3.4 Single period inventory

advertisement

3.4 Single period inventory

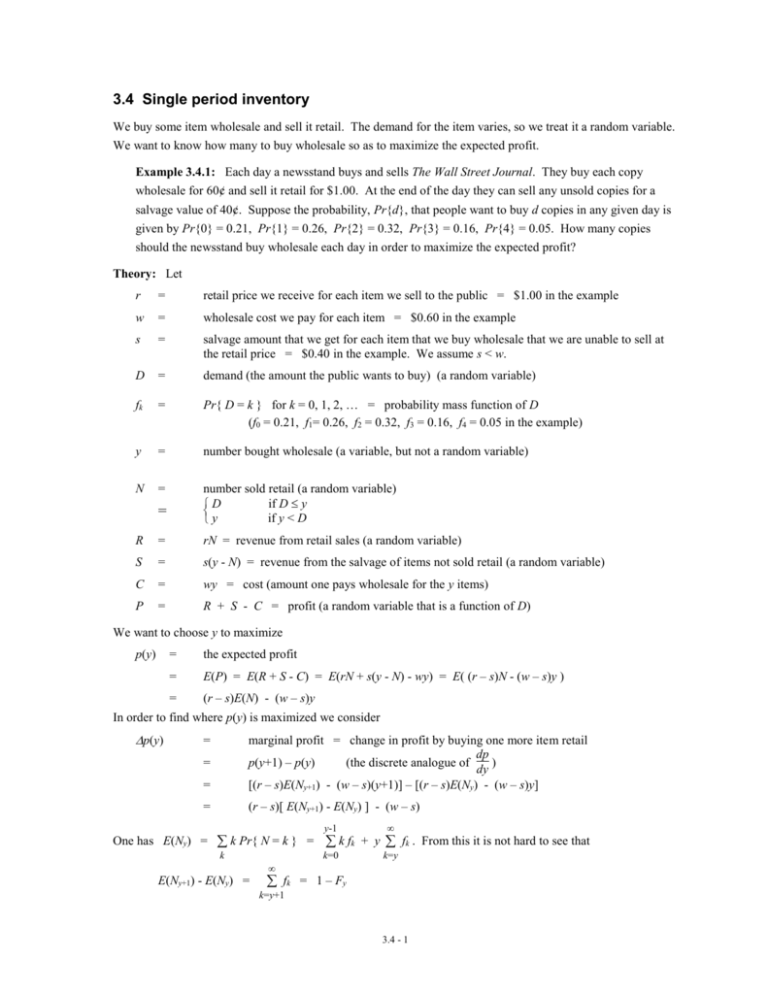

We buy some item wholesale and sell it retail. The demand for the item varies, so we treat it a random variable.

We want to know how many to buy wholesale so as to maximize the expected profit.

Example 3.4.1: Each day a newsstand buys and sells The Wall Street Journal. They buy each copy

wholesale for 60¢ and sell it retail for $1.00. At the end of the day they can sell any unsold copies for a

salvage value of 40¢. Suppose the probability, Pr{d}, that people want to buy d copies in any given day is

given by Pr{0} = 0.21, Pr{1} = 0.26, Pr{2} = 0.32, Pr{3} = 0.16, Pr{4} = 0.05. How many copies

should the newsstand buy wholesale each day in order to maximize the expected profit?

Theory: Let

r

=

retail price we receive for each item we sell to the public = $1.00 in the example

w

=

wholesale cost we pay for each item = $0.60 in the example

s

=

salvage amount that we get for each item that we buy wholesale that we are unable to sell at

the retail price = $0.40 in the example. We assume s < w.

D

=

demand (the amount the public wants to buy) (a random variable)

fk

=

Pr{ D = k } for k = 0, 1, 2, … = probability mass function of D

(f0 = 0.21, f1= 0.26, f2 = 0.32, f3 = 0.16, f4 = 0.05 in the example)

y

=

number bought wholesale (a variable, but not a random variable)

N

=

=

number sold retail (a random variable)

if D y

D

if y < D

y

R

=

rN = revenue from retail sales (a random variable)

S

=

s(y - N) = revenue from the salvage of items not sold retail (a random variable)

C

=

wy = cost (amount one pays wholesale for the y items)

P

=

R + S - C = profit (a random variable that is a function of D)

We want to choose y to maximize

p(y)

=

the expected profit

=

E(P) = E(R + S - C) = E(rN + s(y - N) - wy) = E( (r – s)N - (w – s)y )

=

(r – s)E(N) - (w – s)y

In order to find where p(y) is maximized we consider

p(y)

=

=

marginal profit = change in profit by buying one more item retail

dp

p(y+1) – p(y)

(the discrete analogue of

)

dy

[(r – s)E(Ny+1) - (w – s)(y+1)] – [(r – s)E(Ny) - (w – s)y]

=

(r – s)[ E(Ny+1) - E(Ny) ] - (w – s)

=

y-1

k=0

k=y

One has E(Ny) = k Pr{ N = k } = k fk + y fk . From this it is not hard to see that

k

E(Ny+1) - E(Ny) =

fk = 1 – Fy

k=y+1

3.4 - 1

where

Fk = cumulative distribution function of D = Pr{ D k } =

k

fj

j=0

In Example 1 one has F0 = 0.21, F1 = 0.47, F2 = 0.79, F3 = 0.95, F4 = 1. Thus

p(y)

=

=

(r – s)(1 – Fy) - (w – s)

(r-w) - (r-s) Fy

Since Fy is increasing with y, it follows that p(y) is decreasing with y. The maximum of p(y) occurs at the first

value of y such that p(y) 0. This is the first value of y such that

(r-w) - (r-s) Fy 0

or

Fy

r-w

r-s

In our example (r-w)/(r-s) = 2/3. So the first value of y that is larger than 2/3 is y = 2. So the maximum

expected profit occurs when we order 2 newspapers wholesale each day.

Problem 1. A news vendor buys newspapers at the start of every day to sell on the street corner. Each

newspaper costs 15 cents and is sold for 25 cents. Any unsold newspapers will be bought back by the supplier

for 10 cents. After observing demand for a few months the news vendor has determined that the demand

follows a uniform distribution between 21 and 40 newspapers, i.e. the probability of selling k newspapers is

1/20 for k = 21, 22, …, 40 and the probability is 0 for any other value of k. Suppose the news vendor buys q

newspapers at the start of the day.

a.

Suppose the news vendor would be able to sell k newspapers where k is greater than or equal to q.

What is his profit?

b.

Suppose the news vendor sells k newspapers where k is less than q. What is his profit?

c.

What is the expected profit. For this part you can express your answer using summation notation.

Express the sum in part c in closed form. You can use the fact that 1 + 2 + 3 + … + n = n(n+1)/2.

d.

e. Find q to maximize the result in part d.

3.4 - 2