PUBLIC FINANCIAL MANAGEMENT AND CONTROL LAW

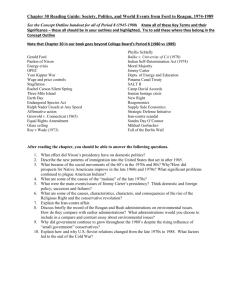

advertisement