Apr.9

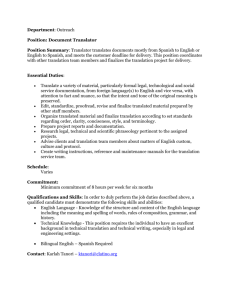

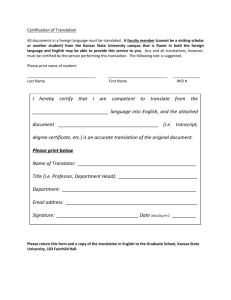

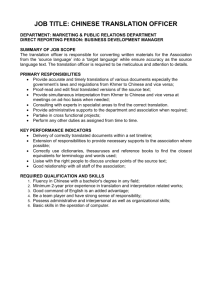

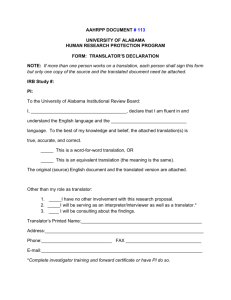

advertisement

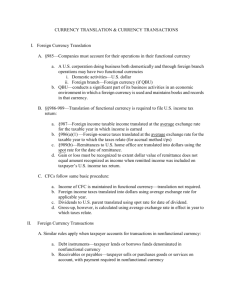

Accounting Exposure Overview of Translation Accounting exposure, also called translation exposure, arises because financial statements of foreign subsidiaries – which are stated in foreign currency – must be restated in the parent’s reporting currency for the firm to prepare consolidated financial statements. The accounting process of translation, involves converting these foreign subsidiaries financial statements into US dollar-denominated statements. Translation exposure is the potential for an increase or decrease in the parent’s net worth and reported net income caused by a change in exchange rates since the last translation. Translation in principle is simple: Foreign currency financial statements must be restated in the parent company’s reporting currency If the same exchange rate were used to remeasure each and every line item on the individual statement (I/S and B/S), there would be no imbalances resulting from the remeasurement What if a different exchange rate were used for different line items on an individual statement (I/S and B/S)? An imbalance would occur Why would we use a different exchange rate in remeasuring different line items? Translation principles in many countries are often a complex compromise between historical and current market valuation Historical exchange rates can be used for certain equity accounts, fixed assets, and inventory items, while current exchange rates can be used for current assets, current liabilities, income, and expense items. Two basic methods for the translation of foreign subsidiary financial statements are employed worldwide: The current rate method: The current rate method is the most prevalent in the world today. Assets and liabilities are translated at the current rate of exchange Income statement items are translated at the exchange rate on the dates they were recorded or an appropriately weighted average rate for the period Dividends (distributions) are translated at the rate in effect on the date of payment Common stock and paid-in capital accounts are translated at historical rates Gains or losses caused by translation adjustments are not included in the calculation of consolidated net income. Rather, translation gains or losses are reported separately and accumulated in a separate equity reserve account (on the B/S) with a title such as cumulative translation adjustment (CTA). The biggest advantage of the current rate method is that the gain or loss on translation does not pass through the income statement but goes directly to a reserve account (reducing variability of reported earnings). The temporal method 1 Under the temporal method, specific assets are translated at exchange rates consistent with the timing of the item’s creation. This method assumes that a number of individual line item assets such as inventory and net plant and equipment are restated regularly to reflect market value. Gains or losses resulting from remeasurement are carried directly to current consolidated income, and not to equity reserves (increased variability of consolidated earnings). If these items were not restated but were instead carried at historical cost, the temporal method becomes the monetary/nonmonetary method of translation. Monetary assets and liabilities are translated at current exchange rates Nonmonetary assets and liabilities are translated at historical rates Income statement items are translated at the average exchange rate for the period Dividends (distributions) are translated at the exchange rate on the date of payment Equity items are translated at historical rates The US differentiates foreign subsidiaries on the basis of functional currency, not subsidiary characterization. A foreign subsidiary’s functional currency is the dominant currency used by that foreign subsidiary in its day-to-day operations. The US, requires that the functional currency of the foreign subsidiary be determined based on the nature and purpose of the subsidiary. If the financial statements of the foreign subsidiary are maintained in US dollars, translation is not required If the statements are maintained in the local currency, and the local currency is the functional currency, they are translated by the current rate method If the statements are maintained in local currency, and the US dollar is the functional currency, they are remeasured by the temporal method If the statements are in local currency and neither the local currency or the US dollar is the functional currency, the statements must first be remeasured into the functional currency by the temporal method, and then translated into US dollars by the current rate method Managing Translation Exposure The main technique to minimize translation exposure is called a balance sheet hedge A balance sheet hedge requires an equal amount of exposed foreign currency assets and liabilities on a firm’s consolidated balance sheet. If this can be achieved for each foreign currency, net translation exposure will be zero. If a firm translates by the temporal method, a zero net exposed position is called monetary balance. Complete monetary balance cannot be achieved under the current rate method. The cost of a balance sheet hedge depends on relative borrowing costs. 2 If a firm’s subsidiary is using the local currency as the functional currency, the following circumstances could justify when to use a balance sheet hedge: The foreign subsidiary is about to be liquidated, so that the value of its CTA would be realized The firm has debt covenants or bank agreements that state the firm’s debt/equity ratios will be maintained within specific limits Management is evaluated on the basis of certain income statement and balance sheet measures that are affected by translation losses or gains The foreign subsidiary is operating in a hyperinflationary environment Management will find it almost impossible to offset both translation and transaction exposure at the same time. As a general matter, firms seeking to reduce both types of exposure usually reduce transaction exposure first Transaction losses are considered “realized” and are deductible from pre-tax income while translation losses are only “paper” losses and are not deductible from pre-tax income. Examples (next class) 3