NRAProceduresv1 - Northern Illinois University

advertisement

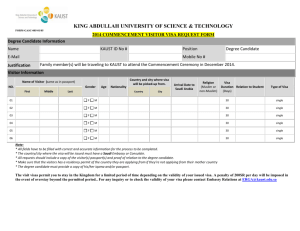

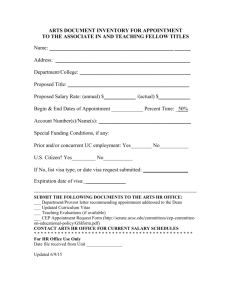

Northern Illinois University Requirements to Pay a Foreign Visitor, Other Than Employment This document is intended to assist departments at NIU with non-employment payments to foreign nationals (nonresident aliens). Payments to foreign individuals for either services or goods require a social security number or taxpayer identification number. Additionally, for the foreign visitor to claim exemption based upon a tax treaty, the individual must possess a social security number or taxpayer identification number. Payments will not be made to individuals without a social security number or taxpayer identification number. In order to secure the Tax Treaty benefits, the following information is required: Completed IRS Form W-8 “Certificate of Foreign Status” U.S. Social Security Number or IRS ITIN (Individual Taxpayer Identification Number) If traveling on a B-1 or B-2 visa, a signed compliance statement (see sample) A completed Foreign National Information Form, with attachments (this is a NIU form) To complete the Foreign National Information Form, the following items are required: Copy of Passport Copy of I-94 Copy of IAP-66 or I-20 ITIN, Social Security Card, or EAD For employed individuals: Copy of contract terms, if applicable Stipend agreement, if applicable An estimate of wages to be paid by the University A completed IRS Form 8233 “Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual” The University can assist the individual with the completion and filing of the Form 8233. The Foreign National Information Form, with the required attachments, will allow the University to automatically generate a Form 8233, citing the correct tax treaty language. This will allow the visitor to minimize the tax consequences. The Form 8233 is required to be signed by the visitor. A resident alien must use Form W-9 to claim tax treaty benefits. Failure to complete the forms will delay the payment. Payment can not be made until all applicable federal requirements have been fulfilled. If insufficient information is available, the U.S. default tax rates will be applied. 1 The Process The first step is to plan in advance. The federal requirements involved in the payment to a nonresident alien take a considerable amount of time to comply with. An estimate of the time required in advance of having the service performed by the nonresident alien could range from two work weeks to six work weeks, depending on the individual. Plan in advance. The second step is to contact the individual and determine the following: Do they have a social security number or taxpayer identification number? If they do not, have them apply for one immediately. Payment can not be made with out a social security number or taxpayer identification number. This is the single longest process involved in paying a nonresident alien. What type of visa do they have? Allowable payments are determined by the visa of an individual (refer to chart of allowable payments by visa type). Please ensure that the visa type of the visitor allows for the type of payment that is being planned. This is a critical step. Failure to travel on the correct visa type will impact the University’s ability to pay / reimburse the foreign national. Do they want to claim a treaty benefit? If no, the required federal rate of 14% for Scholarships / Fellowships for F, J, M, and Q visa holders, and 30% for all other income and visa types will be withheld. If they want to take advantage of the treaty benefits, they will have to fill out the NIU Foreign National Information Form and provide the required attachments. A tax analysis will be prepared by the University to determine which treaty benefits apply. The required IRS forms will be generated and filed with the IRS. Payment can not be made until ten days after filing the forms with the IRS. The IRS can reject the forms within the ten day period, and if the forms are rejected, tax treaty benefits will not apply. Please reference the Nonresident Alien Tax Withholding Schedule for the tax rates. The third step is to have the NIU Foreign National Information Form filled out as soon as possible. Fax or e-mail the form (it is available as an Excel file) when possible to eliminate any potential processing delays. Have the completed form returned as soon as possible. The University can begin the analysis stage as soon as the information is available. If, during the analysis stage, any IRS forms are produced, they will require the signature of the visitor. The form can not be filed unless it is signed. Again, a fax will expedite the process. It is important that the required attachments be provided; verification of the information on the Foreign National Information Form can not be completed without the attachments. The fourth step is to make sure everything is in place for the visit. Paperwork must be signed and processed very quickly to ensure that payment is not delayed. Make sure that the tax forms being used are the current forms (most tax forms have a revision date in the upper left-hand corner of the form, by the form’s name). Forms that have been recently revised by the IRS include the W-8, W-9, and the 8233. Finally, process the payment paperwork, using existing NIU forms (check request, honoraria, travel reimbursement). Attach a copy of the completed Foreign National Information Form (including attachments) in addition to the normal attachments required for payment processing. 2 Visa Classifications and Employment Parameters Visa Type Purpose of Visa Employment Restrictions Length of Stay Grace Period Sponsor/Employer Requirements Beneficiary's Responsibilities INS Document Visa Type Purpose of Visa Employment Restrictions Length of Stay Grace Period Sponsor/Employer Requirements Beneficiary's Responsibilities INS Document Visa Type Purpose of Visa Employment Restrictions B-1 Visitor for Business May only be paid "reasonable" reimbursement for incidental expenses, including accommodations, meals and travel expenses and honorarium. The payee must sign a "compliance statement" which attests to the fact that the visitor performed the compensated activities for 9 days or less while at the University and they have not been compensated by more than 4 other entities during the previous 6 months. Up to 1 year None Letter of invitation for business purposes. Conduct business activity I-94 Card B-2 Visitor for Pleasure (Tourist) May only be paid "reasonable" reimbursement for incidental expenses, including accommodations, meals and travel expenses and honorarium. The payee must sign a "compliance statement" which attests to the fact that the visitor performed the compensated activities for 9 days or less while at the University and they have not been compensated by more than 4 other entities during the previous 6 months. Up to 6 Months None N/A Have Fun, Sight see, Take Pictures, Visit Relatives, Etc. I-94 Card WB Visitor for Business May only be paid "reasonable" reimbursement for incidental expenses, including accommodations, meals and travel expenses and honorarium. The payee must sign a "compliance statement" which attests to the fact that the visitor performed the compensated activities for 9 days or less while at the University and they have not been compensated by more than 4 other entities during the previous 6 months. 90 Days None Length of Stay Grace Period Sponsor/Employer Letter of invitation for business purposes. Requirements Beneficiary's Conduct business activity Responsibilities INS Document Green I-94 Card 3 Visa Type Purpose of Visa Employment Restrictions Length of Stay Grace Period Sponsor/Employer Requirements Beneficiary's Responsibilities INS Document Visa Type Purpose of Visa Employment Restrictions WT Visitor for Pleasure (Tourist) May only be paid "reasonable" reimbursement for incidental expenses, including accommodations, meals and travel expenses and honorarium. The payee must sign a "compliance statement" which attests to the fact that the visitor performed the compensated activities for 9 days or less while at the University and they have not been compensated by more than 4 other entities during the previous 6 months. 90 Days None N/A Have Fun, Sight see, Take Pictures, Visit Relatives, Etc. Green I-94 Card F-1 Student 1) May work on-campus 20 hours/week during semester and 40 hours/week during vacations. 2) May work off campus due to economic hardship only with Immigration and Naturalization Service (INS) approval (rare exceptions). 3) Eligible for 12 mos. Optional Practical Training (OPT) in field of study. May participate in Curricular Practical Training (CPT) if required by degree. Must have INS approval. Dependents (F-2 Visa holders) may not be employed. Duration of Studies 60 Days Length of Stay Grace Period Sponsor/Employer Maintain current information on each student. Requirements Must maintain legal nonimmigrant status: Be a full-time student Beneficiary's Responsibilities Have a valid passport Must not work illegally 1) I-20 & I-94 Card 2) EA Card INS Document 3) CPT: I-20 & I-94 Card OPT: EA Card Visa Type J-1 Student Purpose of Visa Exchange Visitor: Student May be employed on campus of school in which they are enrolled up to 20 hours/week Employment (Full-time during vacations). Restrictions Eligible for 18 months of Academic Training (AT) following the completion of their program (36 months for Postdoctoral positions). Length of Stay Duration of Studies Grace Period 30 Days Maintain current information on each student. Sponsor/Employer Academic Training: Requirements Advisor's recommended form. Offer letter with goals and objectives of program, salary & title. Medical health insurance is mandatory for individual and family members. Beneficiary's English proficiency is necessary. Responsibilities Maintain status (see F-1 above) 4 IAP-66 I-94 Card Visa Type J-1 Exchange Visitor Exchange Visitor: Purpose of Visa 1) Professor & Research Scholar 2) Short-Term Visitor Eligible to receive payment from organization listed on Form IAP-66 and/or the Designated Program Sponsor for the period of validity as stated on the IAP-66 form. Employment Under limited circumstances, may receive compensation from other. IAP-66 form Restrictions authorizes employment. May not accept tenure track positions. 1) 3 Years Length of Stay 2) 6 Months Maximum Grace Period 30 Days Sponsor/Employer Proof of financial support. Requirements Offer letter with goals and objectives of program. Medical health insurance is mandatory for individual and family members. Beneficiary's English proficiency is necessary. Responsibilities Bachelor's degree or higher required. IAP-66 INS Document I-94 Card Visa Type J-2 Purpose of Visa Dependent of J-1 Employment May work for any employer with INS approval. Restrictions Length of Stay Same as J-1 Grace Period Same as J-1 Sponsor/Employer N/A Requirements Beneficiary's Obtain Employment Authorization (EA) Card from INS. Responsibilities INS Document EA Card Visa Type H-1B Purpose of Visa Temporary Worker in Specialty Occupation Employment permitted only with sponsoring institution and with INS approval. Employment May accept tenure track positions. Restrictions Dependents (H-4) may not be employed. Length of Stay 6 Years Maximum Grace Period 10 Days Must pay actual or prevailing wage. Sponsor/Employer If dismissed alien early, is liable for the return transport home. Requirements Position requires Bachelor's Degree or higher Beneficiary's Must have specific qualifications for the job Bachelor's degree or higher in field job is Responsibilities offered. I-797 INS Document I-94 Card Visa Type O-1 Purpose of Visa Persons of Extraordinary Ability Employment Employment permitted only with sponsoring institution and with INS approval. INS Document 5 Dependents (O-3) may not be employed. 3 Years Length of Stay 1 Year Extension Grace Period 10 Days Sponsor/Employer If dismisses alien early, is liable for the return transport home. Requirements Must have written contract. Beneficiary's Must show extraordinary ability in field. Responsibilities Must have written consultation from a peer group in area of expertise. I-797 INS Document I-94 Card Visa Type TN Purpose of Visa Trade NAFTA (for citizens of Canada and Mexico) May be employed and compensated only by sponsoring employer through whom the status was obtained. Employment Restrictions Must meet established professional qualifications. Dependents (TD) may not be employed. Length of Stay 1 Year at a time Grace Period None Sponsor/Employer Job offer letter. Requirements Canadian presents the following to the INS officer: Offer letter Proof on Canadian citizenship Diploma $50 fee Beneficiary's For Mexicans: Responsibilities The prospective employer files a labor condition application. Prospective employer must file an I-29 with INS. After the I-29 has been approved, the alien must apply for a no-immigrant visa at a U.S. Embassy or Consulate in Mexico. Restrictions INS Document Canadians: I-94 Card Mexicans: I-797 I-94 Card 6 Nonresident Alien Tax Withholding Schedule Type of Income Royalty Scholarship or Fellowship (tuition, Waiver, required fees, books) Scholarship or Fellowship (in excess of tuition, waiver, required fees, books) Independent Personal Services Employee Compensation Compensation as teacher / researcher Compensation as student / trainee Miscellaneous General Payee Immigration Status Any Generally, B-1, B-2, F-1, F-2, J-1, J-2, M-1, Q-1, R-1, TN Service or Nonservice Non-service Non-service Withholding Form Required if Rate if Treaty not Treaty Applicable Applicable 30% W-8BEN N/A N/A Generally, B-1, B-2, F-1, F-2, J-1, J-2, M-1, Q-1, R-1, TN Non-service B-1, B-2, WB, WT, J-1 (non-student), TN TN Service 30% 8233 Service 8233 J-1 (non-student), H-1B F-1, J-1 (student) Service Single, 1 allowance(s), plus $7.60wk* Single, 1, $7.60/wk* Service Single, 1, $7.60/wk* 8233 30% N/A Any Non-service 14% (if F, J, M, or Q visa) 30% (all other visas) W-8BEN, 8233 8233 *Individuals from Canada, Mexico, Japan, Koreas, American Samoa, the Northern Mariana Islands, and students from India may be eligible to claim additional withholding allowances. Rates are $7.60 per week; $15.30 biweekly; $16.60 semimonthly, and $33.10 monthly. 7 US VISA General Information There are two broad categories of visas for those coming to the United States -- "not an immigrant" and "immigrant". Any visa with a letter in front of it (F-1, J-1, B-2,...) is a non-immigrant visa. Anyone on a non-immigrant visa is restricted as to what he or she can and must do in the US, has a date by which he or she must leave the US or apply for further visa privileges, and for most categories must have a home outside the United States to which he or she intends to return. Anyone on the immigrant visa (known also as the green card, permanent residence, P.R., I-551, alien resident), has permission to remain indefinitely in the United States and, generally speaking, has the same rights and privileges as a citizen, with the exception of voting and holding certain government jobs. While permanent residents or immigrants can become citizens, there is no requirement that they do so and many prefer to keep their original citizenship and carry their home country passport. It is possible to apply for US citizenship. Visa Types The following table lists non-immigrant visa types and provides informal descriptions. For more precise definitions and additional information, consult U.S. Department of State Visa Services. Visa Type Applies to A-1, A-2, A-3 Ambassadors, diplomats, and certain other foreign officials and their families B-1 Temporary visitor for business B-2 Temporary visitor for pleasure C-1, C-2, C-3 Certain aliens in transit D-1 Crewman (seaman or airman) E-1 Treaty trader, spouse, and children E-2 Treaty investor, spouse, and children F-1 Student in academic or language program F-2 Spouse or child of student in academic or language program G-1, G-2, G-3 Certain government or international organization officials and their families G-4, G-5 H-1A Temporary worker performing professional nursing services H-1B Temporary worker in a specialty occupation H-2A Temporary agricultural worker H-2B Temporary worker performing non agricultural services unavailable in the U.S. H-3 Trainee (not a student) H-4 Spouse or child of alien classified H-1, H-2, or H-3 I-1 Representative of foreign information media; spouse or child of this representative J-1 Exchange visitor (can include students and scholars) J-2 Spouse or child of exchange visitor K-1 Fiancée or fiancé of U.S. citizen K-2 Child of fiancée or fiancé of U.S. citizen Intracompany transferee L-1 (such as managers who have worked abroad for a branch of a U.S. firm) L-2 Spouse or child of intracompany transferee M-1 Student in vocational or other recognized nonacademic institution 8 M-2 N-8, N-9 NATO 1-7 O-1 O-2 O-3 P-1 P-2 P-3 P-4 Q-1 Q-2 R-1 R-2 S-1 TN TD WB WT Spouse or child of student in vocational or other recognized nonacademic institution Parents and children of an alien granted permanent residency as a special case Certain NATO personnel Workers of "extraordinary" ability in the sciences, arts, education, business, or athletics Workers who accompany and assist O-1 aliens Family members of O-1 aliens Member of an entertainment group or an athlete "Reciprocal exchange" artists and entertainers "Culturally unique" artists and entertainers Family members of P-1, P-2, P-3 visa holders Cultural Exchange Visitors Irish Peace Process, Cultural and Training Program visitors Religious workers Dependents of religious workers Federal witnesses Professionals from Canada or Mexico who enter the U.S. under the NAFTA agreements Dependents of TN professionals Like a B-1 visitor for business, but from a country under visa waiver program Like a B-2 visitor for pleasure, but from a country under visa waiver program Definitions - Immigration and Visa Terminology "A" number. Also known as Alien Registration Number. An INS 8-digit identification number. Most nonimmigrants will not have an "A" number. All immigrants and persons with EADs will have one. Academic Training Work related to a J-1 student's field of study. Generally, J-1 students do academic training when they complete their course work for a degree. NIU students remain in J-1 visa status, documented on the NIU IAP-66. However, they may work anywhere in the U.S. Work that F-1 students may be authorized to do after they complete their degrees is called Practical Training. Canadian A foreign national, just like any other country, but with several possible documentation differences. Does not need a visa stamp, or a passport if entering from the Western Hemisphere, but must have the usual other documentation. Will not receive an I-94 if entering in B-1 or B-2 status. The TN visa is available to Canadians. Dependent Spouse of primary visa holder (must be married to primary visa holder), or unmarried child under 21. D/S - Duration of Status F-1 and J-1 students do not have specific limitations on their period of stay in the U.S. Their I-94s are marked D/S, allowing them to remain here up to the completion of studies date on their Form I-20. EAD: Employment Authorization Document (Form I-688B or I-766) A laminated card issued to some non-immigrants by INS with photo and specifics on how long work is authorized. H-1s, J-1s, and TNs will not have an EAD. F-1 practical trainees, TPS, applicants for asylum, refugees, asylees, and J-2 workers will. I-9 INS Employment Eligibility Verification Form, to be completed for any person hired, including U.S. citizens. I-20 9 Visa document issued to an F-1 student, showing beginning and expected completion of studies. The date for completion of studies as listed on the I-20 is the expiration date for an I-94 that notes D/S. I-94 Little white card, usually stapled in passport, sometimes stapled to pink copy of IAP-66 by INS. Visitors to the U.S. receive a white card on their flight into the U.S. They complete this card and present it to an INS officer at immigration inspection. The INS officer marks visa status and date of expiration of legal stay in the U.S. (or D/S) on it and then attaches part of it usually to the visitor's passport. The INS markings are often illegible. The part attached to the passport is officially called the "Departure Record." It is removed by an official of the airlines when a visitor departs. If you lose the card, INS will replace it for $85. If the I-94 is light green, the visitor has entered under the Visa Waiver Program. IAP-66 Visa document issued to a J-1 Exchange Visitor. Exchange students, short-term scholars, and longer-term scholars may receive this document. All who do will enter with J-1 visa status. I-688B Employment Authorization Document (EAD) INS Immigration and Naturalization Service. INS is responsible for admission, control, and status of foreign visitors in the United States. Embassies and consulates abroad and not part of INS; they are under the direction of the U.S. State Department, so the State Department Foreign Service is responsible for issuing the visa stamp at the embassy or consulate. Lottery Each year, the U.S. makes 55,000 permanent resident visas (green cards) available by random selection through the diversity visa lottery. Deadlines for applying are usually in the fall. Decisions usually come the following spring or summer, and green cards are available the following fall. Non-Immigrant Person in the U.S. who is not an U.S. citizen, who is authorized to stay for a limited time, and who is expected to leave the U.S. Non-immigrants must meet certain reporting requirements, and there are restrictions on work and study. Practical Training Work related to an F-1 student's field of study. Generally, F-1 students do practical training when they complete their course work for a degree. NIU students on practical training remain in F-1 visa status, documented on the NIU I-20. However, they may work anywhere in the U.S. Work that J-1 students may be authorized to do after they complete their degrees is called Academic Training. TPS - Temporary Protected Status For nationals of countries specifically designated by the Attorney General in which there is fighting or a natural disaster. This status permits foreign visitors to stay for a longer time in the U.S. and allows them to request work authorization. U.S.Citizen Person born or naturalized in the U.S., entitled to carry U.S. passport. A permanent resident, or green-card holder, is not an U.S. citizen, but an immigrant who still carries passport from home country. Immigrants may apply for citizenship after they have had a green card for 3 or 5 years. Permanent residents are not required to become U.S. citizens, and many choose to retain their foreign citizenship. USIA - United States Information Agency Runs the J-1 Exchange Visitor program. Visa The term visa is used in different ways. It is sometimes used to describe the immigration status that a foreign visitor has while in the U.S., such as F-1 or J-1. We generally refer to this as your visa status. Sometimes, visa is used to describe the large sticker that the U.S. consulate puts into your passport. We refer to this sticker as your visa stamp. Your visa stamp will usually indicate the visa status that you will have when you begin your stay in the United States. The visa stamp will also have an expiration date. Depending on the rules of your visa status, you may stay in the 10 U.S. beyond the expiration date on the visa stamp. However, if you leave the U.S. and wish to return after the visa stamp has expired, then you must obtain a new visa stamp. Common Visa Types at NIU Below are some visa types that foreign visitors to the University often have: B-1. Temporary visitor for business. B-2. Tourist, or temporary visitor for pleasure. B-1/B-2. Standard visa notation in passport. When a foreign visitor enters the U.S., INS may mark the I-94 as B-1, B-2, or B-1/B-2 at their discretion. This notation on the I-94 controls a visitor's status in the U.S. regardless of what the visa stamp in the passport says. F-1. Student. F-2. Dependent of an F-1 student. H-1B. Temporary worker in a specialty occupation (professional). H-4. Dependent of H-1. J-1. Exchange Visitor (May be in "Student" category, or may be in "Professor, Researcher, or Scholar" category.) J-2. Dependent of J-1 Immigrant = Green Card Holder = Permanent Resident = Resident Alien. Has all the rights and obligations of a citizen, except that of voting or carrying a U.S.passport. Recent legislation limits eligibility for some public benefits. May, after certain residence requirements, apply for citizenship although this is not required. Refugee or Asylee Treated for payment and student loan purposes like an immigrant or permanent resident. TN. Canadian or Mexican who entered under NAFTA as a professional. Similar to H-1B. WB. Waived Business visitor under Visa Waiver Pilot Program. Equivalent to B-1. WT. Waived Tourist visitor under Visa Waiver Pilot Program. Equivalent to B-2. Visa Waiver Pilot Program (VWPP). Persons coming to the U.S. as visitors for business or pleasure from certain designated countries can enter the U.S. without having to get a visa stamp in the passport. They are limited to 90 days' stay, and may not extend stay or change status. The I-94 should be marked WT (WaivedTourist) or WB (Waived Business). Visa Waiver Program The Visa Waiver Pilot Program (VWPP) allows nationals of 29 countries to visit the U.S. for pleasure or business up to 90 days without a visa stamp. These individuals do not need to apply or pay for a visa stamp, and they do no need to visit an U.S. consulate before they visit the U.S. The 29 countries are: Andorra Germany New Zealand United Kingdom Argentina Iceland Norway Uruguay Australia Ireland Portugal Austria Italy San Marino Belgium Japan Singapore Brunei Liechtenstein Slovenia Denmark Luxembourg Spain Finland Monaco Sweden France The Netherlands Switzerland Travelers from participating countries must: Have a valid passport issued by the participating country and be a citizen (not just a resident) of that country. Be seeking entry for 90 days or less. Extensions of time are not permitted. If entering by air or sea, have a round-trip ticket issued on a carrier that has signed an agreement with the U.S. government to participate in the waiver program, and arrive in the U.S. aboard such a carrier. Have proof of financial solvency. 11 Travelers may enter by land from Canada or Mexico. Such travelers do not need to present a round-trip ticket or arrive on an approved carrier. All other requirements above still apply. Visitors who enter under this program are admitted either as WT (Waived Tourist) or WB (Waived Business). Regulations for the WT holder are essentially the same as for a B-2 visa holder. Regulations for the WB holder are essentially the same as for a B-1 visa holder. Visitors may not be employed. Payments WT visa holder. The University may pay an honorarium and reasonable travel expenses to a WT visa holder for academic activities on an NIU campus. The paid activity may not exceed nine days. The visitor may not have been paid by more than five other universities or other qualified government and non-profit institutions in the previous six months. All other standard NIU rules for payments and travel reimbursements apply. WB visa holder. The University may pay reasonable travel expenses to any WB visa holder. In addition, the University may pay an honorarium to a WB visa holder for academic activities on an NIU campus. The paid activity may not exceed nine days. The visitor may not have been paid by more than five other universities or other qualified government and non-profit institutions in the previous six months. All other standard NIU rules for payments and travel reimbursements apply. Changes of Status WT and WB visa holders may not change to a different visa status in the United States. They may not apply for an extension of their stay beyond 90 days. Special Circumstances Some travelers still need to apply for a visa, such as those who plan to work or study, who stay more than 90 days, or who might otherwise be ineligible for a visa. Travelers previously denied visas, or who have criminal records, or who believe they may be ineligible for a visa should contact the nearest U.S. embassy or consulate before attempting to travel on the Visa Waiver Pilot Program. TN Status The TN (Trade NAFTA) classification is available to a Canadian or Mexican citizenship who seeks to enter the US on a temporary basis to work in a professional-level job under provisions of the North American Free Trade Agreement. The individual must be employed in one of the professions listed in the federal regulation at 8 CFR 214.6 and have at least a baccalaureate degree unless an alternative credential is specified. The list (attached) includes university professors and researchers in addition to many other professions. A Canadian citizen may request admission to the US as a TN professional at a US class A port of entry, a US airport handling international traffic, or at a US pre-clearance/pre-flight station. No petition, labor certification, visa or prior approval is required. The applicant should present documentation that he or she is a Canadian citizen, copies of degrees or diplomas (or license, if required) to establish that he or she meets the criteria to perform the occupation at a professional level, payment of a $50 fee, and a letter from the prospective employer in the US which states the profession in which the applicant will be working, a summary of the job responsibilities, salary, and anticipated length of stay. Mexican citizens applying for TN status face certain additional requirements that Canadian citizens do not. For example, a Mexican citizen must first obtain a TN visa at a US consulate before he or she can enter the US in TN status. Prior to issuance of the TN visa, the Mexican citizen will need to be the beneficiary of an approved Labor Condition Application and Petition for a Nonimmigrant Worker (similar to H-1B applicants). Thus, the Mexican citizen seeking status as a TN professional is required to have had all documentation submitted to and approved by INS prior to his or her arrival at the port of entry. Upon admission into the US in TN status, the applicant will be issued Immigration form I-94 Arrival/Departure Record. The date and place of admission, the period of admission (up to one year), and the specific occupation and name of employer will be noted on the I-94. If the TN professional visits 12 Canada or Mexico before the authorized period of stay expires, he or she may be readmitted to the US in TN status for the unexpired period of stay noted on the I-94, provided the original intended activity and employer have not changed. If the TN professional wishes to continue employment beyond one year, the employer may petition INS on form I-129 Petition for a Nonimmigrant Worker for an extension of stay. Extensions are granted in one-year increments. As an option to filing a request for extension of stay, the TN may prefer to return to his or her home country and then re-enter the US in TN status, repeating the procedures for initial entry, outlined above. There is no limitations on the number of years a Canadian or Mexican citizen may remain in US in TN classification. If the Canadian or Mexican citizen is currently in the US and wishes to change to TN status from some other nonimmigrant category (for example, from F-1 "student"), or if he or she currently holds TN status but wishes to change employers, the prospective must file form I-129 Petition for a Nonimmigrant Worker with INS to request that the beneficiary be classified in TN status. Alternatively, he or she may depart the US and re-enter as a TN professional by following the procedures for initial entry, outlined above. The spouse and children on the TN professional are admitted in TD (Trade Dependent) status. TD dependents may not accept employment, but may attend school full-time or part-time. 13 Sample Letter To Invite International Visitors To NIU [On NIU letterhead] [Scholar name and address] Dear [scholar name], This letter is written to confirm your visit to Northern Illinois University from [date] to [date] in order to [describe activity]. In order for the university to reimburse your expenses [describe what will be reimbursed], it is critical that you enter the United States in the appropriate visa status. If nationals from your country need a visa to enter the U.S., you will need to visit the American Consulate in your country and apply for a B-1 visa (visitor for business). If you are a national from a country that does not need a visa, you may apply for WB status (waiver of visa for business) at the port of entry as long as you do not intend to remain here for more than 90 days. In either case, you need to present this letter to the immigration officer at the port entry and you need to make sure that the notation on your form I-94 (arrival/departure document issued at the port of entry) says B-1 or WB. (For other acceptable visa types, please refer to the Visa Classifications and Employment Parameters chart) Sincerely, [signature] Sample Compliance Statement For B-1 or B-2 Visas (and WT & WB) [On NIU letterhead] [Scholar name and address] I have accepted an invitation by the University for the purpose of engaging in an academic activity. I will receive an honorarium payment and/or reimbursement for incidental expenses for my academic activity. The activity did not exceed nine days and I have not accepted honoraria and/or incidental expense reimbursements within the prior six-month period from more than four institutions. (In order to receive an honorarium payment you must have or have applied for a social security number or an individual taxpayer identification number) SS# or ITIN __________________ [signature] _________ [date] 14