ready made garments and fashion apparel industry

advertisement

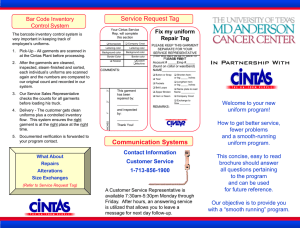

Cost Accounting Guidelines for Readymade Garments and Fashion Apparel Industry Research Department Institute of Cost of Management Accountants of Pakistan COST ACCOUNTING GUIDELINES (CAG) FOR READY MADE GARMENTS AND FASHION APPAREL INDUSTRY 1. OBJECTIVE 1.1. This Guideline is aimed at facilitating the companies engaged in production of readymade garments, clothing and fashion apparel, to maintain their cost accounts as per the internationally accepted principles and concepts of cost accounting. 1.2. The Guideline also aims at standardizing the different types of cost formats, being used by the garments and fashion apparel industry in Pakistan. 2. MAINTENANCE OF RECORDS 2.1 Every company to which these guidelines apply, shall keep proper books of accounts, containing the particulars relating to utilization of material, labour and other items of cost, in so far as these are applicable to the ready made garments and fashion apparel produced by it. 2.2 The books of account be kept on a regular basis so as to make it possible to calculate the ‘cost of production’ and ‘cost of sale’ of the garments and apparel at regular intervals, say quarterly, during the financial year, as well as for the financial year as a whole, from the particulars entered therein and every such books of account and the Performa specified therein shall be completed before the end of the financial year of the company. 3. MATERIALS 3.1 Proper records be maintained, batch wise, showing separately all receipts, issues and balances both in quantities and cost of each item of raw materials such as yarn, fabrics, accessories etc. used in the production of different types of garments and apparel. 3.2 The records for ‘direct materials’ must contain such details as to enable the company to determine the quantity, cost of receipts (including all direct charges upto the works in respect of all major direct materials), issues and balances of each item of direct materials, separately for ‘imported’ and ‘indigenous supplies’ for each batch of garments / apparel produced. 3.3. In case of imported material, details of ‘procurement cost’, ‘insurance, freight charges (CIF value), custom duty, port charges, inland freight and handling and clearance charges paid be recorded separately. The basis on which the said quantities and costs of issue and consumption have been calculated be indicated in the cost records and followed consistently. 3.4. The records, related to consumption of various materials in the production of garments be identified with specific batch of production or cost centers to which the materials are issued. If the quantity and value of materials consumed are determined on any basis other than actual, the method adopted be mentioned in the cost records and followed consistently. 3.5. Proper records be maintained to show the receipts, issues and balances both in quantities and costs of each type of garment (such as shirts, trousers, etc). The issues and consumption be properly identified with the departments, cost centers and products. (2) 4. CONSUMABLE STORES AND SPARES 4.1. Proper records be maintained to show the receipts, issues and balances, both in quantities and cost of store items, tools and machinery spares. The cost must include all direct charges upto works. The cost of consumption of consumable stores, small tools, and machinery spares shall be charged to the relevant cost centers on the basis of actual issues. 5. WASTAGES AND SPOILAGES 5.1. Proper records be maintained showing the quantity and value of wastages, spoilages, rejections and losses of raw materials (yarn, fabrics, accessories etc), consumable stores, spares, etc, whether in transit, storage, production or at any other stage. The method followed for adjusting these losses, and income derived from disposal of rejected / waste materials, including spoilages if any, in determining the cost of garments, be indicated in the cost records. Any abnormal wastages or spoilages be indicated distinctly and separately along with reasons thereof. 6. SALARIES AND WAGES 6.1. Proper records be maintained to show the attendance and earnings of all temporary and permanents employees and workers of different production units such as cutting, stitching, finishing, packaging, marketing and other departments of the company. The records must also indicate the following separately for each cost center or department: (a) (b) (c) (d) Piece rate wages earned (wherever applicable); Incentive wages earned, either individually or collectively as production bonus or under any other scheme based on output; Overtime Wages earned; Earnings of casual labour; 6.2. The records must be maintained in such a manner as to enable the company to furnish necessary particulars under this head. Where the employees work in such a manner that it is not possible to identify them with any cost center, the labour charges be apportioned to the cost centers on equitable basis and applied consistently. 6.3. Idle time must be separately recorded under classified headings, indicating the reasons thereof. The method followed for accounting of idle time payments in determining the cost of garment must be disclosed in the cost records. 6.4. Any wages and salaries allocable to capital works e.g. additions to plant and machinery, buildings, or other fixed assets be accounted for under the relevant capital heads. 6.5. If the wages and salaries are charged to production on any basis other than actuals, the method adopted be indicated in cost records. The reconciliation of such wages and salaries with actuals be made at least quarterly, during the financial year, explaining the reasons for variations. The treatment of such variations in determining the cost of garment be indicated in cost records. (3) 7. SERVICE DEPARTMENT EXPENSES 7.1. Detailed records be maintained to indicate expenses incurred in respect of each service department or cost center. These expenses be applied to other services and production departments on equitable basis and applied consistently. 8. UTILITIES 8.1. Water – Proper records showing the quantity and cost of treated/ cooling water produced and consumed for the production (washing) of garments must be maintained in such details as may enable the company to furnish the necessary particulars. 8.2. Steam – Where steam is produced by the company proper records showing the quantity and cost of steam produced and consumed in the production of garments must be maintained in such details as may enable the company to furnish the necessary particulars. 8.2. Power Proper records must be maintained for the quantity and cost of power purchased. Where power is generated by the company itself, adequate records be maintained to show the cost of power generated and consumed for the production of Garments. These records be maintained in such details as may enable the company to furnish necessary particulars. 9. REPAIRS AND MAINTENANCE 9.1. Proper records showing the expenditure incurred on repairs and maintenance by the various departments must be maintained. Where maintenance work is done by direct workers of any production cost center, the wages and salaries of such workers be treated as direct expenses of respective cost center. If the services are utilized for other products also, the manner of charging a share to garment be equitable and indicated in records and applied consistently. 9.2. Expenditure on major repair works from which benefit is likely to accrue for more than one financial year, must be shown separately in the cost records, indicating the method of accounting in determining the cost with reference to the relevant period. 10. DEPRECIATION 10.1 Proper records be maintained showing the cost and other particulars of fixed assets in respect of which depreciation is to be provided for. These records must, inter alia, indicate the cost of each item of asset including installation charges, if any, the date of its acquisition, the date of installation, rate of depreciation and the location of each asset. (4) 10.2. The fixed assets whose original cost of acquisition cannot be ascertained without any unreasonable expenditure or delay, the valuation shown in the books on the first day of the financial year beginning on or after the commencement of these rules be taken as ‘cost’. Such evaluation shall exclude revaluation of any asset that had been done prior to the aforesaid date. 10.3. The basis on which depreciation is calculated and allocated/ apportioned to various cost centers and departments and absorbed on the products must be clearly indicated in cost records. 11. OTHER OVERHEADS 11.1. Proper records be maintained showing the various items of expenses, comprising the other overheads. These expenses be analyzed, classified and grouped according to functions, viz. works, administration and selling and distribution. 11.2. Overheads chargeable to capital works must be indicated separately in the cost records. Basis of apportionment or absorption of overheads to cost centers and products be also indicated in the cost records. 11.3. The details of works, administration and selling and distribution overheads be maintained in such a manner as to enable the company to fill up necessary particulars. 12. RESEARCH AND DEVELOPMENT EXPENSES 12.1. Proper records be maintained separately, showing the details of expenses, if any, incurred by the company for the research and development work viz. design and development of products, processes of manufacture, market research etc. The method of charging these expenses to the cost of the products be indicated in the cost records. 13. INTEREST 13.1. Proper records be maintained separately, showing interest charges on term loan and cash credit / overdraft (working capital). The amount of interest be allocated/ apportioned to the products and other activities on a reasonable and equitable basis and to be followed consistently. The basis of such apportionment shall be spelt out clearly in the cost statements. 14. EXPENSES / INCENTIVES ON EXPORTS 14.1. Proper records showing expenses incurred on ‘export sales’ of garments be maintained separately so that the cost of export sales could be determined correctly. The expenses incurred on exports, as well as any export incentives(s) earned be reflected in the cost statement. 14.2. Export incentives be treated as ‘other income’ and reflected in the cost records. Separate cost statement be prepared for products exported, giving details of export expenses incurred /incentive earned. (5) 14.3. In case, duty free imports are made, the cost statements should reflect this fact. The company should maintain a separate ‘Price Stock ledger’ for duty free import items and their consumption. If the duty free imports are made after the actual production, the cost statements should reflect this fact. However, no amount of notional custom duty etc. should be charged to this production. 15. PACKING 15.1. Proper records be maintained showing the quantity and cost of various packing materials and other expenses incurred for packing the finished products for marketing of garments. 15.2. Detailed records of the expenses incurred on export packing, if any, also be kept separately and exhibited in the relevant cost statements for exports. 16. WORK IN PROGRESS AND FINISHED GOODS STOCK 16.1. The method followed for determining the cost of work in progress and finished goods be indicated in the cost records so as to reveal the cost elements that have been taken into account in such computation. 17. RECORDS OF PHYSICAL VERIFICATIONS 17.1. Records of physical verifications be maintained in respect of all items held in stock, such as raw materials (yarn, fabrics etc), accessories, consumable stores, machinery spares, chemicals, finished garments etc. Reasons for shortage/surpluses arising out of such verifications and the method followed for adjusting the same in the cost of products be indicated in the records. 18. STATISTICAL RECORDS 18.1. Data regarding available machine hours, direct labour hours in different production departments, and actually utilized be maintained and shortfall suitably analyzed. Suitable records for computation of idle time of machines must be maintained. Production Flow (Woven Garments) Purchase of Woven Fabrics Marking & Grading Fabrics Spreading & Cutting Sewing / Stitching Washing / Bleaching/ Dying / Printing and other process Embroidery Trimming Pressing Finishing & Packing Dispatch / Shipment Production Flow (Knitted Garments) Purchase of Yarn and Accessories Knitting Washing / Bleaching/ Dying and other process Embroidery and Printing Fabrics Spreading & Panel Cutting Trimming Stitching Pressing Finishing & Packing Dispatch / Shipment COST STATEMENTS STATEMENTS SHOWING THE FOLLOWING: Total Cost of Production of Garments Total Cost of Sales of Garments Cost of Material Consumed: (a) Yarn (b) Fabric (c) Accessories (d) Chemicals