Compound Interest Formulas: Finance Cheat Sheet

advertisement

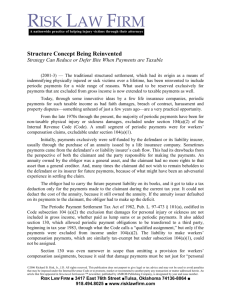

COMPOUND INTEREST FORMULAS (Use to learn procedures and for examinations and quizzes) Frequency of payments Direction Values are Carried Through Time Forward in Time (Compounding) Single Payment 1 - Final value (Value as of end point of series) Vn = V0 (1+i)n Backward in Time (Discounting) 2 - Present value 3 - Rate earned when V0 and Vn (Value as of starting point of a time period ) V0 = Vn/(1+i)n =fv(rate, npr, pmt, [pv],[type]) Vn/V0 = (1+i)n =pv(rate, npr, pmt, fv],[type]) Series ends at a given point of time (Terminal Series) Annual payments and annual rate of interest 4 - Final value of an annuity (Value as of ending point in time of a series of annual payments) Vn = a ((1+i)n -1)/i are known Isolate i on right side, 6 - Present value of an annuity (Value as of the starting point in time of a series of annual payments) Solve for (1+ i) by taking nth root of Vn/V0 and subtracting 1 i =( Vn/V0)1/n - 1 Series goes on indefinitely (Perpetual Series) 10 - Capital value of an Annuity (Value as of the starting point in time of a perpetual series of annual payments) V0 = a/i n 5 - Annual payment to a sinking fund (Amount of annual payment, a, needed to have set amount, Vn, at end of series of payments) a = Vn [i /((1+i)n -1)] Periodic payments (interest period different from payment period 8 - Final value of a series of periodic payments (Value as of ending point in time of a series of periodic payments, p) n V0 = a ((1+i) -1)/(i (1+i) ) 7 - Annual installment payment (Amount of annual payment, a, needed to pay off the amount, V0, over n years) a = V0 [( i (1+i)n)/((1+i)n -1)] 12 - Annual payment to obtain a capital value (Amount of annual payment, a, obtainable in perpetuity from the capital value, V0) a = V0 i 9 – Present value of a series 11 – Capital value of a periodic of periodic payments, a. series (Faustman formula) V0 = p [((1+i)nt -1) / ((1+i)t -1) ((1+i)nt)] V0 = p /((1+i)t -1) Vn = p ((1+i)nt -1)/((1+i)t -1) Interest rate r ≡ real interest rate adjustment for f ≡ rate of inflation i=r+f+rf (1+i) = (1+r) (1+f) r = [(1+i)/(1+f)] - 1 inflation i ≡ nominal interest rate i ≡ nominal interest rate n Ξ total number of payments and total number of periods if interest and payment periods are the same a ≡ amount of annual payment p ≡ amount of periodic payment t ≡ number of interest periods between payments when interest and payment periods differ. nt ≡ total number of interest periods W.L. Hoover, 2011 COMPOUND INTEREST FORMULAS (Use to learn procedures and for examinations and quizzes) Compound Interest Formula Assumptions Time line Time (years) elapsed, also called point of time 1 0 Year 1 2 3 Year 3 Year 2 n Year n Number of the period (year) Single payment that is compounded - Payment is made at point 0, beginning of the first period, and is compounded for n years. Single payment that is discounted – Payment is made at the end of the nth year, and is discounted back n periods to point 0. Annuities and Periodic payments – All payments are made at the end of each period. Therefore, starting at point 0, the first payment occurs at the end of year 1 and is compounded over n periods. The last payment, made in the nth period, is not compounded at all. If there is an initial payment, i.e. at point 0, as well as the series of annuity or periodic payments, the payment in year 0 must be compounded separately since it’s not included in the formula. In the annuity and periodic payment formulas that discount payments back to the beginning of period 1 (point 0), the first payment is discounted back 1 period, and the nth payment is discounted back for n periods. If there is an initial payment it must be added to the value obtained from the formula. See demonstration of these concepts in Excel file W.L. Hoover, 2011