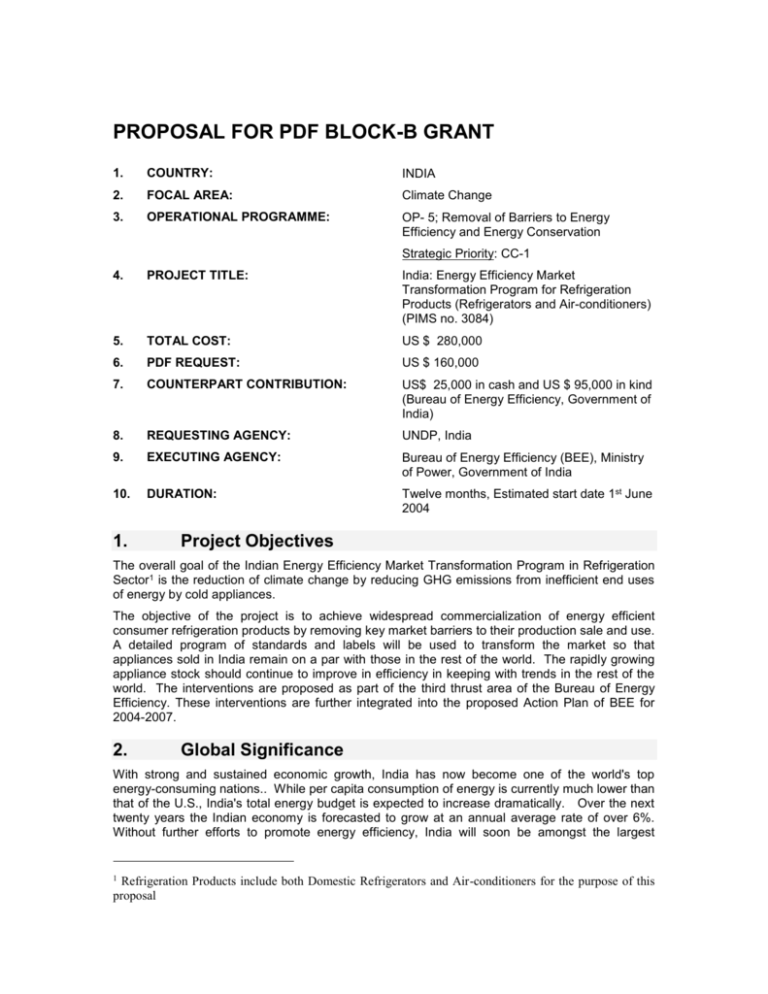

1 - Global Environment Facility

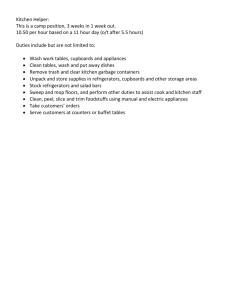

advertisement