Expenses Policy

advertisement

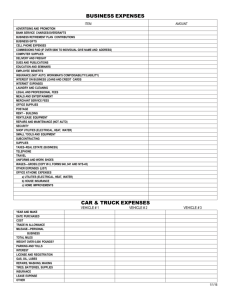

TRAVEL AND EXPENSES POLICY CORPORATE POLICIES AND PROCEDURES Agreed: Issue Date: January 2010 TRAVEL AND EXPENSES POLICY VisitBritain and VisitEngland (VB/VE) are funded primarily by Grant in Aid from the Department for Culture Media and Sport (DCMS) under the provisions of the Tourism Act 1969. We seek to obtain best value for public investment in tourism by ensuring that optimum use is made of all resources during the year including travel and subsistence. We expect all employees to act with prudence with regard to travel and expenses, ensure that they obtain best value for money and comply with all the provisions of this policy. This policy sets out the procedures, which should be followed when UK and Overseas employees are travelling on business or staying in accommodation (including attendance at our London office or outside conferences). This document supersedes all other financial circulars on the subject of travel. It is acknowledged that in certain circumstances it may be necessary to operate outside the terms of this policy. Any variations must be agreed in writing with the relevant Director before arrangements are made. Failure to comply with this policy could result in the individual having to bear the excess costs and could lead to disciplinary action. This policy applies to all staff, except the Chairmen, Board Members and Chief Executive Officers who are subject to a separate policy statement. CONTENTS SECTION PAGE NO. 1 Introduction 2 2 Responsibilities 2 3 Expenses 2 4 Cash advances 3 5 Corporate credit card 3 6 General Travel 4-5 7 Accommodation & Subsistence 6 8 Entertainment 6 9 Mobile Phones 7 10 Working from Home 8 11 Meetings 8 12 Travel Insurance / Security of Assets 8-10 Appendix 1 – Travel Authorisation Form Appendix 2 – Expense Claim Form Appendix 3 – Overseas Travel Expense Claim Form 1 1 INTRODUCTION 1.1 Your CEO or your respective Director, Office Manager or Head of Department must give permission to travel outside your country of normal residence, prior to any arrangements being made e.g. air tickets and/or car hire. The permission will be given on completion of the form, attached as Appendix 1, which will be signed by the CEO, Director, Office Manager or Head of Department as appropriate. The business justification for this travel must be given on the form. As a courtesy, when visiting overseas offices contact should be made with the Regional Director responsible for the office to which you are travelling. 2 RESPONSIBILITIES 2.1 The Chief Executives are responsible for ensuring all employees adhere to the Travel and Expenses Policy. 2.2 The Chief Executives will authorise and monitor Directors’ expenses (or in his/her absence the Director of Business Services who will also authorise the Chief Executives’ expenses). 2.3 Directors will monitor expenses from Heads of Department/Line Managers who in turn are responsible for monitoring departmental/office employees’ expenses and highlighting any discrepancies. 2.4 All employees are responsible for ensuring they obtain best value for money and for adhering to this policy. 2.5 All employees must provide comprehensive factual claims for reimbursement promptly, supported by local VAT receipts, vouchers or other proof of payment. Failure to provide supporting documentation could result in the expense being deemed personal by VisitBritain and/or the Inland Revenue. 2.6 The Director of Business Services is responsible for the monitoring and updating of this Policy and procedures. 3 EXPENSES 3.1 We do not expect employees to fund travel and subsistence expenditure out of their own pocket. Therefore, we will reimburse reasonable and necessary expenses based on actual costs incurred by employees. 3.2 All claims for reimbursement of expenditure (not paid for on a corporate credit card) should be made on an Expense Claim Form as soon as possible (copies are attached to this policy and are also available on VIBE [under “Quick Access Forms”]; from the Cashier’s Office in London or from your local accountant in an Overseas Office). 3.3 Corporate credit card expenditure has to be authorised by attaching the credit card statement (or copy of it) to a Credit Card Claim form (Forms are available from the Finance Intranet site under Forms; from cashiers in London and local accountants) and having it authorised in the usual way. 3.4 Receipts, vouchers or other proof of payment must support each claim. Expenses are then authorised by the CEO, Director, Regional Director, Office Manager or Head of Department as appropriate. 3.5 All claims for cash expenditure must be made within one month of incurring the expenditure. Reimbursement may be forfeited if there is not a good reason for the delay. 2 4 CASH ADVANCES 4.1 Cash advances in sterling and/or foreign currency up to £100 are available for travel, subsistence and entertainment expenses and are available on completion of an Advance Form. (Forms are available from the Finance Intranet site under Forms; from the Cashier’s Office in London or from your local accountant in the Overseas Office). Advances not repaid in full will be deducted from a future salary payment or other expenses submitted. (As set out in the Employee Advance Form). 4.2 All advances should be reconciled and repaid within 5 working days of return to the office. 4.3 No employee will be allowed to take out a second advance if the first has not been reconciled and/or repaid. 5 CORPORATE CREDIT CARD 5.1 Employees who travel regularly on business as part of their role can be provided with a corporate credit card with approval from their Director, Office Manager or Head of Department. 5.2 All cardholders in London are required to settle their account directly and claim the expenses supported by receipts immediately once the credit card statement has arrived. We will then reimburse your account within 10 days. Any late payment charges will be the sole responsibility of the cardholder and not VB/VE. We will settle the statement on your behalf if you are travelling overseas or if you are on sick leave, provided that the employee gives the London Finance Department prior notice. Any late paid balance or non paid balance that has to be settled by VisitBritain will be recovered through salary immediately. 5.3 The CEOs, Directors and overseas staff, who have a corporate credit card, do not settle their own accounts directly. They must settle their expense claims directly with their local accountant or with Cashiers Department in London who will reconcile their individual statements. No balances should remain outstanding for more than one month after the statement date. 5.4 Generally the corporate card is for business use only. If by mistake those individuals in item 5.3 apply a personal charge to the card, a cheque for the total amount should accompany the corporate credit card expenses. The cheque should be made payable to VisitBritain or VisitEngland as appropriate. London based cardholders should settle the account in full and reclaim the total less any personal expenses. 5.5 Failure to observe the guidelines may lead to review/withdrawal of your corporate card and possible disciplinary action, including agreement on the recovery of any outstanding monies. 3 6 GENERAL TRAVEL 6.1 Travel should be planned as far as possible in advance to take advantage of cheaper fares and allow flexibility in the time of travel to obtain best value for money. 6.2 All employees are expected to take the most cost-effective means of travel available. 6.3 We will reimburse the cost of Oyster travel for individual journeys; no employee may charge Oyster card travel in London if they have a travel warrant covering the London zones in which they are travelling on business. 6.4 Your travelling arrangements should be planned and considered carefully before booking any mode of transport. For example if it is cheaper to hire a car than to take the train then this should be considered as the preferred option. Likewise it may be cheaper to travel by train than to drive. 6.5 RAIL 6.5.1 Rail travel will normally be in Standard Class. However, if the journey will last for more than 3.5 hours and you will need to work on the train, First Class travel may be purchased providing it is approved in advance by your Director and you are able to purchase a discounted ticket. 6.5.2 Please note that a fare can be much cheaper if two single tickets are purchased rather than a return ticket. All tickets should be purchased as soon as date of travel is known to reduce cost of travel. 6.6 CAR 6.6.1 When planning your journey by car, all employees must be aware of the costs of using your personal car compared to the cost of hiring a car. Employees are expected to use the most economical option and should request prior approval from the Line Manager if they are choosing a higher cost option. Private Car 6.6.2 Private car should be used only when it is a faster and cheaper alternative to public transport. When reclaiming the mileage, an employee must produce evidence of insurance documents and driving licence to the salary department in London or the local office accountant. The insurance documentation must cover business usage. 6.6.3 Where employees use their own vehicles for approved business purposes, a mileage allowance of 40p per mile will be paid up to a limit of 10,000 miles per annum, thereafter 25p per mile will be paid. 6.6.4 It should be noted that the cost of private mileage should be reconciled against the cost of hiring a car prior to the journey taking place, any journey over 150 miles the hired car option should be taken if possible. Overseas rates are agreed with the Head of Financial Accounting on an annual basis or when there are significant movements in costs of fuel. 4 Car Hire 6.6.5 The hire of self-drive vehicles for business requires prior approval from the relevant line manager and normally a vehicle with the lowest practical engine capacity should be hired, e.g. Grade A (Micra) or Grade B (Corsa). If there are three or more individuals in the party, a Grade C (Astra/Almera) or Grade D (Mondeo/Vectra) can be booked. Consideration should be given also as to whether equipment is being carried. Contract rates within the UK have been negotiated by Finance and employees wishing to hire a car should use VIBE for the policy and the negotiated contract rate under [Car Hire Policy] 6.6.6 All cars must be hired using the Hire Car Company’s Collision Damage Waiver (CDW) and Theft Protection (TP) policy and not our Company Insurance. It is illegal to drive on public roads without any insurance. There may also be a Vehicle Licence Fee (VLF) that is payable and this is acceptable. You may take out PAI (Personal Accident Insurance) but VisitBritain will not reimburse you for this cost. 6.6.7 Claims for petrol supplied for the hire car should be accompanied by receipts and show suitable deductions for any private mileage. 6.7 AIR 6.7.1 The company standard is Economy Class throughout the world. However, you may book Business Class for journeys that are in excess of 5 hours providing that the fare is discounted and you will not have time to rest on territory before commencing work commitments. In these circumstances if discounted fares are not available, premium economy or equivalent can be booked. 6.7.2 All employees should find a competitive deal with operators before booking tickets, including low cost carriers, discounted tickets and tickets through gateways outside the country of origin. Two quotes are required for short haul and at least 3 for long haul and the Overseas Travel Authorisation form must be completed and authorised before you book for all travel outside your country of residence (see 1.1. above). 6.8 TAXIS 6.8.1 Taxis should be hired only where public transport is unavailable or when there are special circumstances such as significant inconvenience, unfamiliar locations, or when staff are carrying heavy or bulky packages or luggage, safety issues, or reasons of economy, e.g. a group of people when combined public transportation costs would be higher. Taxi’s between our offices in London or hotels to our offices are not permitted. 6.8.2 Wherever possible taxis or mini-cabs should be pre-booked at a fixed rate. 6.8.3 Taxis for journeys home may only be used in exceptional circumstances and with the agreement of your Director, Head of Department or Office Manager. 5 7 ACCOMMODATION & SUBSISTENCE 7.1 Employees are expected to take advantage of any negotiated deals and apply best value. Assessed accommodation in the VE, VS and VW – or failing that the AA - Quality Schemes must be used. 7.2 Employees who are required to stay away overnight may stay in 3 or 4 star accommodation providing that, on a discounted basis the accommodation does not cost any more than £100 per night inclusive of VAT plus breakfast or the local currency equivalent. Assistance from overseas offices should be sought to obtain the best rate, as costs will vary from city to city. It is appreciated that, given global differences in the cost of living and fluctuating exchange rates the guide figure at 7.2 may need to be exceeded on occasions. However, you must always obtain your Manager’s consent prior to booking if this will be the case. 7.3 While an employee is away from home on business, we will reimburse the cost of a short personal telephone call/telephone calls home each night provided the total duration is no longer than 5 minutes. Hotel phones should be avoided in preference to mobile rates or phone cards, which are much more cost effective. 7.4 No charges relating to mini-bars, (other than for water or a soft drink) films or newspapers will be reimbursed. If the stay is over 7 days, or in exceptional circumstances (eg. loss of luggage) reasonable laundry services may be charged (i.e. no more than £25 or the local currency equivalent.) 7.5 Excluding breakfast, employees travelling on business may claim for a maximum of £35 plus VAT for meals and non-alcoholic drinks in a twenty-four hour period. All expenditure must be supported by receipts and you may not carry over any part of this unspent allowance to another day. 7.6 Employees may claim for a large glass of wine or a pint of beer or its equivalent (or additional soft drinks to a similar value) with their evening meal. No other alcoholic drinks may be claimed for unless you are entertaining. See below. 7.7 If an employee stays with friends or family when travelling on business, he/she can claim £15 for bed and breakfast or £30 for dinner, bed and breakfast using standard expense claim procedures. 7.8 If an employee stays with a colleague, the host can claim £15 for bed and breakfast or £30 for dinner, bed and breakfast. The guest employee’s name must be included on the expense claim form, together with the reason for their stay. 8 ENTERTAINMENT 8.1 All entertaining must be on a modest scale. The names of all persons entertained must be listed when seeking reimbursement of expenses. No reimbursement will be made without this list. Alcohol must be kept to a reasonable level. 8.2 Use of expensive restaurants is to be avoided wherever possible. If there are pressing reasons for using a high tariff restaurant, prior authorisation from the Director must have been obtained and the reasons noted on the expense claim form. 8.3 Working lunches are not reimbursable for employees entertaining each other, except when it is necessary to order sandwiches or similar food during seminars and meetings. 8.4 An employee may take a colleague who is visiting from another country out to dinner with their Manager’s prior consent providing the cost does not exceed £25 per person and the alcohol limit as per 7.6 is observed. 6 9 MOBILE PHONES 9.1 Mobile phones are available only to employees in the UK who undertake business travel and need access to a phone at all times. Overseas staff on secondment or who move overseas must apply for a local phone contract and not use a UK phone at UK rates. 9.2 Mobile phones can be ordered by logging a call with the Service Desk in Technology Department in London or from the Office Manager overseas with prior approval from your Line Manager, Head of Department or Director. All costs are charged to your departmental budget. 9.3 The Administration department in London is billed monthly by Orange, the current contractor, and will charge each department budget quarterly with rental fees and call costs. The current contractors charge overseas office mobile phone costs directly to the overseas office each month. 9.4 We have negotiated extremely competitive rates for London office mobile phones through the Vodaphone network but the contract is run by Garnell. Employees defined in 9.1 must use a mobile phone supplied under the Vodaphone / Garnell contract. 9.5 Phone holders are responsible for reimbursing any personal calls made by highlighting personal calls on the phone bill. The money, inclusive of any local VAT, will be sent to the local accountant or the cashiers department in London. These costs are then reimbursed to the departmental budget. A monthly bill must be signed off even if there are no private phone calls made. 9.6 We will reimburse employees for business calls made on “pay as you go” mobile phones. Employees are asked to note the credit amount used on the business call and to claim for the expense on an Expense Claim Form. 9.7 We will reimburse employees 50% of line rental costs for personal “contract” mobile phones for employees undertaking business travel on a frequent basis who make regular business telephone calls. 9.8 From time to time, we will audit the cost of the phone calls and rental against the personal call costs. If it is obvious that the phone is not being used for business calls we reserve the right to reclaim the mobile phone and take possible disciplinary action, including agreement on the recovery of any monies due. 9.9 For any further information on mobile phones, please contact the Head of Financial Accounting in London or your local accountant in overseas offices. 9.10 Employees should not use hand-held telephones or similar devices while driving, nor hold hands free equipment as to do so is both a criminal offence and a disciplinary matter. Driving can include sitting in a stationary vehicle with the engine on. The only exemption is where the driver is using the phone to call an emergency service in response to a genuine emergency and it is unsafe or impracticable for him/her to stop driving to make the call. In exceptional circumstances, if an employee has to use a mobile phone for business purposes whilst driving, a ‘hands free’ kit will be supplied with the approval of the employee’s Director. 9.11 It is the responsibility of the individual to ensure that all VB/VE property, including mobile phones, are safe and secure at all times. A pin number must be placed on the phone when it is first issued to increase security. If a mobile phone is lost or stolen the individual must cancel the line or ask the London Finance department or their local office to cancel the line on their behalf immediately the loss has been noticed. Failure to carry out the cancellation may result in the phone being used fraudulently and we reserve the right to take possible disciplinary action. 9.12 The Finance department in London holds a losses register and all records of any loss must be notified in writing to the Head of Financial Accounting in London. 7 10. WORKING FROM HOME 10.1 For any entitlement of reimbursement of costs relating to working at home please refer to the “Homeworking Policy” on the P&P section of VIBE. 11. MEETINGS 11.1 The contents of this policy apply not only to individual travel arrangements but to meetings, etc. Meetings include: - Annual Conferences Trade conferences (BTTF/WTM) HUB managers’ meetings in UK and overseas Overseas regional meetings Divisional awaydays. The organiser of the meeting will have negotiated suitable value for money rates for the venue, accommodation (if appropriate) and meals in accordance with this policy and the limit on alcoholic drinks at 7.6 will apply. Staff may of course purchase drinks in excess of this at their own expense. Should the meeting include entertaining 3rd parties section 8 above will apply and expense claims must be supported by the name(s) of the person(s) entertained and the purpose. 12. INSURANCE 12.1 General We are required to follow the Government’s policy of not taking out commercial insurance cover except in the circumstances outlined in the Grant in Aid Conditions. The current Grant in Aid Conditions allow insurance for the following reasons: Where this is a statutory requirement to insure, e.g. motor vehicle insurance as described in paragraph 6.4 above. Where there is an unavoidable contractual obligation to insure, e.g. where a landlord requires a property to be insured under the terms of a lease. To provide travel insurance for employees while travelling on duty. The Grant in Aid Conditions forbid insurance against risk for all other circumstances. 12.2 Personal Property, Theft & Insurance We do not carry insurance to cover personal property and, therefore, you are responsible for any personal property brought on to our premises. We do not accept liability to provide compensation for loss or damage to personal property whilst working in the office. Should personal property be lost or damaged during the course of employment, we have the discretion to make a payment of £50 maximum, providing: the loss or damage is not covered by insurance or by any provision for free replacement 8 12.3 the employee has not been negligent. Business Travel Insurance We have a Business Travel Insurance Policy which covers the following: all employees travelling on VB/VE business. families accompanying expatriate employees of VB/VE who are travelling on expatriate families returning to the UK, or travelling on business outside the domiciled country. business It does not cover: employees for medical expenses whilst travelling on business within the domiciled country leisure time after the business trip has ended. All employees, therefore, are advised to ensure that they take out their own insurance for any such period. We will not reimburse this. Insurance cover is effected once an employee leaves their office or actual residence to start their journey. Cover is provided for the following : i) ii) iii) iv) v) vi) vii) viii) ix) x) xi) Emergency medical and repatriation/transportation expenses Personal accident Medical disablement Provision of screened blood Employee cover where individual is unable to complete assignment Cancellation and curtailment Travel delay and disruption Personal and business effects Personal liability Legal expenses Hazard and kidnap The cover limits can be accessed via the Finance intranet. A copy of the full policy can be obtained from the Head of Financial Accounting. Conditions: cover is for any trip in connection with business, commencing from time of leaving home or normal place of business and return to home or normal place of business. Reporting Procedures: Any incident necessitating a claim should be reported to the appropriate police authorities within 24 hours. Failure to do so may prejudice the insurance claim and any subsequent costs incurred will be recharged to the relevant office/department. If at all possible, the Head of Financial Accounting or in his absence the Director of Business Services should be contacted prior to notifying the authorities; otherwise they must be informed as soon as possible. Finance will advise other departments as necessary. Claims will be facilitated by the provision of full information. Records should be kept with details 9 describing the time, place of incident, parties involved and names and addresses of any witnesses. Police crime report reference numbers must be on all claims for stolen or lost articles. 12.4 The reporting process should be completed within 10 working days of an incident occurring. Security of VisitBritain Assets If an employee takes a valuable item on a business trip (e.g. blackberry, blackberry charger, laptop, laptop charger/ power unit, printer, mobile phone, mobile phone charger, other power unit or power supply, key fobs or a LCD projector) it must be supervised closely at all times or locked away in a cupboard or other secure location. It must not be left in the boot of a car or left unattended in hotel conference rooms. Failure to do so may result in disciplinary action, including agreement on contribution towards any loss. 12.4.1 These items are covered under the Travel Insurance policy only if they are stolen while locked away or in a secure location. If they are lost and staff are negligent they will be asked to cover the cost of a new item 10 Appendix 1 OVERSEAS TRAVEL AUTHORISATION Please complete PART A and return to your director/hub manager for authorisation. On booking travel please complete PART B and then submit to finance with the final invoice to show that a competitive fare has been sought. N.B. Overseas travel should not be undertaken without a signed travel authorisation. 3 Quotes must be obtained for flights PART A Name: Date: Department: Floor: Ext. Date of Outbound Travel: Departure From: Travel to: Date of Return Travel: Departure From: Travel to: Business Justification for Travel: General Manager Approval? Yes/No Employee's Signature: Director's/General Manager’s Signature: PART B (Delete as applicable) Type of Travel: Air Rail Ferry Other: (Please State) Car (Delete as applicable) Cost Comparison: Class: First Business Standard Economy Company: Price: Flexible: Yes No Company: Price: Flexible: Yes No Company: Price: Flexible: Yes No Total Fare Paid: Budget Code: (Delete as applicable) Budget Available: Yes No If ‘NO’ budget available, which cost centre was payment taken from? 11 VisitBritain Appendix 2 EXPENSE CLAIM FORM LOEX No: SUPPLIER Name: Dept: Level 1 (Nominal Code) Date of Expense Details of Expenditure A/C No: Processing Date: 67306 67307 67308 67309 CAR CAR AIR RAIL FUEL HIRE FARES FARES 67310 TAXIS 67311 67312 MILEAGE OTHER ALLOW TRAVEL 67313 ACCOM/ ENTERTAIN GROSS VAT Total (72365) NET I claim the full amount below which has been spent on official VisitBritain business Signature of Claimant: TOTAL PAYABLE Approved by: 12 67314 SUBSIS OTHER Codes Sub Acc Level III VISIT BRITAIN OVERSEAS EXPENSES Name Advance Ref No:- Department Total Foreign Cash Appendix 3 Currency Travellers Cheques Date Level 1 (Nominal 67306 Code): Car Fuel Currency Total 67307 67308 67309 67310 67312 67313 67314 Car Hire Air Fairs Rail Taxis Other Travel Entertain Accm/subsis Finance Department Useage Only ROE £ Value Doc Type PCOS PCRC CDOA Doc Number Total Expenses :Total Foreign Cash Returned :Travellers Cheques Returned :- Signature of Claimant :- Expenses Approved By :- 13 67809 Bank Comm Codes Level II Level III