Econ 399 A3 Topics covered

advertisement

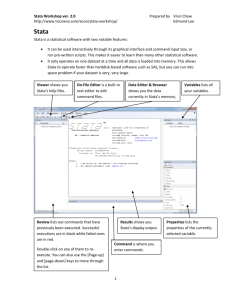

Econ 399 A1/A3 Topics covered by date Date September 1 September 3 September 8 September 10 September 15 September 17 September 22 Topics Covered Course outline, course aims, “What is Econometrics?”, examined class example data sets, discussed basic ‘basketball ticket price’ and ‘commodity price’ models. setting up a model for econometrics (dependent variable, explanatory variables, coefficients, random error term); review of functional forms for econometric models (including slopes and elasticities); discussion of preliminary basketball model; introduction to using Stata for graphs, summary statistics and correlations. Estimation Methods - “Fitline” example with 10 data points - Derivation of the OLS estimator for a model with only one explanatory variable Using OLS for models with no X’s, one X, multiple X’s Using Stata’s regress comand for OLS with multiple X’s, using Stata’s predict command to find “y-hat” and “u-hat” - Algebraic Properties of OLS - Finding Total, Explained (Model) and Residual Sum of Squares in Stata - Derivation and interpretation of R2 and adjusted-R2 - Introduction to statistical properties of OLS: random and non-random components of Y; assumptions about u - statistical properties of u, Y and OLS estimators ̂1 ) in a model with only one explanatory - (E(𝛽 variable; - unbiased estimators ̂1 ) : formula developed for simple case -- Var(𝛽 of only one explanatory variable - Gauss Markov Theorem - omitted variable bias - adding the assumption of normality for the error term - t-tests Readings Chapter 1 of Textbook Chapter 1 of Textbook; functional form handout from web page; First Stata example from webpage. Fitline handout from web page; -Chapter 2.1, 2.2, Appendix 2A in Textbook Chapter 2.3, 3.1, 3.2 in Textbook First Stata example from webpage - Chapter 2.3, 3.1, 3.2, 3.3 in Textbook - Class handout: Review of summation, expectation and variance operators First Stata example from webpage - Chapter 2.5, 3.3, 3.4, 3.5 - Chapter 4.1, 4.2 - illustrations from Stata examples 1 and 2 September 24 September 29 October 1 October 6 - review of t-test procedure - using the lincom command in Stata for t-tests - interpreting p-values - confidence intervals: formula and how to calculate in Stata - introduction to F tests: restricted and unrestricted models - F test of overall significance - proof that R-square is zero when there are no X’s in the model - F tests continued - the relationship between t and F tests - F tests for whether or not a subset of X’s belong in the model - An introduction to dummy (binary) variables - Allowing for different intercepts across 2 groups October 8 - F tests for seasonal effects - Chow test (with and without the use of dummy variables) October 13 - F tests for seasonal effects (same results regardless of “base” period or drop intercept and put in all 4 quarterly dummies) - Reset test for functional form - Using a dummy variable for your “Y”: OLS - Detailed answers to Part B of Assignment #1 including review of determining whether or not an estimator is unbiased, deriving the OLS estimator for various models, properties of Cobb-Douglas production functions; overview of Part A answers - Discussed sample mid-term - Discussed answers to Assignment #2 - Assignment # 1 returned MIDTERM - Writing Across the Curriculum Presentation (Daniel Harvey) - Review of using OLS with a dummy variable Y (see Oct. 13) - Measuring prediction success with a dummy variable Y - Probit and Logit as alternatives to OLS October 15 October 20 October 22 October 27 October 29 - Chapter 4.2, 4.3, 4.4 - Stata example 2 - Chapter 4.5 - Stata example 2 - Chapter 4.5 - Stata example 2 - Chapter 7.1, 7,2 - Stata example 3 - Excel version of example 3 data - Chapter 7.3, 7,4, Chapter 10.5 (see sub-section on seasonality) - Stata example 3 - Stata example 6 - Stata example 6 - Chapter 9.1 - Chapter 7.5 - Part A answers are posted on website; - If you missed class, you will need to get the Part B answers from a classmate - sample midterm on website - Assignment 2 answer key on website - link to presentation slides has been posted on course web page - Stata example 4 - Chapter 17.1 November 3 November 26 - Midterm returned. (Answers will not be posted. If you missed class you will should get the answers from a classmate.) - Heteroskedasticity (definition, consequence, intro to testing strategies) -Weighted Least Squares - Heteroskedasticity: how do we detect it (what tests can we use)? (White and BP tests) - Heteroskedasticity: correcting the standard errors, t-tests and F test (using the vce(robust) option in Stata) - Autocorrelation: Introduction: what is it? what are the consequences? - Rewriting the model (quasi-differencing) to obtain a new equation with no autocorrelation - Autocorrelation tests (BG and DurbinWatson) - Remedies for autocorrelation (using Stata’s PRAIS and NEWEY commands) - Empirical Report Workshop December 1 - Dynamic Models December 3 - Multicollinearity and VIFs November 5 November 17 November 19 November 24 - Chapter 8.1, 8.3, 8.4 - Chapter 8.2, 8.3 - Example 7 Chapter 12.1, 12.3 - Chapter 12.2, 12.3 - Example 8 - Sample Template posted on class website Chapter 9.2 (crime rate lagged dependent variable example), 10.2; - Example 9 Chapter 3.4, 4.2 - Example 9