contents page

advertisement

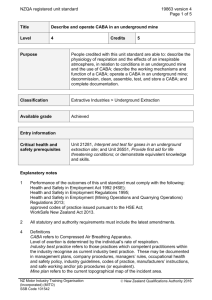

Market Sizing North America Intelligent and Integrated Technologies BACKGROUND The Continental Automated Buildings Association (CABA) is a not-for-profit industry association dedicated to the advancement of intelligent home and intelligent building technologies. The organization is supported by an international membership of over 350 organizations involved in the design, manufacture, installation and retailing of products relating to home automation and building automation. Public organizations, including utilities and government, are also members. CABA's mandate includes providing its members with networking and market research opportunities. The CABA Intelligent & Integrated Buildings Council (IIBC) works to strengthen the large building automation industry through innovative technology-driven research projects and other initiatives. The IIBC is proposing a market sizing exercise of the North American market for intelligent and integrated building technologies, that gaining prominence in the creation of high performance and green / sustainable buildings. OBJECTIVES The purpose of the study is to provide a detailed assessment of the current and future markets around intelligence in non-domestic buildings in North America. The emphasis is on a quantitative assessment of the market, supported by qualitative description and explanation where required. This study is targeted to assist CABA member companies, a range of concerns involved in the design, manufacture and installation of Intelligent Buildings Controls (IBC) including: Building Controls Manufacturers Systems Integrators / Controls Contractors - Facility Management Companies (Energy Management Service Companies) - OEMs of HVAC Hardware - Architects and Building Services Consultants - Security, Fire Alarm and Lighting Control Companies - Telecommunications and Computer Hardware Manufacturers - Network and Structured Cabling Suppliers / Installers. In the space of twenty years computer/microprocessor devices have progressed through multiple generations, each increasingly more reliable, “user friendly”, capable and less expensive. IBC manufacturers have taken advantage of the latest electronic technology and software available and they have taken a lead over most other sectors in the IBC industry. As a result, they have become the lynchpin and technological mainstay of the building services controls industry. However, this position is potentially under "threat" from "open systems" and the seamless integration of control and data networks. This study will seek to quantify the scale of threat from new entrants to this business. The move towards an IT-centric business and the role that XML and TCP/IP is playing in convergence and integration in intelligent buildings will have a major impact on the way business is conducted in the future. What makes convergence important is that XML is incorporated in IT Infrastructures both within major companies and across the worldwide web. The IT Infrastructures will eventually carry all the IBC information that management will analyze and act upon to both improve building and estate performance and provide holistic solutions that will also effect the operations being carried out in the building. Increasingly, this will be demanded by building owners and they will seek out suppliers to partner with them to ensure that they get robust and reliable solutions that are cost effective and appropriate for their needs. Understanding and making the business case will be key to winning business in this new environment where more business will be conducted directly with the client or his consultant and less will be bid against traditional contractual procedures. For those whose business is providing product, not solutions, little will change, provided that their products are designed around XML, and they assist their clients to ensure that they can deliver total solutions. This study will therefore seek to evaluate the value of the market for integrated and IT-converged solutions. Market Sizing North America Intelligent and Integrated Technologies The contractual procedures and routes to market are changing, partly as a result of convergence with IT as discussed above, but more significantly at this time because of the trend to elevate the controls contract to a major sub-contract. The sale of control hardware direct to the OEMs and soft solutions such as interfacing and integration will increasingly become a separate contract. This study will evaluate the proportion of hardware passing through the principal direct and indirect routes to market. Many are curious to know who will be the major players in this evolving total solution business, and whether they will come from the existing controls business structure or the IT Computer and Communications businesses. This study will analyze and assess what positions are being taken now by all of those in the supply chain in order so that companies can establish an appropriate strategy to accommodate the "threat" and take advantage of the "opportunity". The main demand driver for IBC now is the provision of appropriate comfort control whilst optimizing energy consumption, as well as achieving flexibility and management of space, so maximizing the productivity and performance of the building at the optimum life cycle cost. The components that drive demand are many and changing and we shall investigate the programmers that are, or likely to be introduced to govern energy consumption, reduce CO2 and improve air quality in buildings. By contrast, Europe has now introduced the "Energy Performance in Buildings Directive" and this is now having a dramatic impact on the penetration and growth of ddc controls. The study will carefully assess how the energy agenda has moved forward on these issues in North America and measure the latent potential that will become available. The models and procedures that will be used, are aimed at providing all the necessary qualitative and quantitative data so that suppliers can establish their current position, and also that of their competitors. The study will distinguish between hype and substance, unraveling the complex web of techno-commercial considerations, in order to present a clear and constructive report on which future marketing and product strategy can be determined. SCOPE This study is about integrated and converged intelligent building control systems that provide for the management of non-domestic buildings such as control and supervision of all forms of environmental control, fire detection and alarm, electronic security, lighting systems, water saving/control systems, audio visual and digital signage systems. A detailed project description outlining the segmentation and product categories is available upon request. The report shall: Establish 2008 market sizes by products at first point of distribution prices, products at engineered and commissioned prices and the total value added of the business by all in the supply chain. Chart the growth in the market, looking back at least five (5) years and forecasting five (5) years ahead. Assess hardware price erosion, so that "real" growth over the last five (5) years can be established Market Sizing North America Intelligent and Integrated Technologies DELIVERABLES Presentation The report will be presented in two (2) sections: Section 1 - Executive Summary This will provide an analysis and comparison of markets including size and structure, supplier shares, trading patterns and procedures and comparison with other developed markets in the world. Technology, compatibility issues, technical standards and code of practice will be analyzed with particular emphasis on the progress made since a similar 2005 study. The role of all those involved in the supply chain and any changes that are taking place because of technology, consolidation and downsizing leading to the subcontracting of facilities management of buildings, together with consolidation and performance contracting issues will be analyzed and their implications discussed. Section 2 – Report and Analysis PART 1 - MARKET ANALYSIS - SUPPLY SIDE 1. Market Analysis – 2008 Size, Structure and Form - This will provide a performance review sizing the market for IBC in seven (7) different segmentations and eleven (11) product categories. 2. Market Analysis - Building Type - Commercial, Public and Industrial. This will assess future prospects in new construction activity and through existing building stock including the refurbishment and retrofit opportunities: Market Analysis – Suppliers Supplier Share - all significant suppliers to the market will be listed together with their market share band for both product and system. Supplier Profile - all significant suppliers to the market will be profiled including facts about their size, activities product scope and web site details. Market Analysis - Third Party Suppliers System Integrators Energy Management Service Companies OEMs of HVAC Hardware 3. Trading Practices and Procedures 4. Industry Dynamics and Growth Prospects 5. Market growth: 2003 to 2008 and Forecast to 2013 PART 2 - DEMAND SIDE ANALYSIS 1. Forces that Determine Demand 2. Convergence of IT and Intelligent Infrastructures in Buildings 3. Technology The report will be delivery in print and electronic format. Market Sizing North America Intelligent and Integrated Technologies 1. Level 1: CABA member participation fee: $10,000 US Non-CABA member participation fee: $14,000 US a. Appoint a primary and secondary person to the Steering Committee with voting privileges b. Opportunity to finalize the research methodology and deliverables as it relates to your organization and industry sector c. Send five (5) complimentary participants to a one-day Charrette with BSRIA and all funding partners at a location to be named later or via Cisco’s Telepresence d. Receive five (5) complimentary printed final reports and an electronic version 2. Level 2: CABA member participation fee: $5,000 US Non-CABA member participation fee: $9,000 US a. Valued input regarding suggested market segmentation direction in order to influence the Steering Committee b. Send two (2) complimentary participants to a one-day Charrette with BSRIA and all funding partners at a location to be named later or via Cisco’s Telepresence c. Receive two (2) complimentary printed final reports and an electronic version Note: After the three (3) month embargo period, the final report will be available for the price of $7k for CABA members and $9k for non-CABA members for the next twelve (12) months ESTIMATED TIMELINE Proposed timelines for the research has been outlined below. It is expected that this project will start early April 2009. When the research is approved, BSRIA will prepare detailed timelines with specific project milestones, responsible parties, and action/delivery dates. All funding companies will form the Steering Committee and there will be a project manager. Market Sizing North America - Intelligent and Integrated Technologies Activity Project Approval Anticipated Date(s) Weeks 1 - 2 Primary Research Weeks 3 - 12 Data Analysis Weeks 12 - 20 Final Project Due Weeks 20 - 22 PROJECT CONTACT: Alex Detre CABA’s Research Director 888.798.CABA (2222) or 613.686.1814 ext 228 detre@caba.org You can also review the latest CABA research report “ Convergence of Green and Intelligent Buildings “ and webinar at: www.caba.org/brightgreen