ACCT 8190 Accounting Strategies for Decision Making

advertisement

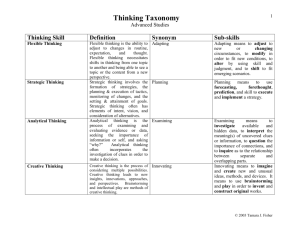

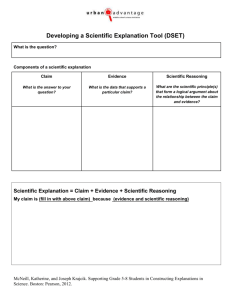

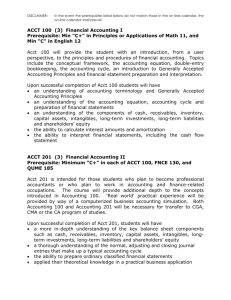

KENNESAW STATE UNIVERSITY GRADUATE COURSE PROPOSAL OR REVISION, Cover Sheet (10/02/2002) Course Number/Program Name: ACCT 8190 – Accounting Strategies for Decision Making in a Global Environment/MAcc Department: School of Accountancy Degree Title (if applicable): Master of Accounting Proposed Effective Date: 8/1/2011 Check one or more of the following and complete the appropriate sections: Sections to be Completed II, III, IV, V, VII I, II, III I, II, III I, II, III I, II, III I, II, III XX New Course Proposal ___ Course Title Change Course Number Change Course Credit Change Course Prerequisite Change Course Description Change Notes: If proposed changes to an existing course are substantial (credit hours, title, and description), a new course with a new number should be proposed. A new Course Proposal (Sections II, III, IV, V, VII) is required for each new course proposed as part of a new program. Current catalog information (Section I) is required for each existing course incorporated into the program. Minor changes to a course can use the simplified E-Z Course Change Form. Submitted by: X X Approved Dr. Divesh Sharma Faculty Member Nov 3, 2010 Date Not Approved 11/16/2010 Approved Not Approved Department Curriculum Committee Date 11/16/2010 Department Chair Date Approved Not Approved Approved Approved Approved Approved College Curriculum Committee Date College Dean Date GPCC Chair Date Dean, Graduate College Date Not Approved Not Approved Not Approved Not Approved Vice President for Academic Affairs Date Approved Not Approved 1 President Date KENNESAW STATE UNIVERSITY GRADUATE COURSE/CONCENTRATION/PROGRAM CHANGE I. Current Information Page Number in Current Catalog: Course Prefix and Number: Course Title: Class Hours: Laboratory Hours Credit Hours: Prerequisites: Description: II. Proposed Information (Fill in the changed item) Course Prefix and Number: ACCT 8190 Course Title: Accounting Strategies for Decision Making in a Global Environment Class Hours: 2 Laboratory Hours 0 Credit Hours: 2 Prerequisites: ACCT 8100; ACT 8120 Description: This course examines the value of accounting strategies from the perspectives of various stakeholders in a global economic environment. A unique feature of the course is that it integrates traditional and contemporary financial accounting, audit, tax and managerial strategies. III. Justification A review of the Master of Accounting (MAcc) program curriculum indicates that the program should incorporate a strong core of graduate accounting seminars and topic coverage in the specialization areas of Financial Reporting/Auditing and Taxation. Additionally, graduates of the degree program should possess advanced professional practice skills, technical expertise in core and specialized accounting courses, and advanced communication and critical thinking abilities. The curriculum review has included a comparison of the Master of Accounting curriculum with peer, competitor, and aspirant institutions. Additionally, relevant research on graduate accounting education was analyzed and feedback was obtained from Master of Accounting faculty, Coles College leadership, Master of Accounting program recruiters, the 2 School of Accountancy Advisory Board, and current and former Master of Accounting students. This proposed course meets the goal of providing appropriate topic coverage in Financial Reporting / Auditing. This course is the capstone course in the MAcc program and accordingly serves to adopt an integrated and comprehensive approach to consolidate and extend prior accumulated knowledge using stakeholder decision making contexts in a global economic environment. IV. Additional Information (for New Courses only) Instructor: Dr. Divesh Sharma Text: Compilation of readings from various sources primarily academic and professional journals Prerequisites: ACCT 8100; ACCT 8120 Objectives: The course aims to enhance skills related to critical thinking, analytical reasoning, evaluation and synthesis both individually and in a team environment using various accounting strategies in a global decision making context as the learning vehicle. Specific objectives include: o Understand and appreciate the decision making perspective of various stakeholders (analytical reasoning). o Understand, analyze and evaluate various accounting strategies in a global economic environment (critical thinking, analytical reasoning, evaluation). o Be able to understand, analyze and evaluate the implications of various accounting strategies on each other (critical thinking, analytical reasoning, evaluation and synthesis). Instructional Method Classes will be structured to facilitate discussion and debate and provide opportunities for students to demonstrate their skills related to critical thinking, analytical reasoning, evaluation and synthesis both individually and in a team environment. Method of Evaluation Presentation (20%), project/essay (25%), Case studies (40%), participation (15%). V. Resources and Funding Required (New Courses only) Resource Amount Faculty Other Personnel Equipment Supplies Travel New Books New Journals Other (Specify) TOTAL 3 Funding Required Beyond Normal Departmental Growth NOTE: NO ADDITIONAL FUNDING REQUIRED BEYOND NORMAL DEPARTMENT GROWTH. 4 VI. COURSE MASTER FORM This form will be completed by the requesting department and will be sent to the Office of the Registrar once the course changes have been approved by the Office of the President. DISCIPLINE Accounting COURSE NUMBER ACCT 8190 COURSE TITLE FOR LABEL Accounting Strategies for Decision Making in a Global Environment CLASS-LAB-CREDIT HOURS 2, 0, 2 Approval, Effective Term Fall 2011 Grades Allowed (Regular or S/U) Regular If course used to satisfy CPC, what areas? Learning Support Programs courses which are required as prerequisites APPROVED: __________________________________________________ Vice President for Academic Affairs or Designee __ 5 VII. SYLLABUS VIII. Course Prefix and Number: ACCT 8190 Course Title: Accounting Strategies for Decision Making in a Global Environment Class Credit Hours: 2 hours Prerequisites: ACCT 8100; ACCT 8120 Course Description: This course examines the value of accounting strategies from the perspectives of various stakeholders in a global economic environment. A unique feature of the course is that it integrates traditional and contemporary financial accounting, audit, tax and managerial strategies. Course Objectives: The course aims to enhance skills related to critical thinking, analytical reasoning, evaluation and synthesis both individually and in a team environment using various accounting strategies in a global decision making context as the learning vehicle. Specific objectives include: o Understand and appreciate the decision making perspective of various stakeholders (analytical reasoning). o Understand, analyze and evaluate various accounting strategies in a global economic environment (critical thinking, analytical reasoning, evaluation). o Be able to understand, analyze and evaluate the implications of various accounting strategies on each other (critical thinking, analytical reasoning, evaluation and synthesis) Corporate life cycle, types of decision makers, types and nature of decision making, corporate distress, strategic survival in a competitive and global economy, mergers and acquisitions, balanced-scorecard as performance measurement and strategic management. Possible Topics to be Covered: Possible Instructors: Divesh Sharma Possible Texts: Compilation of readings from various sources primarily academic and professional journals Instructional Method: Live (Face to Face) Instruction. In classroom Possible Evaluation Tools and Weightings: Presentation (20%), project/essay (25%), Case studies (40%), participation (15%). 6 Other Information Students must take initiatives to become familiar with current business news and issues in publicly available media such as The Wall Street Journal, AICPA and SEC web sites, and other major media (e.g., New York Times, CFO, CPA Journal). No more than one class absence that must be due to extenuating circumstances (e.g., death in family). 7