Chapter 8 and 9

advertisement

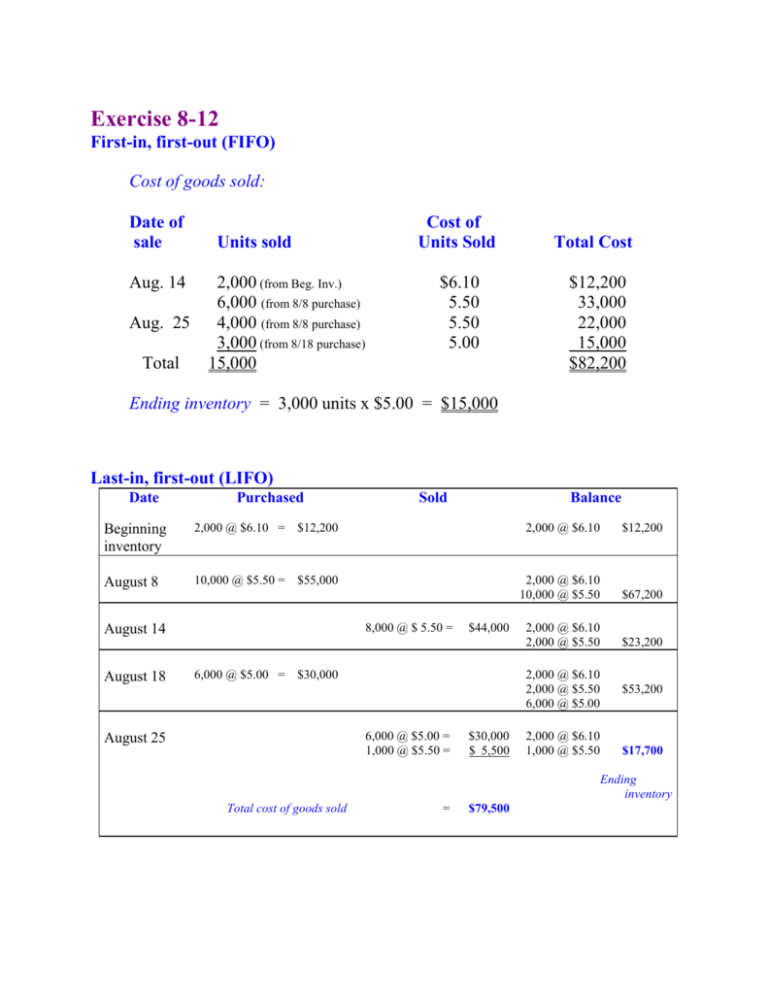

Exercise 8-12 First-in, first-out (FIFO) Cost of goods sold: Date of sale Aug. 14 Aug. 25 Total Cost of Units Sold Units sold 2,000 (from Beg. Inv.) 6,000 (from 8/8 purchase) 4,000 (from 8/8 purchase) 3,000 (from 8/18 purchase) 15,000 $6.10 5.50 5.50 5.00 Total Cost $12,200 33,000 22,000 15,000 $82,200 Ending inventory = 3,000 units x $5.00 = $15,000 Last-in, first-out (LIFO) Date Purchased Sold Balance Beginning inventory 2,000 @ $6.10 = $12,200 2,000 @ $6.10 $12,200 August 8 10,000 @ $5.50 = $55,000 2,000 @ $6.10 10,000 @ $5.50 $67,200 2,000 @ $6.10 2,000 @ $5.50 $23,200 8,000 @ $ 5.50 = August 14 August 18 $44,000 6,000 @ $5.00 = $30,000 2,000 @ $6.10 2,000 @ $5.50 6,000 @ $5.00 6,000 @ $5.00 = 1,000 @ $5.50 = August 25 $30,000 $ 5,500 2,000 @ $6.10 1,000 @ $5.50 $53,200 $17,700 Ending inventory Total cost of goods sold = $79,500 Exercise 8-12 (concluded) (Note: the perpetual inventory LIFO results are the same as periodic LIFO results would be, due to the timing of sales and purchases. The same LIFO layers are on hand at the end of the period under each method. This is unusual. LIFO perpetual and LIFO periodic normally produce different results for ending inventory and cost of goods sold.) Average cost Date Beginning inventory August 8 Purchased Sold Balance 2,000 @ $6.10 = $12,200 2,000 @ $6.10 $12,200 8,000 @ $5.60 = $44,800 4,000 @ $5.60 $22,400 7,000 @ $5.24 = $36,680 3,000 @ $5.24 $15,720 10,000 @ $5.50 = $55,000 $67,200 = $5.60/unit 12,000 units August 14 August 18 6,000 @ $5.00 = $30,000 $52,400 = $5.24/unit 10,000 units August 25 Ending inventory Total cost of goods sold = $81,480 Problem 8-10 Date Ending Inventory at Base Year Cost 1/1/06 $400,000 Inventory Layers at Base Year Cost Ending Inventory DVL Cost Inventory Layers Converted to Cost = $400,000 $400,000 (base) $400,000 x 1.00 = $400,000 $400,000 = $420,000 $400,000 (base) 20,000 (2006) $400,000 x 1.00 = 20,000 x 1.05 = $400,000 21,000 421,000 $400,000 (base) 20,000 (2006) 15,000 (2007) $400,000 x 1.00 = 20,000 x 1.05 = 15,000 x 1.12 = $400,000 21,000 16,800 437,800 $400,000 (base) 20,000 (2006) 5,000 (2007) $400,000 x 1.00 = 20,000 x 1.05 = 5,000 x 1.12 = $400,000 21,000 5,600 426,600 1.00 12/31/06 $441,000 1.05 12/31/07 $487,200 = $435,000 1.12 12/31/08 $510,000 = $425,000 1.20 Exercise 9-7 Cost $35,000 19,120 Beginning inventory Plus: Net purchases Net markups Less: Net markdowns Goods available for sale ______ 54,120 Retail $50,000 31,600 1,200 (800) 82,000 $54,120 Cost-to-retail percentage: = 66% $82,000 Less: Net sales Estimated ending inventory at retail Estimated ending inventory at cost (66% x $50,000) Estimated cost of goods sold (32,000) $50,000 (33,000) $21,120 Exercise 9-16 Cost $160,000 350,200 Beginning inventory Plus: Net purchases Net markups Less: Net markdowns Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) _______ 350,200 510,200 Retail $250,000 510,000 7,000 (2,000) 515,000 765,000 $160,000 Base layer cost-to-retail percentage: = 64% $250,000 $350,200 2006 layer cost-to-retail percentage: = 68% $515,000 Less: Net sales Estimated ending inventory at current year retail prices Estimated ending inventory at cost (calculated below) Estimated cost of goods sold (380,000) $385,000 (234,800) $275,400 ___________________________________________________________________________ Ending Inventory at Year-end Retail Prices Step 1 Ending Inventory at Base Year Retail Prices Step 2 Inventory Layers at Base Year Retail Prices Step 3 Inventory Layers Converted to Cost $385,000 $385,000 (above) = $350,000 1.10 $250,000 (base) 100,000 (2006) x 1.00 x 64% = x 1.10 x 68% = Total ending inventory at dollar-value LIFO retail cost ...................... $160,000 74,800 $234,800 Problem 9-6 Requirement 1 Cost $ 20,000 100,151 5,100 (2,100) Beginning inventory Plus: Purchases Freight-in Less: Purchase returns Plus: Net markups ($2,500 - 265) Retail $ 30,000 146,495 (2,800) 2,235 175,930 $123,151 Cost-to-retail percentage: = 70% $175,930 Less: Net markdowns Goods available for sale Less: Normal spoilage Net sales Estimated ending inventory at retail Estimated ending inventory at cost (70% x $34,900) _______ $123,151 (800) 175,130 (4,500) (135,730) $ 34,900 $24,430 Requirement 2 The difference between the inventory estimate per retail method and the amount per physical count may be due to: 1. Theft losses. 2. Spoilage or breakage above normal. 3. Differences in cost-to-retail percentage for purchases during the month, beginning inventory, and ending inventory. 4. Markups on goods available for sale inconsistent between cost of goods sold and ending inventory. 5. A wide variety of merchandise with varying cost-to-retail percentages. 6. Incorrect reporting of markdowns, additional markups or cancellations. Problem 9-8 ($ in 000s) Cost $80 671 30 Beginning inventory Plus: Net purchases Freight-in Net markups Less: Purchase returns Net markdowns Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) (1) ___ 700 780 Retail $125 1,006 4 (2) (8) 1,000 1,125 $80 Base layer cost-to-retail percentage: = 64% $125 $700 2006 layer cost-to-retail percentage: = 70% $1,000 Less: Net sales Estimated ending inventory at current year retail prices Estimated ending inventory at cost (calculated below) Estimated cost of goods sold (916) $209 (130) $650 ___________________________________________________________________________ Ending Inventory at Year-end Retail Prices Step 1 Ending Inventory at Base Year Retail Prices Step 2 Inventory Layers at Base Year Retail Prices Step 3 Inventory Layers Converted to Cost $209 $209 (above) = $190 1.10 $125 (base) 65 (2006) x 1.00 x 64% = x 1.10 x 70% = Total ending inventory at dollar-value LIFO retail cost ...................... $ 80 50 $130

![Winter 2010 Quiz 2 Ch 9 10[1]](http://s3.studylib.net/store/data/005849740_1-93a37338ab62849607e52f87564e2567-300x300.png)