107G - American Bar Association

advertisement

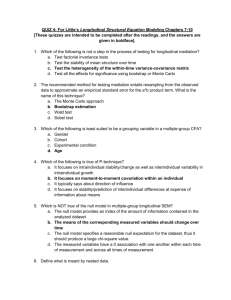

107G AMERICAN BAR ASSOCIATION ADOPTED BY THE HOUSE OF DELEGATES FEBRUARY 16, 2009 RECOMMENDATION RESOLVED, That the American Bar Association recommends that state, and territorial governments adopt the following standards for handling residential and small business insurance claims for property damages resulting from hurricanes or storms: 1. Uniform standards should be established for all insurers as to the procedures used in the adjusting of property damage claims. A. Such standards should be consistent with the Unfair Claims Settlement Act of the National Association of Insurance Commissioners. B. Such standards should also contain guidelines for training and certification, licensing, or other appropriate form of oversight and regulation of all adjustors who engage in claims procedures. 2. Mediation programs should be created and maintained in advance of a particular disaster. A. Such programs should be modeled on the programs made available by Mississippi, Louisiana, and Florida with the assistance of qualified dispute resolution administrators, state bars, courts, or insurance companies. B. Mediation programs should allow any insured to request mediation and require the participation of both the insured and the insurer or insurers. The mediation fee should be paid by the insurer. Both the insured and the insurer or insurers should be able to be represented by an attorney if they so choose, the process should be non-binding unless the parties agree otherwise and qualitative measures of programs effectiveness should be tracked and publicly reported. 107G FURTHER RESOLVED, That the American Bar Association recommends that the national, state, and territorial governments should conduct two studies of the handling of residential and small business insurance claims for property damages resulting from hurricanes or storms: 1. A study should be undertaken to assess whether or not states have enacted laws designed to prevent price gouging during times of catastrophe and whether those laws are uniformly and consistently enforced. A study should also be conducted to assess the impact of major catastrophes on supply and demand in the realm of consumer goods and services, the range of price fluctuations and changes in the availability of certain goods. FURTHER RESOLVED, That the American Bar Association urges Congress to enact legislation that authorizes and directs the National Flood Insurance Program to participate in the mediation programs established by the states and territories so there is a single mediation venue for resolving all disputes for insurance claims resulting from hurricanes or storms. 107G REPORT As a result of Hurricanes Katrina and Rita, there had been widespread criticism of the insurance system as it relates to the kinds of disasters precipitated by hurricanes and storms. In response, in the spring of 2007, Peter Neeson, Chair of the ABA Tort Trial & Insurance Practice Section (TIPS), appointed the Task Force on Disaster Insurance Coverage. The Task Force was reappointed the following year by the next Chair of TIPS, Peter Bennett. Task Force Mission The specific mission of the Task Force was "to examine insurance coverage difficulties arising from the hurricanes, including (1) why so much litigation has surfaced in surrounding states over the wind/water issue, and (2) why insurers are departing from hurricane-prone areas in Florida and along the entire east coast. The scope of the Task Force's research has included the full range of issues arising out of insurance coverage, availability, and affordability for hurricanes and storms and the executive, administrative, legislative, and judicial framework for addressing such issues. The Task Force extends its gratitude to its ex officio members representing various stakeholders for their outstanding contributions to the difficult work of the Task Force. However, it is important to stress that the positions expressed in this Report and Recommendations, while resulting in an overall general consensus, does not necessarily represent the opinions of the entire ex officio membership or their respective policies. Meetings, Hearings, and Deliberations of the Task Force The Task Force met on May 18, 2007 in Newport Beach, CA; August 12, 2007 in San Francisco, CA; October 6, 2007 in Palm Beach, FL; February 9 2008 in Los Angeles. CA; April 15, 2008 in Washington, D.C.; August 9, 2008 in New York City, N.Y.; September 22, 2008 in Chicago, IL; and October 4, 2008 in Hilton Head, SC. It heard presentations from a wide variety of officials from the insurance industry, state and federal governments, and consumer and other non-governmental organizations. Concerns with the Present Insurance System Following Hurricanes Katrina and Rita some national insurers moved to terminate existing policies, or to cease writing new policies entirely, in coastal areas ranging from Florida to New England. A few states moved to establish state mechanisms for the hurricane insurance business, while others looked to Washington for a solution. Various hearings and investigations were initiated by Congressional and state legislators, state 3 107G insurance regulators, and certain attorneys general, and the Task Force has reviewed the testimony and proposals that have resulted from this process. From the presentations and effort conducted by the Task Force, it was noted that, among other things, some raised “concerns” about adequacy of coverage provided under insurance policies and the National Flood Insurance Program (NFIP) in regard to wind and water damage, the varying interpretations of "anticoncurrent cause" provisions in insurance policies and questions of enforcement, promptness and/or consistency surrounding claims determinations during times of catastrophe. The Task Force while having considered the referenced “concerns” recognized that it was not a fact-finding body and did not express any view on the accuracy or validity of such matters revealed or discussed in the course of its efforts. In furtherance of its mission, the Task Force proposals intend to address both possible causes and solutions to challenges inherent in the present insurance system, including the NFIP, and those arising from mega catastrophes in seven separate but highly integrated Recommendations. Recommendation “107G” This Recommendation “107G” deals with reported observations concerning claims handling and adjustment procedures. While there is evidence that insurers handled the vast majority of the 1.7 million claims in a responsible manner, the Task Force concluded that to reduce litigation following catastrophes there is a demonstrated need for uniform standards for claims handling and adjustments. The standards should also include guidelines for training and for certification or licensing of adjustors. The Task Force also studied mediation programs that were adopted in various states, with particular success in Mississippi, Louisiana, and Florida. This Recommendation therefore proposes to strengthen the use of alternative dispute resolution by the creation of mediation programs by states and territories that will be in place before a hurricane or storm disaster occurs, together with minimum standards for the mediation process and for training and certification of mediators. The purpose of mediation is to facilitate communication between the insurer and insured and to explore possible voluntary solutions in the interests of settlement in lieu of litigation. Noted disagreements as to value, prices, and causation in the post-Katrina litigation are appropriate matters for consideration. In the insurance mediation programs in Mississippi, Louisiana, and Florida, insureds often chose not to be represented by an attorney. In contrast, the insurer's representative was usually a repeat-participant with experience and expertise in negotiating such settlements. It is therefore important that insureds be adequately informed in advance of 107G the nature of the mediation process and as to the availability of legal advice or representation if they are not able to afford an attorney. Also, it should be noted that by referencing the state mediation programs, this Recommendation is implicitly providing that an insured not represented by counsel shall have a reasonable period of time (for example, three days) in which to rescind any mediation settlement agreement for any reason. Rescission, however, would only be permissible if the insured has not cashed or deposited any check or disbursement resulting from such agreement. The Task Force received information which alleged that there were widely disparate adjustment results due to different factual assumptions by adjustors as to costs of items and services required for the repair or replacement of real property. Therefore to further reduce the causes of litigation, the Recommendation calls for the conduct of two studies. One to assess whether or not states have enacted laws designed to prevent price gouging during times of catastrophe which are also are uniformly and consistently enforced. The second study should assess the impact of major catastrophes on supply and demand in the realm of consumer goods and services, the range of price fluctuations and changes in the availability of certain goods. These studies, depending on the outcomes, could establish the basis for the creation of a database to provide reliable current information on such costs, broken down according to geographical areas. Data for such a database might be obtained from such sources as FEMA, insurers, the contracting and construction industry, and material suppliers. Finally, since there can be two carriers involved (private insurance company and National Flood Insurance Program) and one adjuster that simultaneously adjusts the wind loss claim for the private insurance company and the flood loss claim for the NFIP, both carriers are necessary parties at any mediation to resolve the insureds claims for property loss. To assure that the National Flood Insurance Program has the authority to participate in state mediation program and must participate in claims with its insureds, the third resolve was required. Respectfully submitted, Timothy Bouch, Chair Tort Trial and Insurance Practice Section February 2009 5 107G GENERAL INFORMATION FORM Submitting Entity: Tort Trial and Insurance Practice Section Submitted By: Timothy W. Bouch, Chair 1. Summary of Recommendation(s). As one of seven integrated and highly interdependent set of Recommendations to reduce the nature and extent of post hurricane (catastrophe) litigation, this Recommendation seeks to minimize litigation through increased transparency and consistent claims adjustment outcomes and effectively use voluntary alternative dispute mediation programs to further reduce the extent of the litigation that gets filed following catastrophes by: establishing uniform standards for adjustment of claims and mediations, establishing a database for the cost of services and materials after a catastrophe available to all parties, strengthening and making permanent the infrastructure and administration of post catastrophe mediation programs, with standards for the training and certification of mediators 2. Approval by Submitting Entity. Approved by the Council of the Tort Trial and Insurance Practice Section on October 5, 2008 3. Has this or a similar recommendation been submitted to the House or Board previously? No. 4. What existing Association policies are relevant to this recommendation and how would they be affected by its adoption? Not applicable 5. What urgency exists which requires action at this meeting of the House? Reducing the burden of class-action lawsuits on state and federal courts following hurricanes and other storms is projected to be a complex 10 year project involving multiple levels of governments, regulatory agencies, private insurers and related entities. The next hurricane season begins June 1. (See Status of Legislation) 6. Status of Legislation. (If applicable.) Not applicable. [Although there were hundreds of bills referencing “flood” and “hurricane” in the 110th Congress, including the main set of bills (HR 920, HR 1682, HR 3121 and S 2284), the House passed HR 3121 “Flood Insurance Reform & Modernization Act of 2007” was amended by the Senate by substituting S 2284 and was languishing in Conference when Congress adjourned. New legislation is expected to be filed after the 111th Congress convenes.] 7. Cost to the Association. (Both direct and indirect costs.) Not applicable 8. Disclosure of Interest. (If applicable.) Not applicable 107G 9. Referrals. This Report and Recommendation is referred to the Chairs and Staff Directors of all ABA Sections and Divisions. 10. Contact Persons. (Prior to the meeting.) a) Hervey P. Levin Law Offices of Hervey P. Levin 6918 Blue Mesa Drive Dallas, Texas 75252 972-733-3242-O 972-896-4312-Cell hervey@airmail.net b) James F. Carr 1525 Sherman St. Fl 5 Denver, Colorado 80203-1714 303-866-5283-O 303-513-0026-Cell c) Janice Mulligan Mulligan & Banham 2442 4th Avenue, Suite 100 San Diego, CA 92101-1609 619/238-8700/cell phone 619-977-4444 jfmulligan@yahoo.com 11. Contact Person. (Who will present the report to the House.) Hervey P. Levin Law Offices of Hervey P. Levin 6918 Blue Mesa Drive Dallas, Texas 75252 972-733-3242-O 972-896-4312-Cell hervey@airmail.net 7 107G EXECUTIVE SUMMARY 1. Summary of the Recommendation This Recommendation seeks to minimize litigation through increased transparency and consistent claims adjustment outcomes and effectively use voluntary alternative dispute mediation programs to further reduce the extent of the litigation that gets filed following catastrophes. 2. Summary of the Issue that the Resolution Addresses As a result of Hurricanes Katrina and Rita, there had been widespread criticism of the insurance system as it relates to the kinds of disasters precipitated by hurricanes and storms. In response, TIPS established the Task Force on Disaster Insurance Coverage. The specific mission of the Task Force was "to examine insurance coverage difficulties arising from hurricanes, including (1) why so much litigation has surfaced over the wind/water issue, and (2) why insurers are departing from hurricane-prone areas in Florida and along the entire east coast.' The scope of the investigation included the full range of issues arising out of insurance coverage, availability, and affordability for hurricanes and storms and the executive, administrative, legislative, and judicial framework for addressing such issues. The seven Recommendations are an integrated and highly interdependent set of proposals that begin with a major goal of reducing the nature and extent of post hurricane (catastrophe) litigation. This is accomplished first by suggesting that the coverage of the basic homeowners policy be changed to include damages caused by wind driven storm surge and then lessening the nature and extent of the risk of losses as much as possible over a 10 year period to increase access to “available” and “affordable” insurance. Resolution of ambiguity regarding causation is also shifted to the insurers and the National Flood Insurance Program; two parties better able to resolve the boundaries of their respective coverages, in ways that do not burden state and federal courts with excessive litigation. 3. Please Explain How the Proposed Policy Position will Address the Issue Establish uniform standards for adjustment of claims and mediations, establish a database for the cost of services and materials after a catastrophe available to all parties, strengthen and make permanent the infrastructure and administration of post catastrophe mediation programs with standards for the training and certification of mediators. 4. Summary of Minority Views or opposition which have been identified: 107G TIPS extends its gratitude to the ex officio members of the Task Force representing various stakeholders for their outstanding contributions to the difficult work of the Task Force. However, it is important to stress that the positions expressed in this Report and Recommendations, while resulting in an overall general consensus, does not necessarily represent the opinions of the entire ex officio membership or their respective policies. 9