Belgium - European Association of Tax Law Professors

Avoidance of multiple inheritance taxation within Europe

Belgian report

Daniel Garabedian

Université Libre de Bruxelles

1.

COMPARATIVE (DOMESTIC) TAX LAW

1.1 Overview a. Belgium has death duties and a gift tax, both of which are levied by the Federal State.

However, the proceeds of death duties go to the Regions (Brussels-Capital, and the

Flemish and Walloon Regions), which can adjust the rates and exemptions for death duties (Special Act of 16 January 1989, secs. 3, para. 1, 4

, and 4 (2)). b. Death duties are an inheritance tax, i.e. they are based on the amount of property received by each particular heir. Gift tax is likewise based on the amount of property received by each particular recipient.

3.

Death duties are called ‘succession duties’ ( droits de succession/successierechten ) where the deceased was domiciled in Belgium at the time of death, and ‘duty on transfer by death’ ( droit de mutation par décès/recht van overgang bij overlijden ) where the deceased was not domiciled in Belgium at the time of death. In both cases, the legal basis is a federal statute called the Succession Duties Code ( Code des droits de succession/Wetboek der successierechten – hereafter “SDC”).

Gift tax is one of the registration duties ( droits d’enregistrement/registratierechten ) imposed on various types of transactions by a federal statute called the Code on

Registration, Mortgage and Court Duties (

Code des droits d’enregistrement, d’hypothèque et de greffe/Wetboek der registratie-, hypotheek- en griffierechten – hereafter “RDC”). Gift tax is commonly referred to as ‘registration duty on gifts’

( droit d’enregistrement de donation/registratierecht op schenkingen

). By contrast with death duties, the proceeds of gift tax remain entirely federal.

1.2 Criteria for tax liability a. For death duties, the criterion for tax liability is

either that the deceased was domiciled in Belgium at the time of death, in which case the tax is called succession duties (SDC, art. 1, al. 1, 1°),

or that the deceased owned immovable property located in Belgium at the time of death, in which case the tax is called duty on transfer by death (SDC, art. 1, al. 1, 2°).

For gift tax, the situation is more complex. Gift tax is due only where the gift contract

2 is presented to the Belgian registration authority. Presentation is compulsory only where:

either the object of the gift is immovable property located in Belgium (RDC, art. 19, 2°),

or the gift contract is executed before a Belgian notary public (RDC, art. 19,

1°).

Thus, donations of property other than immovable property located in Belgium do not have to be presented to the Belgian registration authority, and therefore de facto escape gift tax where made either in the form of a manual transfer ( don manuel/nl )

(including a credit transfer between bank accounts) or before a foreign notary public

(registration is also not compulsory if the gift is made by a private deed, but this legal form is not valid under the Civil Code). In addition, gifts of immovable property located outside Belgium are in any event exempt from gift tax (RDC, art. 159, 7°). b.

Definition and consequences of criteria

The criterion of the deceased’s domicile in Belgium at the time of death is expressed in the statute by the concept of ‘inhabitant of the Kingdom’ ( habitant du

Royaume/Rijksinwoner ), defined as persons who, at the time of their death, have established their domicile or the seat of their estate in Belgium (SDC, art. 1, al. 2). As the Court of Cassation has put it, “domicile is factual domicile, characterized of necessity by a certain level of permanence or continuity, and the seat of one’s estate is the place from where it is managed, characterized naturally by a certain unity” (Court of Cassation, 7 February 1979, Pasicrisie , 1979, I, 673). Domicile thus refers to a situation of fact, as the place where the deceased had his or her last principal place of abode. It is disputed whether domicile and the seat of one’s estate are two expressions of a single concept of domicile or rather alternative criteria; in any event, even under the latter interpretation, situations where domicile and the seat of one’s estate are not situated in the same jurisdiction should remain quite the exception.

The alternative criterion for death duties, ownership of immovable property in

Belgium by the deceased at the time of death, is self-explanatory.

Except under the alternative criterion mentioned above, the domicile of the deceased at the actual time of death is the only criterion. Other criteria such as the location of assets (except for immovable property under the alternative criterion), the domicile or nationality of the heirs, or the nationality or former domicile of the deceased, are irrelevant. Death duties are levied on the assets belonging to the deceased at the time of death, but certain assets are fictitiously deemed to be included in the estate of the deceased for the purposes of the tax (see infra, 1.3, anti-avoidance rules).

For gift tax, the only criterion is the registration of the gift contract with the relevant authority in Belgium (see above, 1.2.a); other criteria, such as the location of the object gifted (except for immovable property located abroad, the donation of which is

exempt from tax) or the nationality or domicile of the donor or donee, are irrelevant.

3 c.

Unlimited or limited tax liability

Gift tax triggers limited tax liability, on the net value of the gift (RDC, art. 133).

Where a deceased is domiciled in Belgium at the time of death, this triggers unlimited death duty liability, on the net value of the assets bequeathed (SDC, art. 1, al. 1, 1°).

Where the deceased is not domiciled in Belgium at the time of death, death duties apply only to the gross value of immovable property located in Belgium and owned by the deceased at the time of death (SDC, art. 1, al. 1, 2°).

1.3 Tax avoidance

Although a general anti-avoidance rule has been progressively introduced into Belgian tax law since 1993, it does not apply in the case of death duties and gift tax.

There are several special anti-avoidance provisions, under which certain assets not actually belonging to the deceased at the time of death are nevertheless deemed to be part of the estate, thus making such assets subject to death duties (see esp. SDC, art. 4 to 14).

Example: gifts made by the deceased during the three-year period prior to death

(except gifts on immovable property located outside Belgium) are taken into account for death duties in one of the following ways:

if the gift was not subject to gift tax (for instance because it was made manually), the object of the gift is deemed to be part of the estate (SDC, art. 7); if the gift was subject to gift tax, the value of the gift is taken into account to apply the progressive rates of death duties due by the donee (‘reservation of progression’) (SDC, art. 66 bis ).

Example 2: if the deceased purchased an asset in usufruct and an heir of his/hers purchased the reversionary interest ( nue-propriété/naakte-eigendom ), the deceased is deemed to have had full property of the asset at the time of death and to have bequeathed the asset to the heir, unless evidence is adduced that the purchase was not intended to disguise a gift to the heir (a right of usufruct grants the life-tenant full enjoyment of the asset until death, at which moment the usufruct automatically extinguishes and the owner of the reversionary interest recovers full property in the asset) (SDC, art. 9).

1.4 Valuation and exclusions a.

Under the unlimited tax liability (deceased domiciled in Belgium), the tax is

calculated on the fair market value ( valeur vénale/verkoopwaarde

) of the assets, less

4 the debts of the deceased and less the funeral costs (SDC, art. 19 and 27).

Under the limited tax liability (deceased domiciled abroad) the tax is calculated on the fair market value of the immovable properties located in Belgium, with no deduction for debts (SDC, art. 19 and 27 a contrario ).

Gift tax is computed on the fair market value of the property (RDC, art. 133).

A few special rules apply for assets whose fair market value is very difficult to ascertain, such as rights of usufruct (see SDC, art. 21 to 25). b.

See infra, 1.5.a-b(2).

1.5 Rates and tax-free amounts (reliefs) a-b.

Rates and categories of beneficiaries

(1) General rates

(i) Gift tax

Different scales apply according to the degree of sanguinity between the donor and donee. In each scale, the rates are progressive, based on the entire value transferred to each donee.

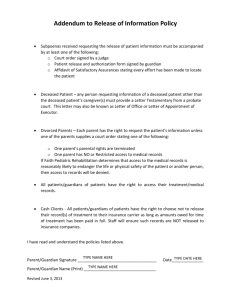

The following tables show the tax rates that are generally applicable (RDC, art. 131).

Item “a” is the tax rate for the relevant bracket and item “b” the total amount of tax due for the preceding brackets.

TABLE I - recipient spouse or direct ascendant or descendant

Value received from

EURO*

1

12,394.68

24,789.35

49,578.70

99,157.41

148,736.11

198,314.81

247,893.52 over 495,787.04 to

EURO

12,394.68

24,789.35

49,578.70

99,157.41

148,736.11

198,314.81

247,893.52

495,787.04

3

4

5

7 a

%

10

14

18

24

30

* All amounts in euro converted from Belgian francs. b

EURO

371.81

867.63

2,107.09

5,577.60

10,535.47

17,476.49

26,400.66

85,895.11

TABLE II - other recipients

Value received

from

EURO

1

12,394.68

24,789.35

74,368.06 to

EURO

12,394.68

24,789.35

74,368.06

173,525.46 over 173,525.46

(ii) Death duties a

%

20

25

35

50

65 between siblings b

EURO

2,478.94

5,577.60

22,930.15

72,508.86 between uncles or between other aunts and nephews or persons nieces a

%

25

30

40

55

70 b

EURO

3,098.67

6,817.07

26,648.55

81,185.13 a

%

30

35

50

65

80 b

EURO

3,718.40

8,056.54

32,845.89

97,298.21

5

The rates and exemptions for death duties differ in the Brussels and Walloon Regions, on the one hand, and the Flanders Region, on the other hand. The Region that has jurisdiction is determined by the last domicile of the deceased (for unlimited tax liability) or, where the deceased was not last domiciled in Belgium, by the situs of the

Belgian immovable property owned by the deceased (if the deceased owned properties in different Regions, then jurisdiction lies with the Region whose office has jurisdiction over the property with the highest deemed rental income ( revenu cadastral / kadastrale inkomsten ) (Special Act of 16 January 1989, sec. 5 (2), 4

).

6

In the Brussels and Walloon Regions , the rates are the same as for gift tax and are calculated in the same way (SDC, art. 48, as applicable in those Regions). However, a

(rather low) base amount is exempt where the deceased was domiciled in Belgium: for the spouse and each ascendant and descendant (except for bequests above that which devolves by intestate succession), the first EUR 12,394.68. Where one of the heirs is a child of the deceased aged under 21, this base amount is increased by EUR 2,478.94 multiplied by the number of full remaining years until he/she reaches 21; in such case, the exempt base amount for the spouse is increased by one half of the total increase granted to the heirs that are common issue (SDC, art. 54, 1°). In other cases, there is only an exemption where the total net value of the estate does not exceed EUR 619.73

(SDC, art. 54, 2°).

In the Flanders Region , the rates are as follows (SDC, art. 48, as applicable in that

Region) :

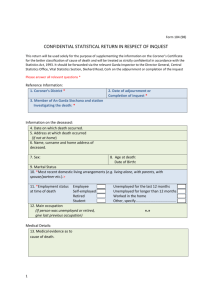

TABLE I - recipient spouse or direct ascendant or descendant

Value received from

EURO

1

49,578.70 over 247,893.52 to

EURO

49,578.70

247,893.52 a

%

3

9

27 b

EURO

1,487.36

19,335.69

The rates are calculated separately on the net value of movable and immovable property transferred to each heir. Debts are deducted by priority from the value of movable assets, except for debts incurred especially for the acquisition or conservation of other assets.

For the spouse and each ascendant and descendant (except for bequests outside the bounds of what is devolved by intestate succession), the tax is reduced by a variable amount of up to EURO 495.79. Where one of the heirs is a child of the deceased aged under 21, there is an additional tax reduction of EUR 74.37 times the number of full remaining years until he/she reaches 21; in such case, the spouse receives an additional reduction equal to one half of the total additional reductions granted to the heirs who are common issue (SDC, art. 56, as applicable in the Flanders Regions).

7

TABLE II - recipient keeping a common household with the deceased for at least three years at the time of death

Value received from

EURO

1

74,368.06 over 123,946.76 to

EURO

74,368.06

123,946.76 a

%

10

35

50 b

EURO

7,436

24,789.35

The rates are applied to the entire value transferred to each heir.

TABLE III - all other recipients

Value received Between brothers and sisters from

EURO

1

74.368.06

Over 123,946.76 to

EURO

74,368.06 a

%

30

123,946.76 55

65 b

EURO

22,310.42

49,579.70

Between other persons a b

% EURO

45

55 33,465.63

65 60,733.91

In the case of siblings, the rates are applied to the entire value transferred to each heir.

In the case of other persons, the rates are applied to the aggregate value transferred to heirs belonging to that group.

(2) Special rates for “business assets”

Since 1996, legislation has provided a special rate, resulting in an exemption or quasiexemption (0% for death duties in the Flanders Region; 3% for death duties in the

Brussels and Wallonia Regions and for gift tax nationwide), for business assets, i.e.: assets invested in a business operated by the deceased or his/her spouse, and shares in a company in which the deceased, alone or together with members of his/her family or parties to a shareholders’ agreement, had a 50% interest or higher.

This regime has been established by a Federal law for gift tax (act of 22 December

1998 inserting RDC, art. 140 bis to 140 octies ) and by Regional Statutes on death duties in each of the Brussels, Flanders and Walloon Regions (SDC, art. 60bis established by

: Brussels: Ordinance of 29 October 1998 - Flanders: Decree of 20 December 1996, amended several times - Wallonia: Decree of 17 December 1997). Because of these

8 four bodies of legislation, the definition of qualifying assets and shares and the specific rules vary in many aspects (employment requirement, inclusion or exclusion of noncommercial activities, size of company, holding requirements, etc.).

For business assets that do not qualify for the above reduction of or exemption from death duties and that are received by the spouse or direct ascendants or descendants, the rate that is applicable to the slice over EUR 247,893.52 is reduced under certain conditions to 22% for the bracket from EUR 247,893.52 to 495,787.04 and to 25% for the bracket above EUR 495,787.04 (SDC, art. 48-2).

(3) Special rates for special heirs/donees

Gifts and bequests to certain public authorities and institutions are exempt (SDC, art.

55).

Certain legal entities such as non-profit organizations, provinces and municipalities enjoy reduced rates of 1.1%, 6.6% or 8.8%, as the case may be (SDC, art. 59). c.

Yes. Under the Civil Code, the “ordinary” regime is one of limited community between the spouses: assets acquired during marriage are community property except those received by one spouse as an inheritance or gift and those which a spouse has acquired as a reinvestment of his or her own assets. Death duties are paid on half of the community property only upon the death of one spouse.

1.6 Striking features

exemption or virtual exemption for business assets, including shares in controlled corporations;

taxation of immovable property located in Belgium where the deceased was domiciled abroad without deduction for any debts, even those especially secured by the property.

2.

DOUBLE TAXATION RELIEF

2.1 Unilateral relief

Domestic measures for relief from double taxation are limited to the following two. a. A tax credit is granted for the foreign death duties (irrespective of whether they are an inheritance tax or an estate tax) actually paid on the transfer of immovable property owned by the deceased to the foreign State where the immovable property is located

(SDC, art. 17).

b. Death duties which are of the nature of an estate tax and are paid to a foreign State on

9 the value of movable property owned by the deceased are deducted from the value of the movable property of the deceased for the purpose of calculating the taxable base.

2.2 Tax treaties - Overview a. Tax treaties

Belgium has concluded only two tax treaties in the field, which cover death

duties only:

Treaty, and accompanying protocol, between Belgium and Sweden, dated 18

January 1956, came into force on 1 April 1958, still in force;

Treaty between Belgium and France, dated 20 January 1959, came into force on 12 June 1960, still in force. b. Main differences compared to the OECD Model:

neither treaty covers gift taxes;

the Swedish treaty covers the situation where the deceased was a national of

Belgium or Sweden and only partially the situation where the deceased had his or her domicile in one of the Contracting States;

the list of assets that can be taxed in the State of the situs is broader in the

French treaty (it includes boats and aircraft registered in that State as well as all tangible movable property, including cash in legal tender, actually located in that State at the time of death) and narrower in the Swedish treaty (it includes immovable property only);

only debt secured by the assets that can be taxed in the State of the situs are deducted by priority from the value of those assets;

the French treaty also provides for assistance in the recovery of death duties.

2.3 Conformity with the OECD Model?

The only two tax treaties in force predate the work of the OECD in this field by several years. They nevertheless have many features in common with the OECD

Model.

2.4 Method for avoiding double taxation

Ordinary credit method under both treaties.

3. EC LAW

No case pending to my knowledge.

10

In my view, where the deceased was not domiciled in Belgium, the taxation of immovable property in Belgium without any deduction for debts, even especially secured by the property, could be challenged as an infringement of the free movement of capital.

Some of the conditions of the exemption or quasi-exemption from death duty for business assets (minimal employment in Flanders : Flemish Region – ongoing activity in Belgium : Walloon Region) appear questionable vis-à-vis the freedom of establishment (cf. CJCE, 13 April 2000, C-251/98, Baars).

4. CASE

Individual X who

-- is domiciled in country A

(`domicile´ to be understood in its Anglo-saxon meaning)

-- is a national of country B, that was left by the individual within the last 10 years

-- is a resident of country C

-- has situs property in country D

-- dies during a holiday in country E

Would Belgium levy tax if it was in the position of:

-- country A? Yes if principal place of abode in Belgium.

-- country B? No.

-- country C? Yes if principal place of abode in Belgium.

-- country D? Yes but on immovable property located in Belgium only.

-- country E? No.

2 May 2000