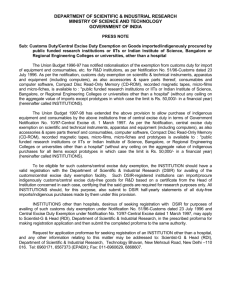

AIT-2012- -HC - indian taxes

advertisement