Insert - Connecticut Individual Development Account Initiative

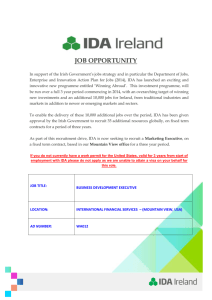

advertisement

The Connecticut Individual Development Account Initiative Eligibility Participants in the CT IDA Initiative Program must reside in a household located in the state of Connecticut, which has an adjusted gross income not in excess of 80% of the Area Median Income (AMI). DOL will provide you with the updated AMI each year. The AMI can also be found by putting the words “HUD Area Median Income” into your web browser. Be sure to specify the current year. (Note: This will give you the AMI; you will need to calculate 80% of AMI.) A “household” is defined as “…all individuals who share use of a dwelling unit as primary quarters for living and eating separate from other individuals.” Also, program operators must make their best effort to ensure that at least 30% of the IDA account holders have earned income at or below 200% of the Federal Poverty Level. DOL will provide you with the updated Federal Poverty Guidelines each year. The Federal Poverty Guidelines can also be found by putting the words “Federal Poverty Guidelines” into your web browser. (Be sure to specify the current year.) In addition, participants in the CT IDA Program must meet one of the following criterion: Have earned income (Note: Proceeds from the Earned Income Tax Credit are considered “earned income”),OR Meet the definition of an individual with a qualified disability. To meet the definition of having a qualified disability an individual must: Be receiving Supplemental Security (SSI) or Social Security Disability Income (SSDI), OR Be receiving Medicaid on the basis of a disability, OR Be participating in rehabilitation services under Chapter 319mm of the CT General Statutes, OR Provide confirmation by the Bureau of Rehabilitation Services (BRS) that the individual is eligible for assistance pursuant to Chapter 319mm of the CT General Statutes, OR September 24, 2013 Provide confirmation of his/her disability by any other agency deemed comparable by DOL. There is no asset test for participation in the CT IDA Program. Allowable Assets Funds may be withdrawn to purchase one of the six Allowable Assets no earlier than 6 months after the initial deposit by a Participant into their IDA, providing the Account Holder has reached his/her savings goal. Purchase of a Home as a Primary Residence – In the Connecticut IDA Initiative an IDA Participant may use their IDA and matching funds to purchase a ”primary residence,” even if it is not a “first home.” Homes must be purchased within the State of Connecticut, but can be purchased outside of the area where the IDA Program operates. The cost of the home cannot exceed 120% of the average area home purchase price for a comparable residence. It is important that you be aware of the housing market in your area. You will want to steer Participants away from areas where housing prices are depreciating and away from poorly constructed homes that will likely not appreciate in value. Usually a Participant will need more than the savings in their IDA and their matching funds for their down payment on a home. You should research other sources of homeownership assistance and form partnerships with first-time homeownership programs so that these resources can supplement Participants’ IDAs. Small Business Capitalization – The Participant’s savings and matching funds can be used for the development of a new or existing entrepreneurial activity. Funds must be paid directly into a business capitalization account that is established in a federally-insured financial institution and restricted for the sole use for qualified business capitalization expenses of the eligible individual in whose name the account is held. The business must not contravene any law or public policy. A business plan must be developed. This business plan: Must be approved by a financial institution, a micro-enterprise development organization, or a non-profit loan fund having demonstrated fiduciary integrity; Must include a description of services or goods to be sold, a marketing plan and projected financial statements; September 24, 2013 May require the Account Holder to obtain the assistance of an experienced entrepreneurial advisor. Post-Secondary Education or Job Training – Such costs may include the costs of tuition and fees which are required for the enrollment or attendance of the Account Holder at an approved educational institution. Such costs also may include the books, supplies and equipment required for the education or job training. Funds must be paid directly to an eligible educational institution. Education is defined as a post-secondary program of instruction provided by a college, university, community college, area vocational-technical school, professional institution or specialized college or school legally authorized to grant degrees; or any related educational program approved by the community-based organization (CBO) and DOL. Job Training is defined as a program of job entrance or skill development approved by the CBO and DOL. Education or Job Training for a Dependent Child At the time of asset purchase, the participant’s IDA savings and the matching funds will be deposited into a 529 account or Job Training program. Lease deposit on an apartment, including security deposit and/or first and last months’ rent. Purchase of an automobile, for the purpose of obtaining or maintaining employment. The purchase of an automobile includes all expenses due at the time of purchase that will assist an IDA participant in making the automobile drivable. This would include any license fees, dealer preparation fees, repairs done at the time of purchase, and automobile insurance paid in advance for up to one year. All IDA savings and matching funds must be expended at the time of the purchase of the automobile. NOTE: Participants saving for a home, post-secondary education or job training, or an automobile for the purpose of obtaining or maintaining employment, must complete the corresponding Asset Purchase Plan, a copy of which must be included in the Participant’s file before the asset purchase is completed. Match Rate Programs can match up to 2:1, up to a maximum match of $3,000. For a 2:1 match, a Participant can save up to $1,500 in their IDA and receive a match of up to $3,000 for a total of $4,500 for their asset purchase. For a 1:1 match, a Participant can save $3,000 in their IDA and receive a match of up to September 24, 2013 $3,000 for a total of $6,000 for their asset purchase. Be sure to match at the rate that you specified in your original grant proposal. o No more than 2 concurrent IDAs are allowed per household. The maximum total match is $3,000 per individual and $6,000 per household. Participants earn interest on the funds that are in their IDA. This interest must be matched even if this results in a match that exceeds the $3,000 maximum limit. Participants able to save more than the matchable amount over the program duration will have even higher savings to be used towards purchasing their asset, although the maximum match limitation applies regardless of higher personal savings. Any amount above the allowable goal should be deposited into a separate account opened by the Participant in their own name. Maximum Savings Goal Participants are encouraged to strive toward a goal of $1,500 in savings in order to receive the maximum allowable match (or a goal of $3,000 if the Program is matching $1: $1). Participants should be encouraged to save as much as is feasible, in order to build their assets faster, although the match limitation will apply regardless of higher savings. Any amount above the maximum allowable savings goal should be deposited into a separate account opened by the Participant in their own name. Topics for Asset-Specific Training/Savings Clubs Homeownership Training Preparation for first home purchase Looking for a Home/Home buying process Credit issues Mortgage Application Process Mortgage pre-qualification requirements Mortgage product types First Home Ownership Programs in the Community Legal issues/The Closing Presentations by local realtors Life as a Homeowner Home Maintenance and Repair Foreclosure Prevention Higher Education Financial Aid Choosing a College September 24, 2013 (Agencies should use existing relationships with local institutions of higher learning and post-secondary vocational educational schools, as well as forge new relationships with such institutions.) Saving for a Child’s Education What is a 529 Plan? Choosing a Plan Tax Considerations Investment Options Making a Withdrawal to Pay for Your Child’s Education Small Business/Entrepreneurial Training Entrepreneurial Training Individual Mentoring Developing a Business Plan Each agency will arrange for small business/entrepreneurial training to be provided by qualified individuals or entities. Group classes may be made available for general entrepreneurial training, and shall be followed by individualized training with small business training professionals. Vehicle Purchase (for Employment) What kind of car best fits my needs? Shopping Around/Researching Deals Is “Going Green” Right for You? Reading a Car Window Sticker Negotiating Your Deal Shopping for a Loan Car Financing Service Contracts/Warranties Lemon Law Lease Deposit on an Apartment Apartment Hunting Choosing the Right Apartment Inspections The Lease Your rights and responsibilities as a renter The landlord’s responsibilities Security deposit Renter’s insurance When repairs are needed Eviction prevention Other Topics Tax issues Increasing Your Earning Potential Job Marketability September 24, 2013 Job Retention and Advancement Dealing with a Difficult Boss Handling Disputes with Co-Workers Asking for a Raise or a Promotion Advocating for Yourself Decision Making Critical Thinking Skills Parenting Motivational Issues Stress Reduction and Anger Management Other groups that can be solicited to assist with Financial Education and/or Savings Club presentations are: Housing Finance Authority (CHFA) Non-Profit Housing Agencies/Housing Authorities Lenders/Realtors SBA-funded organizations/SCORE Women’s Business Development Agencies Community Colleges (Business Development or Entrepreneurial Centers) Local Chambers of Commerce Colleges/Financial Aid Representatives Trade Schools/Apprenticeships Job Training Entities/Workforce Development/Career Counselors Industry Associations Banks Cooperative Extension Services You can find experts on many of these topics that might be willing to come talk to your classes. Also, information on many of these topics can be found on the Internet. Serving Individuals Out of Your Service Area You can admit an individual who lives out of your service area into your program, as long as there is not a DOL IDA program with available slots operating closer to where the individual lives. On rare occasions, an individual might live in one town and work in another, and it would be more convenient for them to join an IDA program where they work. This can be permitted, after consultation with DOL and with the program operator in the town where the participant lives. Making Changes to Your IDA Program Plan If you wish to make any changes to the program plan that you specified in your original program proposal, you must first get permission from DOL. September 24, 2013