THE IMPACT OF MISLEADING AND DECEPTIVE CONDUCT

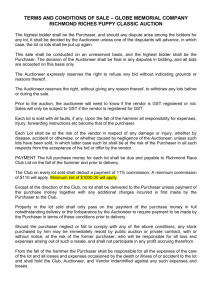

advertisement