CMTH-Vvedensky-4

advertisement

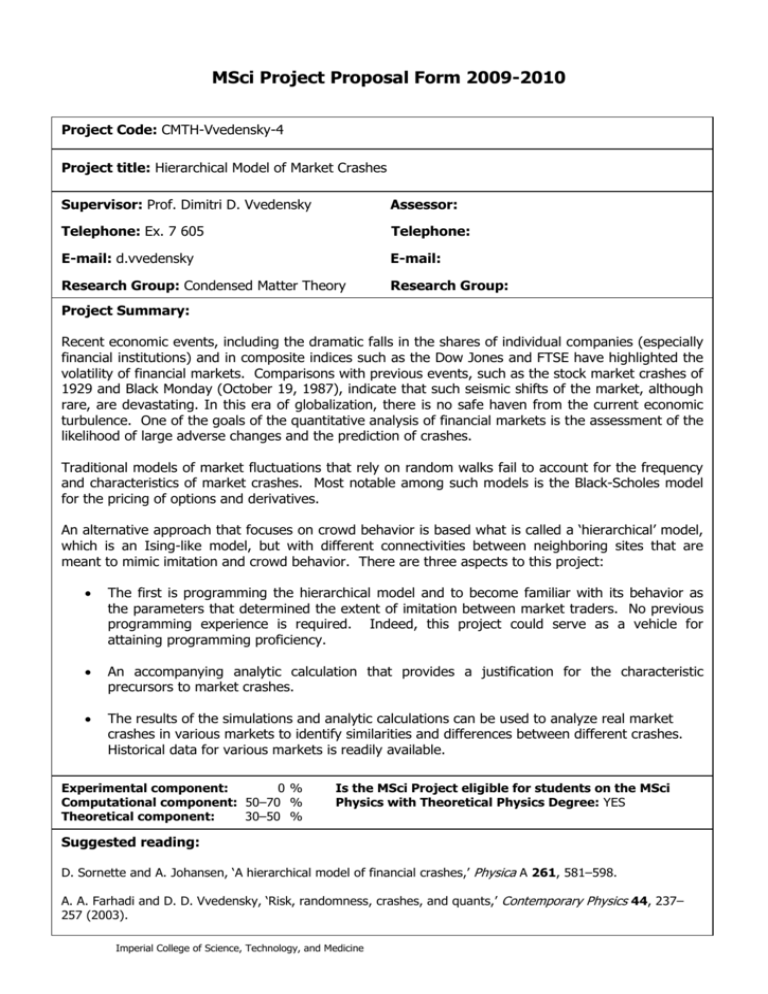

MSci Project Proposal Form 2009-2010 Project Code: CMTH-Vvedensky-4 Project title: Hierarchical Model of Market Crashes Supervisor: Prof. Dimitri D. Vvedensky Assessor: Telephone: Ex. 7 605 Telephone: E-mail: d.vvedensky E-mail: Research Group: Condensed Matter Theory Research Group: Project Summary: Recent economic events, including the dramatic falls in the shares of individual companies (especially financial institutions) and in composite indices such as the Dow Jones and FTSE have highlighted the volatility of financial markets. Comparisons with previous events, such as the stock market crashes of 1929 and Black Monday (October 19, 1987), indicate that such seismic shifts of the market, although rare, are devastating. In this era of globalization, there is no safe haven from the current economic turbulence. One of the goals of the quantitative analysis of financial markets is the assessment of the likelihood of large adverse changes and the prediction of crashes. Traditional models of market fluctuations that rely on random walks fail to account for the frequency and characteristics of market crashes. Most notable among such models is the Black-Scholes model for the pricing of options and derivatives. An alternative approach that focuses on crowd behavior is based what is called a ‘hierarchical’ model, which is an Ising-like model, but with different connectivities between neighboring sites that are meant to mimic imitation and crowd behavior. There are three aspects to this project: The first is programming the hierarchical model and to become familiar with its behavior as the parameters that determined the extent of imitation between market traders. No previous programming experience is required. Indeed, this project could serve as a vehicle for attaining programming proficiency. An accompanying analytic calculation that provides a justification for the characteristic precursors to market crashes. The results of the simulations and analytic calculations can be used to analyze real market crashes in various markets to identify similarities and differences between different crashes. Historical data for various markets is readily available. Experimental component: 0% Computational component: 50–70 % Theoretical component: 30–50 % Is the MSci Project eligible for students on the MSci Physics with Theoretical Physics Degree: YES Suggested reading: D. Sornette and A. Johansen, ‘A hierarchical model of financial crashes,’ Physica A 261, 581–598. A. A. Farhadi and D. D. Vvedensky, ‘Risk, randomness, crashes, and quants,’ Contemporary Physics 44, 237– 257 (2003). Imperial College of Science, Technology, and Medicine