Exam One - Multiple Choice Review Questions and Answers

advertisement

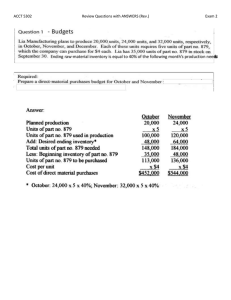

ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 1. Dorra Corporation manufactures lawnmowers in five work stations. Dorra's weekly demand is 5,000 mowers but Dorra can only produce 4,200. According to the theory of constraints, to increase production output Dorra would benefit the most by concentrating improvement efforts on the: A. first work station. B. last work station. C. largest work station. D. slowest work station. 2. Managerial accounting is applicable to A. service entities. B. manufacturing entities. C. not-for-profit entities. D. all of these. 3. The Sarbanes-Oxley Act of 2002 contains all of the following provisions EXCEPT: A. A CFO must be a CPA or CMA. B. The audit committee of the board of directors of a company must hire, compensate, and terminate the public accounting firm that audits the company's financial reports. C. Severe penalties are established for altering or destroying documents that may eventually be used in an official proceeding. D. Both the CEO and CFO must certify in writing that their company's financial statements and accompanying disclosures fairly represent the results of operations. 4. Green Company's costs for the month of August were as follows: direct materials, $27,000; direct labor, $34,000; selling, $14,000; administrative, $12,000; and manufacturing overhead, $44,000. The beginning work in process inventory was $16,000 and the ending work in process inventory was $9,000. What was the cost of goods manufactured for the month? A. $105,000 B. $132,000 C. $138,000 D. $112,000 1|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 5. During August, the cost of goods manufactured was $73,000. The beginning finished goods inventory was $15,000 and the ending finished goods inventory was $21,000. What was the cost of goods sold for the month? A. $79,000 B. $109,000 C. $67,000 D. $73,000 6. Walton Manufacturing Company gathered the following data for the month. How much net operating income will be reported for the period? A. $54,000 B. $17,000 C. $52,000 D. Cannot be determined. 7. Using the following data for August, calculate the cost of goods manufactured: The cost of goods manufactured was: A. $106,000 B. $92,000 C. $95,000 D. $89,000 2|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 8. The following data have been provided by a company for a recent accounting period: The cost of goods manufactured for the period was: A. $147,000 B. $151,000 C. $153,000 D. $154,000 Questions 9-12 are based on the following information Corcetti Company manufactures and sells prewashed denim jeans. Large rolls of denim cloth are purchased and are first washed in a giant washing machine. After the cloth is dried, it is cut up into jean pattern shapes and then sewn together. The completed jeans are sold to various retail chains. 9. Which of the following terms could be used to correctly describe the cost of the soap used to wash the denim cloth? A. Option A B. Option B C. Option C D. Option D 3|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 10. Which of the following terms could be used to correctly describe the wages paid to the workers that cut up the cloth into the jean pattern shapes? A. Option A B. Option B C. Option C D. Option D 11. Which of the following terms could be used to correctly describe the cost of the thread used to sew the jeans together? A. Option A B. Option B C. Option C D. Option D 12. Which of the following terms could be used to correctly describe the wages paid to the data entry clerk who enters customer order information into the company's computer system? A. Option A B. Option B C. Option C D. Option D 4|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 Questions 13-15 are based on the following information A partial listing of costs incurred at Peggs Corporation during September appears below: 13. The total of the manufacturing overhead costs listed above for September is: A. $71,000 B. $351,000 C. $669,000 D. $40,000 14. The total of the product costs listed above for September is: A. $351,000 B. $669,000 C. $71,000 D. $318,000 15. The total of the period costs listed above for September is: A. $389,000 B. $318,000 C. $71,000 D. $351,000 5|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 The following data pertain to Harriman Company's operations during July: 16. The beginning work in process inventory was: A. $10,000 B. $14,000 C. $1,000 D. $4,000 Questions 17-18 are based on the following information Tator Corporation reported the following data for the month of April: 6|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 17. The cost of goods sold for April was: A. $178,000 B. $146,000 C. $126,000 D. $234,000 18. The net operating income for April was: A. $22,000 B. $81,000 C. $46,000 D. $104,000 Questions 19-21 are based on the following information Management of Sourwine Corporation is considering whether to purchase a new model 320 machine costing $389,000 or a new model 280 machine costing $318,000 to replace a machine that was purchased 6 years ago for $376,000. The old machine was used to make product C78P until it broke down last week. Unfortunately, the old machine cannot be repaired. Management has decided to buy the new model 280 machine. It has less capacity than the new model 320 machine, but its capacity is sufficient to continue making product C78P. Management also considered, but rejected, the alternative of simply dropping product C78P. If that were done, instead of investing $318,000 in the new machine, the money could be invested in a project that would return a total of $405,000. 19. In making the decision to buy the model 280 machine rather than the model 320 machine, the sunk cost was: A. $376,000 B. $318,000 C. $405,000 D. $389,000 20. In making the decision to buy the model 280 machine rather than the model 320 machine, the differential cost was: A. $58,000 B. $13,000 C. $29,000 D. $71,000 7|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 21. In making the decision to invest in the model 280 machine, the opportunity cost was: A. $376,000 B. $389,000 C. $405,000 D. $318,000 Callaham Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $115.80 per unit. 22. The best estimate of the total monthly fixed cost is: A. $24,000 B. $478,050 C. $427,600 D. $528,500 23. Faram Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product. The best estimate of the total cost to manufacture 2,300 units is closest to: A. $446,660 B. $465,840 C. $462,415 D. $478,170 8|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 Questions 24-25 are based on the following information Boening Enterprises, Inc., produces and sells a single product whose selling price is $130.00 per unit and whose variable expense is $39.00 per unit. The company's monthly fixed expense is $509,600. 24. Assume the company's monthly target profit is $11,000. The unit sales to attain that target profit is closest to: A. 7,692 B. 13,349 C. 4,005 D. 5,721 25. Assume the company's monthly target profit is $22,000. The dollar sales to attain that target profit is closest to: A. $1,021,010 B. $759,429 C. $1,772,000 D. $531,600 Gallager Company, which has only one product, has provided the following data concerning its most recent month of operations: 9|Page ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 26. The total gross margin for the month under the absorption costing approach is: A. $303,600 B. $132,000 C. $19,800 D. $148,600 Rappaport Corporation reported the following data for the month of February: 27. The cost of goods manufactured for February is: A. $220,000 B. $238,000 C. $241,000 D. $223,000 28. Last year, Gransky Corporation's variable costing net operating income was $52,100 and its ending inventory increased by 400 units. Fixed manufacturing overhead cost was $7 per unit. What was the absorption costing net operating income last year? A. $52,100 B. $2,800 C. $54,900 D. $49,300 10 | P a g e ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 29. Viren Corporation has provided the following data from its activity-based costing system: The company makes 240 units of product T91H a year, requiring a total of 550 machine-hours, 90 orders, and 40 inspection-hours per year. The product's direct materials cost is $16.98 per unit and its direct labor cost is $12.09 per unit. According to the activity-based costing system, the average cost of product T91H is closest to: A. $79.66 per unit B. $90.81 per unit C. $29.07 per unit D. $75.70 per unit 11 | P a g e ACCT 5302 Multiple Choice Review Questions and Answers – Exam 1 Answers: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 12 | P a g e D D A D C B D A C A B B A A B A B C A D C A B D B B B C B