History and Future of the Strategic Commodity Oil

advertisement

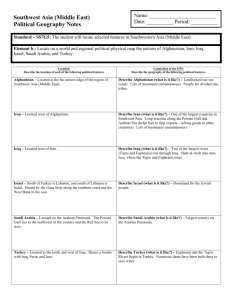

History and Future of the Strategic Commodity Oil By Dr. Karin Kneissl Political relations between the Muslim world and the West have been strongly moulded by mutual dependency in the production and marketing of petroleum. Because of negative experiences in the past, mistrust is often the predominant note on both sides. The author of this article is a freelance journalist in Vienna, reporting on Opec, among other things. She also teaches international relations at that city's university, at the Vienna Diplomatic Academy, and at two universities in Lebanon. "Oil makes and breaks nations." That is common shorthand for 20th century history in the petroleum industry. The degree to which the oil factor is crucial in the very existence or nonexistence of peoples and nations is illustrated not only by the present hostilities going on in Iraq and stretching from the Hindu Kush to the Caucasus, but also in the modern history of the Middle East as a whole. The list of Mideastern conflicts revolving around oil is a long one. Among the most recent were the war of attrition between Iraq and Iran (1980-88) and Iraq's invasion of Kuwait (1990). In both cases, Iraqi president Saddam Hussein bet on the oil card in his power-political poker over long-standing territorial claims. Over and above the U.S. war objective of fighting terrorism, the battle for Afghanistan is intimately linked to the project for a pipeline running from Turkmenistan to Pakistan. Currently we observe the US— rush towards Iraq’s upstream production, which disposes of the world’s second largest resources. Chechnya's desire to secede from Russia, which first surfaced in 1994, was - and still is - also linked to the transport route for oil from the Caspian Basin. Recurrent Border Problems Border problems, often involving oil fields close to frontiers, are a constant source of regional instability in the Near and Middle East. Both secular pan-Arabism and the ideology of Islamism regard the borders between Arab states as artificial and regularly challenge their legitimacy. Oil was often the major factor at the birth of nation-states in the Levant and around the Persian Gulf. 1 The borders between Iraq, Syria and Turkey were established after World War I at the San Remo Conference in April 1920, accompanied by the conclusion of an Anglo-French oil agreement. In the light of the new mobility modern warfare required the Great Powers were eager to obtain physical control over oil sources. Oil had turned into a strategic commodity, indispensable for running a war and an industrialised society. In a process of secret diplomacy, Great Britain and France had agreed back in 1915 on their respective spheres of influence, in the form of mandates on the territory of the former Ottoman Empire. But the socalled Sykes-Picot Agreement provided for an internationalised status for Palestine and gave France control over more territory. The new post-war power relationships favoured London, however, and led to a reshuffling which gave Britain mandate status over Palestine. And it was the granting of rights to ship British oil from Mossul (Iraq) through the French mandate territory of Syria which made possible the establishment of the mandate borders which exist to this day.2 At the same time, there began the interdependence of East and West with regard to the flow of petroleum, which reached an explosive climax in 1973. Western Firms as "States within States" By 1945, when the USA took over the British role as the hegemony power in the Middle East, 90 percent of Allied oil supplies came from U.S. sources. But because of oil's growing strategic importance, there was an increasingly urgent desire to hold back on American production and rely more on "cheap" oil from the Middle East3. In addition to the long-known Mossul oil fields in Iraq, test drilling on the Arabian Peninsula encouraged an outsourcing of oil production in the region. The young Kingdom of Saudi Arabia had already become by 1934 a close partner to the United States. The “strategic alliance” between Washington and Riyadh, dating back to 1947, in fact is much older than the US-Israeli relationship. Interestingly enough, the signing of the first major oil concession on Saudi territory coincided with the “all-out-speech” by US-President Harry Truman which became known as the “Truman doctrine” in order to contain communism. This geopolitical leitmotiv put the Gulf States into the role of close allies against the Soviet Union.4 The role of the firms known as the "Big Seven Sisters" in the oil-producing states on the Persian Gulf is legendary. For a long time they controlled the production, refining and marketing of virtually all Arab oil. The "Seven Sisters" consisted of British petroleum (BP), Royal Dutch/Shell, and the five American companies Texaco, Mobil Oil, Gulf Oil, Standard Oil of California (Socal) and Standard Oil of New Jersey (which later was renamed Exxon). They were, quite evidently, a predominantly Anglo-Saxon group. In Saudi Arabia, Texaco, Exxon and Mobil, along with Chevron, were active as the Arabian-American Oil Company Aramco. Even after the wave of nationalisations in the mid-1970s, the name remained, in the form of Saudi Aramco. Until that time, Aramco functioned as a state within the state, a lobby of a very special kind. The management of Aramco dominated day-to-day politics in the host country, and regional policy was set in the grand style in the offices of the oil companies. In other countries too, the extensive concessions granted to Western oil companies - which often covered a country's entire territory - turned those host nations into little more than disenfranchised suppliers. Pent-up conflicts with the host countries finally escalated because even the "posted price" for petroleum was dictated by the producing companies. After sharp price cuts in the late 1950s, the oil-producing countries felt cheated of their own natural wealth. At a meeting with his colleagues in July 1960, Saudi Oil Minister Abdallah al-Tariki complained in the following terms about the Western concerns and their high-handed pricing policies: "They treat us like children, and do not consult with us at all."5 One outcome of the tensions between oil-producing countries and the oil companies was the creation of Opec, the Organization of Petroleum Exporting Countries. The founding meeting, held in Baghdad in September 1960, aroused hardly any interest in the world at large. The main demands of the five founding members - Iraq, Iran, Kuwait, Saudi Arabia and Venezuela - were price stability and more consultation on production and pricing policies. Most of them were still far from contemplating such steps as the expropriation of the international oil concerns. But what began in Iran in 1951 with the Mossadegh crisis was continued in 1969 in revolutionary Libya: the "big majors" lost their concessions to nationalized oil companies, which took over the work of production. By the early 1970s, almost all oil-producing countries had achieved sovereignty over their own petroleum resources. Many heads of Western companies were furious at this, angered at the "ingratitude" of their host countries, whose new-found wealth was entirely due to the oil production which had been built with Western capital and at Western risk. The trauma of the concession era still dominates much thinking today, with Arab countries inevitably reacting with great sensitivity to what they see as attempts at intervention by the West in their internal affairs. Xenophobia in the Middle East Most countries of the Middle East are still determined to retain sovereignty over their oil resources. But a shortage of capital is slowly bringing about a rethinking. When, in June of last year, Saudi Arabia for the first time gave foreign direct investors access to the production of natural gas, market observers began to hope that Western firms may soon be able to resume their activities in oil production. There are certainly some tendencies in that direction. Of particular interest is the debate which has been going on in Iran since last summer about "buy-back agreements." Made between a foreign company and the government of Iran, these agreements are a kind of preliminary financing for the purpose of developing oil and gas fields, with repayment being made in the form of the commodities themselves. But what Iran's Oil Minister Namdar Zanganeh sees as a life preserver for his country's totally obsolete oil industry, is criticized by his opponents as a sell-out of national interests.6 The heated debates on this issue in the Iranian parliament cannot be reduced to the power struggle between reformers and conservatives. The old fear of a loss of sovereignty certainly plays a part, since Iranian history has been deeply affected by invasions from Russia, Britain and the U.S. secret service. The Iranian oil minister defends his view with the argument that his country needs the West's expert knowledge. But the mundane fact is that Iran needs cash - just as Saudi Arabia does. Iran also provides a classic example of why U.S. sanctions regimes - another sensitive point in East-West relations - are essentially toothless and lacking in credibility on the Muslim side. Because of sanctions, it is risky for Western companies to engage in oil transactions in countries like Iran. Last August, the U.S. Congress extended ILSA - the 1996 Iran-Libya Sanctions Act - which threatens severe American punishment for companies engaging in investments of more than 20 million dollars per year. But the oil companies - the American ones operating through their European subsidiaries - are nonetheless engaged in fierce rivalry over the potential markets in Iran and Iraq. Iraq is a burning example at stake. The U.S. initiative of "smart sanctions," which were supposed to counter the steady erosion of the embargo and the smuggling of oil and other goods, received a severe setback in June 2001 in the UN Security Council. Iraq has to live the tragedy of geopolitical ambitions mixed up with a “crusade” the current US-administration, marked by the obsession to be part of a “divine plan” as President George W. Bush formulates it. The “reborn Christian” Bush feels inspired by his literal interpretation of the Old Testament and sees his war campaign also as a battle against Babylon. All that creates a tragic blend of a war about oil and global US-domination doomed for disaster. At 112 billion barrels, Iraq boasts oil reserves second only to those of Saudi Arabia in the region, and Saddam Hussein exploits that fact to the limit.7 The US-invasion of Iraq started on March 20th is – among a few more reasons - about oil. To be precise, the world’s growing dependence on oil form the Mideast Gulf threatens serious disorder, and the current confrontation is an example of this. The International Energy Agency sees the Gulf’s share of global supply rising form 28pc to 36pc in 2020, or as high as in the 1973 oil shock. By 2030 the share will be 43pc and consumers could be held hostage as never before. Regional producers – which apparently the USA would like to direct towards US oil companies – will control the market. And supply security would be even more vulnerable to internal turmoil in a post-Saddam Hussein period which looks gloomy under the given circumstances. Oil is a finite resource. As early as 2005, non-Opec output of conventional oil is likely to peak, promising the most profound market shift in 30 years.8 Now opening up Iraq – big doubt remaining for whom and for how long – could postpone a supply crunch. But would that give a blow to Opec ? Suspicion is rising inside the cartel and also among important Non-Opec producers, such as the Russian Federation, that a master- plan of taking out a US-run Iraq out of Opec exists. A lot of uncertainties accompany this design, the main one being: can the United States really manage to occupy Iraq the way they wish to do it ? Two weeks after the start of operation “Liberating Iraq” these endeavours are unlikely. Bin Laden and the House of Saud Even the rise of Osama bin Laden's terrorist network - the newest symbol of East-West animosities - is closely related to oil. Bin Laden grew up in a Saudi Arabia loyal to the U.S. and was moulded by conditions there. Washington's strategic alliance with the house of Saud, which united the tribes of the Arabian Peninsula back in 1932, is also a history of personal friendships between the top men in the former Aramco concern and the sons of the Sauds, a fact which is amply clear to bin Laden as a Saudi billionaire. To bin Laden the Islamist, the Sauds - guardians of Islam's holiest sites - are traitors to Islam because of their ties to the USA. The foremost goal of his al-Qaeda organization is to drive the Americans out of the Gulf region and to topple the royal house of Saud. That is why intelligence services used to figure on acts of sabotage inside Saudi Arabia rather than terrorist strikes in the USA. The Saudi bashing triggered of the events of 9/11 is another example of short sighted US policy. For the merged US-Saudi banks, just line SAMA, have always been active in “exporting Wahabite charity” to South East Asia and Western Africa. That religious zealots are also trained, was apparently a visible fact the USA steadfastly refused to see. First in the name of “containing communism”, then under the title of whichever friendship. Former US National Security Advisor Robert McFarlane has called this “enduring a relation of contradictions”. One could also simply call it stupid. Although it is primarily Asia and Europe that are heavily dependent on Middle Eastern oil, rather than the United States, the American interest in access to the sources of oil is doctrinal. At the same time, there is an increasing tendency in the USA to distance itself from Persian Gulf sources of oil. U.S. Secretary of State Henry Kissinger made a start with the creation of the International Energy Agency (IEA) and the establishment of strategic oil reserves in response to the oil embargo of 1973. However, there is an institutionalised dialogue between the former adversaries IEA and Opec. Under President George W. Bush's energy plan, there is now supposed to be increased drilling in American fields.9 Moreover, when Bush met his Russian counterpart Vladimir Putin in Slovenia for the first time in June 2001, the two leaders agreed to closer cooperation on questions of energy. Russia, which closely coordinated its oil production policy with Opec during the past two years, has now obviously decided to go its own way. In order to prevent a further slip in the price of oil by limiting production, however, Opec urgently needs the cooperation of such non-Opec producers as Russia, Mexico and the North Sea coastal states. Speculation versus Stability But which factors determine the price of oil? "In the short term it is politics, but in the long term it is the laws of the market," says former Saudi Oil Minister Zaki Ahmed Yamani. And with the growing importance of futures and other derivatives since the early 1980s - first in the trading of heating oil, then of crude oil - short-term stock market tactics also now play into the mix, which means that prices are subject to short-term wild fluctuations. Robert Mabro, head of the Energy Institute at Oxford University, blames these blurring factors as very harmful to the oil market.10 The course of the oil price since the winter of 1998 has been like a roller coaster. At the start of 1999 the price was still at a low point of less than 10 dollars per barrel, and there was talk that "the world was drowning in oil." But by the summer of 2000 the price rose to about 35 dollars a barrel. And in spring 2003 nobody dares to foretell the price, for anything is possible between 10 and 50 dollars a barrel, as the OPEC Secretary General Dr. Alvaro Silva-Calderón has stated in an interview with the author.11 Given the threat of global recession and military crises, Opec today finds itself in a more than difficult position. At present, its 11 members account for about 35 percent of global supply, but they are sitting on some 65 percent of known reserves. Since Opec can influence prices only from the supply side, by means of production quotas, its oil ministers' hands are tied when demand declines. Opec's attempts to pursue a long-term energy policy in dialogue with consumer countries appear to have been totally overshadowed at present by recession and political conflicts. There is every indication that, for a long time to come, petroleum will go on being something more than just another commodity. Oil remains a strategic commodity and as the focal point of conflicting interests, war and peace will continue to be decided upon in its name. And the curse of oil is that all the cheapest reserves are concentrated in one small region. Ultimately, nations will fight to ensure access to them. The Iraqi people experience the bitter curse of the “black gold” in these days and nights of brutal bombing of their cities by the combined air-forces of the USA and the United Kingdom. End of the Text kk+ Wilkinson John C., Arabia’s Frontiers: The Story of Britain’s Boundary Drawing in the Desert, London 1991, p.3-21 2 Nevakiki Jukka, Britain, France and the Arab Middle East 1914 – 1920. London 1969 3 Yergin Daniel, The Prize – The Epic Quest for Oil, Money and Power. London 1991, pp.416 4 Geopolitics of Energy and Saudi Oil Policy, speech by Oil minister Ali Naimi; Dec.8 th, 1999 at the Centre for Strategic and International Studies, Washington, D.C. “I want to emphasize here that the US and Saudi Arabia, the world’s largest consumer and producer respectively, have had a special relationship for many years. We have been allies in war and in peace. Saudi Arabia, as the largest supplier of petroleum to the US, has worked hard to fulfil its role in this partnership. The Kingdom has shown itself, time and again, to be a reliable supplier of petroleum to world markets as well as a force for price stability.” (…) in Middle East Economic Survey Dec. 13th, 1999 1 Seymour Ian, Opec – Instrument of Change, London 1980. p.194 Interview with Leo Drollas, chief economist of the London based Centre of Global Energy Studies, in september 2001 7 for further data see: Smart alliances against smart sanctions, an analysis by the author done for the Centre for Global Energy Studies in May 2002. 8 Petroleum Argus Global Markets, 3.2.2003 9 The Bush Energy Plan: The International Dimension, in Middle East Economic Survey, May 28th, 2001. 10 Interview with Robert Mabro in Vienna on Sept. 25th, 2001. 11 Die Welt 22nd of March 2003 5 6