Brand Management-Pharmaceutical Industry

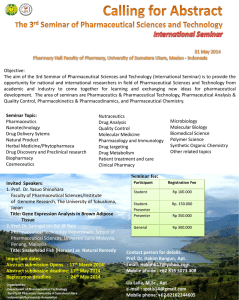

advertisement