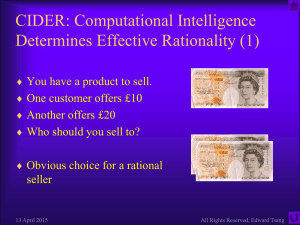

Adapting financial rationality: Is a New Paradigm

advertisement