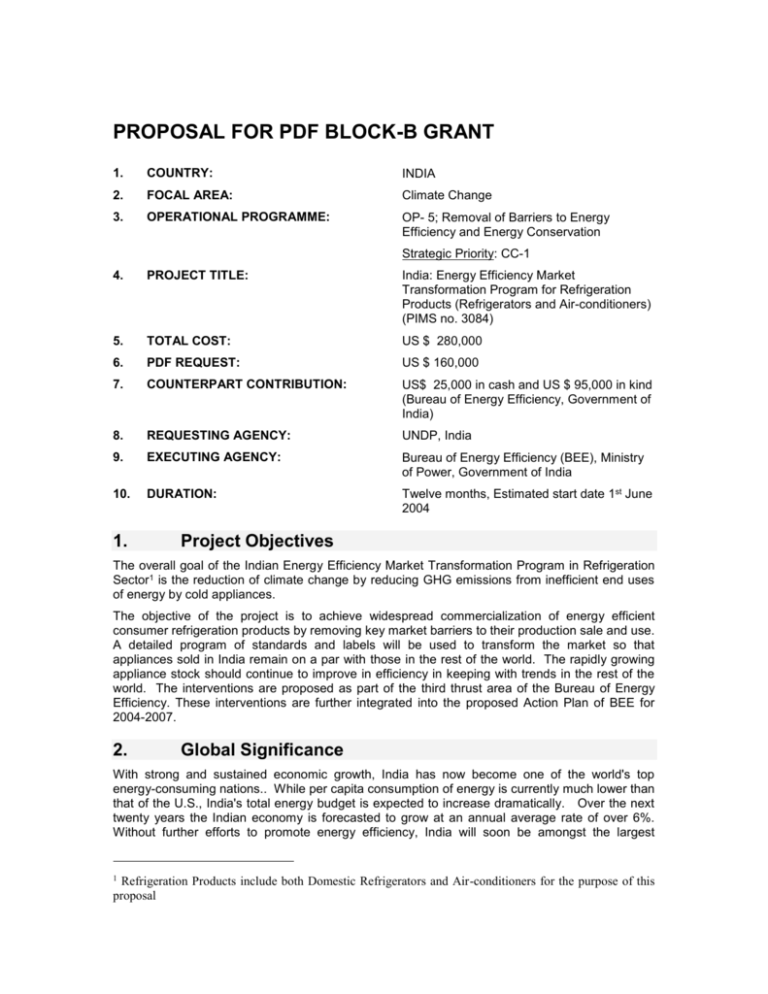

1 - Global Environment Facility

advertisement