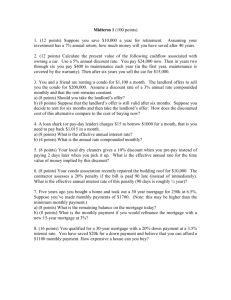

Present value problems

advertisement

ANALYSIS FOR FINANCIAL MANAGEMENT 10TH Edition Robert C. Higgins Additional Problems Chapter 7 A brief tutorial on Excel financial functions (problems to follow) You may find the following Excel, built-in financial functions helpful when analyzing the problems below. (To access these functions, select Insert, Functions, and choose Financial.) =PV(rate, nper, pmt, fv, type) returns the present value of a series of cash flows. =FV(rate, nper, pmt, pv, type) returns the future value of a series of cash flows. =PMT(rate, nper, pv, fv, type) calculates the periodic payment for a loan based on constant payments and a constant interest rate. =NPER(rate, pmt, pv, fv, type) returns the number of periods for an investment based on periodic, constant payments and a constant interest rate. =NPV(rate, range) returns the net present value of an investment based on a discount rate and a series of future payments (negative values) and income (positive values). (Warning: By convention, NPV calculates the net present value one period before the first cash flow.) =IRR(range, guess) returns the internal rate of return for a series of cash flows. In these functions, rate = the discount, or interest rate. nper = number of periods. pmt = annual uniform payment. fv = future value, or future cash flow. type is a logical value allowing you to specify if cash flows occur at the end or the beginning of the period. A value of 1 indicates beginning of period, 0 or omitted indicates end of period. pv = present value. range = the cells on your spreadsheet containing the cash flows you want to analyze. For example, if the cash flows are in the first 10 rows of column A, the entry for range would be a1:a10. guess = your guess as to the internal rate of return. This helps the computer get started and may be left blank. An example Suppose you want to know the present value of $100 per year for 19 years and $500 at the end of the 19th year when the interest rate is 13 percent. Select a spreadsheet cell and enter =PV(0.13,19,100,500). Excel will return ($742.83). This is the amount one should be willing to pay today to receive the indicated stream of cash flows when the interest rate is 13 percent. 1 Problems 1) An investment costing $50,000 promises an after tax cash flow of $18,000 per year for 6 years. a. Find the investment's accounting rate of return and its payback period. b. Find the investment's net present value at a 15 percent discount rate. c. Find the investment's profitability index at a 15 percent discount rate. d. Find the investment's internal rate of return. e. Assuming the required rate of return on the investment is 15 percent, which of the above figures of merit indicate the investment is attractive? Which indicate it is unattractive? 2) A $1,000 par value, 10 percent coupon bond matures in 20 years. If the price of the bond is $1,196.80, what is the yield to maturity on the bond? Assume interest is paid annually. 3) Ten years ago you invested $1,000 for 10 shares of Trublock common stock. You sold the shares recently for $2,000. While you owned the stock it paid $10.08 per share annual dividends. What was your rate of return on Trublock stock? 4) Having heard of your knowledge of present value techniques, you have been asked to testify as an expert witness in the following lawsuit. Several homeowners in a nearby community have organized to protest against alleged gouging on the part of a local lending institution. One resident presents his payment book as evidence. The resident has a 30-year, fixed rate loan at 6 percent interest for $200,000. He got the loan 10 years ago and has been making equal annual payments of $14,529.60 ever since. He observes that he has paid the lending company $145,296.00 yet his payment book indicates that the principal due on the loan has only declined by $33,345.40. He presents this as obvious proof of "gouging on the part of the money changers". Do you agree? Why, why not? 5) In 1984, the city council of the town of Patterson agreed that their community badly in need of a modern hotel that would cost approximately $25 million. To finance construction members of the council organized the Patterson Hotel Corporation. Through strenuous promotion they raised $15 million by selling 15,000 shares of stock at $1,000 per share. They secured the other $10 million necessary to build the hotel as a loan provided by a local bank on a 10 year, 14 percent mortgage that called for uniform annual payments sufficient to pay interest and to extinguish the debt at the end of 10 years. Upon completion, the Patterson Hotel Corporation leased the hotel to a national company that operated a chain of hotels. The lease ran for 30 years and contained a clause permitting the lessee to purchase the hotel for $10 million at the end of the 30-year period. The lessee agreed to furnish the hotel and pay all taxes (including income taxes) and operating expenses, and was to meet the interest and repayment obligations on the mortgage during the first 10 years of the lease. During the last 20 years of the lease, the operating company agreed to make payments sufficient to permit annual dividends of $400 per share. No payments at all were to be made to the stockholders during the first 10 years. This was the most favorable operating contract that Patterson Hotel Company was able to negotiate. When stockholders, many of whom had bought stock under considerable pressure, learned that there was no prospect of dividends for 10 years, they were quite upset, and a number of them were anxious to sell their stock. Conrad Billings, a local businessmen in the original group that promoted the hotel, was reported to be buying stock from some of these disgruntled stockholders at $750 a share. Some locals were heard to comment that Conrad Billings was a "clever old bastard" who was taking advantage of his public-spirited neighbors. There were remarks regarding the "fat dividends" he would be receiving after the mortgage was paid off. One man was said to have declined Billings’ offer of $750 a share and to have commented publicly that nobody was going to get his stock unless they paid what it was worth. 2 Make whatever assumptions and calculations you find necessary to estimate the fair value of the stock. Was $750 a share really too low a price? 6) You need four new tires for your car. You can buy cheap retread tires for $25 a piece and replace them every 20,000 miles or you can spend $40 per tire and replace them every 40,000 miles. If money has an opportunity cost of 10 percent to you, how many miles must you drive annually to warrant the more expensive tires? 7) Consider the following investment opportunity. Initial cost Annual revenues Annual operating costs, exclusive of depreciation Expected life Salvage value after taxes Annual depreciation for tax purposes Tax rate $850,000 $500,000 $200,000 20 years $40,000 $25,000 34% What is the rate of return on this investment? Assuming the investor wants to earn at least 12 percent, is this investment an attractive one? 8) Management has decided to construct a new building. A concrete structure will cost $2 million, will have an expected life of 40 years and will cost $100,000 annually before tax to maintain. A frame structure will cost $800,000, will have an expected life of 20 years and will cost $250,000 annually to maintain. If the company's tax rate is 50 percent, its cost of capital is 12 percent, and both structures will be depreciated on a straight-line basis, which alternative is financially superior? Assume the company expects to be profitable in future years. You may ignore inflation. 9) Sanderson Electronics has made a long-run commitment to produce semi-conductor chips of a specific type. Two designs are to be evaluated for their production. Design Y involves a present investment of $60,000. Estimated annual profits after tax for 15 years are $10,000. Design Z involves a present investment of $120,000. Estimated annual profits after tax for 20 years are $22,000. Assuming zero salvage value and straight-line depreciation, what recommendation would you give the company when the discount rate is 12 percent? 10) A company is considering two alternative methods of producing a new product. The relevant data concerning the alternatives are presented below. Alternative Alternative I II Initial investment $64,000 $120,000 Annual receipts $50,000 $60,000 Annual disbursements $20,000 $12,000 Annual depreciation $16,000 $20,000 Expected life 4 yrs 6 yrs Salvage value 0 0 At the end of the useful life of whatever equipment is chosen the product will be discontinued. The company's tax rate is 50 percent and it cost of capital is 10 percent. a. Calculate the net present value of each alternative. b. Calculate the benefit cost ratio for each alternative. c. Calculate the internal rate of return for each alternative. d. If the company is not under capital rationing which alternative should be chosen? Why? 3 e. Again assuming no capital rationing, suppose the company plans to produce the product indefinitely rather than quit when the equipment wears out. Which alternative should the company select? Why? f. If the company is experiencing severe capital rationing, and plans to terminate production when the equipment wears out, would any of your answers above change? 11) Given the following information about a possible average-risk, new product investment, calculate the investment's net present value. Initial cost Expected life Salvage value Annual depreciation Incremental annual sales Incremental annual production costs Incremental annual selling and administrative costs Tax rate Expected inventory turnover (production cost/end. inv.) Expected collection period Cost of capital Borrowing rate Target debt-to-equity ratio $200,000 10 yrs 0 $20,000 $200,000 $110,000 $20,000 50% 4 times 45 days 8% 7% 130% The following problems are best analyzed using a business calculator or a computer. 12) Given the following information about three bonds, answer the questions below. Bond Par value Coupon rate Time to maturity A $1,000 6% 1 yr. B $1,000 6% 5 yrs. C $1,000 6% 20 yrs. a. Assume interest is paid annually and calculate the prices of the bonds at an 11 percent interest rate. b. Do bond prices vary directly or inversely with interest rates? c. Do bond prices become more, or less, sensitive to interest rate changes as time to maturity increase? Does this suggest short-term bonds are more, or less, risky than long-term bonds? 13) In many financial transactions, interest is computed and charged more than once a year. For example, interest on corporate bonds usually is payable every six months. Consider a loan transaction in which interest is charged at the rate of 1 percent per month. Sometimes such a transaction is described as having an interest rate of 12 percent per annum. More precisely, this rate should be described as a nominal 12 percent per annum coumpounded monthly. Clearly, it is desirable to recognize the difference between 1 percent per month compounded monthly and 12 percent per annum compounded annually. If $1,000 is borrowed with interest at 1 percent per month compounded monthly, the amount due in one year is: F = $1,000(1.01)12 = $1,000(1.1268) = $1,126.80 Hence, the monthly compounding has the same effect on the year-end amount due as the charging of a rate of 12.68 percent compounded annually. 12.68 percent is referred to as the effective interest rate. To generalize, if interest is compounded m times a year at an interest rate of r/m per compounding period. Then, 4 The nominal interest rate per annum = m(r/m) = r. The effective interest rate per annum = (1+r/m)m - 1. Consider a $100,000, 30 year, fixed-rate, 11 percent, home mortgage requiring monthly payments. a. The monthly interest rate on the mortgage is 11%/12 months = .91666%. What is the annual nominal interest rate on the mortgage? b. What is the annual effective interest rate on the mortgage? c. The borrower's payment book will look something like the following. Complete the entries for the first 6 months. Date 1/31 Outstanding balance beginning of month $100,000 Monthly payment Interest due Principal payment Outstanding balance end of Month d. After paying on this mortgage for 15 years, what will be the remaining principal outstanding? You may find it useful to know that the present value of an annuity paying $A per period equals: $A[(1+i)n - 1]/i(1+i)n where i is the interest rate per period and n is the number of periods. e. Suppose after 15 years the borrower has the opportunity to refinance the remaining principal on the mortgage with a new 15-year mortgage carrying an interest rate of 8 5/8%. Refinancing will involve $300 in costs and "points" equal to 2 percent of the amount borrowed. If the borrower plans to live in the house for 15 more years, does it make economic sense to refinance? Does your answer change if the borrower only intends to live in the house for 3 more years and will pay off any loans outstanding at that time? You may ignore taxes and may assume there are no prepayment penalties on either mortgage. 5