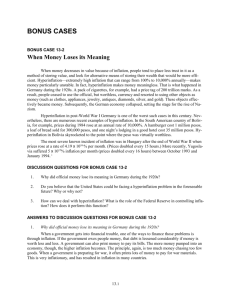

The Dynamics of Inflation and Hyperinflation

advertisement

The Dynamics of Inflation and Hyperinflation http://www.applet-magic.com/infldynamic.htm applet-magic.com Thayer Watkins Silicon Valley & Tornado Alley USA The Dynamics of Inflation and Hyperinflation Very early in history astute observers noted that there was some relationship between the amount of money in circulation and the level of prices. At first these observers postulated a direct proportional relationship between the amount of money in circulation and the level of prices. This became explicit in the sixteenth century when gold and silver from Mexico and Peru entered the Spanish economy. For an investigation of the effects of this treasure on the price level in Spain see Spanish Treasure. The notion that the amount of money in circulation determines the price level is called the quantity theory of money. A more sophisticated approach replaced the notion that the price level is simply proportional to the amount of money in circulation. This old theory of a simple proportional relationship became known as the crude quantity theory of money. The more sophisticated approach is involves the the equation of exchange. 1 of 6 7/30/08 4:56 PM The Dynamics of Inflation and Hyperinflation http://www.applet-magic.com/infldynamic.htm M*V = P*T where M is the amount of money in circulation V is the velocity of money, the number of times per year that on average a unit of money enters into transactions P is the price level T is the level of transactions Originally the equation involves the total transactions, intermediate as well as final sales, used goods as well as newly produced goods and so on. It was not feasible to get statistics on total transactions so T was replaced with Q the level of gross domestic product and the concept of P and V were similarly restricted. Thus the equation of exchange is 2 of 6 7/30/08 4:56 PM The Dynamics of Inflation and Hyperinflation http://www.applet-magic.com/infldynamic.htm M*V = P*Q The equation of exchange may be solved for P; i.e., P = M*V/Q It is convenient to represent the equation of exchange in terms of the ratios of the variables at two different times, say time 1 and time 2. Thus in this form the equation of exchange is (P2/P2) = (M2/M1)*(V2/V1)/(Q2/Q1) Now the source of the astronomical prices increases involved in hyperinflation can be explained. Suppose the amount of money in circulation doubles; i.e., M2 /M1 =2. This will lead to an increase in the velocity of money, say 50 percent, so V2 /V1 =1.5. Furthermore suppose 3 of 6 7/30/08 4:56 PM The Dynamics of Inflation and Hyperinflation http://www.applet-magic.com/infldynamic.htm the level of output drops by 50 percent so Q2 /Q1 =0.5. The ratio of price levels is then P2/P1 = 2(1.5)/(0.5) = 6 Thus a doubling of the money supply could lead not just to a doubling of the price level but instead an increase by six fold. Suppose the monetary authorities then create money to allow the government to cope with the higher prices. Let us say that the money supply is increased by six fold. The velocity of money may then triple and let us say the quantity of production drops by 50 percent. This would lead to a ratio of price levels of 6(3)/(0.5)=36. An increase in the money supply by a factor of 36 might lead to an increase in the velocity of money by a factor 10 and let us again suppose the level of output falls by 50 percent. This would lead to an increase in the price level of 36(10)/(0.5)= 720. One can see that it would not take very long for the price levels to reach astronomical levels. There is an Americanism that expresses the effect quite well. In hyperinflation prices get hit by a triple whammy due to the increase in the money supply, the increase in the velocity of money and the decrease in production. It is this concatenation of increases that accounts for some inflations, the extreme ones called hyperinflations reaching astronomical numbers. For examples of these see Episodes of Hyperinflation. In reality for hyperinflations in countries with well established market economies the level of output does not decrease but remains constant until the very last stages when the economy falls apart. For countries making a transition from central control to market-orientation the 4 of 6 7/30/08 4:56 PM The Dynamics of Inflation and Hyperinflation http://www.applet-magic.com/infldynamic.htm output does decrease drastically because some state enterprises which are operating at a financial loss have to cut back production drastically. The Real Value of the Money Supply in a Hyperinflation It is surprising but explanable that the monetary authorities during episodes of hyperinflation have the feeling that there is a shortage of money. The monetary authorities compare the amount of money in circulation to the price level and it seems that there is relatively little money in circulation. They are looking at the real value of the money supply, M/P. In fact, the real value of the money supply does become small during a hyperinflation and the equation of exchange explains why. M/P = Q/V Because money velocity V increases during the hyperinflation while the production Q stays constant or declines the ratio Q/V becomes very small. Monetary authorities may also look at the ratio of the real value of the money supply compared to the level of output. This would be (M/P)/Q = 1/V 5 of 6 7/30/08 4:56 PM The Dynamics of Inflation and Hyperinflation http://www.applet-magic.com/infldynamic.htm Thus in normal, noninflationary times the money supply might be equivalent to three months of output but in a hyperinflation it might drop to two weeks worth of output. HOME PAGE OF applet-magic HOME PAGE OF Thayer Watkins 6 of 6 7/30/08 4:56 PM