Land Drainage Utility Implementation Plan

advertisement

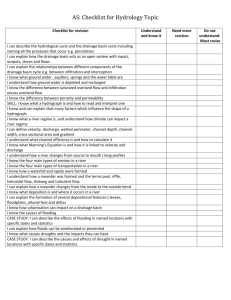

Attachment 1 Agenda Item No.:__________ Land Drainage Utility Implementation Plan Recommendation: 1. That the City of Edmonton, Sewers Use Bylaw be amended to establish a Drainage Utility consisting of a land drainage utility and the existing sanitary utility commencing January 1, 2003. 2. That the projected 2003 land drainage utility rate charged to customers be $0.01232 per m2 per month of contributing property area based on the land area, the intensity of development and the land zoning of the property. 3. That the portion of property tax revenue currently used to finance land drainage capital and operational costs be deducted from future City of Edmonton property tax revenue estimates once the utility is activated. Report Summary This utility implementation plan sets out an approach that will provide adequate funding for current and future land drainage maintenance, rehabilitation, growth and environmental protection. Approval of this plan would eliminate the need to finance land drainage services through property taxes. approved in principle, subject to the administration preparing a further report outlining a plan for implementation.” Report Previous Council/Committee Action At the regular meeting of City Council on July 4, 2000 the following motion was approved: “That the City of Edmonton’s Utility Fiscal Policy be amended to establish a stormwater utility with the utility rate to be based on the unique characteristics of properties relating to size, intensity of development and imperviousness, and dealing with tax-exempt properties to be Routing: Delegation: Written By: April 23, 2002 File: 2002PWD047 The land drainage utility and implementation plan are consistent with City Council approved strategies and initiatives that promote sustainable growth, infrastructure and sources of funding. The attached Land Drainage Implementation Plan (Attachment 1) provides the following details regarding the creation and operation of a land drainage utility beginning January 1, 2003: o Customer base o Rate model o Rate model impacts on customer groups o Billing & collection system o Revenue projections o Legal issues o Municipal comparisons All property owners who use land drainage services will pay for future operating and capital costs. The Municipal Government Act prohibits the discrimination of any utility user, either in the rate charged or the service provided. The assessment and fee structure is therefore predicated on fairness and equity and includes all property owners who benefit from land drainage services. This includes property owners exempt from paying property taxes. The rate model is based, as directed by City Council, on the area of a property, the intensity of development and land Transportation and Public Works Committee, City Council W. D. Burn Kurt Sawatzky/Chris Ward Asset Management and Public Works Department (Page 1 of 3) Land Drainage Utility Implementation Plan zoning. All users will pay the same base rate, but monthly fees will vary significantly depending on the nature, size and use of a property. Development of this implementation plan included an extensive public consultation program. A summary report is attached (Attachment 2). A number of suggestions by stakeholders have been incorporated in this plan including an appeals process, and a recommendation to ensure property owners do not pay twice for land drainage services. Based on stakeholder feedback, consideration has also been given to funding options for community groups. Implementation of the plan will result in one overall Drainage Utility, as the sanitary sewer system already generates its revenue through a utility. A communications program to raise awareness of the utility, the rate model and to ensure a smooth transition for customers to a utility structure, will be developed once the implementation plan is approved. Canadian municipalities with partial or full land drainage utilities include Regina, Saskatoon, Strathcona County, Calgary and Winnipeg. Likewise there are more than 300 land drainage utilities in the United States. Budget / Financial Implications In 2003, approximately $12.5 million will be deducted from that portion of the property tax levy currently used to fund land drainage services. In 2003, $13.5 million will be collected from land drainage utility users. The projected capital and operating budgets of the land drainage system will range from $20-$25 million per year. “Pay as you go” financing is unable to meet current and future demands on the system. The ability to borrow money allows an adequate level of investment and spreads payments out over the life span of the infrastructure. Customer billing will occur through EPCOR. One-time costs to modify the billing system are estimated to be $500,000 to $600,000. On-going billing costs are estimated to be $300,000 per year. This includes the creation of one new FTE. Legal Implications Section 7(g) of the Municipal Government Act provides a municipality with the authority to establish a public utility. Under the Act, land drainage is considered an activity that may be conducted as a public utility. Municipalities can finance public utility activities by way of bylaws that establish charges and conditions of service, in addition to the construction and use issues that are already addressed in existing bylaws. Justification of Recommendation 1. To ensure future operating and capital funding is adequate to pay for all needed land drainage system’s upgrades, rehabilitation and environmental protection activities. A bylaw (Page 2 of 3) Land Drainage Utility Implementation Plan amendment is required under the Municipal Government Act. 2. To ensure the rate model is fair and equitable to all users and considers the unique characteristics of individual properties. The initial per month rate fee will ensure the utility has adequate financing at start-up. 3. To ensure property owners they are not paying twice for land drainage costs. Background Information Available Upon Request 1. Implementation Plan for a New Drainage Utility. 2. Proposed Land Drainage Utility Public Consultation Final Report - April 8, 2002 (Overview, Methodology and Key Findings). Others Approving this Report Randy Garvey, Corporate Services (Page 3 of 3)