3. Ratio Analysis - الجامعة الإسلامية بغزة

advertisement

بسم هللا الرحمن الرحيم

Islamic University – Gaza

Faculty of Commerce

Department of Accounting

الجامعة اإلسالمية – غزة

كلية التجارة

قسم المحاسبة

Importance of financial ratios

(Applied Study on PALTEL Company)

prepared By :

Ali Own Moheisen

Khaled Kamel Dawoud

120092647

120092173

Supervisor's name :

Dr. Salah Shubair .

August, 2012

1

بسم هللا الرحمن الرحيم

"ي ْرفعِ هللاه الَّ ِذين آمنهوا ِمن هك ْم والَّ ِذين

أ هوتهوا ْال ِع ْلم درجات"

صدق هللا العظيم

} سورة المجادلة{ 11،

2

Dedication:

For Our Palestine…

For Our University…

For Our Teachers…

For Our Family…

We Present This Research…

3

Acknowledgment:

- First of all, we thank Allah for helping us to complete

our Research.

- Our ability to accomplish this research is due to the

good effort provided by our great university IUG.

- We thank very much our parents, who were granted

every thing in their life for us, and also we thank

them for push us to success.

- We would like to thank Mr. Salah Shubair for his

advice and continuous supports.

- For all our teachers at IUG and for the IUG library

staff.

- We would like to express our personal gratitude to

Jawwal Company.

- Also we would like to thanks our friends for their

help.

- Finally, thanks for every one who contributes in any

way to support us.

4

List of content:

Averse of Quran…………………………………………………………2

Dedication…………………………………………………….………3

Acknowledgment……………………………………………….……4\

List of Content……………………………………….………………….5

List of Tables...………. …………………………………….………...5

Table of Figures…………………………………..……………5

CHAPTER 1: RESEARCH PROPOSAL

Introduction ……………………………………………9

Statement of the problem…………………………………11

Objectives ……………………………………………………11

Main objective …………………………………………………11

Specific objectives ………………………………………………12

Significance of the project (work) …………………………………..14

Scope and limitations of the project (work) ………………………..15

Methodology………………………………………………………15

Current state of the art………………………………………….17

Related work…………………………………………………18

CHAPTER 2: INTODOCURY DEFENITIONS

Introduction…………………………………………………….21

Managerial (Business) Finance……………………………………21

Finance in the organizational structure of the firm……………………22

Financial Manager's Responsibilities……………………………………23

Methods Of Analyzing Financial Statements……………………….…25

Ways to Analyze Financial Statements……………………………….26

Component of The Financial Statement…………….……………27

Users of Financial statement…………………………………27

5

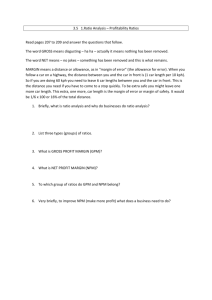

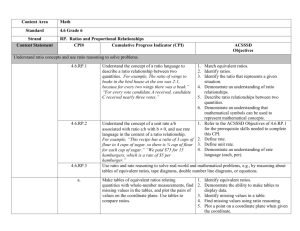

CHAPTER 3: financial ratios

Introduction ……………………………………………….…31

What Does Financial Ratio Mean…………………………….31

Standards Of Comparison………………………………….…31

Financial Ratio Classification…………………………………32

Efficiency Ratios…………………………………………..…33

Investment Ratios………………………………………….…38

profitability Ratios……………………………………………40

Short Summary…………………………………………….…43

How to Use Financial Ratios to Make Managerial Decisions? ……44

Advantages and Uses of Ratio Analysis……………………………45

Limitations of Ratio Analysis………………………………….……47

Summary……………………………………………………..…….48

CHAPTER 4: APPLIED STUDY

Introduction…………………………………………………50

Key Steps in Financial Ratio Analysis…………………..…50

Palestinian Telecommunications Company…………………51

Corporate Information…………………………………….51

PalTel Group……………………………………………..52

The Mission………………………………………………52

The Promise………………………………………………52

The Vision…………………………………………….…52

The Methodology……………………………………..…52

What Can PalTel Group Do For You? ……………………..52

Financial Ratios Analysis……………………………………53

Profitability Ratios………………………………………..…53

Efficiency Ratios……………………………………………55

Liquidity Ratios………………………………………………58

Investment Ratios……………………………………………59

CHAPTER 5: conclusion and recommendation

CONCLUSION……………………………………………64

RECCOMMENDATIONS…………………………………65

6

Chapter -1-

7

Research

prposal

8

1.1 Introduction:

The basic financial statements containing (income statement, balance

sheet, the statement of stockholders` equity and the statement of cash

flow) of quantitative and qualitative information can be used in the

analysis of financial and economic decision-making appropriate.

Income Statement - provide a financial summary of the firm’s operating

results during a specified time period.

Balance Sheet –present a summary of the assets owned by the firm, the

liabilities owed by the firm, and the net financial position of the owners

as of a given point in time.

Statement of Retained Earnings

- This statement reconciles the net

income earned during the year, and any cash dividends paid, with the

change in retained earnings during the year.

Statement of Cash Flows - This statement provides a summary of the

cash inflows and the cash outflows experienced by the firm during the

period of concern.(1) (Gitman ، 2009 ، P44-51).

The financial statements contain a great deal of accounting data for the

previous financial periods and the current financial period, so it is not

enough to prepare the inventory, but must be analyzed using the methods

and tools appropriate to convert such data into useful information on

company performance in the past as well as to predict its future, and then

interpret the results of the analysis to serve all the parties used for

accounting data.

The analysis using financial ratios are the oldest tools of financial

analysis and most important, financial ratios were defined by many

9

authors, such as: "The financial ratios are studying the relationship

between variables, one representing the numerator and the other

represents a primarily" (Gitman, 2009 , P53); or that the financial ratios

"is a relationship between two or more items of the financial statements

are expressed as a percentage or number of times."

It features financial analysis using ratios, ease of calculating the ratio of

Finance and the possibility of their use in the comparison from year to

year or between the facility and the other, and the disclosure of

information that do not directly Disclose the Final Financial Statements

(Gitman ، 2009 ، P54).

Financial ratios can be convenience into five basic categories: liquidity,

activity, debt, profitability, and market ratio (Gitman ، 2009 ، P57-69).

1. Liquidity ratios:

The liquidity of a firm is measured by its ability to satisfy its short-term

obligations as they come due.

2. Activity ratios:

Measure the speed with which various accounts are converted into sales

or cash –inflows or outflows.

3. debt ratios:

The debt position of a firm indicates the amount of other people's money

being used to generate profit. Debt ratios measure both the degree of

indebtedness and the ability to service debt.

4. Profitability ratios:

Measure the firm's ability to generate profits from money invested .

5. Market ratios:

Relate a firm's market value, as measured by its current share price, to

certain accounting values.

10

1.2 The Problems Of The Study :

Our research's problem will answer these questions :

1. Why do financial analysts engage in the analysis of a firm's

statements?

2. What are common size financial statements and how are they

constructed?

3. What is the financial ratio intended to measure?

4. How the financial statement influence on making decision?

1.3 Objectives

1.3.1 Main Objective

To study the financial ratios, and knowing how it might influence on the

decision making, profitability and liquidity of the corporation.

1.3.2 Specific Objectives

The specific objectives of the project are:

1. To identify the meaning of each ratio.

2. To determine how each ratio can be computed.

3. To interpret the financial ratios and their significance.

4. To identify what might a high or low value be telling us.

5. To evaluate the firm's financial performance in light of its

competitor's performance.

11

1.4 Significance Of The Project

1. Holding Of Share

Shareholders are the owners of the company. Time and again, they

may have to take decisions whether they have to continue with the

holdings of the company's share or sell them out. The financial

statement analysis is important as it provides meaningful information

to the shareholders in taking such decisions.

2. Decisions And Plan

The management of the company is responsible for taking decisions

and formulating plans and policies for the future. They, therefore,

always need to evaluate its performance and effectiveness of their

action to realize the company's goal in the past. For that purpose,

financial statement analysis is important to the company's

management.

3. Extension Of Credit

The creditors are the providers of loan capital to the company.

Therefore they may have to take decisions as to whether they have to

extend their loans to the company and demand for higher interest

rates. The financial statement analysis provides important information

to them for their purpose (www.ehow.com).

12

4.Investment Decision

The prospective investors are those who have surplus capital to invest

in some profitable opportunities. Therefore, they often have to decide

whether to invest their capital in the company's share. The financial

statement analysis is also important to them because they can obtain

useful information for their investment decision making purpose.

Other significant of our project :

Company can analyze its own performance over the period of

time through financial statement analysis.

Financial ratios are an important tool of economic decisionmaking for all businesses.

Investors get enough idea to decide about investments of their

funds in specific company.

Regulatory authorities like International Accounting Standard

Board can ensure whether the company is following accounting

standard or not.

Financial statements can help the government agencies to

analyze the taxation due to the company.

Ratios are used in the financial aspects of businesses. They are

used for comparison purposes in finding out how their company

is doing compared to prior years and compared to other

businesses in the same industry.

13

1.5 Limitations of the Project (Work)

The limitations of our project could be presented in the following

points:

Making the research was very hard, and there is no enough time to

make a good research.

Analyzing the financial ratios requires analytical skills .

As students we still not working in any business we didn’t get

this skills yet .

There are various types of financial ratios and also various

classifications, depending on an investor's perspective or areas that

corporate leadership wants to review.

Not all of the Palestinian corporations declare their financial

statements for the public.

Taking the Palestinian Telecommunications Company (PALTEL)

as a case study was

very challengeable because it is a service company and its

financial statements differ from the financial statements for the

merchandising or manufacturing companies.

14

1.6 Methodology

In our research we used the analytical methodology will follow a

systematic way in which we can put the key titles for each chapter and

then beginning talking about each title separately depending on the

information that we can get it from the books in the university’s libraries

and by searching on the internet.

we realize that our research’s topic needs a Palestinian corporation

to be a case study for this research, so we will apply this research

on the Palestinian Telecommunications Company (PALTEL) ,using

its financial statements with its declarations and notes.

1.6.1 Overview of the Current State of the Art

Analysis of financial statements is the process of reviewing and

evaluating a company’s financial statements (such as the balance sheet or

profit and loss statement), thereby gaining an understanding of the

financial health of the company and enabling more effective decision

making. Financial statements record financial data; however, this

information must be evaluated through financial statement analysis to

become more useful to investors, shareholders, managers and other

interested parties.

So our topic will contain five chapters which are as follows:

The first Chapter:

In which we will take an introduction about the whole research and

introduce the significance of my research topic and its limitations.

15

The second chapter :

This chapter will be as introductory chapter for almost all the definitions

that we will need it in my research, beginning talking in introduction

about the financial statement analysis, then talking about the importance

of analyzing the financial statements.

The third chapter:

In this chapter we will talk particularly about one method of many

methods of analyzing the financial statements, taking the clearest

classification for the financial ratios. we shall see financial (or

accounting) ratios can help in assessing the financial health of a business.

we shall also discuss the problems that are encountered when applying

this technique.

The fourth chapter:

In this chapter we will take Palestinian Telecommunications Company

(PALTEL) as a case

study, and then introduce its financial statements by analyzing them

according to the financial ratios. we shall also interpret each financial

ratio by comparing this ratio among two years which are 2009 and 2010.

16

The fifth chapter:

In this chapter we include the conclusion from our research, also the

results and recommendations .

Sources to collect information:

1. Primary sources:

• Previous researches.

• Related websites.

2. Secondary sources:

• Related books.

• Magazines and periodicals.

Our main reference is (www.accountingformanagement.com) .

17

Time table and budget:

The research has a time limit; it should be done in nine weeks. The

following chart describes the way we will spent the research time.

July

Activity

August

Table 1.1 time table

Week Number

1

2

3

4

5

6

Generate Topic

Read books and related researches

Writing research proposal

Introdocury definitions

Financial ratios

Applied study

Conclusion & recommendations

Discussion the Search

The estimated research budget could be 200 NIS. This budget will be

spent on copying, typing and other expenses related to this research.

18

Chapter -2-

19

Introdocury

Definition

20

2.1 Introduction

In simple terms, finance is concerned with decisions about money, or

more appropriately, cash flows. Finance decisions deal with how money

is raised and used by businesses, government, and individuals; To make

rational financial decisions .

The study of the finance consists of four interrelated areas: (1)financial

markets institutions, (2)investments, (3)financial services, (4)managerial

finance.

Managerial (Business) Finance:

Managerial finance deals with decisions that all firms make concerning

their cash flows. As a consequence, managerial finance is important in all

types of businesses, whether they are public or private, deal with financial

services, or manufacture products. The types of duties encountered in

managerial finance range from making decisions about plant expansions

to choosing what types of securities to issue to finance such as

expansions.

Managerial finance is very important area, because all areas of the

finance are interrelated, an individual who works in any once area should

have a good understanding of the other areas as well. For example, a

banker lending to a business must have a good understanding managerial

finance to judge how well the borrowing company is operated.

2.2 Finance in the organizational structure of the firm

Finance is intimately woven into any aspect of the business that involves

the payment or receipt of money in the future. For this reason it is

important that everyone in a business have a good working knowledge of

the basic principle of finance. However, within a large business

organization, the responsibility for managing the firm financial affairs

falls to the firm's chief financial officer (CFO).

Figure 2.1 shows how the finance function fits into firm's organizational

chart.

In the typical large corporation, the CFO serves under the corporation's

Chief Executive Officer (CEO) and is responsible for overseeing the

firm's finance-related activities. Typically, both a treasure and controller

serve under the CFO, although in a small firm the same person may fulfill

both roles. The treasure generally handles the firm's financing activities.

These include managing its cash and credit, exercising control over the

firm's major spending decision, raising money, developing financial plan,

and managing any foreign currency the firm receives.

The firm's controller is responsible for managing the firm's accounting

duties, which include producing financial statement, paying taxes, and

21

gathering and monitoring data that the firm's executives need to oversee

its financial well-being.

Board of Directors

Chief Executive Officer

Vice PresidentMarketing

Treasure

Duties:

Cash

management

Credit management

Capital

expenditure

Raising capital

Financial

planning

Vice President-Finance

or Chief Financial

Officer(CFO) Duties

Oversee financial

planning Corporate

strategic planning Control

corporate cash flow

Vice PresidentProduction and

Operation

Controller

Duties:

Taxes

Financial

statement

Cost

accounting

Data processing

2.3 Financial Manager's Responsibilities

The financial manager's task is to make decisions concerning the

acquisition and uses of funds for the greatest benefit of the firm. Here are

some specific activities that are

involved:(www.accountingformanagment.com)

1. Forecasting and planning. The financial manager must interest

with other executives as they look ahead and lay the plans that will

shape the firm's future positions.

2. Major investment and financing decisions. A successful firm

generally has rapid growth in sales, which requires investments in

plant, equipment, and inventory. The financial manager must help

determine the optimal sales growth rate, and he or she must help

decide on the specific assets to acquire and the best way to finance

those assets.

3. Coordinating and controlling. The financial manager must

interact with other executrices to ensure that the firm is operated as

efficiently as possible. All business decisions have financial

implications, and all managers, financial and other wise need to

take it into account.

22

4. Dealing with the financial markets. The financial manager must

deal with the money and capital markets. Each firm affects and is

affected by the general financial markets where funds are raised,

where the firm's securities are traded, and where its investors are

either rewarded or penalized.

From what we have already said, we can say that all the previous tasks

required the financial manager to analyze the financial statements for the

company which he works in, so what is financial analysis?

Financial statement analysis is defined as the process of identifying

financial strengths and weaknesses of the firm by properly establishing

relationship between the items of the statement of financial position and

the income statement.

2.4 Methods Of Analyzing Financial Statements

There are various methods or techniques that are used in analyzing

financial statements, such as comparative statements, schedule of changes

in working capital, common size percentages, funds analysis, trend

analysis, and ratios analysis (www.accountingformanagment).

1. Horizontal or Trend Analysis

Methods of financial statement analysis generally involve comparing

certain information. The horizontal analysis compares specific items

over a number of accounting periods. For example, accounts payable

may be compared over a period of months within a fiscal year, or

revenue may be compared over a period of several years. These

comparisons are performed in one of two different ways.

Absolute Dollars

One method of performing a horizontal financial statement analysis

compares the absolute dollar amounts of certain items over a period

of time. For example, this method would compare the actual dollar

amount of operating expenses over a period of several accounting

periods. This method is valuable when trying to determine whether a

company is conservative or excessive in spending on certain items.

This method also aids in determining the effects of outside influences

on the company, such as increasing gas prices or a reduction in the

cost of materials.

23

Percentage

The other method of performing horizontal financial statement

analysis compares the percentage difference in certain items over a

period of time. The dollar amount of the change is converted to a

percentage change. For example, a change in operating expenses

from $1,000 in period one to $1,050 in period two would be reported

as a 5% increase. This method is particularly useful when comparing

small companies to large companies.

2. Vertical Analysis

The vertical analysis compares each separate figure to one specific

figure in the financial statement. The comparison is reported as a

percentage. This method compares several items to one certain item

in the same accounting period. Users often expand upon vertical

analysis by comparing the analyses of several periods to one another.

This can reveal trends that may be helpful in decision making. An

explanation of Vertical analysis of the income statement and vertical

analysis of the balance sheet follows.

Income Statement

Performing vertical analysis of the income statement involves

comparing each income statement item to sales. Each item is then

reported as a percentage of sales. For example, if sales equals

$10,000 and operating expenses equals $1,000, then operating

expenses would be reported as 10% of sales.

Balance Sheet

Performing vertical analysis of the balance sheet involves comparing

each balance sheet item to total assets. Each item is then reported as a

percentage of total assets. For example, if cash equals $5,000 and

total assets equals $25,000, then cash would be reported as 20% of

total assets.

24

3. Ratio Analysis

Ratio analysis is a dynamic way of analyzing a financial

statement. It involves taking two or more numbers and comparing

them to calculate a result that accurately displays a business's

financial strengths and weaknesses. There are many categories of

ratios, including profitability ratios, liquidity ratios, debt ratio and

asset ratios. A business can compare ratios to industry and

competitive benchmarks in order to gauge its performance and

make decisions on how to operate in the future.

2.5 Ways to Analyze Financial Statements

Users may choose different methods to analyze financial statements

depending on the types of business insight they desire:

1. Common-size Statements

A common-size statement may be either the balance sheet or income

statement. Financial statements are restated in "comment-size" terms

by converting their numbers to percentages. This standardizes the

financial results to allow comparison between companies in the same

industry, regardless of their size. For example, the common-size

income statement reports every line item as a percentage of sales. The

common-size income statement allows companies to compare their

percentage of SG&A expenses or cost of goods sold against industry

averages or other similar companies. A common-size balance sheet

reports every item as a percentage of total assets. For example, if total

assets of the company are $1 million, and cash is $80,000, then cash

is 8 percent of total assets.

2. Comparative Statements

Comparative financial statements show different periods compared to

each other. For example, an income statement might show three years

worth of profit and loss data, and to use this to demonstrate the

growth from one year to the next for certain line items, such as sales

or specific types of expenses. Companies may use comparative

financial statements internally, to compare one month to the next and

look for trends in sales or expenses throughout the year. This

information also helps formulate the company's monthly and yearly

budgets and forecasts.

25

3. Ratio Analysis

Financial ratios on their own are simply one number divided by

another. Alone, one ratio does not mean much, but several used

together can provide users with a substantial amount of information.

Financial ratios are a relatively quick method of assessing a

company's liquidity, how effectively it manages its resources, how

efficiently it turns inventory and the company's level of reliance on

debt-to-finance operations.

4. Industry Comparison

Financial statements analyzed against industry averages or other

specific companies in the same industry tell how competitive a

business is among its peers. Return Merchandise Authorization

'RMA' is a nonprofit association that publishes annual financial

statement studies, providing comparative financial data from the

financial statements of small to medium size businesses in various

industries. This information allows businesses to benchmark

themselves against the industry, using metrics, such as sales growth,

cost of goods sold as a percent of sales .

5. Financial Statement Forecasts

Forecasts are sometimes assembled based on the results of financial

statement analysis, but once the forecast period has passed, the

projected financial information can be compared to actual data to

measure the company's performance against its objectives, and spot

any potential trends that management was not previously aware of.

2.6 Component of The Financial Statement

Financial statements consist of three different statements: income

statement, balance sheet and cash flow statement. All three are necessary

to provide an accurate overview of the financial stability and viability of a

business. At the least, firms prepare annual financial statements, and most

businesses compile them monthly or quarterly as well.

1. The Income Statement

An income statement, also called a profit and loss statement, measure

the amount of profits generated by a firm over a given time of period

(usually a year or quarter). In its most basic form, the income

statement can be expressed as follow:

26

Revenues (or sales) – Expenses = Profits

Revenue represent the sales for the period. Profit are the difference

between the firm's revenues and the expenses the firm incurred in

order to generate those revenues for the period.

2. The balance sheet statement

The balance sheet is a snapshot of the firm's financial position on an

a specific date. In its simplest form, the balance sheet is defined by

the following equation:

Total Assets = Total Liabilities + Total Shareholders' Equity

Total Liabilities represent the total amount of money the firm owes

its creditors (including the firm's total bank and suppliers).

Total shareholders' equity refers to the difference in the value of

the firm total assets and the firm's recorded in the firm's balance

sheet. As such, total shareholders' equity refers to the book value of

their investment in the firm, which includes both the money they

invested in the firm to purchase its share and the accumulation of

past earnings from the firm's operation. The sum of total

shareholders' equity and total liabilities is equal to the firm's total

asset, which are the resources owned by the firm.

3.The Cash Flow Statement

The cash flow is a report, like the income statement and balance

sheet, that’s firms use to explain changes in their cash balances over

a period of time by identifying all of the recourse and the uses of

cash for the period spanned by the statement. The focus of cash flow

statement is the change in the firm's cash balance for the period of

time covered by the statement.

Change in cash balance =

Ending Cash Balance – Beginning Cash Balance

2.7 Users of Financial statement

Financial statements are intended to be understandable by readers who

have "a reasonable knowledge of business and economic activities and

accounting and who are willing to study the information diligently."

There are different kinds of users of financial statements. The users of

financial statements may be inside or outside the business (Eugene,

2000).

27

1. Internal users

The internal users of financial statements are individuals who have direct

bearing with the organization. They may include:

Owners

Owners are typically the most interested user of financial statements.

Not only do owners have an interest in profits, but also in the amount

of money they retain for personal income. This information comes

from the income statement. Owners want to know how much capital

the business consumed in order to generate sales revenue.

Employees

Employees have an interest in financial statements because they need

assurances for job retention. Employees can also have an interest in

their company's stock price, which has a close relationship to the

company's accounting information. Employee stock options may

increase or decrease precipitously based on the company's financial

health. Employees need this information to determine if they should

buy more or hold their current investment level.

2. External Users

The external users comprise of:

Institutional Investors: The external users of financial statements are

basically the investors who use the financial statements to assess the

financial strength of a company. This would help them to make logical

investment decisions.

Financial Institutions: The users of financial statements are also the

different financial institutions like banks and other lending institutions

who decide whether to help the company with working capital or to issue

debt security to it.

Government: The financial statements of different companies are also

used by the government to analyze whether the tax paid by them is

accurate and is in line with their financial strength.

Vendors: The vendors who extend credit to a business require

financial statements to assess the creditworthiness of the business.

General Mass and Media: The common people as well as media also

make part of the users of financial statements.

28

Chapter-3-

29

Financial

Ratios

30

3.1 Introduction

Ratios are among the more widely used tools of financial analysis

because they provide symptoms of underlying condition.

A ratio can help us uncover conditions and trends difficult to detect by

inspecting individual component making up the ratio. Ratios, like other

and analysis tools, are usually future oriented; that is, they are often

adjusted for their probable future trend and magnitude, and their

usefulness depends on skillful interpretation.

Ratios are particularly important in understanding financial statement

because they permit us to compare information from one financial

statement with information from another financial statement.

For example, we might compare net income (taken from the income

statement) with total assets(taken from the balance sheet) to see how

effectively management is using available recourses to earn a profit.

For a ratio to be useful, however, the two amount being compared must

be logically related.

3.2 What Does Financial Ratio Mean

A ratio is a simple mathematical expression of the relationship of one

item to another. It can be expressed as a percent, rate, or portion.

For instance, a change in an account balance from $100 to $250 can be

expressed as (1) 150%, (2) 2.5 times, or (3) 2.5 to 1 (or 2.5:1).

A financial ratio is a comparison between one bit of financial

information and another. Consider the ratio of current assets to current

liabilities, which we refer to as the current ratio. This ratio is a

comparison between assets that can be readily turned into cash -- current

assets -- and the obligations that are due in the near future -- current

liabilities. A current ratio of 2:1 or 2 means that we have twice as much in

current assets as we need to satisfy obligations due in the near future.

3.3 Standards Of Comparison

When interpreting measures from financial statement analysis, we need to

decide whether the measures indicate good, bad, or average performance.

To make such judgment, we need standard (benchmarks) for comparison

that include the following:

Intracompany__ The company under analysis can provide standards

for comparisons based on its own prior performance and relations

between its financial items.

Competitor__ One or more direct competitors of the company being

analyzed can provide standards for comparisons.

Industry__ Industry statistic can provide standards of comparisons.

Guidelines ( rules of thumb )__ General standards of comparison can

develop from experience.

31

3.4 Financial Ratio Classification

Financial ratio can be grouped into four types (liquidity, efficiency,

Investment, and profitability). No one ratio gives us sufficient

information by which to judge the financial condition and performance of

the firm. Only when we analyze a group of ratios are we able to make

reasonable judgments.

3.4.1 Liquidity Ratio

Liquidity refers to the availability of recourses to meet short-term cash

requirements. It is affected by the timing of cash inflows and cash

outflows along with prospect for future performance.

The following ratio are widely used:

Current ratio.

Acid test ratio (Quick ratio).

Working capital ratio.

Current ratio

The current ratio is calculated by dividing current assets by current

liabilities:

Current ratio =

Total current assets

Total current liabilitie s

Current assets include cash, marketable securities, account receivable and

inventories. Current liabilities consist of account payable, short-term note

payable, current maturities of long-term debt, accrued income taxes, and

other accrued expenses. It measures a company's ability to pay its

expenses with money it has on hand. If the current ratio is higher than

one, the company can pay its bills. For example, if a business has

$200,000 in current assets and $100,000 in current liabilities, its current

ratio is 2. This means the company has $2 available to pay every $1 of

debt it owes. Companies with current ratios of less than one may not be

able to pay their bills, as they have fewer current assets than current

liabilities.

If the current ratio of the company is too low, it may be able to raise it by:

Paying some debts.

Increasing your current assets from loans or other borrowings with

a maturity of more than one year.

Converting non-current assets into current assets.

32

Increasing your current assets from new equity contributions.

Putting profits back into the business.

Acid Test Ratio (Quick Ratio)

The quick ratio is calculated by deducting inventories from current assets

and then dividing the reminder by current liabilities:

Acid test ratio =

Current assets (excluding stock)

Current liabilitie s

Inventories are typically the least liquid of a firm’s current assets, so they

are the assets on which losses are most likely to occur in the event of

liquidation. Therefore, a measure of the firm’s ability to pay off shortterm obligations without relying on the sale of inventories is important.

Working Capital Ratio

Working Capital is more a measure of cash flow than a ratio. The result

of this calculation must be a positive number. It is calculated as shown

below: (Williams, 2002)

Working Capital = Total Current Assets - Total Current Liabilities

Bankers look at net working capital over time to determine a company's

ability to weather financial crises.

A general observation about these three liquidity ratios is that the higher

they are the better, especially if you are relying to any significant extent

on creditor money to finance assets.

3.4.2 Efficiency Ratios

Efficiency ratios examine the ways in which various resources of the

business are managed. The following ratios consider some of the more

important aspects of resource management:

Average stock (inventory) turnover period.

Average settlement period for debtors (receivables).

Average settlement period for creditors (payables).

Sales revenue to capital employed.

Sales revenue per employee.

33

These ratios give us an insight into how efficiently the business is

employing those resources invested in fixed assets and working capital

(Williams, 2002).

Average stock turnover period

Average stock turnover period is the ratio of cost of goods sold to

inventory. This ratio indicates how many times inventory is created and

sold during the period.

Stocks often represent a significant investment for a business. For some

types of business (for example, manufactures), stocks may account for a

substantial proportion of the total assets held. The average stock

turnover period measures the average period for which stock are being

held. The ratio is calculated as follows:

Average stock turn over period =

Average stock held

365

Cost of sales

The average stock for the period can be calculates as a simple average of

opening and closing stock levels for the year. However, in the case of

highly seasonal business where stock levels may vary considerably over

the year, a monthly average may be more appropriate )Foster, 1986).

Average settlement period for debtors

A business will usually be concerned with how long it takes for

customers to pay the amounts owing. The speed of payment can have a

significant effect on the business's cash flow. The average settlement

period for debtors calculates how long, on average, credit customers

take to pay the amounts that they owe to the business. The ratio is as

follows

Average settlement period for debtors =

Trade deptors

365

Credit sales revenue

A business will normally prefer a shorter average settlement period to a

longer one as, once again, funds are being tied up that may be used for

more profitable purposes. Though this ratio can be useful, it is important

to remember that it produces an average figure for the number of days for

34

which debts are outstanding. This average may be badly distorted by, for

example, a few large customers who are very slow or very fast payers.

The average time taken by customers to pay their bills varies from

industry to industry, although it is a common complaint that trade debtors

take too long to pay in nearly every market ( Foster, 1986).

Among the factors to consider when interpreting debtor days are:

The industry average debtor days needs to be taken into account. In

some industries it is just assumed that the credit that can be taken is 45

days, or 60 days or whatever everyone else seems (or claims) to be

taking.

A business can determine through its terms and conditions of sale how

long customers are officially allowed to take.

There are several actions a business can take to reduce debtor days,

including offering early-payment incentives or by using invoice

factoring( Block, 2005).

Average settlement period for creditors

The average settlement period for creditor measures how long, on

average, the business takes to pay its trade creditors. The ratio is

calculated as follows:

Average settlement period for creditors =

Trade creditors

365

Credit purchases

This ratio provides an average figure, which, like the average settlement

period for debtors' ratio, can be distorted by the payment period for one or

two large suppliers.

As trade creditors provide a free source of finance for the business, it is

perhaps not surprising that some businesses attempt to increase their

average settlement period for trade creditors. However, such a policy can

be taken too far and result in a loss of goodwill of suppliers.

In general a business that wants to maximize its cash flow should take as

long as possible to pay its bills. However, there are risks associated with

taking more time than is permitted by the terms of trade with the supplier.

One is the loss of supplier goodwill; another is the potential threat of

legal action or late-payment charges ( Block, 2005).

35

Sales revenue to capital employed

The sales revenue to capital employed ratio (or net assets turnover ratio)

examines how effectively the assets of the business are being used to

generate sales revenue. It is calculated as follows:

Sales revenue to capital employed

=

Sales revenue

Share capital + Reserves + Long - term (non - current) loans

Generally speaking, higher sales revenue to capital employed ratio is

preferred to a lower one. A higher ratio will normally suggest that the

long-term capital invested in assets is being used more productively in the

generation of revenue.

However, a very high ratio may suggest that the business is overtrading

on its assets', that is, it has insufficient capital (net assets) to sustain the

level of sales revenue achieved.

A variation of this formula is to use the total assets less current liabilities

(which is equivalent to long-term capital employed) in the denominator

(lower part of the fraction) the identical result is obtained ( Harrington,

1993).

Sales revenue per employee

The sales revenue per employee ratio relates sales revenue generated to

a particular business resource, that is, labor. It provides a measure of the

productivity of the workforce. The ratio is: ( Harrington, 1993)

Sales revenue per employee =

Sales revenue

Number of employees

Generally, businesses would prefer to have a high value for this ratio,

implying that they are using their staff efficiently.

36

The relationship between profitability and efficiency

In our earlier discussions concerning profitability ratios, we saw that

return on capital employed is regarded as a key ratio by many businesses.

The ratio is:

ROCE =

Net profit before interest and taxation

100%

Long - term capital employed

Where long-term capital comprises share capital plus reserves plus longterm loans.

This ratio can be broken down into two elements. The first ratio is the net

profit margin ratio, and the second is the sales revenue to capital

employed (net asset turnover) ratio.

By breaking down the ROCE ratio in this manner, we highlight the fact

that the overall return on funds employed within the business will be

determined both by the profitability of sales and by efficiency in the use

of capital.

37

3.4.3 Investment Ratios

There are various ratios available that are designed to help investors

assess the returns on their investment. The following are widely used:

Dividend payout ratio.

Dividend yield ratio.

Earnings per share.

Price/earnings ratio.

Dividend payout ratio

The dividend payout ratio measures the proportion of earnings that a

business pays out to shareholders in the form of dividends. The ratio is

calculated as follows: ( Brigham, 1979)

Dividend payout ratio =

Dividends announced for the year

100%

Earnings for the year available for dividends

In the case of ordinary shares, the earnings available for dividend will

normally be the net profit after taxation and after any preference

dividends announced during the period. This ratio is normally expresses

as percentage.

Dividend yield ratio

The dividend yield ratio relates the cash return form a share to its

current market value. This can help investors to assess the cash return on

their investment in the business.

Dividend yield =

{Dividend per share / (1 - t ) }

100%

Market val ue per share

Where t is the lower rate of income tax. The dividend yield ratio is also

expresses as a percentage.

Earnings per share

The earnings per share (EPS) ratio relate the earnings generated

by the business, and available to shareholders, during a period to

the number of shares in issue. For equity shareholders, the amount

38

available will be represented by the net profit after tax. The ratio for

shareholders is calculates as follows: (Harrington, 1993)

Earnings per share =

Earnings available to ordinary shareholde rs

Number of ordinary shares in issue

'Earning per share' is one of the most widely quoted statistics when there

is a discussion of a company's performance or share value.

It serves no purpose to compare the earnings per share in one company

with that in another because a company can elect to have a large number

of shares of low denomination or a smaller number of a higher

denomination. A company can also decide to increase or reduce the

number of shares on issue. This decision will automatically alter the

earnings per share.

Price/earnings (P/E) ratio

The price/earnings ratio relates the market value of a share to the

earnings per share.

This ratio can be calculated as follows:

P/E ratio =

Market val ue per share

Earnings per share

The ratio is a measure of market confidence in the future of a business.

The higher the P/E ratio, the greater the confidence in the future earning

power of the business and, consequently, the more investors are prepared

to pay in relation to the earnings stream of the business.

P/E ratio provides a useful guide to market confidence concerning the

future and they can, therefore, be helpful when comparing different

businesses. However, differences in accounting policies between

businesses can lead to different profit and earnings per share figures, and

this can distort comparison ( Harrington, 1993).

We should say that no single financial indicator will provide enough

information to determine a company’s financial health. Therefore, ratios

must be carefully interpreted. It is important to look at a group of

financial ratios over a period of time, evaluate other companies with

similar sales and functions, and compare performance with other

companies in the same geographical area.

39

3.4.4 profitability Ratios

Profitability ratios are used in determining the profitability of a company.

Profitability ratios (also referred to as profit margin ratios) compare

components of income with sales.

They give us an idea of what makes up a company's income and are

usually expressed as a portion of each dollar of sales (Foster, 1986).

The following ratios may be used to evaluate the profitability of the

business:

Return on ordinary shareholder's funds.

Return on capital employed.

Net profit margin.

Gross profit margin.

We now look at each of these in turn.

Return on ordinary shareholders' funds (ROSF)

The return on ordinary shareholders' funds compares the amount of

profit for the period available to the owners, with the owner's average

stake in the business during the same period. The ratio is as follows :

( Harrington, 1993)

ROSF =

Net profit after taxa tion and preference dividend

100%

Ordinary share capital plus reserves

The net profit after taxation and any preference dividend is used in

calculating the ratio, as this figure represents the amount of profit that is

left for the owners.

Note that, in calculating the ROSF, the average of the figures for ordinary

shareholder's funds as at the beginning and at the end of the year has been

used. It is preferable to use an average figure, as this might be more

representative. This is because the shareholder's funds did not have the

same total throughout the year, yet we want to compare it with the profit

earned during the whole period. The easiest approach to calculating the

average amount of shareholder's funds is to take a simple average based

on the opening and closing figures for the year. This is often the only

information available.

Where not even the beginning of year figure is available, it is usually

acceptable to use just the year end figure, provided that this approach is

40

adopted consistently. This is generally valid for all ratios that combine a

figure for a period (such as net profit) with one taken at a point in time

(such as shareholder's funds).

Return on capital employed (ROCE)

The return on capital employed is a fundamental measure of business

performance.

This ratio expresses the relationship between the net profit generated

during a period and the average long-term capital in the business during

that period.

The ratio is expressed in percentage terms and is as follows:

ROCE =

Net profit before interest and taxation

100%

Share capital + Reserves + Long - term loans

Note, in this case, that the profit figure used is the net profit before

interest and taxation. This is because the ratio attempts to measure the

returns to all suppliers of long-term finance before any deductions for

interest payable to lenders or payments of dividends to shareholders are

made. The figure needs to be compared with the ROCE from previous

years to see if there is a trend of ROCE rising or falling.

, with the return on capital employed, or net assets, being less than the

rate that the business has to pay for most of its borrowed funds.

To improve its ROCE a business can try to do two things:( Harrington,

1993)

Improve the top line (i.e. increase operating profit) without a

corresponding increase in capital employed, or

Maintain operating profit but reduce the value of capital employed.

Net profit margin

The net profit margin ratio relates the net profit for the period to the

sales revenue during that period. The ratio is expressed as follows:

( Schall,1986)

Net profit margin =

Net profit before interest and taxation

100%

Sales revenue

The net profit margin before interest and taxation is used in this ratio as it

represents the profit from trading operations before the interest costs are

taken into account. This is often regarded as the most appropriate

measure of operational performance. When used as a basis of

41

comparison, because differences arising from the way in which the

business is financed will not influence the measure.

This ratio compares one output of the business (profit) with another

output (sales revenue). The ratio can vary considerably between types of

business. For example, supermarkets tend to operate on low prices and,

therefore, low profit margins in order to stimulate sales and thereby

increase the total amount of profit generated. Jewelers, on the other hand,

tend to have high net profit margins but have much lower levels of sales

volume. Factors such as the degree of competition, the type of customer,

the economic climate, and the industry characteristics (such as the level

of risk) will influence the net profit margin of a business.

Gross profit margin

The gross profit margin is the ratio of gross income or profit to sales.

This ratio indicates how much of every dollar of sales is left after costs of

goods sold.

The gross profit margin ratio relates the gross profit of the business to

the sales revenue generated for the same period. Gross profit represents

the difference between sales revenue and the cost of sales. The ratio is

therefore a measure of profitability in buying and selling goods before

any other expenses are taken into account. As cost of sales represents a

major expense for many businesses, a change in this ratio can have a

significant on the 'bottom line' (that is the net profit for the year). The

gross profit margin ratio is calculated as follows:( Schall, 1986)

Gross profit margin

Gross profit

100%

Sales revenue

This ratio tells us something about the business's ability consistently to

control its production costs or to manage the margins its makes on

products its buys and sells. While sales value and volumes may move up

and down significantly, the gross profit margin is usually quite stable (in

percentage terms). However, a small increase (or decrease) in profit

margin, however caused can produce a substantial change in overall

profits ( Harrington, 1993).

42

Short Summary

We’ve introduced to a few of the financial ratios that a financial analyst

has in his or her tool kit. Of course there are hundreds of ratios that can be

formed using available financial statement data. We’ll see in the next

chapter how to use these ratios to get an understanding of a company’s

condition and performance.

3.5 How to Use Financial Ratios to Make Managerial Decisions?

Managers have many tools at their disposal to help with decision making,

and among the key tools used are financial ratios as prepared by an

accountant or financial officer. These ratios form a measure of the health

of an organization, and can be a signal danger ahead, or smooth sailing.

Using the quick or current ratio:

Both these ratios are a measure of current (due or liquid in one year

or less) assets to liabilities, with the key difference being that

inventory is subtracted from the quick ratio as it can be difficult to

liquidate and have uncertain liquidation value. Ideally, the current

ratio should be around 2. If it is 1 or less, this is an indication that a

company may not be able to pay its bills if they came due at this

point. The higher the current or quick ratios are, the more

comfortable a company should be taking on new debt to finance

expansion or new development efforts. If these ratios are already

low, then new debt should not be acquired.

Compare your ratios to averages for your industry. See if any debt

can be paid off or refinanced to long-term debt if it these ratios are

too low.

Decide whether to proceed with debt-based financing of a new

project, or to work harder to create more revenue first.

Increase revenue by either repositioning your products, or adding

features.

Analyze your efficiency ratios:

Review your accounts receivable ratio, which is accounts

receivable divided by sales times 365 days. If this is low, make a

decision to double your efforts to collect on outstanding debt.

43

Adding more stringent credit requirements, adding staff to the

accounts receivable department or hiring an outside collections

agency are all ways to improve collections efficiency.

Review your sales to inventory ratio. If this is high, you may be

losing sales as there is not enough inventories. It makes sense in

this case to increase inventory on hand. If it is too low, then you

have stocked too much inventory and need to make a decision to

build less in the future.

Review your assets to sales ratio. A high number here means that

you need to be more aggressive in creating sales. Decisions should

be made to incentive the sales team. If this number is low, the

business is generating more sales than can be covered by its assets-so assets should be increased. In this case, increasing inventories

would make sense.

Using profitability ratios:

Review two of the most common profitability ratios: return on

assets and return on equity. Return on assets is net income/total

assets, and return on equity is net income/total stockholders’

equity.

Create a plan to increase overall income if these ratios are too low,

as this shows that you are not achieving enough return on your

assets or your investors' money.

Incentive your team to increase sales by increasing commission

percentages or adding other rewards.

Find new ways to enhance your product's acceptance in the

marketplace to increase income by either repositioning the

products, adding features. You can promote your products for free

by using Twitter, Facebook or user forums.

3.6 Advantages and Uses of Ratio Analysis

There are various groups of people who are interested in analysis of

financial position of a company. They use the ratio analysis to workout a

particular financial characteristic of the company in which they are

interested. Ratio analysis helps the various groups in the following

manner:(Schall, 1986)

To workout the profitability: Accounting ratio help to measure the

profitability of the business by calculating the various profitability ratios.

It helps the management to know about the earning capacity of the

44

business concern. In this way profitability ratios show the actual

performance of the business.

To workout the solvency: With the help of solvency ratios,

solvency of the company can be measured. These ratios show the

relationship between the liabilities and assets. In case external

liabilities are more than that of the assets of the company, it shows

the unsound position of the business. In this case the business has

to make it possible to repay its loans.

Helpful in analysis of financial statements: Ratio analysis help

the outsiders just like creditors, shareholders, debenture-holders,

bankers to know about the profitability and ability of the company

to pay them interest and dividend etc.

Helpful in comparative analysis of the performance: With the

help of ratio analysis a company may have comparative study of its

performance to the previous years. In this way company comes to

know about its weak point and be able to improve them.

To simplify the accounting information: Accounting ratios are

very useful as they briefly summarize the result of detailed and

complicated computations.

To workout the operating efficiency: Ratio analysis helps to

workout the operating efficiency of the company with the help of

various turnover ratios. All turnover ratios are worked out to

evaluate the performance of the business in utilizing the resources.

To workout short-term financial position: Ratio analysis helps to

workout the short-term financial position of the company with the

help of liquidity ratios. In case short-term financial position is not

healthy efforts are made to improve it.

Helpful for forecasting purposes: Accounting ratios indicate the

trend of the business. The trend is useful for estimating future.

With the help of previous years’ ratios, estimates for future can be

made. In this way these ratios provide the basis for preparing

budgets and also determine future line of action.

3.7 Limitations of Ratio Analysis

In spite of many advantages, there are certain limitations of the ratio

analysis techniques and they should be kept in mind while using them in

interpreting financial statements. If ratio analysis conducted in a

mechanical, unthinking manager it would be dangerous.

45

The following are the main limitations of accounting ratios:(Daniel,1989)

Limited Comparability: Different firms apply different accounting

policies. Therefore the ratio of one firm cannot always be compared with

the ratio of other firm. Some firms may value the closing stock on LIFO

basis while some other firms may value on FIFO basis. Similarly there

may be difference in providing depreciation of fixed assets or certain of

provision for doubtful debts etc.

False Results: Accounting ratios are based on data drawn from

accounting records. In case that data is correct, then only the ratios

will be correct. Therefore the data must be absolutely correct.

Effect of Price Level Changes: Price level changes often make the

comparison of figures difficult over a period of time. Changes in

price affect the cost of production, sales and also the value of

assets. Therefore, it is necessary to make proper adjustment for

price-level changes before any comparison.

Qualitative Factors Are Ignored: Ratio analysis is a technique of

quantitative analysis and thus, ignores qualitative factors, which

may be important in decision making. For example, average

collection period may be equal to standard credit period, but some

debtors may be in the list of doubtful debts, which is not disclosed

by ratio analysis.

Costly Technique: Ratio analysis is a costly technique and can be

used by big business houses. Small business units are not able to

afford it.

Misleading Results: In the absence of absolute data, the result may

be misleading. For example, the gross profit of two firms is 25%.

Whereas the profit earned by one is just $ 5,000 and sales are $

20,000 and profit earned by the other one is $ 10,000 and sales is $

40,000. Even the profitability of the two firms is same but the

magnitude of their business is quite different.

Absence of Standard Universal Accepted Terminology: There

are no standard ratios, which are universally accepted for

comparison purposes. As such, the significance of ratio analysis

technique is reduced.

46

3.8 Summary

The main points in this chapter may be summarized as follows:

Ratio analysis

Ratios compare two related figures, usually both from the same set

of financial statements.

Ratios are an aid to understanding what the financial statements

portray.

Past analysis is an inexact science and so results must be

interpreted cautiously.

Past periods. The performance of similar businesses and planned

performance are often used to provide benchmark ratios.

A brief overview of the financial statements can often provide insights

that may not be revealed by ratios and/or may help in the interpretation of

them.

Liquidity ratio – concerned with the ability to meet short-term

obligations

Current ratio.

Acid test ratio.

Working capital ratio.

Efficiency ratio – concerned with efficiency of using assets/resources

Average stock (inventory) turnover period.

Average settlement period for debtors (receivables).

Average settlement period for creditors (payables).

Sales revenue to capital employed.

Sales revenue per employee.

Investment ratios – concerned with returns to shareholders

Dividend payout ratio.

Dividend yield ratio.

Earnings per share.

Price/earnings ratio.

Profitability ratios – concerned with effectiveness at generating profit

Return on ordinary shareholders' funds (ROSF).

Return on capital employed (ROCE).

Net profit margin.

47

Gross profit margin.

Chapter-4-

48

Applied

Study

49

4.1 Introduction

In this chapter we will take Palestinian Communications Company as a

case study for my research, and we will use its 2009 to 2010 financial

statements in calculating the key ratios to get a deeper understanding for

our topic.

4.2 Key Steps in Financial Ratio Analysis

When undertaking ratio analysis, analysts follow a sequence of steps:

The first step involves identifying the key indicators and relationships

that require examination. In carrying out this step, the analyst must be

clear who the target users are and why they need the information. We saw

earlier that different types of users of financial information are likely to

have different information needs that will, in turn, determine the ratios

that they find useful.

The next step in the process is to calculate ratios that are considered

appropriate for the particular users and the purpose for which they require

the information.

The final step is interpretation and evaluation of the ratios. Interpretation

involves examining the ratios in conjunction with an appropriate basis for

comparison and any other information that may be relevant.

The significance of the ratios calculated can then be established.

Evaluation involves forming a judgment concerning the value of the

information uncovered in the calculation and interpretation of the ratios.

Whereas calculation is usually straightforward, and can be easily carried

out by computer, the interpretation and evaluation are more difficult and

often require high levels of skill. This skill can only really be acquired

through much practice. The three steps described are shown in Figure 4.1.

50

Now we will take a quick view for the Palestine Telecommunications

Company which is our research’s case study.

4.3 Palestinian Telecommunications Company

4.3.1 Corporate Information

Palestine Telecommunications Company P.L.C. (PALTEL) is a limited

liability public shareholding company registered and incorporated in

Nablus - Palestine on August 2, 1995. PALTEL commenced operations

on January 1, 1997. PALTEL operates under the Telecommunication Law

No. (3) of 1996 decreed by the Palestinian National Authority (PNA).

PALTEL is engaged in providing, managing, and rendering wire line and

wireless services.

The consolidated

financialstatementsofPalestineTelecommunicationsCompanyP.L.C.forthe

yearended December 31, 2009 was authorized for issuance in accordance

with a resolution of the Board of Directors on March 10, 2010.()

4.3.2 PalTel Group

The People. The Companies. The Principles.

"Goodwill begets goodwill and success will always breed success.

responsibility.

Sabih Masri, Chairman, of PalTel Group.

51

4.3.3 The Mission

Maximizing shareholder value with perpetual growth and enriching

Palestine's information communication technology sector with a

commitment to excellence and with continues commitment to major

society social issues.

4.3.4 The Promise

Perpetual Growth in Palestine.

4.3.5 The Vision

Technology is a tool for both human resource development and nation

building. The future holds opportunities that will evolve with the

convergence of Information technology and communications.

The opportunities intertwined with the convergence trend will

exponentially grow. The foremost challenge is utilizing those

opportunities with a certain, solid discipline that is based on the scientific

thinking process and good governance.

4.3.6 The Methodology

We firmly believe that good governance leads to increase in shareholder

equity. Ethics and profits are never mutually exclusive.

From our vision and Mission stems our overall methodology.

We base our methodology on six pillars following pillars:

I. Creating national partnerships in Palestine based on win/win

scenarios.

II. Our people are unique and well-trained. The career paths of our

professionals are as important as any item on our balance sheet.

III. Customers are interested in tangible, convenient and high value

products of technology (and not technology per say). It is true that

technology provides opportunities for growth. But, at each level of the

value chain, players are demanding higher levels of efficiency, better

quality and lower prices. Therefore, our teams will focus on the

continuous improvement of a seamless process that introduces high

quality products and services that are developed from technological

improvements.

IV. We Think. We develop our thoughts with creative techniques and a

culture of excellence.

52

V. Corporate Social Responsibility endeavors are not a mere obligation.

They are a cherished responsibility. Our people will contribute and

we will work side by side with the Palestinian authority institutions,

local communities to all social development aspects in Palestinian

cities, villages and communities.

VI. Fair competition is always healthy and continually beneficial on both

the micro and the macro levels. Our teams will enhance and improve

our overall levels to improve our ability to compete. Our teams

enhance our companies' competitiveness by realizing plans and ideas

that improve our economies of scale.

4.3.7 What Can PalTel Group Do For You?

PalTel Group is built on a tradition of success and a convention of

continuous improvements. We never stop developing our people, our

products and our procedures and plans. The PalTel Group people,

nationwide, are committed and dedicated to serve our customers. They

are committed to creative thinking that produces ideas that spawn, new

services, new products and new Palestinian companies.

As a shareholder and/or customer, expect clear and transparent

professional procedures when dealing with any of our teams on both the

demand side and the supply side.

We value the investment (large and small) of all our shareholders and we

are committed to offer the highest returns, every month of every year.

We value each customer and we are dedicated to serve and honor his/her

needs and demands.

We value the social life, environment, health and safety of our

communities. Moreover we are devoted to enhance and improve the state

of our nation...Palestine.

4.4 Financial Ratios Analysis

Now we will analyze the financial statements of the Palestine

Telecommunications Company (PALTEL) for the year 2010 and 2009,

using financial ratios analysis.

Figure 4.2 shows the Income Statement for this company, and Figure 4.3

shows the Balance Sheet for the same company which we will use them

in our analysis.

Figure 4.2

Palestine Telecommunications Company P.L.C

53

Consolidated income statement

For the year ended December 31, 2010

54

Figure 4.3

1.4.1 profitability ratios

The following ratios may be used to evaluate the profitability of the

business:

Return on ordinary shareholder's funds.

55

Return on capital employed.

Net profit margin.

Gross profit margin.

We now look at each of these in turn.

Return on ordinary shareholders' funds (ROSF)

The ratio is as follows:

From the balance sheet of the company we can notice that there are three

types of reserves which are: statutory reserve, voluntary reserve, and

special reserve, so the total reserves will be the sum of these three

reserves.

Total reserves for 2009 = 32,906 + 6,756 + 7,950 = JD 47,612

Total reserves for 2010 = 32,906 + 6,756 + 7,950 = JD 47,612

The ROSF for 2009 is:

70,335

ROSF

100% 78.4%

(131,625 47,612) / 2

The ROSF for 2010 is:

86,336

ROSF

100% 96.34 %

(131,625 47,612) / 2

The total of the shareholder's funds for the year 2009 was JD 131,625. By

a year later, however, it had still the same equaled to JD 131,625,

according to the balance sheet as at 31 December 2010.

Return on capital employed (ROCE)

The ratio is expressed in percentage terms and is as follows:

ROCE for 2009 is:

ROCE for 2010 is:

ROCE =

90,491

100% 42.15%

131,625 + 47,612 + 35,450

ROCE is considered by many to be a primary measure of profitability. It

compares inputs (capital invested) with outputs (profit). This comparison

is vital in assessing the effectiveness .

56

Net profit margin

The ratio is expressed as follows:

Net profit margin for 2009 is:

Net profit margin for 2010 is:

Net profit margin =

90,491

100% 26.62%

339,929

A good performance compared with that of 2009. Whereas in 2009 for

every JD 1 of sales revenue and average of 22.3 (that is, 22.3 %) was left

as profit, after paying other expenses of operating the business, for 2010

this had increased to 26.62 for every JD 1.

Gross profit margin

The gross profit margin ratio is calculated as follows:

Gross profit margin for 2009 is:

Gross profit margin for 2010 is:

Gross profit margin

261,071

100% 76.8%

339,929

The increase in this ratio means that gross profit was higher relative to

sales revenue in 2010 than it had been in 2009. Bearing in mind that:

Gross profit = sales revenue – cost of sales (or cost of goods sold)

This means that cost of sales was lower relative to sales revenue in 2010,

than in 2009.

This could means that sales prices were higher and the purchase cost of

goods sold had decreased. It is possible that both sales prices and goods

sold prices had increased, but the former at a greater rate than the latter.

Similarly, they may both have increased, but with sales prices having

increased at a higher rate than costs of the goods sold.

The analyst must now carry out some investigation to discover what

caused the increases in both cost of sales and operating costs, relative to

sales revenue, from 2009 to 2010. This will involve checking on what has

happened with sales and stock prices over the two years. Similarly, it will

57

involve looking at each of the individual expenses that make up operating

costs to discover which ones were responsible for the increase, relative to

sales revenue.

4.4.2 Efficiency Ratios

The following ratios are considered as efficiency ratios:

Average settlement period for debtors (receivables).

Sales revenue to capital employed.

Average settlement period for debtors

This ratio is as follows:

Average settlement period for debtors =

Trade debtors

365

credit sales revenue

Average settlement period for debtors for 2009 is:

Average settlement period for debtors =

63,313

365 73.3 days

315,092

Average settlement period for debtors for 2010 is:

Average settlement period for debtors =

69,642

365 74.78 days

339,929

This increase in the average settlement period is not welcome. It means