Exam 2A, Fin 350, Spring 2011 answers

advertisement

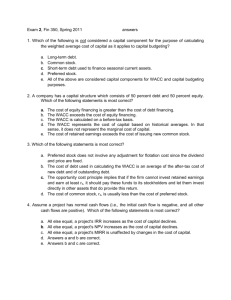

Exam 2A, Fin 350, Spring 2011 answers 1. Which of the following is not considered a capital component for the purpose of calculating the weighted average cost of capital as it applies to capital budgeting? a. b. c. d. e. Long-term debt. Common stock. Preferred stock. Short-term debt used to finance seasonal current assets. All of the above are considered capital components for WACC and capital budgeting purposes. 2. Which of the following statements is most correct? a. Preferred stock does not involve any adjustment for flotation cost since the dividend and price are fixed. b. The cost of debt used in calculating the WACC is an average of the after-tax cost of new debt and of outstanding debt. c. The opportunity cost principle implies that if the firm cannot invest retained earnings and earn at least rs, it should pay these funds to its stockholders and let them invest directly in other assets that do provide this return. d. The cost of common stock, rs, is usually less than the cost of preferred stock. 3. A company has a capital structure which consists of 50 percent debt and 50 percent equity. Which of the following statements is most correct? a. b. c. d. The cost of equity financing is greater than the cost of debt financing. The WACC exceeds the cost of equity financing. The WACC is calculated on a before-tax basis. The WACC represents the cost of capital based on historical averages. In that sense, it does not represent the marginal cost of capital. e. The cost of retained earnings exceeds the cost of issuing new common stock. 4. Assume a project has normal cash flows (i.e., the initial cash flow is negative, and all other cash flows are positive). Which of the following statements is most correct? a. b. c. d. e. All else equal, a project's NPV increases as the cost of capital declines. All else equal, a project's IRR increases as the cost of capital declines. All else equal, a project's MIRR is unaffected by changes in the cost of capital. Answers a and b are correct. Answers b and c are correct. 5. Project A and B both have normal cash flows. Project A has an internal rate of return (IRR) of 15 percent. Project B has an IRR of 14 percent. Both projects have a cost of capital of 12 percent. Which of the following statements is most correct? a. Both projects have a positive net present value (NPV). b. Project A must have a higher NPV than Project B. c. If the cost of capital were less than 12 percent, Project B would have a higher IRR than Project A. d. Statements a and c are correct. e. Statements a, b, and c are correct. 6. Which of the following statements is most correct? a. If a project with normal cash flows has an IRR which exceeds the cost of capital, then the project must have a positive NPV. b. If the IRR of Project A exceeds the IRR of Project B, then Project A must also have a higher NPV. c. The modified internal rate of return (MIRR) can never exceed the IRR. d. Answers a and c are correct. e. None of the answers above is correct. 7. Which of the following is not an incremental cash flow that results from the decision to accept a project? a. b. c. d. e. Changes in working capital. Shipping and installation costs. Sunk costs. Opportunity costs. Cannibalization of existing products. 8. Risk in a project which has only negative cash flows can best be adjusted for by a. b. c. d. e. Ignoring it. Adjusting the discount rate upward for increasing risk. Adjusting the discount rate downward for increasing risk. Picking a risk factor equal to the average discount rate. Reducing the NPV by 10 percent for risky projects. 9. Which of the following statements is most correct? a. The NPV method assumes that cash flows will be reinvested at the cost of capital while the IRR method assumes reinvestment at the IRR. b. The NPV method assumes that cash flows will be reinvested at the risk free rate while the IRR method assumes reinvestment at the IRR. c. The NPV method assumes that cash flows will be reinvested at the cost of capital while the IRR method assumes reinvestment at the risk-free rate. d. The NPV method does not consider the inflation premium. e. The IRR method does not consider all relevant cash flows, and particularly cash flows beyond the payback period. 10. Suppose the firm's WACC is stated in nominal terms, but the project's expected cash flows are expressed in real dollars. In this situation, if prices are expected to increase, the calculated NPV would a. b. c. d. e. Be correct. Be biased downward. Be biased upward. Possibly have a bias, but it could be upward or downward. More information is needed; otherwise, we can make no reasonable statement. Show your work for problems and label your answers. 1. (12 points) Flagstaff Manufacturing’s (FM) only debt is represented by 800,000 bonds with a market price per bond of $1,040. It has 20 million shares of common stock outstanding with a market price of $60 per share, and no preferred stock. a. Calculate the market value of long-term debt and common equity, and the percentage of capital obtained from each source. $ % Debt 832M 40.94 Com St 1,200M 59.06 Total 2,032M b. The bonds have a coupon rate of 7% and based on the market price of the bonds, the yield to maturity is 6%. FM has a 40% tax rate. Calculate the after-tax cost of debt financing. ATrd = 3.6% The market price of common stock is $50. The firm paid a dividend of $2.00 per share of common stock in the fiscal year that just ended. Dividends are expected to increase at an annual rate of 5%. The stock’s beta is 0.70. The risk-free rate is 5% and the expected return on the market is 11%. c. Calculate the required return on common stock using CAPM. rs = 9.2% d. FM does not plan to sell any additional shares of common stock this year and anticipates adding $20 million to retained earnings this year. Use the market value weights and your answers above to calculate the weighted average cost of capital (WACC). WACC = .4094 (3.6) + .5906 (9.2) = 1.47 + 5.43 = 6.90% 2. (10 points) At any given time, should the same WACC be used to evaluate each of a company’s capital budgeting projects? Explain why or why not. In answering, explain what kinds of capital budgeting mistakes could result and the consequences of those mistakes if firms do not use the appropriate WACC for each project. Read pp. 347-350 of the text. 3. (10 points) Acme Chemical is considering two mutually exclusive machines: Machine X has a cost of $62,000 and provides after-tax cash flows of $42,600 per year for 2 years. It has a required return of 10%. Project Y has a cost of $100,000, provides after-tax cash flows of $40,000 per year for 4 years and has a required return of 12%. Machine prices and cash flows are expected to remain constant in the foreseeable future. Evaluate the two machines and make a decision: which should Acme purchase and why? Show your analysis, including any necessary calculations and make it clear what your decision is based on. Over the 4 year common life, the replacement chain NPVs are: X $21,797 Y $21,494 The equivalent annual annuities are: A $6,876 B $7,077 Because the required returns are different, project X has a slightly higher RCNPV, while Y has a slightly higher EAA. Therefore you decision depends on which method you use. 4. (10 points) The cash flows associated with a project under consideration are shown below. The required return is 10%. Year CF 0 (1,000) 1 500 2 300 3 350 a. Calculate the NPV of the project. NPV = -$34.56 b. Calculate the IRR of the project IRR = 7.88% c. Calculate the MIRR of the project. MIRR = 8.72% 5. (20 points) Replacement project. Existing machine was purchased 1 years ago at a cost of $20,000. For tax purposes, it is being depreciated straight line at $4,000 annually. It can be sold now for 12,000 or used for 4 more years at which time it will be sold for an estimated $2,400. It provides revenue of $15,000 annually and has cash costs of $2,500 annually. A replacement machine can be purchased now for $26,000. It would be used for 4 years, and depreciated using straight line at $6,500 annually. It will result in total sales revenue of $20,000 annually, but because of its increased efficiency its cash expense would remain at $2,500 annually. It is expected to have a salvage value of $4,200 in 4 years. The new machine would require additional inventories of $800, and accounts payable would increase by $500. The tax rate is 40% and the required rate of return is 10%. a. Calculate the incremental initial cash flow associated with acquiring the replacement machine (i.e., CF0). Price of new -ATSV of old, if sold now Increase in net WC Initial investment 26,000 -13,600 300 12,700 The initial investment is a negative cash flow. Problem 5, continued. c. Calculate the incremental annual operating cash flows. (They are the same each year, so do it for one year only.) Annual operating CF, new = (20,000 – 2,500) (.6) + (6,500) (.4) = 13,100 Annual operating CF, old = (15,000 – 2,500) (.6) + (4,000) (.4) = 9,100 Incremental operating CF = 4,000 This is a positive CF. d. Calculate the incremental terminal cash flow. ATSV of new in 4 years -ATSV of old in 4 years Change in net WC Terminal CF This is a positive CF. 2,520 -1,440 300 1,380 Problem 5, continued. e. Show the incremental CFs that should be used to evaluate the replacement project in the table below. Year Cash Flow 0 (12,700) 1 4,000 2 4,000 3 4,000 4 5,380 6. (8 points) Under what conditions might a project have more than one IRR? When that happens, how should you decide whether or not to accept the project? If you were comparing two mutually exclusive projects one with a single IRR of 12% and the other with two IRRs of 10% and 150%, how should you choose between the two projects? Read pp. 420-422 of the text. 7. (10 points) Shown below are the cash flows for two mutually exclusive projects, A and B, as well as an excel worksheet showing analysis of those cash flows. Year 0 1 2 3 CFA ($1,200) $800 $500 $200 CFB ($200) $120 $100 $80 CF ($1,000) $680 $400 $120 IRR 15.3% 25.3% 12.9% r 0 10 14 20 25 NPVA $300.00 $90.76 $21.48 ($70.37) ($137.60) NPVB $100.00 $51.84 $36.21 $15.74 $0.96 $350.00 $300.00 $250.00 $200.00 $150.00 $100.00 NPVA $50.00 NPVB $0.00 ($50.00) 0 5 10 15 20 25 30 ($100.00) ($150.00) ($200.00) Use the information above to answer the questions on the next page. Problem 7, continued. As stated above, the two projects are mutually exclusive. a. If the cost of capital is 10%, which project(s) should be selected? State what your decision is based on. b. What is the third column of cash flows (CF) and what is the significance of its IRR? a. A: higher NPV at 10%. b. Read pp. 417-420 of the text. Be sure to read footnote 4 on p. 419.