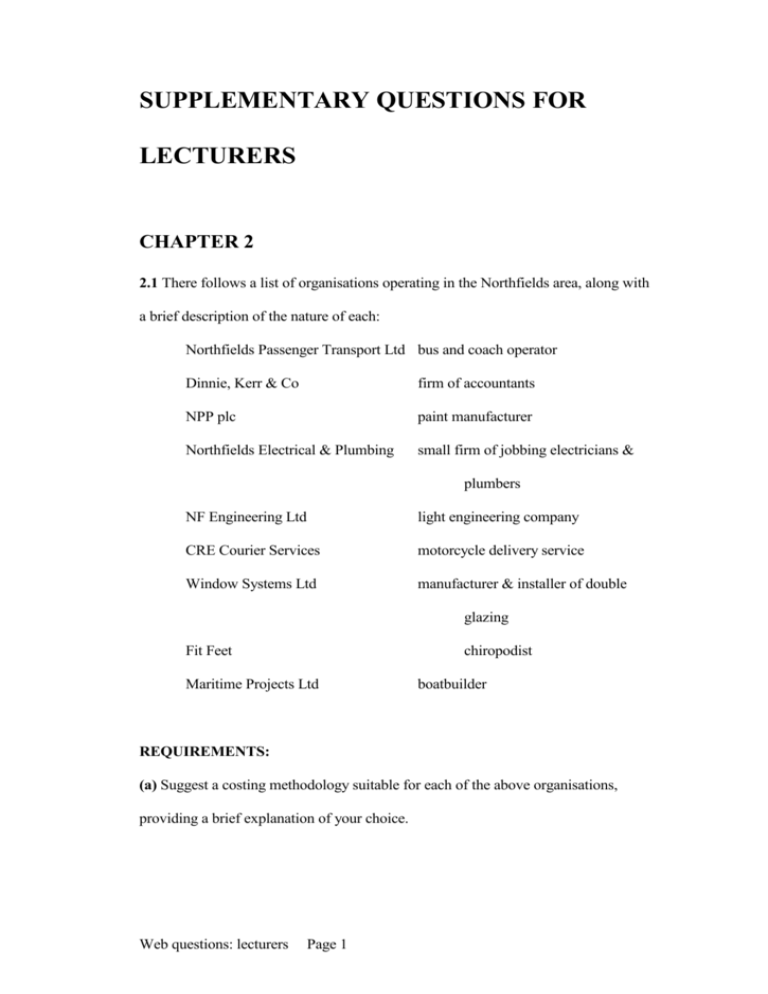

Cost Accounting Questions for Lecturers

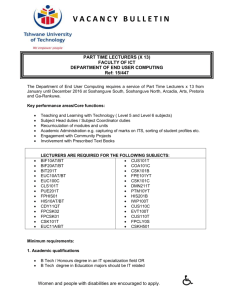

advertisement