Department of Human Services Privacy Policy

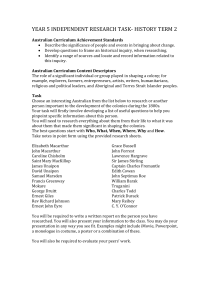

advertisement