solutions to exam two review

advertisement

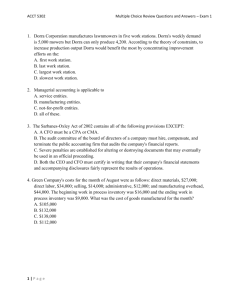

ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 7 – Inventory Methods (Solution) The inventory records of Martin Corporation reflected the following information for the month of August: Required: A. Determine the amount of the ending inventory and cost of goods sold under each of the following methods assuming the periodic inventory system. B. Why would cash flow considerations relate to the choice of an inventory method? A. B. Cash flow considerations would relate to the choice of an inventory method because of income taxes levied on a corporation. In times of rising unit costs, LIFO would produce a higher cost of goods sold, and a lower net income and taxable income than the other methods. Therefore, less cash would be required to pay the taxes. ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 8 – Cost of Factory Equipment (Solution) Waterloo Corporation purchased factory equipment for a cost of $1,800,000. There was also the cost of $100,000 for delivery, $220,000 for installation and modifications to the factory building, and $60,000 in interest costs on borrowed funds used to acquire the equipment. Required: Calculate the acquisition cost of the new equipment. Equipment cost = $2,120,000 = $1,800,000 + $100,000 + $220,000. Interest is not capitalized because the equipment was purchased and not self-constructed. ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 8 – Revaluation of Depreciation Expense (Solution) Frankel Feed purchased a new machine on January 1, 2014. Relevant information is as follows: It is now the beginning of year 6 and the management reevaluated the estimates related to the machine. Required: Compute the depreciation expense for year 6 under each of the following independent cases: Annual straight-line depreciation expense = $2,400 = ($26,000 - $2,000) ÷ 10. A. ($26,000 - $12,000* - $2,000) ÷ (15 years - 5 years) = $1,200 of depreciation expense. B. ($26,000 - $12,000* - $1,000) ÷ (10 years - 5 years) = $2,600 of depreciation expense. C. ($26,000 - $12,000* - $3,000) ÷ (7 years - 5 years) = $5,500 of depreciation expense. * ($2,400 × 5 years) ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 8 – Disposal of Equipment (Solution) Bennett Corporation sold a piece of equipment on June 30, 2016, for $50,000 cash. The equipment had been purchased on January 1, 2012, for $150,000. The equipment had an estimated useful life of 6 years and a $30,000 residual value. Bennett Corp. has been using the straight-line method of depreciation and has a year-end of December 31st. Required: Prepare any necessary journal entries on June 30, 2016, assuming that 2016 depreciation expense has not been recorded. *[($150,000 - $30,000) ÷ 6] × 6/12 ** [($150,000 - $30,000) ÷ 6] × 4.5 years ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 9 – Adjusting Entries (Solution) ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 9 – Ratios (Solution) ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 9 – Liability Section of Classified Balance Sheet (Solution) The following is a partial list of account balances for Coen, Inc. as of December 31, 2014. Required: Prepare the liabilities section of Coen Inc.'s classified balance sheet for December 31, 2014. ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 10 – Bonds (1) (Solution) On January 1, 2014, Lauren Corporation issued $40,000, 9%, ten-year bonds payable at 108. Interest is payable each December 31. Required: A. Prepare the journal entry to record the issuance of the bonds on January 1, 2014. B. Prepare the journal entry to record the first interest payment on December 31, 2014. Use straight-line amortization. No adjusting journal entries have been made during the year. C. What would the carrying value of the bonds be on December 31, 2015? C. Carrying Value = $40,000 + ($3,200 - $320 - $320) = $42,560. ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 10 – Bonds (2) (Solution) Stone Company issued a $1,000,000 bond on January 1, 2014. The bond was dated January 1, 2014, had an 8% stated rate, pays interest annually on December 31, and sold for $1,084,249 at a time when the market rate of interest was 6%. Stone uses the effective-interest method to account for its bonds. Required: Prepare the necessary journal entry for each of the following dates: January 1, 2014 December 31, 2014 December 31, 2015 ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 11 – Dividends (Solution) Marlin, Inc., declared a cash dividend of $40,000 in 2013 when the following stocks were outstanding: No dividends were declared or paid during the prior year. Compute the amount of cash that would be paid to each stockholder group under each of the following separate cases. ACCT 5301 – Exam 2 Review Questions and Answers CHAPTER 11 – Stockholders Equity (Solution) HighRise Company reported the following amounts of contributed capital in the stockholders' equity accounts as of January 1, 2014: Required: Indicate the journal entry to record each of the following transactions by entering the letter code corresponding to each account that would be debited and credited. Enter the code letter and the amount of each debit and credit (do not use dollar signs). The transactions, including the example, are not interrelated.