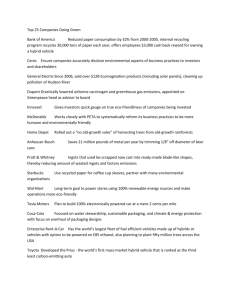

ProgrammeResponseClimate Change 2015

advertisement