Discussion Paper

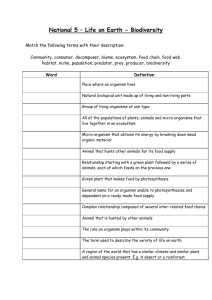

advertisement