LEGAL SOLUTIONS TO MARKET OBSTACLES FOR

ACCELERATED USE OF BIOMASS FUEL

@All rights reserved.

Randy M. Mott1 and Ron Nawrocki2

The European Union Directive on Renewable Energy has ambitious goals for

achieving significantly higher levels of renewable energy use by 2010. There is a new

consensus to greatly increase those goals by 2020. In the generation of power and heat,

most studies show that the increased use of biomass fuel will be the principal prospective

means used to meet these objectives in many new Member States.3 The EU renewable

electricity progress report in January 2007 described biomass as satisfying 21% of the

renewable energy goals for 2010. For Poland, the number is 53% of RES-E.

From EC, “Report on progress in renewable electricity,” January 10, 2007.

Randy M. Mott, Regional Envronmental Coordinator, CEC Government

Relations, Ul. Wiejska 12, 00-490 Warsaw Poland, +48-22-628-2418., Cell +48-691-712

716

Email: rm@cecgr.com This paper is an extended version of one presented at the

“International BioEnergy Conference for Southeastern Europe,” April 25-26, 2007.

1

Ron Nawrocki, Managing Director, B. I. Solutions, Warsaw, Poland, +48-22642-5097, Email: md@bisolutions.eu

2

Biomass is “the most promising renewable energy source is biomass (in Poland,

Latvia, Slovakia, CZ, Lithuania, Hungary)” Korytarova et al. “New Targets and Policies

Required in New Member States,” ReFocus, July/August 2006).

3

2

While the cost differential for biomass fuel compared to traditional fuels is lower

than many forms of renewable energy, the differential still requires active government

policies to provide a sufficient incentive for substitution. The EU Member States have

generally opted for renewable energy quotas for electrical distributors. Since the easiest

and most readily available biomass fuel sources have largely been tapped by 2007, the

goal of increasing its utilization will depend on effective policies that create the economic

incentive to do so.

Most existing studies and reports simply refer to generic “legal and regulatory

obstacles” to more use of renewable energy, including biomass. The basic premise of

this paper is that the legal and policy instruments can only be specifically measured

against the reduction of the “avoidance cost” in not substituting fuels. Current policies in

Poland, for instance, have yet to create a sufficient incentive for more fuel switching and

have failed to address some of the market problems that impede this objective.

BIOMASS POTENTIAL

Most government reports extol an enormous potential for biomass to contribute to

replacement of traditional fuels in Europe. See the European Commission’s January 2007

“Renewable Energy Road Map.” To meet the EU’s renewable energy objectives, the

Commission estimated that biomass utilization would have to double by 2010 over 2003

levels. “Biomass Action Plan,” December 7, 2005 (COM 2005) 628 final. Co-firing of

biomass fuels in power plants and central heating plants is one of the most cost-effective

means of reducing dependence on traditional fossil fuels.

3

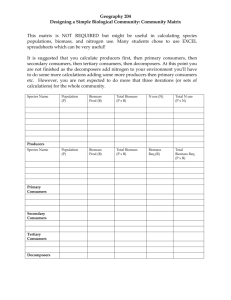

Despite this huge potential, the utilization

of biomass in both the electricity sector

and central heating sector is growing at a

pace unlikely to meet the projected

targets of the EU.4 Early government

projections for the 2010 mix of RES-E

have proven to be wide of the mark, but

biomass continues to be the leading

component in any plan (now 53%). See

graphic. While biomass is playing the

projected dominant role, it is not growing

fast enough to meet the RES-E targets.

Poland will hit 3% total RES-E in 2007,

while the target is

5.1%. See November 2006 ordinance.

What are the real reasons for the slower than projected growth of biomass and what steps

can be taken to address these problems?

Ministry of Economic Affairs and Labor (2005).

BIOMASS UTILIZATION ISSUES

Most of the economically available biomass was quickly absorbed in wood-related

industrial boilers.5 When oil prices hit over $50 a barrel, the obvious wood processing

and forestry wood residues were taken up by the paper, pulp, lumber and furniture

industries for use in their captive boilers. The March 2006 Polish Government Report to

the EU showed that in 2004 some 50.5 MW of the 51.9 MW in biomass installed capacity

were in “industrial power plants and industrial CHP plants.” This occurred before the

Polish laws provided penalties for failure to meet renewable energy fuel targets.6 It

means, however, that expansion of biomass in Poland in any large measure will have to

See Korytarova, supra.; EU Progress Report, January 2007. The Enterprise

Development Committee of Sejm met on November 14, 2006, and generally conceded

that the current law was not adequate to create the RES market called for by the EU

Directive for 2010. Most involved parties in Poland were surprised by the fairly upbeat

EU Roadmap Report on Poland in January 2007.

4

The industries with natural relationships in logistics, contracts and transportation

to the forestry locations and to wood processing scrap have been the first to utilize it, so

that it is not in the market in this point. This trend also occurred in Finland and Sweden,

with forestry-related industries being the first biomass users of wood products,

byproducts and waste. Ericsson, 2006, p. 32.

5

A large amount of the 2005 “bump” in RES-E was the inclusion for the first time

of Polish industrial power plants and CHPs. See “Sustainable Energy Network,” ETS

Poland Country Profile (2007).

6

4

look at less convenient and more expensive options.7 These include biomass crops,

wastes, small forest wood sources, and other less accessible sources. The newest

ordinance sets out minimal percentages of energy crops for biomass which may turn out

to be overly optimistic.

The largest source of potential biomass in the EU is projected to be energy crops,

especially perennials, which are mostly hypothetical at this point. Until the 2007 growing

season, energy crops did not qualify for CAP in the new Member States. 8 See EU Press

Release, Reference: IP/06/1243, September 29, 2006 (“The review of the energy crops

scheme has shown that it is appropriate to extend the aid for energy crops to all Member

States as from 2007 and under the same conditions.“). Even with the change, Polish

farmers get only 25% what French farmers receive for the same “energy crops.” While

annual crops have some value, experts project that perennial crops, like willow, are more

cost-effective as energy crops for electricity and heat generation.9 A perennial crop will

take four years to grow and harvest, so that none can be available until after 2010 if they

depend on CAP.

Virtually all of the EU experience with perennial energy crops is in Sweden (Ericsson,

2006), so that extrapolation of this practice to other European countries is still a largely

theoretical exercise. The cost of growing willow in Poland as an energy crop is lower

than in Sweden (Ericsson, 2006, p. 24). Polish cultivation costs are estimated to be half of

Swedish costs (€1.9 versus €4.2). Id. In total, the Polish cost of cultivation, land and risk

is €3.95 to €5 per GJ compared to the Swedish cost of €5.1 to €5.6 per GJ. The Swedish

cost is underwritten by government incentives, since the wood chip price is €4.7 per GJ

and coal is only € 1.7 per GJ. Id. Despite the potential of competitive perennial energy

crops, the cost differential to other fuels requires some government policy to equalize the

market price. See discussion of “substitution fees” below.

The Polish Government submission to the EU recognizes this fact: “…forest

biomass is primarily intended for use in the wood industry, the pulp and paper industry

and the wood panel industry.” Supra at 13.

7

Until the adjustment of CAP in 2006, many reports did not address the fact that

Poland received a much smaller degree of financial support for agriculture under the

accession agreement: ““Under the CAP EU policy Polish farmers receive 25% of the

average level of agricultural subsidies payable in the old Member States. For the year

2005 the subsidy level is expected to be at the level of 55,46 EUR/ha. …The ECOFUND

gives establishment subsidies for energy crops in the amount of 1.000 PLN/ha (250

EUR/ha) for the plantations 50-500 ha acreage, where the demand must be secured by a

forward signed contract for long term supplies of biomass produced. The support for

renewable heat depends on the priorities of financing institutions, mainly on the regional

level.” Poland Country profile EU ETS (emphasis added):

8

http://www.setatwork.eu/cp_poland.htm

“Perennial energy crops make up the single largest contribution to the long-term

biomass potential….” Ericsson, “Prospects for Bioenergy in Europe: Supply, Demand and Trade,”

9

October 2006.

5

Sweden also used an “establishment subsidy” of €100 to €330 per hectare to help

create farming of perennial energy crops (Ericsson, 2006, p. 27). Financial assistance is

available in Poland at €250 per hectare where the project is supported by a long-term

contract in hand.10 With more competitive costs and comparable potential establishment

financial support, the lag in development of the market must be explained by other

reasons, noted below.

While technically heating is covered by the Polish feed-in law, the exceptions

actually take away the impact of the inclusion. Heating by renewable energy sources is

only covered if it can be delivered at no more than 5% of the prior year’s price for “the

same volume of heat supplied to consumers from the district heat network.” Feed In

Ordinance (2204), Section 2.3.(b). After inflation, this does not leave much of a margin

to say the least. This gap in EU policy is the subject of a new proposal working its way

through the EU Parliament.

While Poland burns massive amounts of coal for its energy and allows boilers up to 5

MW to go on line with a simple registration procedure – and no air permit - if they are

burning coal, burning biomass is still treated as a special condition that requires more

precautions than the dirtier fuel it is replacing. While Article 9e of the Energy Law

provides for a seven day turn-around of request from electricity producers for a

“Certificate of Origin” on their renewable energy, the practical problems in obtaining

permission to burn biomass have meant substantial delays in obtaining approval. In

theory, “biomass” is defined by the ordinance as biodegradable material, precluding, for

instance, the use of adulterated wood with paint applied or construction debris. Despite

the relative simplicity of the Polish “biomass” definition, the process is often slow.

Switching fuels as biomass supplies change will be problematic as the system now works.

Given that boiler and feed modifications, even scales for weighing fuel entering the

boiler, may be required the relatively small penalty to the customer to pay a “substituion

fee” has obviously been appealing for many.

The other issue is pricing and long-term supplies. The easy material is accounted for.

Most waste biomass is excluded by current definitions (which seem to assume that it is

better to bury the waste than destroy it). Customers for potential biomass currently have

very high expectations over very low prices. The market has not adjusted to the reality

that new sources of biomass in significant amounts will entail higher prices to end-users.

Despite this situation, Poland had a surplus of green certificates in 2006 due to the low

level of avoidance costs through substitution fees.

Co-firing with biomass replacing a portion of the traditional coal as fuel need not

require extensive boiler modifications in some cases. However, the moisture and physical

properties of the biomass fuel can affect the boiler and the fuel feed system.

Modifications to allow co-firing with biomass fuel can range from €10 to €160 a

kilowatt. See Eriksson (2006), p. 34. Cost calculations for a producer changing to

10

Poland Country profile EU ETS

(2007 website).

6

biomass must include the producer’s direct costs for modifications and compliance with

the Energy Law, as well as the producer’s cost of the biomass.

The Polish plan, like many other national plans, depends on the quota system for

renewable electricity distributors. The power generators themselves have no

requirements. The system works only to the extent that the electricity and heat

distributors have quota requirements that they feel obligated to meet by the purchase of

more expensive “green electricity.” The distributors must incur substantial additional fuel

costs to meet the renewable percentages. Unless the system of fines and penalties is

effective, there is no mechanism to assure that any electricity or heat producer uses

renewable energy. This means the penalty system must be legally punitive to the degree

that it only pays to comply and that the system must be enforced.

The Polish system as modified in 2005 uses quotas and “substitution fees” if green

energy is not purchased by the distributor. The “substitution fee” is the same price as the

green certificate. The penalty for having neither is 130% of the price of the green

certificate. Polish green certificates (even in an emerging market with major supply

problems) were “over-produced” in 2005 and 2006. See Katarzyna MichałowskaKnap, Institute for Renewable Energy, “Wind energy development in Poland: history, main

influencing factors and future prospects” University of Technology Berlin, Wind Energy

Conference (December 2006).11 Despite falling well short of the targets in 2005 and

2006, Poland had a surplus of “green certificates,” indicating that the pricing mechanism

is ineffective. Penalties should be rare, since they can be avoided by paying the unique

“substitution fee” valued at the same price as a green certificate. The actual

Polish Green Certificates, Michałowska, “Wind Energy in Poland,”

U. of Technology, Berlin conference (2006).

This point was also made at a November 14, 2006 meeting of the Parliament’s

Enterprise Development Committee and the Polish Wind energy Association.

11

7

financial incentive to use green energy is only the value of an equivalent amount of

“black energy” less the headaches and burdens of finding green electricity suppliers.

The “substitituon fee” was actually pushed by the renewable energy business

community under the assumption that it would be effective if it was the same price as the

green certificate. However, the real penalty is not the substitution fee, but the black

energy price for the same volume of energy. The statute pegs the value at the same as the

green certificate. The difference between compliance via green energy use and

noncompliance is the value of the equivalent amount of “black energy” used in lieu of

renewable energy. The Polish “substitution fee” has effectively preempted the

noncompliance penalties and is unique in the jurisdictions using a quota system. The

above graphic assumes that the RES supplier gets the purchase. If the energy user simply

pays the “substitution fee,” then there is no use of renewable energy and the producer

does not to take any risk of the performance of the biomass fuel or other renewable

source. An energy producer has little incentive to add renewable energy if the quota is,

for example, 5% and the effective penalty to his customers is 2-2.5% of their total costs

of energy. Reaarranging his pricing to adjust for this 2-2.5% would often be more

attractive than risking modifications of the boiler, uncertain supply conditions, and other

operational inconveniences. This is exactly the predominant form of behavior under the

Polish system.

Another problem is the perceptions in the regulated community where the obligation

to use renewable energy in Poland is often not understood or acknowledged. Electricity

distributors sometimes think that the deadlines are not yet in effect. One power industry

official told a biomass venture that they had until 2012 to comply, for example. There is a

critical lack of communication to both energy users and potential biomass growers. As

simplistic as this point seems, it comes up in every discussion among renewable energy

developers as one of the biggest hurdles they face.

SOLUTIONS

8

Modification of the substitution fee: The Polish Ministry needs to look at the

substitution fee as established by Article 9A, Section 2, of the Energy Law. Traditionally,

the payment of fees in lieu of using green energy was viewed as a less desirable outcome

and fees were adjusted to preclude the regulated community from following a path of

least resistance and avoiding the renewable energy obligations. Thus, even apart from

other financial incentives, like carbon taxes, Sweden charges 150% for failure to meet

quotas,12 while Poland effectively charges only 100% (which ends up being only a 3050% differential between using green energy and paying for not doing so).13 Making the

effective penalty at least the same as other jurisdictions that rely entirely on the RPS

mechanism with no feed-in tariffs makes sense.

Fixing this problem will require legislative changes. The Polish Parliament is now

considering a new renewable energy law and this issue will hopefully be revisited.

Moreover, new legislation expected to be generated by the recent developments in

Brussels on 2020 goals and on heating plants will be another opportunity to get this fixed.

Poland should simply follow the model of other countries using quota systems effectively

and eliminate altogether “substitution fees.” The penalty should be raised to 150%, the

same level as in Sweden, although without carbon taxes, the Polish financial incentive

scheme is still more mild.

Simplification of procedures: The goal should be to make it as easy to burn biomass as

it is to burn coal. This can only be achieved by providing more specific, published,

transparent definition of what is acceptable biomass. Certification of use of biomass fuels

should be accordingly simplified. The filing with the Ministry should be a pro forma

process, subject to auditing or other quality assurance procedures, but not a case-by-case

“adjudication.” Self-policing with more clearly defined and enforced penalties for false

certification submissions would accelerate the process with little or no risk of abuse.14

While this is occurring, Poland should also look hard at allowing “adulterated” biomass

which could be subjected to more review of its environmental impact. In the United

States, New York State has started a two-tier approach for unadulterated biomass and

adulterated biomass, subjecting the latter to a case-by-case review by its Air Programs

office.15 Certainly until energy crops are a more viable option, other sources of biomass

should be looked at carefully.

European Renewable Energy Council, “Renewable Energy Policy Review:

Sweden,” May 2004, p. 7.

12

The Polish substitution fees are among the most mild RPS “penalties” in the

world. In the United States, various state procedures have used penalties from 130% to

500%. See Holt and Bird,“Emerging Markets for Renewable Energy Certificates: Opportunities and

Challenges,“ National Renewable Energy Laboratory, (January 2005) Table 1.

13

See e.g. Renewable Energy Compliance Certification Forms for the State of New Jersey,

pursuant to New Jersey Code Annotated 14:4-8.4 through 8.6.

14

See Technical Workshop for Biomass Project Implementation,

June 2005, NY Public Service Commission, Antares Group Inc.

15

9

More aggressive enforcement: The RES-E system in Poland may be locked into

under-performance unless enforcement actions are taken and perceived as a significant

risk to electricity distributors. Since the only incentive for power generators and heat

producers16 to use more expensive “green energy” is the insistence of the distributors,

the market will remain limited without effective enforcement and communication of

enforcement policies. This has been politically unpopular and will require more

aggressive government policies to achieve effective enforcement. It is likely that these

problems in Poland are typical of other new Member States with a post-communist

tradition of nominal environmental enforcement policies. Fairly dramatic changes in

public perceptions as well as enforcement policies are necessary.

Agricultural policy changes: There seem to be real issues on the shift in the EU-15 to

energy crops under the CAP. Where new Member States, like Poland, are only getting

25% of the CAP amounts on energy crops, it is difficult to see how the potential

cultivation of energy crops in this region can be meet the often high expectations of

government projections. The region has the potential to export energy crops within the

EU under the right conditions, which do not seem to be likely in the near future.

Feed In Tariffs and other taxes: Many experts argue that greater financial incentives

for renewable energy will be necessary for Poland and similar markets to successfully

convert from traditional sources. “Current investment support needs to be complemented

with fossil fuel taxes or other financial incentives that can change relative fuel prices and

production costs.” Nilsson et al. “Bioenergy Policy and Strategies for Poland,” 2005. It is

difficult to speculate on this issue when the existing quota system has weak financial

incentives and is not enforced effectively. More accurate evaluation of cost avoidance

(adjusting the substitution fee) and enforcement of the current quota law should lead to

substantially more biomass and renewable energy utilization. Whether these mechanism

will be able to take Poland and other Member States to the more challenging goals

beyond 2010 remains an open issue.

CONCLUSION

Poland and other newer Member States face difficult transitions to meet renewable

energy objectives in EU legislation. The RPS device is a reasonable mechanism to

provide for lower cost renewable energy at competitive prices. But meeting the objectives

for renewable market shares will require the system be effectively designed and enforced

to create the right economic incentives.

Getting heating plants to use renewables will require repeal of the provision that

limits their obligations to use renewables to no more than 5% higher prices than the prior

year. This will also have to be addressed to reach the new EU objectives for 2020.

16