UPSTREAM REVIEW DOCUMENT

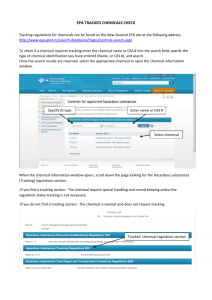

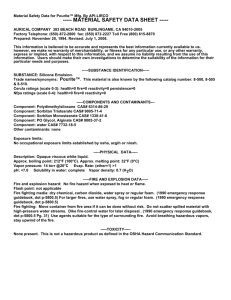

advertisement