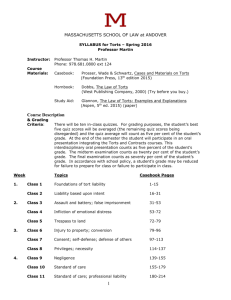

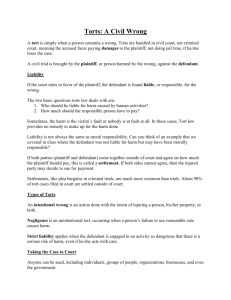

Torts - NYU School of Law

advertisement