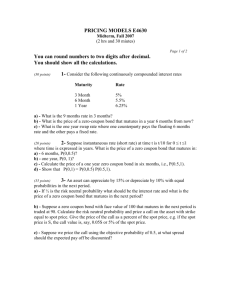

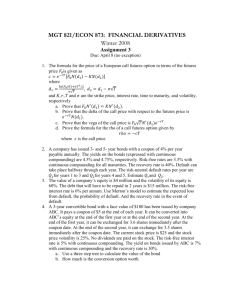

Exam #2 Type B Answers and Solutions

4.

1.

2.

3.

Towson University

Department of Finance

Fin331

Dr. M. Rhee

2010 Spring

NAME:

ID#:

If APR = 10%, what is the EAR (effective annual rate) for quarterly compounding? a. 10.00% b. 10.38% c. 12.36% d. 13.36% e. 15.52%

Answer: b

APR = Nominal rate

Periods/yr

EFF% =(1+(r

NOM

/N))

N − 1

=

10.00%

4

10.38%

If the current one year CD rate is 3% and the best estimate of one year CD which will be available one year from today is 5%, what is the current two year CD rate with 1% liquidity premium? a.

4.0% b.

4.5% c.

5.0% d.

5.5% e.

6.0%

Answer: C

(1 +

0

R

2

– 0.01) 2 = (1.03) 1 × (1.05) 1

0

R

2

= {(1.03) × (1.05)} 1/2 + 0.01 – 1 = 4.9952% ≈ 5.00%

Which of the following statements is CORRECT, assuming positive interest rates and holding other things constant? a. The present value of a 5-year, $250 annuity due will be lower than the PV of a similar ordinary annuity. b. A 30-year, $150,000 amortized mortgage will have larger monthly payments than an otherwise similar

20-year mortgage. c. A bank loan's nominal interest rate will always be equal to or greater than its effective annual rate. d. If an investment pays 10% interest, compounded quarterly, its effective annual rate will be greater than

10%. e. Banks A and B offer the same nominal annual rate of interest, but A pays interest quarterly and B pays semiannually. Deposits in Bank B will provide the higher future value if you leave your funds on deposit.

Answer: d

You have a chance to buy an annuity that pays $550 at the beginning of each year for 3 years. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? a. $1,412.84

6.

7.

5. b. $1,487.20 c. $1,565.48 d. $1,643.75 e. $1,725.94

Answer: c

BEGIN Mode

N

I/YR

PMT

3

5.5%

$550

FV

PV

$0.00

-$1,565.48

Therefore, to receive $550 at the beginning of each year for 3 years at 5.5%, the fair value you should pay is $1,565.48

Your aunt has $500,000 invested at 5.5%, and she now wants to retire. She wants to withdraw $45,000 at the beginning of each year, beginning immediately. She also wants to have $50,000 left to give you when she ceases to withdraw funds from the account. For how many years can she make the $45,000 withdrawals and still have $50,000 left in the end? a. 15.05 b. 16.36 c. 17.22 d. 18.08 e. 18.99

Answer: a

BEGIN Mode

I/Y

PV

PMT

FV

N

5.50%

-$500,000

$45,000

$50,000

15.05

How much do you need to save each year from two years from today and onward so that you can have

$1,000 six years from today at 10% interest rate? a.

$150 b.

$164 c.

$173 d.

$183 e.

$190

Answer: b

N=5, I/Y=10, FV=1,000 => PMT = -163.80

Jennifer can make a 100,000 down payment to buy a house. The house is $380,000 and she was offered 30year mortgage and 15-year mortgage at a market rate of 12%. How much more interest would Jennifer pay if she took out a 30-year mortgage instead 15-year mortgage? a.

$106,430 b.

$413,957 c.

$431,959 d.

$450,790 e.

$490,250

8.

9.

10.

11.

Answer: c

For 30 years: N=30*12=360, I=1%, PV= -(380,000-100,000) => PMT=2,880.12

INT = (2,880.12*360) – 280,000 = 756,843.20

For 15 years: N=15*12=180, I=1%, PV= -(380,000-100,000) => PMT=3,360.47

INT = (3,360.47*180) – 280,000 = 324,884.60

Therefore, the difference in the interests is 756,843.20 - 324,884.60 = 431,958.60

How long will it take for you to pay off $1,500 charged on your credit card, if you plan to make the minimum payment of $15 per month and the credit card charges 24% per annum? a.

10 months b.

35 months c.

10 years d.

863 months e.

You may not be able to pay off the debt

Answer: e

I = 2, PV = -1500, PMT = 15 ⇨ N = ? Error 5 is “No solution exists” in the Texas Instrument BA II Plus

5-year Treasury bonds yield 5.5%. The inflation premium (IP) is 1.9%, and the maturity risk premium

(MRP) on 5-year T-bonds is 0.4%. There is no liquidity premium on these bonds. What is the real risk-free rate, r*? a. 2.59% b. 2.88% c. 3.20% d. 3.52% e. 3.87%

Answer: c

Basic equation: r = r* + IP + MRP + DRP + LP r

T-bond

IP

MRP

LP and DRP r* = r

T-bond

– IP – MRP

5.50%

1.90%

0.40%

0.00%

3.20%

Suppose the interest rate on a 1-year T-bond is 5.0% and that on a 2-year T-bond is 7.0%. Assuming the pure expectations theory is correct, what is the market's forecast for 1-year rates 1 year from now? a. 7.36% b. 7.75% c. 8.16% d. 8.59% e. 9.04%

Answer: e

1-year rate today

2-year rate today

Maturity of longer bond

Ending return if buy the 2-year bond = needed return on series of 1-year bonds

Rate of return, or yield, on a 1-year bond 1 year from now:

5.00%

7.00%

2

1.1449

X in this equation: (1.05)(1 + X) = 1.1449

X = 1.1449/1.05 − 1 = 9.04%

Which of the following statements is CORRECT?

a. The yield on a 2 year corporate bond should always exceed the yield on a 2 year Treasury bond. b. The yield on a 3 year corporate bond should always exceed the yield on a 2 year corporate bond. c. The yield on a 2 year Treasury bond should always exceed the yield on a 2 year Treasury bond. d. If inflation is expected to increase, then the yield on a 2 year bond should exceed that on a 3 year bond. e. The real risk-free rate should increase if people expect inflation to increase.

Answer: a

12.

13.

14

5-year T-bonds yield 4.75%. The real risk-free rate is r* = 3.60%, and the maturity risk premium for all bonds is found with the formula MRP = (t – 1) × 0.1%, where t = number of years to maturity. What inflation premium (IP) is built into 5-year bond yields using 5-year T-bonds? a. 0.68% b. 0.75% c. 0.83% d. 0.91% e. 1.00%

Answer: b

Using 5-year T-bonds

Basic equation: r = r* + IP + MRP r

T-bond r*

Required data

Required data

Years to maturity Required data

MRP = (t – 1) × (0.1) =

IP = r

T-bond

− r* − MRP

4.75%

3.60%

5

0.40%

0.75%

Suppose the real risk-free rate is 3.50%, the average future inflation rate is 2.50%, a maturity premium of

0.2% per year to maturity applies, i.e., MRP = 0.20%(t), where t is the years to maturity. Suppose also that a liquidity premium of 0.50% and a default risk premium of 1.35% applies to A-rated corporate bonds.

What is the difference in the yields on a 5-year A-rated corporate bond and on a 10-year Treasury bond?

Here we assume that the pure expectations theory is NOT valid, and disregard any cross-product terms, i.e., if averaging is required, use the arithmetic average. a. 0.77% b. 0.81% c. 0.85% d. 0.89% e. 0.94%

Answer: c

Real risk-free rate, r*

IP

MRP, 10-year T-bond

MRP, 5-year corporate

Per year: 0.20%

Per year: 0.20% a. PVIFA is greater than or equal to PVIF b. PVIF is a sum of PVIFA from n=1 to n=N c. PVIF is an inverse of PVIFA

Years: 10

Years: 5

LP

DRP

T-bond yield

A bond yield r

T-bond

= r* + IP + MRP + DRP + LP r

Corp

= r* + IP + MRP + DRP + LP

Difference

What is the relationship between PVIFA(r%, N) and PVIF(r%, N)?

3.50%

2.50%

2.00%

1.00%

0.50%

1.35%

8.00%

8.85%

0.85%

15.

16.

17.

18. d. PVIF is used for an annuity e. None of the above

Answer: a

PVIFA is a sum of present values of payments. Therefore, a

Ryngaert Inc. recently issued noncallable bonds that mature in 15 years. They have a par value of $1,000 and an annual coupon of 5.7%. If the current market interest rate is 7.0%, at what price should the bonds sell? a. $817.12 b. $838.07 c. $859.56 d. $881.60 e. $903.64

Answer: d

Coupon rate

PMT

N

I/YR

5.70%

$57.00

15

7.00%

FV

PV

$1,000

-$881.60

Sadik Inc.'s bonds currently sell for $1,180 and have a par value of $1,000. They pay a $105 annual coupon and have a 15-year maturity, but they can be called in 5 years at $1,100. What is their yield to call

(YTC)? a. 6.63% b. 6.98% c. 7.35% d. 7.74% e. 8.12%

Answer: d

N

PV

PMT

FV

I/YR = YTC

5

-$1,180

$105

$1,100

7.74%

In calculating the current price of a bond paying semiannual coupons, one needs to a. Use double the number of payments. b. Use half the annual coupon. c. Use double the annual market rate as the discount rate. d. All of the above need to be done. e. Only a and b are true.

Answer: e

Bonds sell at a premium from par value when market rates for similar bonds are a. Less than the bond’s coupon rate. b. Greater than the bond’s coupon rate. c. Equal to the bond’s coupon rate. d. Both lower than and equal to the bond’s coupon rate.

19.

20.

21.

22. e. Market rates are irrelevant in determining a bond’s price.

Answer: a

Assume that all interest rates in the economy decline from 10% to 9%. Which of the following bonds would have the largest percentage increase in price? a. An 8-year bond with a 9% coupon. b. A 1-year bond with a 15% coupon. c. A 3-year bond with a 10% coupon. d. A 10-year zero coupon bond. e. A 10-year bond with a 10% coupon.

Answer: d

A portfolio with a level of systematic risk less than that of the market has a beta that is a. equal to zero. b. greater than zero but less than one. c. less than the beta of the risk-free asset. d. less than zero. e. equal to infinity.

Answer: b

Cooley Company's stock has a beta of 1.40, the risk-free rate is 4.25%, and the market risk premium is

5.50%. What is the firm's required rate of return? a. 11.36% b. 11.65% c. 11.95% d. 12.25% e. 12.55%

Answer: c

Beta

Risk-free rate

Market risk premium

Required return

1.40

4.25%

5.50%

11.95%

Consider the following information and then calculate the required rate of return for the Global Investment

Fund, which holds 4 stocks. The market’s required rate of return is 13.25%, the risk-free rate is 7.00%, and the Fund's assets are as follows:

Stock

A

B

C

Investment

$200,000

$300,000

$500,000

Beta

1.50

-0.50

1.25

D $1,000,000 0.75 a. 9.58% b. 10.09% c. 10.62% d. 11.18% e. 11.77%

Answer: e r

M r

RF

13.25%

7.00%

23.

24.

25.

Find portfolio beta:

$200,000

$300,000

Weight

0.100

0.150

Beta

1.50

-0.50

Product

0.1500

-0.0750

$500,000

$1,000,000

$2,000,000

0.250

0.500

1.000

1.25

0.75

0.3125

0.3750

0.7625 = portfolio beta

Find RP

M

= r

M

− r

RF

= 6.25% r s

= r

RF

+ b(RP

M

) = 11.77%

Stock A has a beta of 0.8 and Stock B has a beta of 1.2. 50% of Portfolio P is invested in Stock A and 50% is invested in Stock B. If the market risk premium (r

M

− r

RF

) were to increase but the risk-free rate (r

RF

) remained constant, which of the following would occur? a. The required return would increase for both stocks but the increase would be greater for Stock B than for Stock A. b. The required return would decrease by the same amount for both Stock A and Stock B. c. The required return would increase for Stock A but decrease for Stock B. d. The required return on Portfolio P would remain unchanged. e. The required return would increase for Stock B but decrease for Stock A.

Answer: a

Consider the following information and then calculate the projected expected rate of return for the Global

Investment Fund, which holds 3 stocks.

Stock

A

B

C

Investment

$200,000

$300,000

$500,000

Projected Expected Return for Each Security

15%

-5%

10% a. 5.9% b. 6.5% c. 7.8% d. 8.7% e. 9.5%

Answer: b

Stock

A

B

C

Investment

$

$

$

200,000

300,000

500,000

$ 1,000,000

E(Ri)

15%

-5%

10%

Wi

0.2

0.3

E(Rp)

0.5

Wi*E(Ri)

0.0300

-0.0150

0.0500

6.50%

What is the coefficient of variation for security b?

Boom

Average

Recession

Probability Ra(State=?) Rb(State=?)

0.35 0.30 0.05

0.40

0.25

0.10

--0.15

0.05

-0.05 a.

1.73 b.

1.89 c.

2.01 d.

2.35

e.

3.01

Answer: a

Boom

Average

Recession

Probability Rb (state=?) Pi*Ri Ra-E(Ra) {Ra-E(Ra)}^2 [{Ra-E(Ra)}^2]*Pi

0.35

0.05 0.0175

0.0250

0.000625

0.000219

0.40

0.25

0.05 0.0200

-0.05 -0.0125

0.0250

-0.0750

0.000625

0.005625

0.000250

0.001406

E(Ra) 0.0250

Variance 0.001875

Standard deviation (σ) = Square root (Variance; σ^2)) =

Coefficient of variation = σ / E(Ra) =

0.0433

1.7321