Post Bachelor of Business Administration

Internet Specialist 1

Post Bachelor of Business Administration

Degree Career Goal: Internet Specialist for the Banking Industry by

Chris S. Volk

A research project report submitted to the faculty of

Mount Vernon Nazarene University in partial fulfillment of the requirements for the degree of

Bachelor of Business Administration

January, 2002

Internet Specialist 2

Executive Summary

The purpose of this study was to develop a set of

Individual Learning Outcomes related to the post Bachelor of

Business Administration(BBA) career goal, Internet specialist for the banking industry. Achieving the Individual Learning

Outcomes in the BBA program is the plan for preparing the investigator for the post BBA career goal. The research question for this study was: What competencies, abilities, and skills should an Internet specialist for the banking industry possess?

A Plan to Achieve Individual Learning Outcomes was the result of a literature review and interviews with three experts in banking on the Internet. The developed plan is ready for implementation within the BBA program.

Internet Specialist 3

Post Bachelor of Business Administration

Degree Career Goal: Internet Specialist for the Banking Industry

Problem Statement and Purpose

The Bachelor of Business Administration (BBA) program at

Mount Vernon Nazarene University (MVNU) accommodates adult learners working in various careers. All adult learners enroll in the same package of standard courses for a BBA degree. The problem is that adult learners’ post BBA career goals range from improving abilities for a current position to developing competencies for a new career at a new organization. The variety of post BBA career goals require that the individual learning needs be fulfilled within the standard curriculum.

The purpose of this study was to develop a set of

Individual Learning Outcomes related to the post BBA career goal, Internet specialist for the banking industry. Achieving the Individual Learning Outcomes in the BBA program is the plan for preparing the investigator for the post BBA career goal.

Current Career

The investigator is a loan officer for the Park National

Bank located in Hebron, Ohio. This is the highest position available with an associate college degree.

Current Skills and Abilities

Current skills and abilities include the following areas:

Internet Specialist 4

(a) using a personal computer; (b) loan analysis; and (c) conflict resolution. The personal computer skills include using various Microsoft software packages (Word, PowerPoint, and

Excel) and a loan processing program. Analyzing business plans and personal financial statements to determine loan ratios is a result of being a loan officer for seven years. A loan officer attempts to resolve conflicts related to slow payment or default on a loan agreement. It is in the bank’s interest to achieve a resolution that allows some form of cash flow to continue.

Post BBA Career Goal

The post BBA career goal is to become an Internet specialist for the banking industry. The Internet will change the future of the banking industry. Ignoring the Internet will allow outside competitors to draw profitable consumer services away from the banking industry. Internet specialists in the banking industry will be in great demand for the next several years.

Problem Background and Literature Review

An Internet specialist for the banking industry will be at the heart of the next banking revolution. If the banking industry is to survive, it will need specialists to coordinate the variety of software, security, marketing, and service issues related to placing banking on the Internet.

Over the past 10 years, the telephone has been transforming

Internet Specialist 5 the retail-banking industry. It currently accounts for 25% of all personal banking transactions. The Internet is now another way to reach retail-banking customers. Since 1989, the number of financial-services groups on the Internet has gone from zero to over 500 (“Surf’s Up for New-Wave Bankers,” 1995).

Wells Fargo and Bank of America are exploring how to use the Internet for retail-banking. Both institutions are designing security mechanisms to allow financial transactions via the

Internet. Wells Fargo will probably be the first to allow transactions. Bank of America is working with Meca Software to implement a read-only access via the Internet. Both institutions are expecting to solve security problems that are barriers to using the Internet (Nash & Hoffman, 1995).

One primary motivation for the banking industry to quickly move to the Internet is credit-card transactions. This is a substantially profitable area for most banks. The Internet will provide at least 10 billion dollars worth of transactions by the year 2000. Merchants will expect prompt processing of those transactions. If banks are not setup to deal with merchants on the Internet, some other non-banking company will process those credit-card transactions (McWilliams, 1995).

Many non-banking companies will provide retail-banking services in the future (Pierce, 1991).

Banks that learn to use the Internet to reach and serve

Internet Specialist 6 customers will be ready for the next century. Those that do not, will see an erosion of customers within the next few years.

Internet raises the customer’s expectation level for speed and access to information. Waiting till the next day for a response to information will not be acceptable (Cronin, 1994). Customers will demand easy access and prompt processing in future financial transactions. It will be up to the banking industry to decide if it wants to meet these expectations or wither.

Experts Interviewed

See Appendix A for names, addresses, and telephone numbers of the three banking industry experts interviewed for this study. All have expertise in banking and Internet applications.

The literature review yielded information used for selecting the experts.

Research Question

The development of a set of Individual Learning Outcomes related to the post BBA career goal was the problem presented in this study. The research question to solve that problem was:

What competencies, abilities, and skills should an Internet specialist for the banking industry possess?

Method

The development methodology was the design chosen to form the Individual Learning Outcomes related to the post BBA career goal. This method allows for the development of Individual

Internet Specialist 7

Learning Outcomes as a solution for achieving the post BBA career goal within the standard BBA curriculum. Often the purpose of a development study is to find a solution to a specific problem through the development of a product. The product can be in any of the following forms: (a) plan, (b) program, (c) process, or (d) model. For this study, the product was in the form of a plan.

Procedure

The first step was to conduct a literature review related to the research question. Periodicals and books were primary sources. By using banking as a key word, NIFTY identified relevant books in the library. The expression banking and

Internet allowed INFOTRAC to identify periodical sources.

The literature review yielded information used for selecting three banking and Internet experts (see Appendix A).

Each expert gave an opinion of the future impact of Internet on retail-banking. They also stated the ideal set of competencies, skills, and abilities that an Internet specialist for the banking industry should possess.

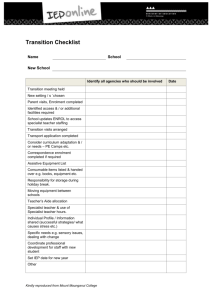

The development of the initial set of Individual Learning

Outcomes was the result of the literature review and expert interviews. The formative committee (consisting of fellow students) evaluated the Individual Learning Outcomes during the third class session for BBA342 Business Research Project I.

Internet Specialist 8

Committee members gave suggestions for improvements.

During the class session, the formative committee’s suggestions resulted in a revised set of Individual Learning

Outcomes. The summative committee (consisting of fellow students not in the formative committee) evaluated the revised Individual

Learning Outcomes during the last portion of the third class session. Committee members gave suggestions for improvements.

The summative committee’s suggestions resulted in a final

Plan to Achieve Individual Learning Outcomes. This plan is ready for implementation within the BBA program.

Results

The implemented procedures outlined in the previous section resulted in the development of a Plan to Achieve Individual

Learning Outcomes (see Appendix B). The literature review described the current relationship between banking and the

Internet. It also identified the banking and Internet experts.

The expert interviews provided advice for developing the

Individual Learning Outcomes.

Discussion

The Plan to Achieve Individual Learning Outcomes is the answer to the research question: What competencies, abilities, and skills should an Internet specialist for the banking industry possess? The plan identifies five Individual Learning

Outcomes achievable within the BBA program.

Internet Specialist 9

The experts placed emphasis on general management and leadership skills. Of course a working knowledge of the Internet and banking regulations is vital. The experts stressed that the

Internet specialist must be able to develop a vision and present that vision to a conservative industry. Change is not the normal mode of operation.

The Internet specialist must be able to implement change.

Depth of technical knowledge is not as important as knowing how to develop and implement a plan of action to bring about change.

Three of the five Individual Learning Outcomes relate to these issues. The Internet specialist who can demonstrate these competencies (with a reasonable knowledge of Internet and banking) will be in great demand for the next several years.

Internet Specialist 10

References

Cronin, M J. (1994). Doing business on the Internet: How the electronic highway is transforming American companies. New

York: Van Nostrand Reinhold.

McWilliams, B. (1995, June 26). Financial insecurity.

Computerworld, 29, 79-84.

Nash, K. S., & Hoffman, T. (1995, August 21). Banks hit info highway at different speeds. Computerworld, 29, 52.

Pierce, J. L. (1991). The future of banking. New Haven, CT:

The Twentieth Century Fund, Inc.

Surf’s up for new-wave bankers. (1995, October 7). The

Economist, 337, 77-78.

Internet Specialist 11

Appendix A

Experts Interviewed

Bryndis A. Rubin

Executive Vice President of Automation and Operations

First Union Corp

1000 Plaza North

Charlotte, NC 33513

1-704-423-2000 e-mail: brubin@union.com

Source: Computerworld (Literature Review)

Roger T. Schwarz

Executive Vice President of Direct Distribution

Wells Fargo

100 Sansome Street

San Francisco, CA 94140

1-415-888-4300 e-mail: rschwartz@fargo.com

Source: Computerworld (Literature Review)

Erica S. Sorohan

Internet Specialist

Meca Software

1200 Ocean View Drive

Fairfield, CT 10023

1-203-697-1250 e-mail: esorohan@meca.com

Source: Computerworld and The Economist (Literature Review)

Internet Specialist 12

Appendix B

Plan to Achieve Individual Learning Outcomes

The following set of five Individual Learning Outcomes relates to the post BBA career goal, Internet specialist, for the banking industry.

Develop a working knowledge of the Internet.

[A plan for achieving this specific Individual Learning

Outcome within

the BBA program is to be written in paragraph format.]

Understand current banking regulations (general overview).

[A plan for achieving this specific Individual Learning

Outcome within

the BBA program is to be written in paragraph format.]

Understand re-engineering, strategic planning, and leadership.

[A plan for achieving this specific Individual Learning

Outcome within

the BBA program is to be written in paragraph format.]

Develop communications skills, oral and written.

[A plan for achieving this specific Individual Learning

Outcome within

the BBA program is to be written in paragraph format.]

Know how to develop and implement training programs.

[A plan for achieving this specific Individual Learning

Outcome within

Internet Specialist 13

the BBA program is to be written in paragraph format.]