850,000) of Grimsley’s stock and lend

$3,154 in order to rebalance her portfolio. Her new shares are worth: 0.349% (585,000) = 20,241. Her

new financial positions are:

Answers to End-of-Chapter Problems

B-

217

Grimsley Shares Borrowing

$

20,421 $

-

Ms.Lease

16.8

a.

Lending

$3,154

Strom is an all–equity firm with 300,000 shares of common stock outstanding, where each share

is worth $20.

Therefore, the market value of Strom’s equity before the buyout is $6,000,000 (= 300,000 shares

* $20 per share).

Since the firm expects to earn $810,000 per year in perpetuity and the appropriate discount rate to

its unlevered equity holders is 13%, the market value of Strom’s assets is equal to a perpetuity

of $810,000 per year, discounted at 13%.

Therefore, the market value of Strom’s assets before the buyout is $6,230,769.23 (= $810,000 /

0.135).

Strom’s market–value balance sheet prior to the announcement of the buyout is:

Assets =

Total Assets =

b.

Strom, Inc.

########### Debt =

Equity =

########### Total D + E =

$

###########

###########

1. According to the efficient–market hypothesis, Strom’s stock price will change immediately to

reflect the NPV of the project. Since the buyout will cost Strom $342,500 but increase the

firm’s annual earnings by $120,000 into perpetuity, the NPV of the buyout can be calculated as

follows:

NPVBUYOUT= –$342,500+ ($126,000 / 0.13)

= $626,730.77

Remember that the required return on the acquired firm’s earnings is also 13% per annum.

The market value of Strom’s equity will increase immediately after the announcement to

$6,857,500 (= $6,230,769.23 + $626,730.77).

Strom’s market–value balance sheet after the announcement of the buyout is:

Old Assets =

NPVBUYOUT =

Total Assets =

Answers to End-of-Chapter Problems

Strom, Inc.

$ 6,230,769.23 Debt =

$ 626,730.77 Equity =

$ 6,857,500.00 Total D + E =

$

$ 6,857,500.00

$ 6,857,500.00

B-

218

3. Since Strom has 300,000 shares of common stock outstanding and the market value of the

firm’s equity is $6,857,500, Strom’s new stock price will immediately rise to $22.858333 per

share $6,857,500 / 300,000 shares) after the announcement of the buyout.

According to the efficient–market hypothesis, Strom’s stock price will immediately rise to $22.858333

per share after the announcement of the buyout.

Strom needs to issue $342,500 worth of equity in order to fund the buyout. Therefore, Strom will need to

issue 14,983.5946 shares (=$342,500 / $22.858333per share) in order to fund the buyout.

4. Strom will receive $342,500 (= 14,983.5946 shares * $22.858333 per share) in cash after the

equity issue. This will increase the firm’s assets by $342,500. Since the firm now has

315,589.8659 (= 300,000 + 14,983.5946 ) shares outstanding, where each is worth $22.858333,

the market value of the firm’s equity increases to $7,200,000 (=314,983.5946 shares *

$22.858333 per share).

Strom’s market–value balance sheet after the equity issue will be:

Old Assets =

Cash =

NPVBUYOUT =

$ 6,230,769.23 Debt =

$

342,500 Equity =

Total Assets =

$ 7,200,000.00 Total D + E =

$

$ 7,200,000.00

$626,730.77

$ 7,200,000.00

5. When Strom makes the purchase, it will pay $342,500 in cash and receive the present value of

its competitor’s facilities. Since these facilities will generate $126,000 of earnings forever,

their present value is equal to a perpetuity of $126,000 per year, discounted at 13%.

PVNEW FACILITIES = $126,000 / 0.13

= $969,230.77

Strom’s market–value balance sheet after the buyout is:

Old Assets =

PVNEW FACILITIES =

Total Assets =

Strom, Inc.

$ 6,230,769.23 Debt =

$ 969,230.77 Equity =

$ 7,200,000.00 Total D + E =

$

$ 7,200,000.00

$ 7,200,000.00

6. The expected return to equity holders is the ratio of annual earnings to the market value of the

firm’s equity.

Strom’s old assets generate $810,000 of earnings per year, and the new facilities generate

$126,000 of earnings per year. Therefore, Strom’s expected earnings will be $936,000 per

Answers to End-of-Chapter Problems

B-

219

year. Since the firm has no debt in its capital structure, all of these earnings are available to

equity holders. The market value of Strom’s equity is $7,200,000.

The expected return to Strom’s equity holders is 13% (= $936,000 / $7,200.000).

Therefore, adding more equity to the firm’s capital structure does not alter the required

return on the firm’s equity as long as the new equity has the same risk as the old one.

7. Strom’s weighted average cost of capital after the buyout is:

rwacc=

=

=

=

{B / (B+S)} rB + {S / (B+S)}rS

( $0/ $7,200,000)(0) + $7,200,000/ $7,200,000)(0.13)

(1)(0.13)

0.13

Therefore, Strom’s weighted average cost of capital after the buyout is 13 if Strom issues equity

to fund the purchase.

c.

1. After the announcement, the value of Strom’s assets will increase by the $626,730.77, the net

present value of the new facilities. Under the efficient–market hypothesis, the market value of

Strom’s equity will immediately rise to reflect the NPV of the new facilities.

Therefore, the market value of Strom’s equity will be $6,857,500 (= $6,230,769.23 +

$626,730.77) after the announcement. Since the firm has 300,000 shares of common stock

outstanding, Strom’s new stock price will be $22.858333 per share per share (=$$6,857,500 /

300,000).

Strom’s market–value balance sheet after the announcement is:

Old Assets =

NPVBUYOUT =

Total Assets =

Strom, Inc.

$ 6,230,769.23 Debt =

$ 626,730.77 Equity =

$ 6,857,500.00 Total D + E =

$

$ 6,857,500.00

$ 6,857,500.00

2. Strom will receive $342,500 in cash after the debt issue. The market value of the firm’s debt

will be $342,500.

Strom’s market–value balance sheet after the debt issue will be:

Old Assets =

Cash =

NPVBUYOUT =

Total Assets =

Strom, Inc.

$

6,230,769 Debt =

$

342,500 Equity =

$ 626,730.77

$ 7,200,000.00 Total D + E =

$

342,500.00

$ 6,857,500.00

$ 7,200,000.00

3. Strom will pay $342,500 in cash for the facilities. Since these facilities will generate $126,000 of

earnings forever, their present value is equal to a perpetuity of $126,000 per year, discounted at

13%.

Answers to End-of-Chapter Problems

B-

220

PVNEW FACILITIES = $126,000 / 0.13

= $969,230.77

Strom’s market–value balance sheet after the buyout will be:

Old Assets =

PVNEW FACILITIES =

Total Assets =

Strom, Inc.

$ 6,230,769.23 Debt =

$969,230.77 Equity =

$ 7,200,000 Total D + E =

$

342,500

$ 6,857,500.00

$ 7,200,000.00

4. The expected return to equity holders is the ratio of annual earnings to the market value of the

firm’s equity.

Strom’s old assets generate $810,000 of earnings per year, and the new facilities generate

$126,000 of earnings per year. Therefore, Strom’s earnings will be $936,000 per year. Since

the firm has $342,500 worth of 11% debt in its capital structure, the firm must make

$37,675 (= 0.11 * $342,500) in interest payments. Therefore, Strom’s net earnings are only

$898,325 (= $936,000 – $37,675). The market value of Strom’s equity is $6,857,500.

The expected return to Strom’s equity holders is 13.099% (= $898,325 / $6,857,500).

Therefore, adding more debt to the firm’s capital structure increases the required return on the

firm’s equity. This is in accordance with Modigliani–Miller Proposition II.

5. Strom’s weighted average cost of capital after the buyout will be:

rwacc= {B / (B+S)} rB + {S / (B+S)}rS

= ( $342,500 / $7,200,000)(0.11) + ($6,857,500/ $7,200,000)(0.13099)

= 0.13

Therefore, Strom’s weighted average cost of capital after the buyout will be 13%

regardless of whether the firm issues debt or equity.

16.10

False. A reduction in leverage will decrease both the risk of the stock and its expected return.

Modigliani and Miller state that, in the absence of taxes, these two effects exactly cancel each other

out and leave the price of the stock and the overall value of the firm unchanged.of debt in a firm’s capital

structure will increase the required return on the firm’s equity.

16.11

a.

Before the announcement of the stock repurchase plan, the market value of the Locomotive’s

outstanding debt is $8.5 million. The ratio of the market value of the firm’s debt to the market

value of the firm’s equity is 40%.

The market value of Locomotive’s equity can be calculated as follows:

Since B = $8.5 million and B/S = 40%:

($8.5 million / S)= 0.40

S = $21.25 million

The market value of the firm’s equity prior to the announcement is $21.25 million.

Answers to End-of-Chapter Problems

B-

221

The value of a levered firm is equal to the sum of the market value of the firm’s debt and the

market value of the firm’s equity.

The market value of Locomotive Corporation, a levered firm, is:

VL

=B+S

= $8.5 million + $21.25 million

= $29.75 million

Therefore, the market value of Locomotive Corporation is $29.75 million prior to the stock

repurchase announcement.

According to MM Proposition I (No Taxes), changes in a firm’s capital structure have no effect

on the overall value of the firm. Therefore, the value of the firm will not change after the

announcement of the stock repurchase plan

The market value of Locomotive Corporation will remain at $29.75 million after the stock

repurchase announcement.

b.

The expected return on a firm’s equity is the ratio of annual earnings to the market value of the

firm’s equity.

Locomotive expects to generate $4 million in earnings per year.

Before the restructuring, Locomotive has $8.5 million of 8.5% debt outstanding. The firm was

scheduled to pay $722,500 (= $8.5 million * 0.085) in interest at the end of each year.

Therefore, annual earnings before the stock repurchase announcement are $3,277,500 (=

$4,000,000 – $722,500).

Since the market value of the firm’s equity before the announcement is $21.25 million, the

expected return on the firm’s levered equity (rS) before the announcement is 0.1542

(= $4 million – .722500 million / $21.25 million).

The expected return on Locomotive’s levered equity is 15.42% before the stock repurchase plan

is announced.

c.

According to Modigliani–Miller Proposition II (No Taxes):

rS = r0 + (B/S)(r0 – rB)

In this problem:

rS = 0.1542

rB = 0.085

B = $8.5 million

S = $21.25 million

Thus:

0.1542= r0 + ($8.5 million / $21.25 million)(r0 – 0.085)

Answers to End-of-Chapter Problems

B-

222

0.1542 = r0 + (0.40)(r0 – 0.085)

Solving for r0:

r0 = 0.1344

Therefore, the expected return on the equity of an otherwise identical all–equity firm is

13.44%.

This problem can also be solved in the following way:

r0 = Earnings Before Interest / VU

Locomotive generates $4,000,000 of earnings before interest. According to Modigliani–Miller

Proposition I, in a world with no taxes, the value of a levered firm equals the value of an

otherwise–identical unlevered firm. Since the value of Locomotive as a levered firm is $29.75

million (= $8.5 + $21.25) and since the firm pays no taxes, the value of Locomotive as an

unlevered firm (VU) is also $29.75 million.

r0 = $4 million / $29.75 million

= 0.1344

= 13.44%

d.

The expected return on Locomotive’s levered equity after the stock repurchase announcement is:

rS = r0 + (B/S)(r0 – rB)

= 0.1344+ (0.55)(0.1344 – 0.085)

= 0.1591

Therefore, the expected return on Locomotive’s equity is 15.91% after the stock repurchase

announcement.

Answers to End-of-Chapter Problems

B-

223