Chapter 010 Home and Automobile Insurance

advertisement

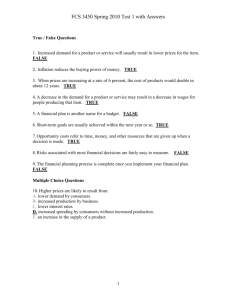

FCS 3450 Fall 2010 Test #4 True / False Questions 1. (p. 309) The purpose of insurance is to help protect you and your family against financial hardship due to hazard, accident, death, and similar risks. TRUE 2. (p. 310) Personal risks, property risks, and liability risks are types of speculative risks. FALSE 3. (p. 310) The most common method of dealing with pure risk is to shift, or transfer it to an insurance company or some other organization. TRUE 4. (p. 311) Self-insurance is the process of establishing a monetary fund that can be used to cover the cost of a loss. TRUE 5. (p. 316) Homeowner's insurance refers to coverage also available to renters. TRUE 6. (p. 317) The purpose of a household inventory is to provide evidence of items covered by home insurance. TRUE 7. (p. 319) Medical payments coverage in a home insurance policy is designed to pay for legal action taken against a homeowner who may be legally responsible for injury or property damage of others. FALSE 8. (p. 322) Replacement cost for settling property insurance claims is less costly than the actual cash value method. FALSE 9. (p. 327) Collision coverage pays for damage to your vehicle for such hazards as fire, theft, or wind damage. FALSE 10. (p. 327) Property damage liability coverage would pay for damage to another vehicle for which you were at fault. TRUE 11. (p. 330) The driver classification category is based on automobile style, model, and value of the vehicle. FALSE 1 FCS 3450 Fall 2010 Test #4 Multiple Choice Questions 12. (p. 310) Using a home security system is an example of ____________ risk. A. shifting B. accepting C. reducing D. sharing E. transferring 13. (p. 317) The purpose of a household inventory is to: A. reduce insurance costs. B. document owned property. C. obtain personal property floater coverage. D. increase liability coverage. E. lower the chance of negligence. 14. (p. 319) Renter's insurance would include coverage for: A. flood damage. B. personal property. C. building and other structures. D. umbrella liability. E. earthquake damage. 15. (p. 319) Which of the following are not covered by renter's insurance? A. medical expenses for injuries to visitors B. fire damage of the building's roof C. additional living expenses D. accidental damage to the property of others E. cost of legal action due to personal liability 16. (p. 322) Your home insurance provides for replacement value for personal property losses. A microwave is stolen. It cost $300 two years ago and has an expected life of six years. A comparable microwave costs $400 today. What amount will the insurance company pay? A. $100 B. $150 C. $200 D. $350 E. $400 2 FCS 3450 Fall 2010 Test #4 17. (p. 322) Which of the following insurance policy provisions requires that the insured must pay for part of the loss of a claim if the property is not insured for the specified percentage of replacement value? A. personal property floater B. an endorsement C. coinsurance clause D. umbrella coverage E. assigned risk clause 18. (p. 322) The ____________ method to settle claims is based on the current replacement cost of a damaged or lost item less depreciation. A. replacement value B. actual cash value C. umbrella D. endorsement E. personal property floater 19. (p. 323) Your home insurance policy has a $250 deductible. If a small fire causes $600 damage to your home, what amount of the claim would the insurance company pay? A. $250 B. $350 C. $450 D. $600 E. not able to determine from this information 20. (p. 326) The 100 in 100/300/50 refers to: A. property damage liability coverage. B. the amount of the deductible. C. collision coverage. D. the total coverage for an accident. E. the limit for bodily injury claims that can be paid to one person. 21. (p. 326-327) Henry Edwards was injured in an accident caused by another driver who did not have insurance. Henry's medical expenses would be covered by: A. medical payments. B. collision. C. bodily injury liability. D. uninsured motorists protection. E. no-fault coverage. 3 FCS 3450 Fall 2010 Test #4 22. (p. 327) Which of the following is a system in which drivers involved in an accident collect medical expenses, lost wages, and related injury costs from their own insurance company? A. assigned risk pool B. financial responsibility coverage C. comprehensive system D. no-fault insurance E. uninsured motorists protection 23. (p. 327) The 25 in 50/100/25 refers to ____________ coverage. A. collision B. bodily injury liability C. comprehensive physical damage D. medical payments E. property damage liability 24. (p. 327) Which of the following types of coverage would pay for damage to your automobile in an accident for which you were at fault? A. property damage liability B. collision C. comprehensive physical damage D. no-fault insurance E. assigned risk pool coverage 25. (p. 328) Comprehensive coverage would cover financial losses due to: A. injuries caused by a driver without insurance. B. damage to your car in an accident for which you were at fault. C. damage to your car caused by wind or hail. D. legal action against you for an accident. E. damage to a neighbor's tree with your car. 26. (p. 326) Thad Joslin was judged at fault in an automobile accident. Three others were awarded damages of $150,000, $75,000, and $75,000 due to injuries. Thad has 100/300 bodily injury liability coverage. What amount, if any, would not be covered by his insurance? A. $150,000 B. $100,000 C. $50,000 D. None. The total amount would be covered by insurance 27. (p. 330) Which of the following refers to a category based on age, sex, marital status, and driving habits that is used to set automobile insurance premiums? A. rating territory B. assigned risk pool C. no-fault system D. driver classification 4 FCS 3450 Fall 2010 Test #4 28. (p. 309) Nick Rodr owns a home in Edmond, Oklahoma and pays $665 per year in insurance on the home. The $665 is an example of: A. A peril B. A hazard C. A risk D. A premium E. A liability 29. (p. 310) Kevin Brown rides his bicycle to work so that he doesn't have to worry about getting in a car accident. How is Kevin managing his risk? A. Risk Avoidance B. Risk Reduction C. Risk Assumption D. Risk Shifting E. Risk Creation 30. (p. 310) Larry Foster has bought a car with front and side airbags and antilock brakes. How is Larry managing his risk? A. Risk Avoidance B. Risk Reduction C. Risk Assumption D. Risk Shifting E. Risk Development 31. (p. 310) Peter Jacobs has set aside $5000 in case he has an accident in his 1980 Honda Civic. He does not have collision insurance on this car. How is Peter managing his risk? A. Risk Avoidance B. Risk Reduction C. Risk Assumption D. Risk Shifting E. Risk Creation 32. (p. 311) Robert Plant pays a premium each month to State Farm Insurance for automobile insurance on his 2003 Dodge Ram pick up truck. How is Robert managing his risk? A. Risk Avoidance B. Risk Reduction C. Risk Assumption D. Risk Shifting E. Risk Assessment 5 FCS 3450 Fall 2010 Test #4 33. (p. 326) The 500 in 200/500/50 refers to: A. property damage liability coverage. B. the amount of the deductible. C. collision coverage. D. the total coverage for an accident. E. the limit for bodily injury claims that can be paid in total. True / False Questions 34 (p. 342) The best way to avoid the high cost of illness is to stay well. TRUE 35 (p. 344) Group health insurance plans comprise the majority of all health insurance issued by health and life insurance companies. TRUE 36(p. 345) Very few group health policy contracts have a coordination of benefits provision. FALSE 37 (p. 346) A stop-loss provision (out of pocket maximum) requires the policyholder to pay up to a certain amount, after which the insurance company pays 100 percent of all remaining covered expenses. TRUE 38. (p. 347) Dread disease and cancer policies are usually very good values. FALSE Multiple Choice Questions 39. (p. 345) Nathanial Drummond has three different insurance policies. He has been injured in an accident and has incurred $30,000 in medical bills. There is a clause in all of his insurance contracts the makes sure that he receives no more than $30,000 in payments from his insurance companies. This clause is called: A. Coordination of benefits B. Deductible C. Coinsurance D. Stop-Loss provisions E. Major medical expense insurance 6 FCS 3450 Fall 2010 Test #4 40. (p. 346) Sophie Bennett must pay $500 in doctor's visits before her insurance company will make any payments for doctors visits. This is called: A. Coordination of benefits B. Deductible C. Coinsurance D. Stop-Loss provision E. Major medical expense insurance 41. (p. 346) Sophie Bennett has met the deductible for her doctor's visits. However, her insurance company requires her to pay 20% of all expenses above this deductible amount. This clause is called: A. Coordination of benefits B. Add on expenses C. Coinsurance D. Stop-Loss provision E. Major medical expense insurance 42. (p. 346) Sophie Bennett has met the deductible for her doctor's visits. She has also paid out 20% of all expenses above this deductible amount. She has paid a total of $5000 in doctor's visits. At this point there is a clause in her insurance contract that make her insurance company pay for 100% of all expenses. What clause is this likely to be? A. Coordination of benefits B. Add on expenses C. Coinsurance D. Stop-Loss provision E. Major medical expense insurance 43. (p. 351) Dean Thomas has an insurance policy that cannot be cancelled unless he fails to pay his premium. What provision in his insurance policy would specify this? A. Eligibility B. Assigned Benefits C. Benefit Limits D. Guaranteed Renewable E. Exclusions and Limitations 44. (p. 346) Which one of the following provisions requires that the policyholder pay a basic amount before the policy benefits begin? A. Coinsurance B. stop loss C. Deductible D. self insurance E. incontestable 7 FCS 3450 Fall 2010 Test #4 True / False Questions 45. (p. 378) Most people buy life insurance to protect someone who depends on them from financial losses caused by their death. TRUE 46. (p. 381) Single persons living alone have need for less life insurance than persons that have dependents. TRUE 47. (p. 381) Households with small children most often have the greatest need for life insurance. TRUE 48. (p. 382) The easy method of determining life insurance is based on the rule of thumb that a "typical family" will need about 70 percent of wage-earner's salary for seven years. TRUE 49. (p. 382) The DINK (Duel Income No Kids) method of determining life insurance needs assumes that the spouse will continue to work after husband's/wife's death. TRUE 50. (p. 386) The premium for the permanent life policy increases with your age. FALSE 51. (p. 384) Two basic types of life insurance are temporary and permanent insurance. TRUE 52. (p. 385) Term life insurance premiums decrease as you get older. FALSE 53. (p. 387) One important feature of term life policy is its cash value. FALSE 54. (p. 393) A beneficiary is a person designated to receive something such as life insurance proceeds, from the insured. TRUE Multiple Choice Questions 55. (p. 378) Individuals and families purchase life insurance to: A. get rich quick B. fill financial needs created by the loss of the breadwinner C. defraud the insurance companies D. keep up with people with a similar financial situation 56. (p. 381) You probably have little or no need for life insurance if you are: A. a single person living alone or with parents B. divorced and have two children C. married and your spouse works D. gainfully employed E. a household with several children 8 FCS 3450 Fall 2010 Test #4 57. (p. 382) Suppose that yours is a typical family. Your annual income is $50,000. Use the easy method to determine your need for life insurance. Your insurance should be in the amount of: A. $245,000 B. $300,000 C. $345,000 D. $400,000 E. $450,000 58. (p. 382) Which method of determining life insurance requirements is best suited for a working couple with no dependents? A. hard method B. easy method C. "nonworking" spouse method D. thorough method E. DINK method 59. (p. 383) The method of determining life insurance requirements that does not ignore such important factors as social security and your liquid assets is called the: A. easy method B. hard method C. DINK method D. "nonworking" spouse method E. "family need" method 60. (p. 383) Using the "nonworking" spouse method, what should be the life insurance needs for a family whose youngest child is 7 years old? A. $50,000 B. $70,000 C. $90,000 D. $110,000 E. $140,000 9