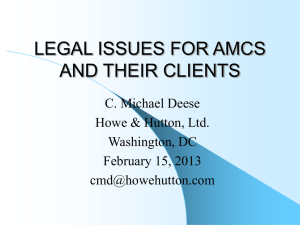

Outline for Academic Medical Centers

advertisement

Hospitals & P4P: Special Operational and Legal Considerations for Academic Medical Centers By William D. Darling, J.D.1 I. Introduction A. Academic Medical Centers (AMC) play a substantial role in the development and implementation of Pay for Performance (P4P) programs. AMCs have assumed responsibility for development of quality indicators based on the research that they do. AMC physicians will publish best practices and analyze the validity of quality indicators adopted by payors. The residency programs will be a challenge for developers of physician report cards for the payors. B. In addition to funding P4P initiatives, certain organizational and regulatory issues present challenges to the success of AMCs in achieving complete success in P4P. This presentation provides an overview of those organizational and regulatory challenges that must be addressed by AMCs in adapting their operations to a P4P payment methodology. C. The focus of this presentation is on adaptive strategies that AMCs may consider for growth and success under the P4P system. Dr. Jackson2 will address these issues from the perspective of the Medical Director of an Academic Hospital. II. Unique Role of Academic Medical Centers A. AMCs play a unique role in the education of physicians and delivery of complex medical care. B. Delivery of care under a P4P program in an AMC setting presents unique challenges and opportunities for the affiliated organizations and physicians that make up the AMC. C. Partnerships by health plans with prestigious AMCs provide all participants in the venture with a win/win possibility. D. Components of an AMC 1. Accredited medical school 2. Affiliated hospital 3. Faculty practice plan 1 Mr. Darling is a partner with Strasburger & Price, L.L.P., and works in its office in Austin, Texas. He can be contacted at 600 Congress Avenue, Suite 1600, Austin, Texas 78701, (512) 499-3664, bill.darling@strasburger.com. 2 Dr. Jackson is a physician practicing with Associates in Medicine in Houston, Texas, and is currently serving as Chairman of the Medical Staff of The Methodist Hospital (Texas Medical Center) in Houston. HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE PAGE 1 E. What is a faculty practice plan? 1. A faculty practice plan is an organization or contractual relationship that is created to facilitate the collection and division of clinical revenues derived from the professional services of faculty members. 2. Many faculty practice plans are tax-exempt organizations and employ the faculty members. 3. A faculty practice plan may be organized under the control of the medical school or the academic hospital. F. AMCs must compete for patients in the same manner as any other health system. G. Costs of care are often higher in AMCs. Higher costs are generated because: 1. Patients have higher care expectations. 2. AMCs have research costs that are not usually incurred by other hospitals or health systems. 3. AMCs and other safety net hospitals provide a disproportionate share of indigent care. 4. The patient acuity of individuals who present at teaching hospitals is significantly more severe than those who present at community hospitals. III. Revenues of many faculty practice plans are insufficient to cover the salaries and expenses of their physicians. Developing alternative revenue sources in order to attract physicians to work in the academic setting is a key to the success of AMCs. A. Certain physician specialties are necessary for teaching and research, but do not produce sufficient revenues to support their salaries. B. Academic hospitals may provide grants to faculty practice plans to offset those deficits. C. P4P will increase costs of faculty practice plans, including: 1. IT costs 2. Additional administrative expertise necessary to manage data and validate payments IV. Academic hospitals and faculty practice plan reorganization may be necessary to fund increases in salaries to recruit to AMCs. A. Ownership of certain ancillary facilities by faculty practice plan as a physician group practice (see Item V.A.8 below). B. Reorganization of the AMC into a single entity that employs all faculty physicians. HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE PAGE 2 V. Health Care Regulations Implicated by the Interaction between an AMC and the Faculty Practice Plan3 A. Physician Self-Referral Laws (i.e., Stark Law)4 1. The Stark Law prohibits a physician from referring a patient for certain designated health services payable by Medicare or Medicaid to an entity with which the physician has a financial relationship, unless each and every element of a Stark Law exception can be satisfied. The penalty for violation of the Stark Law includes the loss of Medicare reimbursement, potential administrative penalties, and potential exclusion as a Medicare provider. 2. Hospital services, both inpatient and outpatient, are considered designated health services for Stark Law purposes. Even services that would otherwise not quality independently as designated health services will be brought under the Stark Law umbrella when provided by an AMC. 3. Because of the collaboration that will be necessary between AMCs and faculty physicians, an analysis of the resulting financial relationships will be necessary to ensure compliance with the Stark Law and its state law equivalents. 4. The Stark Law defines an AMC as:5 a. An accredited medical school (including a university, when appropriate) or an accredited academic hospital; b. One or more faculty practice plans affiliated with the medical school, the affiliated hospital(s), or the accredited academic hospital; and c. One or more affiliated hospital(s) in which a majority of the physicians on the medical staff consists of physicians who are faculty members and a majority of all hospital admissions are made by physicians who are faculty members. d. NOTE—An accredited academic hospital for purposes of this Stark Law exception means a hospital or health system that sponsors 4 or more approved medical education programs 3 State law must be examined to determine whether certain state laws implicate the development and implementation of a P4P program. The discussion contained in this paper and the accompanying presentation slides, however, will focus on the implications of the noted federal laws. Any reference to state law equivalents is for illustrative purposes only. 4 The federal physician self-referral prohibition (i.e., Stark Law) is located at 42 U.S.C. § 1395nn, and its regulatory provisions are located at 42 C.F.R. § 411.350 et seq. An independent analysis of specific state laws will be necessary to determine whether a given state has enacted a state law equivalent. For example, Texas law does not have a specific physician self-referral prohibition, but does have provisions that require physicians to provide patients with notice of any ownership or compensation relationships they have with entities to which they refer patients for medical services. See, e.g., TEX. OCC. CODE. ANN. § 102.006; TEX. OCC. CODE ANN. § 105.002(a)(3); 28 TEX. ADMIN. CODE § 180.24. 5 42 C.F.R. § 411.355(e)(2). HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE PAGE 3 5. The Stark Law includes an exception for AMC financial arrangements involving faculty practice physicians if:6 a. The referring physician: i. Is a bona fide employee of a component of the AMC on a full-time or substantial part-time basis; ii. Is licensed to practice medicine in the state in which he or she practices medicine; iii. Has a bona fide faculty appointment at the affiliated medical school or at one or more of the educational programs at the accredited academic hospital; and iv. Provides either substantial academic services or substantial clinical teaching services (or a combination thereof) for which the faculty member receives compensation as part of his or her employment relationship with the AMC; b. The total compensation paid by all AMC components to the referring physician is set in advance and, in the aggregate, does not exceed fair market value for the services provided, and is not determined in a manner that takes into account the volume or value of any referrals or any other business generated by the referring physician within the AMC; c. The AMC must meet all of the following conditions: v. All transfers of money between components of the AMC must directly or indirectly support the missions of teaching, indigent care, research, or community services; vi. The relationship of the AMC components must be set forth in written agreement(s) or other written document(s) that have been adopted by the governing body of each component. If the AMC is one legal entity, this requirement will be satisfied if transfers of funds between components of the AMC are reflected in the routine financial reports covering the components; vii. All money paid to a referring physician for research must be used solely to support bona fide research or teaching and must be consistent with the terms and conditions of the grant; and d. The referring physician’s compensation arrangement does not violate the AntiKickback Statute (see below), or any federal or state law or regulation governing billing or claims submission. 6. Electronic prescribing items and services exception allows AMC to finance certain computer and software for e-prescribing.7 6 42 C.F.R. § 411.355(e)(1). HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE PAGE 4 7. Electronic health records items and services exception allows AMC to finance certain computer and software for interoperable medical records.8 8. In the event the faculty practice plan offers ancillary services within the structure of the faculty practice plan, satisfaction of the group practice requirements will be necessary to meeting the in-office ancillary services exception.9 B. Federal and State Anti-Kickback Laws10 1. The federal anti-kickback statute (“Anti-Kickback Statute”) is a criminal statute that prohibits payments of remuneration between referring physicians and hospitals involving Medicare and other governmental payment programs. Violation of the law is a federal felony and can result in the criminal and civil penalties. 2. The development of P4P programs is expensive and includes the same legal considerations that exist with any type of hospital-physician joint venture. The natural inclination is for a hospital to fund the development costs. If a hospital provides benefits to a group of referring physicians, however, the Anti-Kickback Statute may be violated. 3. The Anti-Kickback Statute is broad in its reach and is extremely complex. Because of its breadth, certain safe harbors have been adopted to protect certain activities. The analysis of the relationships in a P4P program is critical to assure that there is no exposure to anti-kickback penalties. Because P4P is so new, there is little guidance to the industry from the government with respect to implications raised by the AntiKickback Statute. 4. While safe harbors have been created, no safe harbor exists that corresponds to the Stark Law exception for AMCs. Instead, two OIG11 have been published that address the AMC issue.12 e. The OIG found in the both advisory opinions that the payment grant from each academic hospital to the respective faculty practice plan “[was] straightforward as it [was] problematic.” f. The Advisory Opinions are important in that they find that the proposed donations, which included an office building in one and $1.6 million in the other, 7 42 C.F.R. § 411.357(v). 42 C.F.R. § 411.357(w). 9 See 42 C.F.R. § 411.352 (for requirements to be considered a “group practice”); see also 42 C.F.R. § 411.355(b) (in-office ancillary services exception). 10 The Anti-Kickback Statute can be found at 42 U.S.C. § 1320a-7b(b), and its regulatory safe harbors can be found at 42 C.F.R. § 1001.952. A compilation of state law equivalents has been compiled by AHLA: Gary E. McClanahan, Esq., State Illegal-Remuneration & Self-Referral Laws, 2d ed. (2005). 11 Office of Inspector General, U.S. Department of Health & Human Services. 12 OIG Adv. Op. 00-6 (Sept. 29, 2000) & OIG Adv. Op. 02-11 (Aug. 12, 2002). 8 HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE PAGE 5 would constitute a violation of the Anti-Kickback Statute if the requisite “intent” were present. g. The OIG determined, though, that safeguards developed and implements by the academic hospital, including no requirement or encouragement of referrals from the faculty practice plan and other related restrictions, would prevent a violation of the Anti-Kickback Statute. The OIG also relied on the traditional roles of the AMC components as evidence that there was no intent to violate the AntiKickback Statute. 5. Electronic prescribing items and services safe harbor allows an AMC to finance certain computer and software systems for e-prescribing.13 6. Electronic health records items and services safe harbor allows an AMC to finance certain computer and software systems for interoperable medical records.14 C. Antitrust Laws15 1. Antitrust issues related to competing health care providers joining together to jointly price services has been an issue at the forefront of Federal Trade Commission (“FTC”) enforcement actions over the past 15 years. Managed care, consolidation of payors, and reductions in fee schedules offered to providers have reduced incomes for providers. Agreements as to price among otherwise competing providers constitute a per se violation of antitrust law. 2. The FTC has found that competing providers, including hospitals and physicians, are capable of jointly pricing their services in certain circumstances. In instances where competing providers are either financial or clinically integrated, they may be able to jointly price their services where the joint pricing is ancillary to their integration. The advent of capitation was one way that providers were able to financially integrate themselves sufficiently to jointly price. The substantial reduction in the number of capitation contracts has reduced the opportunities to use this mechanism. 3. The reduction of opportunities for a capitated contract and the emergence of the P4P model have focused attention on the clinical integration of competing providers. The development of a clinically integrated group is a complex legal and clinical problem.16 4. In the AMC setting, price-fixing concerns may arise in the joint pricing of physician services if a faculty practice plan is neither financially nor clinically integrated. 13 42 C.F.R. § 1001.952(x). 42 C.F.R. § 1001.952(y). 15 See 15 U.S.C. §§ 1, 2 (Sherman Act §§ 1, 2); 15 U.S.C. § 18 (Clayton Act § 7); & 15 U.S.C. § 45 (Federal Trade Commission Act § 5). 16 See FTC Adv. Op. In re MedSouth (Feb. 19, 2002). 14 HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE PAGE 6 5. P4P provides significant opportunity to attain either financial integration or clinical integration, or both. 6. Changes to the AMC organization itself or to a faculty practice plan may be necessary to jointly price health care services. 7. Reorganization of the AMC into a financially and/or clinically integrated entity can produce positive results. a. Better coordination of patient care. b. Satisfaction of applicable health care regulatory requirements. c. Coordination of pricing and billing activities. D. Other Legal Issues to be Considered 4. Civil Monetary Penalties Laws17—Prohibits a hospital from making payments to a physician to induce the physician to limit or reduce services to Medicare beneficiaries. 5. Network Exclusion/State Law Defamation18—May be mitigated in the hospital setting by the Health Care Quality Improvement Act (“HCQIA”).19 6. Malpractice Concerns. 7. Privacy, including HIPAA and applicable State laws. 8. Tax-Exempt Status. VI. Selected Contract Issues A. Attribution – Responsibility for acts of residents and interns B. Payments for research regarding clinical indicators VII. Conclusion A. AMCs are uniquely situated to provide leadership in the development of P4P systems because they are best equipped to lead in the research necessary to develop and validate quality indicators. 17 See 42 U.S.C. § 1320a-7a(b). Examples of actions whereby physicians have initiated legal action because of statements related to quality include: Poliner v. Texas Health Sys., 2006 U.S. Dist. LEXIS 13125 (N.D. Tex. Mar. 27, 2006); motion for new trial denied, motion granted in part, motion denied in part, 2006 U.S. Dist. LEXIS 74569 (N.D. Tex. Oct. 13, 2006); Washington State Med. Ass’n v. Regence BlueShield, No. , Wa. Sup. Ct.-King Co. (Sept. 20, 2006). 19 See 42 U.S.C. § 11101 et seq. 18 HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE PAGE 7 B. The concentration of capital for development of the necessary support systems are an advantage to creation of P4P networks positioned to collaborate hospital and physician care. C. There are organizational issues that may have to be overcome for an AMC to meet the challenges of a regulatory system that was not created with P4P in mind. Most, if not all, of the regulatory and organizational issues can be overcome with appropriate planning. HOSPITALS & P4P: SPECIAL OPERATIONAL AND LEGAL CONSIDERATIONS FOR AMCS DARLINGB—5.01@11.15AM PFP--OUTLINE 384615.1/SPA/15556/1303/011707 PAGE 8