Sufficient Statistics - University of Exeter Business School

advertisement

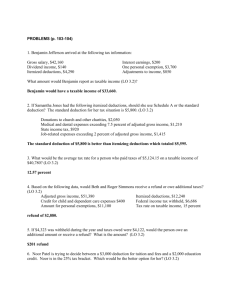

When are “Sufficient Statistics” Sufficient? by Roger Gordon* What information do we need to estimate the efficiency effects of a tax reform? In theory, if the personal income tax consists of a tax schedule t (Y ) on taxable income Y, where taxable income depends on a vector of economic choices, X, then the excess burden generated by a marginal change in any tax provision, denoted by m, can be described by Yh X i , where h is the index for households and i is the index m i t ' (Y ) X h h i for the list of choices entering the tax base. There is a huge empirical literature estimating a wide range of behavioral responses to reforms of the personal income tax, with a key focus on changes in hours of work and labor force participation. In spite of all of this empirical evidence, though, producing an overall measure of the efficiency effects of a tax reform remains a serious challenge, since there any many more behavioral responses that could occur than have been studied to date.1 Feldstein’s seminal work2 showed, however, that it is sufficient simply to estimate the impact of a tax reform on reported personal taxable income.3 The demonstration is trivial: (1) Yh X i dY t ' (Yh ) h m h dm i t ' (Y ) X h h i There is a rapidly growing number of papers examining the impact of behavioral responses to personal tax reforms on personal taxable income.4 The general finding is that taxable income is far more responsive to taxes than past studies find for labor supply. Some other type of behavior must be much more responsive to taxes than labor supply. The elegance of the Feldstein result is that it does not matter the specific * This paper is a synopsis of a presentation to be made at the Public Economics Conference at the University of Exeter on September 14, 2013. 1 Some, such as effort, are particularly hard to document. 2 See Feldstein (1999) 3 To capture just the impact of behavioral responses on taxable income, though, changes in taxable income due to other sources, e.g. direct effects of statutory changes on the tax base as well as general economic trends must be netted out. 4 See Saez, Slemrod, and Giertz (2012) for a recent survey. There are also several recent papers estimating the impact of behavioral responses to the corporate income tax on corporate taxable income. 1 behavioral response that leads to the observed change in taxable income: all that matters is the overall change. But is taxable income really a sufficient statistic for these efficiency effects of tax reforms? The aim of this presentation is to emphasize the many limitations of this summary measure. Four different omissions are emphasized. One important but challenging omission is externalities. The evidence in Gruber and Saez (2002) suggests that changes to itemized deductions may be a key reason why taxable income has been much more responsive to taxes than labor supply. They find in particular that taxable income is much more responsive to taxes than AGI, and the difference is largely itemized deductions. Itemized deductions in the U.S. consist primarily of charitable donations, mortgage interest payments, and state and local tax payments. A related provision is the exclusion of employer-provided health insurance from personal taxable income. Each of these provisions is commonly defended as a means of dealing with one or another form of externality. The externalities from charitable donations are obvious: the recipients of these donations clearly benefit from these donations, as do other donors who care about the same recipients. The mortgage-interest deduction encourages home ownership. There are a variety of possible externalities from owning instead of renting.5 Similarly, the deduction for state and local tax payments is commonly defended as a means of internalizing inter-jurisdictional spillovers.6 The exemption from tax of employer-provided health insurance will increase the propensity of healthy workers to participate in these plans, easing lemons problems and thereby reducing insurance premia for all workers. On efficiency grounds, the optimal Pigovian subsidy to higher spending should equal the value of the externalities generated by this higher spending. If current implicit subsidies do in fact equal these optimal subsidies, then these particular behavioral responses to a tax reform would generate no marginal change in efficiency. The presumption must be, though, that current subsidy rates are well below the optimal Pigovian subsidy. Only about a quarter of households itemize their deductions, leaving no subsidy for three-quarters of households. The quarter who itemize tend to be the richest households. The resulting distributional costs of these subsidies must then be weighed against any efficiency benefits, resulting in a subsidy presumably much below For example, given the large fixed costs of selling one’s house, owners are more willing than renters to exercise “voice” in order to improve local public services, aiding in the process other local residents. Owners, unlike renters, have an incentive to take into account the costs of higher local spending (through higher local property taxes) as well as the benefits, leading to more efficient decisions on local public services when more local residents are owners. 6 State and local redistribution leads to exit of net payers and entry of net recipients, providing a positive fiscal externality to other states and localities. A more commonly cited externality is that non-residents who pass through a jurisdiction benefit from many of its local public services. There may also be externalities when more educated migrants from that jurisdiction locate elsewhere, as argued by Moretti (2004). 5 2 the Pigovian level. If this argument is right, then any fall in itemized deductions (with the associated rise in taxable income) when tax rates fall implies an efficiency loss, rather than the efficiency gain that would be presumed due to the rise in taxable income. Other omissions arise due to implicit simplifications in the above derivation used by Feldstein. Feldstein restricted attention to a one-period setting with just a personal income tax (and no contingent transfer programs). The logic easily generalizes, however. Relaxing these restrictions, we quickly see that the marginal excess burden should be measured by the impact of behavioral responses on the government budget, or on the present value of tax revenue minus the present value of government spending. Feldstein focused on what can be measured easily: changes in contemporaneous personal taxable income. For some types of behavioral responses, this may indeed be sufficient. But in general, many other elements of the government budget can be affected by the expected behavioral responses to reforms in the personal income tax. One major such omission is income shifting between the personal income tax base and the corporate income tax base.7 When any increase in personal taxable income from a tax reform is matched by a drop in corporate taxable income, then the resulting efficiency gain equals the amount of income shifted times the difference between personal and corporate tax rates. Ideally, effective tax rates on corporate and personal income would be equal, to avoid distorting a variety of decisions.8 In this case, there would be no net efficiency effect of any changes in income shifting in response to a tax reform, in spite of the resulting changes in personal taxable income. Changes in income shifting between the corporate and the personal tax bases have been a major response to recent tax reforms. After the Tax Reform Act of 1986 in the U.S., the corporate tax rate shifted from being slightly below the maximum personal tax rate to being slightly above this rate. In response, there was a major jump in the income of both partnerships and sub-chapter S corporations, presumably offset by an equal fall in C corporate income. With such large changes in behavior in response to changes in the sign of small differences between the top personal and corporate tax rates, the presumption must be that the efficiency effects of these changes in behavior were indeed second order, even though these jumps in non-corporate business income were an important source of the overall increase in personal taxable income documented in Feldstein (1999). 7 Gordon and Slemrod (2002) document the sizeable impact of personal tax reforms in the U.S. on reported corporate taxable income. 8 For example, the choice of organizational form (corporate vs. non-corporate) depends on this difference in tax rates; the choice between equity and debt finance depends on this difference in rates; and the choice by an owner of a closely-held business to receive income from her business through wages or instead to retain the earnings within her firm also depends on this difference in rates. Note, though, that the tax rate on corporate income includes not only the corporate tax itself, but also additional personal taxes (on capital gains or dividend income) when shareholders receive this net-of-corporate tax income. 3 Another major such omission from the Feldstein model is inter-temporal income shifting. One of the most dramatic responses to the Tax Reform Act of 1986 was a massive jump in capital gains realizations prior to the date of implementation of the new law. Capital gains must be realized sooner or later.9 By realizing gains prior to the date of implementation of the 1986 Tax Reform, more was paid in tax immediately, but individuals thereby avoided paying even more in present value had they instead waited to realize accumulated gains until after the new higher capital gains tax rate went into effect. These tax savings for the individual, though, mirror tax losses in present value for the government. This jump in taxable income and therefore in current tax revenue must then have been more than offset by a drop in future tax revenue, implying on net an efficiency loss. As another example, Goolsbee (2000) documents that a major component of the drop in reported taxable income following the increase in the top personal tax rate in 1993 was an early exercise of existing managerial stock options, thereby avoiding the increase in tax rates. Managers gave up the remaining value of the option in order to avoid the upcoming higher tax rate on their accumulated net income from the option. While the managers saved on taxes as a result, the government lost revenue in present value, implying an efficiency loss. Taxable income fell as well following the increase in tax rates, so the conventional procedure would also find an efficiency loss. But the true loss depends on the difference in tax rates sufficient to induce this response, and would be much over-estimated by the contemporaneous fall in taxable income in 1993. Another related omission is effects of various behavioral responses to a tax reform on government spending. By the envelope condition, behavioral responses should have no effect at the margin on individual utility or business profits, even when these behavioral responses generate changes in government spending. As a result, the marginal excess burden depends on the impact of these behavioral responses on the overall government budget, including their impact on government spending. For example, a cut in tax rates may lead people to postpone retirement, thereby reducing Social Security payouts. The increase in reported personal taxable income due to postponed retirement then understates the efficiency gain, which now includes any resulting improvement to the budget of entitlement programs due to both lower benefit payouts and additional payroll tax payments. As another example, lower taxes may induce some people to return to work from unemployment more quickly, not only increasing reported taxable income but reducing UI payouts (or other safety-net spending). The resulting increase in taxable income again underestimates the efficiency impact of such a behavioral response. 9 I ignore here the possibility of write-up of basis at death. 4 As final example, a cut in current tax rates may induce some people to leave school more quickly to take advantage of the higher after-tax wage rates currently available.10 If taxes discourage education (in spite of any subsidy to education itself), as argued by Heckman, Lochner, and Taber (1998), then such a behavioral response lowers the present value of tax revenue and generates an efficiency loss, in spite of the resulting increase in contemporaneous taxable income. In spite of these various omissions, there certainly remain a variety of behavioral responses where the change in taxable income is indeed a “sufficient statistic” for the resulting efficiency effects, e.g. changes in effort, hours of work, or occupational choice. However, the efficiency effects of the key behavioral responses that have been identified in the recent literature as being responsible for the large observed changes in taxable income following recent tax changes in the U.S. are not captured correctly by the resulting change in contemporaneous personal taxable income. In many cases, the correct measure of the efficiency effect would not even have the same sign as the change in taxable income. Even when the sign is the same, the magnitude could differ dramatically. The hard work of analyzing the efficiency effects of tax reforms cannot be circumvented through an appeal to the elegant theory of Feldstein’s. References Feldstein, Martin S. 1999. “Tax Avoidance and the Deadweight Loss of the Income Tax,” Review of Economics and Statistics 81, pp. 674-80. Goolsbee, Austan. 2000. “What Happens When You Tax the Rich? Evidence from Executive Compensation,” Journal of Political Economy 108, pp. 352-378. Gordon, Roger and Joel Slemrod. 2000. “Are ‘Real’ Responses to Taxes Simply Income Shifting Between Corporate and Personal Tax Bases?” In Joel Slemrod, ed., Does Atlas Shrug? The Economic Consequences of Taxing the Rich: Gruber, Jon and Emmanuel Saez. 2002. “The Elasticity of Taxable Income: Evidence and Implications,” Journal of Public Economics 84, pp. 1-32. Heckman, James, Lance Lochner, and Christopher Taber. 1998. “Tax Policy and Human Capital Formation,” American Economic Review 88, pp. 293-297. Moretti, Enrico. 2004. “Workers’ Education, Spillovers, and Production: Evidence from Plant-Level Production Functions,” American Economic Review 94, pp. 656-690. The representative tax rate on one’s overall income over the course of a career may be little affected by this year’s tax reform, given how frequently tax reforms occur, leaving the future benefits from education little changed while the current opportunity costs of education go up. 10 5 Saez, Emmanuel, Joel Slemrod, and Seth Giertz. 2012. “The Elasticity of Taxable Income with Respect to Marginal Tax Rates: A Critical Review,” Journal of Economic Literature 50, pp. 3-50. 6