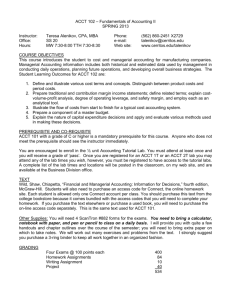

ACCT 100 (3) Financial Accounting I

advertisement

DISCLAIMER: In the event the prerequisites listed below do not match those in the on-line calendar, the on-line calendar shall prevail. ACCT 100 (3) Financial Accounting I Prerequisite: Min "C+" in Principles or Applications of Math 11, and Min "C" in English 12 Acct 100 will provide the student with an introduction, from a user perspective, to the principles and procedures of financial accounting. Topics include the conceptual framework, the accounting equation, double-entry bookkeeping, the accounting cycle, an introduction to Generally Accepted Accounting Principles and financial statement preparation and interpretation. Upon successful completion of Acct 100 students will have an understanding of accounting terminology and Generally Accepted Accounting Principles an understanding of the accounting equation, accounting cycle and preparation of financial statements an understanding of the components of cash, receivables, inventory, capital assets, intangibles, long-term investments, long-term liabilities and shareholders’ equity the ability to calculate interest amounts and amortization the ability to interpret financial statements, including the cash flow statement ACCT 201 (3) Financial Accounting II Prerequisite: Minimum "C+" in each of ACCT 100, FNCE 130, and QUME 185 Acct 201 is intended for those students who plan to become professional accountants or who plan to work in accounting and finance-related occupations. The course will provide additional depth to the concepts introduced in Accounting 100. ‘Real world’ practical experience will be provided by way of a computerized business accounting simulation. Both Accounting 100 and Accounting 201 will be necessary for transfer to CGA, CMA or the CA program of studies. Upon successful completion of Acct 201, students will have a more in-depth understanding of the key balance sheet components such as cash, receivables, inventory, capital assets, intangibles, longterm investments, long-term liabilities and shareholders’ equity a thorough understanding of the normal, adjusting and closing journal entries that make up a typical accounting cycle the ability to prepare ordinary classified financial statements applied their theoretical knowledge in a practical business application DISCLAIMER: In the event the prerequisites listed below do not match those in the on-line calendar, the on-line calendar shall prevail. ACCT 217 (3) Taxation I Prerequisite: Min "C+" in ACCT 201 Acct 217 will introduce the student to individual taxation in Canada. Specific Objectives To provide students, not previously exposed to the Canadian Income Tax system, with knowledge of the basic concepts and application of the key provision of the Canadian Income Tax Act with respect to individuals. To determine types of income and the differences in taxation. To understand the goals and objectives of the government in the development of the different aspects of the Income Tax Act. To develop the student’s ability to read and interpret the Income Tax Act. ACCT 294 (3) Intro to Cost and Managerial Accounting Prerequisite: ACCT 100; FNCE 130; QUME 185 Managerial Accounting provides financial information useful to managers within the organization as distinct from financial accounting, which provides a general package of information primarily for outside users. The purpose of this introductory managerial accounting course is to explore the kinds of information managers need, where this information can be obtained and how this information is used to plan operations, control activities and make decisions. Specific Objectives To provide students with the basic concepts and terminology of Managerial or Cost Accounting and contrasting the application of principles with that of Financial Accounting. To apply knowledge of cost behavior in preparing and analyzing both annual budgets and actual results of operations. To determine the effect of changes in operations on expected results as well as applying the concepts of Responsibility Accounting in investigating material differences. To identify and analyze relevant information with regards to decision making including the identification and consideration of alternative opportunities or options. To use a combination of knowledge and critical thinking skills in situational analysis including considerations such as cost-benefit relationships, quantitative amounts as well as qualitative characteristics. DISCLAIMER: In the event the prerequisites listed below do not match those in the on-line calendar, the on-line calendar shall prevail. ACCT 317 (3) Taxation II Prerequisite: Min "C+" in ACCT 217 Acct 317 is the second introductory course in federal income taxation. It will introduce the student to the principles and practices of Canadian taxation, including a basic understanding of the Canadian Income Tax Act and its implications in relation to corporations and shareholders, partnerships, trusts and international taxation. Specific Objectives To provide students with knowledge of the basic concepts and application of the key provision of the Canadian Income Tax Act with respect to corporations, partnerships and trusts. To develop the student’s tax research skills, including the ability to read and interpret the Income Tax Act, judicial decisions and the CRA’s position. To introduce basic tax planning concepts through practical problems and case applications. ACCT 330 (3) Financial Reporting and Analysis Prerequisite: Min. "C+" in each of ACCT 100 and ACCT 294 Introductory Financial and Managerial Accounting courses provide the background of the mechanics of Accounting. However they do not fully analyze the decision making that goes into the choice of accounting policies and the impact that this has on users of financial statements and their decision making. This course will increase the knowledge and appreciation that the students will have for the choice of accounting policies and the impact on the users of the financial statements. In addition while becoming more familiar with the options for Financial Reporting the student will also utilize different analysis methods to determine the health of a company and to provide understanding of the relationships between the various financial statements. Successfully completion of Acct 300 will enable the student to: understand financial reporting concepts explain how financial reporting standards are developed in Canada and internationally apply financial reporting standards to specific accounting issues critically evaluate financial reporting standards in Canada and internationally demonstrate an understanding of specific reporting problems faced by selected specialised entities, such as construction companies use critical thinking skills and analysis to determine the financial health of a company DISCLAIMER: In the event the prerequisites listed below do not match those in the on-line calendar, the on-line calendar shall prevail. ACCT 335 (3) Intermediate Accounting: Assets Prerequisite: Min "C+" in Acct 201 Acct 335, one of two intermediate accounting courses, begins with a review of the financial accounting information system and reporting the financial position, performance and cash flow of an incorporated business. A review of the basic principles of accounting, focusing on the conceptual framework, is also undertaken. The balance of the course includes an in-depth discussion and analysis of revenue recognition issues and accounting for current and non-current assets (cash, receivables, inventory, investments, capital assets and intangible assets). Discussions will focus on issues related to recognition, measurement and disclosure ACCT 336 (3) Intermediate Accounting: Liabilities and Owners' Equity Prerequisite: Min "C+" in Acct 201 Acct 336 will review accounting principles and develop an understanding of the elements of financial statements. Emphasis will be placed on liabilities and the owners' equity section of the balance sheet for corporations. Specific Objectives To further develop an understanding of Generally Accepted Accounting Principles. To understand the accounting environment and the application of accounting principles. To further develop an understanding of the liabilities and equity/net assets elements of the balance sheet. To prepare and understand a Cash Flow Statement. To enable the student to effectively analyze financial statements. To meet the requirements of various professional bodies, such as the Certified General Accountants' Association, the Society of Management Accountants and the Canadian Institute of Chartered Accountants. This course can prepare the student for further studies in accounting. ACCT 340 (3) Not-For-Profit Accounting Prerequisite: ACCT 201 and ACCT 294 Acct 340 examines accounting, planning, and control for not-for-profit organizations. The unique characteristics of not-for-profit organizations are investigated including financial statements, full cost accounting, the control environment, planning and program analysis, budgeting, and program evaluation. DISCLAIMER: In the event the prerequisites listed below do not match those in the on-line calendar, the on-line calendar shall prevail. Upon successful completion of Acct 340 the student will: understand the characteristics and nature of not-for-profit organizations effectively use management control principles dealing with published financial statements, full-cost accounting, and pricing decisions understand and utilize budgeting and strategic planning and program analysis as a management control system effectively use financial information to control the operation, measure the output, and report on performance perform appropriate operations analysis and program evaluation ACCT 362 (3) Cost and Managerial Accounting II Prerequisite: ACCT 294 Acct 362 will build on the fundamental concepts and procedures introduced in introductory cost and managerial accounting. Topics will relate to the planning function, cost control and decision-making. The course will cover the effect managerial decisions can have on the financial accounting outcome, and will develop an awareness of current issues in designing and implementing effective control systems. Moral responsibilities of management accountants to their profession and to the managers they advise will be explored. ACCT 390 (3) Selected Topics in Accounting Prerequisite: ACCT 201 and ACCT 294 Presentation of selected topics in accounting. objectives are dependant upon topics chosen. Learning outcomes and ACCT 399 (3) Special Topics in Accounting/Assurance (Field School) Prerequisite: ACCT 100 and ACCT 294 Seminar based study of accounting and assurance unique to a specific country/geographic area. Emphasis on understanding the specific business environment including comparative discussions of GAAP, financial statement analysis and the designated country’s accounting industry, financial reporting, market and oversight function(s). Normally delivered through a field school format. Learning outcomes and objectives are dependant upon topics chosen. DISCLAIMER: In the event the prerequisites listed below do not match those in the on-line calendar, the on-line calendar shall prevail. ACCT 410 (3) Principles of Auditing Prerequisite: ACCT 335 and ACCT 336, one of which may be taken concurrently [Effective August 2009 both courses must be taken prior to Acct 410) Acct 410 will introduce the principles of external audit and related methods and procedures. Topics include: types of assurance engagements, the ethical/legal environment, auditor independence, quality control, audit planning, internal control assessment, audit techniques, preparing assurance reports, and detecting fraud and error. Acct 410 will also include discussions on current developments in comprehensive and IT auditing. Effective communication of assurance results will also be emphasized. ACCT 421 (3) Accounting Theory Prerequisite: ACCT 335 and 336 Objectives To describe, examine and explore the various accounting theories that form the basis of Generally Accepted Accounting Principles. To examine the relevance of these theories in understanding financial accounting procedures and reporting. To examine the impact that economic and financial theories have on accounting and the influence of political and social factors in financial accounting information. Specific Objectives Examine accounting models and decision usefulness under ideal conditions. Examine alternative financial and economic theories on markets and decision usefulness. Examine measurement perspective applications and their decision usefulness. Examine the economic consequences of financial information and positive accounting theory. Apply different models to alternative measurement issues. Discuss the economic, social and political framework of accounting standard setting. DISCLAIMER: In the event the prerequisites listed below do not match those in the on-line calendar, the on-line calendar shall prevail. ACCT 435 (3) Advanced Financial Accounting Prerequisite: ACCT 335 and ACCT 336 This course is an in-depth study of accounting standards, topics and procedures in very specific areas. These areas include international accounting, investments and business combinations, consolidated statements, foreign currency, foreign operations, not-for-profit and fund accounting. The main goal is to learn these advanced accounting principles and practices and then to apply them to specific areas. An additional objective is to comprehend and discuss the related issues and changes in the accounting for these areas over the past few years. Applicable sections of the CICA handbook will be presented as part of this course. ACCT 450 (3) Fraud Awareness, Prevention and Detection Prerequisites: Fourth year standing in the BBA including Laww 326 and Acct 294 An exploration of commercial crime and fraud topics in business. Topics include commercial crimes, fraudster psychology, red flags, fraud deterrence and prevention, and analysis of vulnerability to fraud. A wide range of frauds will be examined and analyzed, including general frauds and scams, money laundering, Internet fraud, corporate and personal identity theft, financial statement fraud, and banking fraud. Upon successful completion of Acct 450, students will have an understanding of types of fraud the fraud deterrence cycle auditing and investigation calculating and situation dependent criminals general frauds and scams symptomatic fraud investigation investigation alternatives identifying and evaluating risk factors due diligence and internal controls phishing, vishing, spoofing, ebay and paypal fraud intellectual property identity theft counterfeit goods: currency, software, music, financial instruments money laundering banking, debit and credit card fraud income tax, GST, CPP and EI benefit fraud financial statement fraud documenting and prosecuting