Chapter 001 Personal Finance Basics and the Time Value of Money

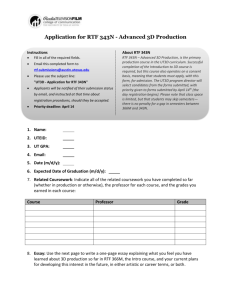

advertisement

FCS 3450 Spring 2010 Test 1 with Answers True / False Questions 1. Increased demand for a product or service will usually result in lower prices for the item. FALSE 2. Inflation reduces the buying power of money. TRUE 3. When prices are increasing at a rate of 6 percent, the cost of products would double in about 12 years. TRUE 4. A decrease in the demand for a product or service may result in a decrease in wages for people producing that item. TRUE 5. A financial plan is another name for a budget. FALSE 6. Short-term goals are usually achieved within the next year or so. TRUE 7. Opportunity costs refer to time, money, and other resources that are given up when a decision is made. TRUE 8. Risks associated with most financial decisions are fairly easy to measure. FALSE 9. The financial planning process is complete once you implement your financial plan. FALSE Multiple Choice Questions 10. Higher prices are likely to result from: A. lower demand by consumers. B. increased production by business. C. lower interest rates. D. increased spending by consumers without increased production. E. an increase in the supply of a product. 1 FCS 3450 Spring 2010 Test 1 with Answers 11. With an inflation rate of 9 percent, prices would double in about ___________ years. A. 4 B. 6 C. 8 D. 10 E. 12 12. Increased consumer spending will usually cause: A. lower consumer prices. B. reduced employment levels. C. lower tax revenues. D. lower interest rates. E. higher employment levels. 13. The main economic influence that determines prices is: A. the stock market. B. interest rates. C. employment. D. government spending. E. supply and demand. 14. As Jean Tyler plans to set aside funds for her young children's college education, she is setting a(n) ____________ goal. A. intermediate B. long-term C. short-term D. intangible E. durable 15. Brad Opper has a goal of "saving $50 a month for vacation." Brad's goal lacks: A. measurable terms. B. a realistic perspective. C. specific terms. D. the type of action to be taken. E. a time frame. 16. Opportunity cost refers to: A. money needed for major consumer purchases. B. what a person gives up by making a choice. C. the amount paid for taxes when a purchase is made. D. current interest rates. E. evaluating different alternatives for financial decisions. 2 FCS 3450 Spring 2010 Test 1 with Answers 17.If a person deposited $50 a month for 6 years earning 8 percent, this would involve what type of computation? A. simple interest B. future value of a single amount C. future value of a series of deposits D. present value of a single amount E. present value of a series of deposits 18. Which type of computation would a person use to determine current value of a desired amount for the future? A. simple interest B. future value of a single amount C. future value of a series of deposits D. present value of a single amount E. present value of a series of deposits 19. If inflation is increasing at 3 percent per year, and your salary increases at the same rate, how long will it take your salary to double? A. 30 years B. 24 years C. 18 years D. 12 years E. 6 years 20. When prices are increasing at a rate of 6 percent, the cost of products would double in about how many years? A. 7.2 years B. 10 years C. 6 years D. 12 years E. 18 years 3 FCS 3450 Spring 2010 Test 1 with Answers 21. If you put $1,000 in a saving account and make no further deposits, what type of calculation would provide you with the value of the account in 20 years? A. future value of a single amount B. simple interest C. present value of a single amount D. present value of a series of deposits E. future value of a series of deposits 22. The financial planning process concludes with efforts to A. develop financial goals. B. create a financial plan of action. C. analyze your current personal and financial situation. D. review the financial plan. E. review and revise your actions. 23. A family spends $40,000 on living expenses. With an annual inflation rate of 3 percent, they can expect their expenses to be approximately _______ in three years. A. $40,300 B. $41,200 C. $42,000 D. $43,700 E. $46,000 24. Barb Hotchkins is in the 28 percent tax bracket. A tax-exempt employee benefit with a value of $500 would have a tax-equivalent value of: A. $694. B. $528. C. $500. D. $360. E. $140. 25. Tax-deferred employee benefits are A. not subject to federal income tax. B. not subject to state income tax. C. taxed at some future time. D. are taxed at a special rate. True / False Questions 26. Opportunity costs are only associated with money management decisions involving longterm financial security. FALSE 4 FCS 3450 Spring 2010 Test 1 with Answers 27. A budget is a specific plan of how a person or family will spend their money. TRUE 28. A personal balance sheet reports your income and expenses. FALSE 29. A person's net worth is the difference between the value of the items owned and the amounts owed to others. TRUE 30. Furniture, jewelry, and an automobile are examples of liquid assets. FALSE 31. Current liabilities are amounts that must be paid within a short period of time, usually less than a year. TRUE 32. A personal cash flow statement presents income and outflows of cash for a given time period, such as a month. TRUE 33. If expenses for a month are greater than income, an increase in net worth will result. FALSE Multiple Choice Questions 34. A personal balance sheet presents: A. amounts budgeted for spending. B. income and expenses for a period of time. C. earnings on savings and investments. D. items owned and amounts owed. E. family financial goals. 5 FCS 3450 Spring 2010 Test 1 with Answers 35. The current financial position (including net worth) of an individual or family is best presented with the use of a(n): A. budget. B. cash flow statement. C. balance sheet. D. bank statement. E. time value of money report. 36. A family with $45,000 in assets and $22,000 of liabilities would have a net worth of: A. $45,000. B. $23,000. C. $22,000. D. $67,000. E. $41,000. 37. Items that you own with a monetary worth are referred to as: A. liabilities. B. variable expenses. C. net worth. D. income. E. assets. 38. Items of value minus the amounts owed to others equals: A. net assets. B. net worth. C. total liabilities. D. total income. E. budgeted expenses. 39. Liabilities are amounts representing: A. debts. B. items of value. C. living expenses. D. taxable income. E. current assets. 40 . A person's net worth is computed by: A. adding assets and liabilities. B. deducting current living expenses from total assets. C. subtracting total liabilities from total assets. D. subtracting assets from current liabilities. E. adding liabilities and budgeted expenses. 6 FCS 3450 Spring 2010 Test 1 with Answers 41. A cash flow statement reports a person's or a family's: A. net worth. B. current income and payments. C. plan for spending. D. value of investments. E. balance of savings. 42. Which of the following presents a summary of income and outflows for a period of time? A. A balance sheet B. A bank statement C. An investment summary D. A cash flow statement E. An asset report 43. A common deduction from a person's paycheck is for: A. interest. B. taxes. C. rent. D. unemployment. E. current liabilities. 44. A decrease in net worth would be the result of: A. income greater than expenses for a month. B. expenses greater than income for a month. C. assets greater than expenses. D. increased earnings on the job. E. income and expenses equal for a month. 45. The difference between the amount budgeted and the actual amount is called a: A. financial plan. B. current liability. C. change in net worth. D. budget variance. E. variable living expense. 7 FCS 3450 Spring 2010 Test 1 with Answers 46. Patricia McDonald has determined that the value of her liquid assets is $4,500, the value of her real estate is $128,000, the value of her personal possessions is $62,000 and the value of her investment assets is $73,000. She has also determined the value of her current liabilities is $7,500 and the value of her long term liabilities is $98,000. What is Jamie's net worth? A. $267,500 B. $105,500 C. $162,000 D. $205,500 E. $132,000 47. A family has a net worth of $156,000 and liabilities of $167,000, what is the amount of their assets? A. $11,000 B. $156,000 C. $167,000 D. $323,000 48. In a recent month, Ken Grossman has cash inflows of $3,100 and cash outflows of $2,950, resulting A. a balanced budget. B. a surplus of $150. C. a deficit of $150. D. a surplus of $3,100. E. a deficit of $2,950. 49. An investment account that increases from $3,000 to $3,271 in one year is earning about ___ percent. A. 3 B. 5 C. 7 D. 9 E. 11 True / False Questions 50. Taxes are only considered as financial planning activities in April. FALSE 8 FCS 3450 Spring 2010 Test 1 with Answers 51. A state may impose a personal property tax. TRUE 52. Real-estate property taxes are a major source of revenue for local governments. TRUE 53. A general sales tax is also referred to as an excise tax. FALSE 54. A tax on the value of automobiles, boats, or furniture is referred to as a personal property tax. TRUE 55. Taxable income is the total earnings of a person. FALSE 56. Exemptions are deductions for yourself, your spouse and qualified dependents that you can deduct from adjusted gross income. TRUE Multiple Choice Questions 57. The main purpose of taxes is to: A. generate revenue for funding government programs. B. reduce the chances of inflation. C. create jobs. D. discourage use of certain goods and services. E. decrease competition from foreign companies. 58. Which type of tax is imposed on specific goods and services at the time of purchase? A. estate B. inheritance C. excise D. general sales E. value-added 59. The ______________ property tax is based on the value of land and buildings at some point in time. A. personal B. real estate C. direct D. proportional E. regressive 9 FCS 3450 Spring 2010 Test 1 with Answers 60. Interest earnings of $1,600 from a taxable investment for a person in a 28 percent tax bracket would result in after-tax earnings of A. $1,600 B. $1,152 C. $1,100 D. $448 E. $152 61. A $2,000 deposit to a tax-deferred retirement account for a person in a $25 percent tax bracket would result in a reduced tax bill of A. $2,000 B. $1,500 C. $1,200 D. $500 E. $300 62. A taxpayer with a taxable income of $47,856 and a total tax bill of $5,889 would have an average tax rate of ____ percent. A. 8.6 B. 10.3 C. 12.3 D. 14.2 E. 16.7 63. Which of the following would be deducted from gross income to obtain adjusted gross income? A. alimony payments B. mortgage interest C. medical expenses D. foreign income exclusion E. charitable contributions 64. Reductions from gross income for such items as individual retirement account contributions and alimony payments will result in: A. adjusted gross income. B. taxable income. C. earned income. D. passive income. E. total exclusions. 10 FCS 3450 Spring 2010 Test 1 with Answers 65. Which of the following items is a set amount on which no taxes are paid? A. itemized deductions B. the standard deduction C. an earned tax credit D. withholding E. capital gains 66. An expense that would be included in the itemized deductions of a taxpayer is: A. travel to work. B. life insurance premiums. C. real estate property taxes. D. a driver's license fee. 67. A deduction from adjusted gross income for yourself, your spouse, and qualified dependents is: A. the standard deduction. B. a tax credit. C. an itemized deduction. D. an exclusion. E. an exemption. 68. Michele Barbour is considering an additional charitable contribution of $2,000 to a taxdeductible charity, bringing her total itemized deductions to $16,000. If Michelle is in a 28 percent tax bracket, and is not subject to a phase out of deductions, how much will this $2,000 contribution reduce her taxes? A. nothing B. $560 C. $1,600 D. $2,000 E. $4,480 69. Which of the following would qualify a person for an exemption when computing taxable income? A. mortgage interest B. a tax shelter C. a dependent D. charitable contributions E. passive income 11 FCS 3450 Spring 2010 Test 1 with Answers 70. A tax ____________ is an amount subtracted directly from the amount of taxes owed. A. credit B. exemption C. deduction D. exclusion E. shelter 71. A tax credit of $50 for a person in a 28 percent tax bracket would reduce a person's taxes by: A. $10. B. $28. C. $14. D. $50. E. $35. 72. A person with a total tax liability of $4,350 and withholding of federal taxes of $3,975 would: A. receive a refund of $3,975. B. owe $4,350. C. owe $375. D. receive a refund of $4,350. E. receive a refund of $375. 73. An example of an itemized deduction is: A. interest on a credit card or charge account. B. certain job-related travel expenses. C. the cost of commuting to work. D. life insurance premiums. E. a traffic violation fee. 74. The state of Oklahoma imposes a tax of $.17 per gallon on gasoline. What type of tax is this most likely to be? A. General sales tax B. Excise tax C. Personal property tax D. Income tax E. Estate tax 12 FCS 3450 Spring 2010 Test 1 with Answers 75. Tim Bridges purchases a bass fishing boat in the state of Oklahoma. The state imposes a 3.25% tax on the value of this purchase. What type of tax is this most likely to be? A. General sales tax B. Excise tax C. Personal property tax D. Income tax E. Estate tax 76. Drew Davis earns $4500 per month from his job at Cisco Systems; $900 is withheld from this amount each month for taxes. What type of tax is this most likely to be? A. General sales tax B. Excise tax C. Personal property tax D. Income tax E. Estate tax 77. Kim Ye is single and earns $40,000 in taxable income. He uses the following tax rate schedule to calculate the taxes he owes. Calculate the dollar amount of estimated taxes that Kim owes. A. $2,737.50 B. $6,747.50 C. $10,000.00 D. $17,587.50 78. If Edward received a $1,600 raise to increase his annual salary from $37,000 to $38,600 during a year with an annual inflation of 4%, what would his personal increase be in nominal terms? A. .3% B. 4.15% C. 4.3% D. 6% 79. Using the same information as problem 93, what is his real personal increase? A. .3% B. 4.15% C. 4.3% D. 6% 13